United Arab Emirates (UAE) Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Arab Emirates (UAE) Power Market Report Overview

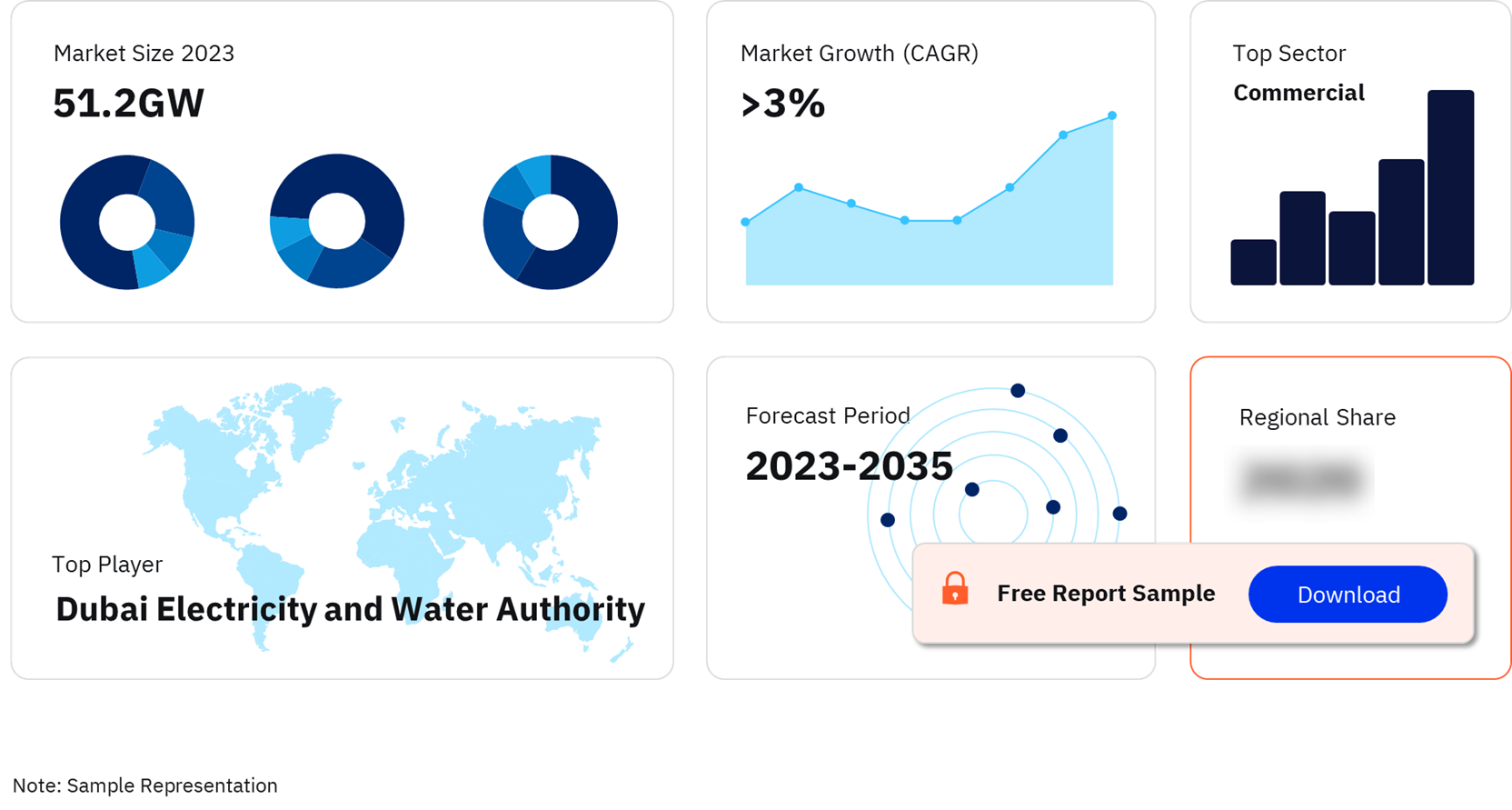

The power market in the United Arab Emirates had a total installed power capacity of 51.2GW in 2023 and will achieve a CAGR of more than 3% during 2023–2035. Thermal power dominated the capacity segment, followed by renewable power.

The United Arab Emirates (UAE) Power Market Outlook 2023-2035 (GW)

Buy the Full Report to Get More Insights on the United Arab Emirates (UAE) Power Market Forecast

The UAE power market research report discusses the power market structure of the country and provides historical and forecast numbers for capacity, generation, and consumption up to 2035. A detailed analysis of the country’s power market regulatory structure, competitive landscape, and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential.

| Market Size (2023) | 51.2GW |

| CAGR (2023 – 2035) | >3% |

| Historical Period | 2015-2022 |

| Forecast Period | 2023-2035 |

| Key Sectors | · Commercial

· Residential · Industrial · Others |

| Key Deal Types | · Acquisitions

· Partnerships · Debt Offerings · Venture Financing · Equity Offerings |

| Leading Players | · Dubai Electricity and Water Authority

· Abu Dhabi National Energy Company · Emirates Global Aluminium PJSC · Sharjah Electricity & Water Authority |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

The United Arab Emirates Power Market Dynamics

The UAE is one of the biggest exporters of oil in the world and plays a major role in the Organization of the Petroleum Exporting Countries (OPEC). It is currently on a high growth trajectory due to substantial oil and gas reserves and is one of the most prosperous countries in the Middle East. The Federal Ministry of Energy and Infrastructure is the primary regulator at the federal level and is responsible for establishing policies for the water and electricity sectors in the UAE. Several regulating authorities are present in different emirates to oversee the electricity market. For instance, Abu Dhabi’s electricity sector is regulated by the Department of Energy (DoE) and the Emirates Water and Electricity Company (EWEC). The main authorities regulating the electricity sector in Dubai are the Dubai Electricity and Water Authority (DEWA), the Dubai Supreme Council of Energy (DSCE), and the Dubai Regulation and Supervision Bureau (RSB Dubai).

Since 1971, the United Arab Emirates (UAE) has relied on its large oil and natural gas resources to support its economy. Rapid economic and demographic growth over the past decade pushed the UAE’s electricity grid to its limits. The country is planning to add nuclear, renewable, and coal-fired electricity generating capacity to accommodate rising demand. For the past few years, the UAE has been investing significantly in renewable technologies to diversify its power mix. Dubai has set targets to increase electricity from renewable sources so that these will account for at least 21.6% of electricity generation by 2035.

Buy the Full Report to Get More Insights on the UAE Power Market Dynamics

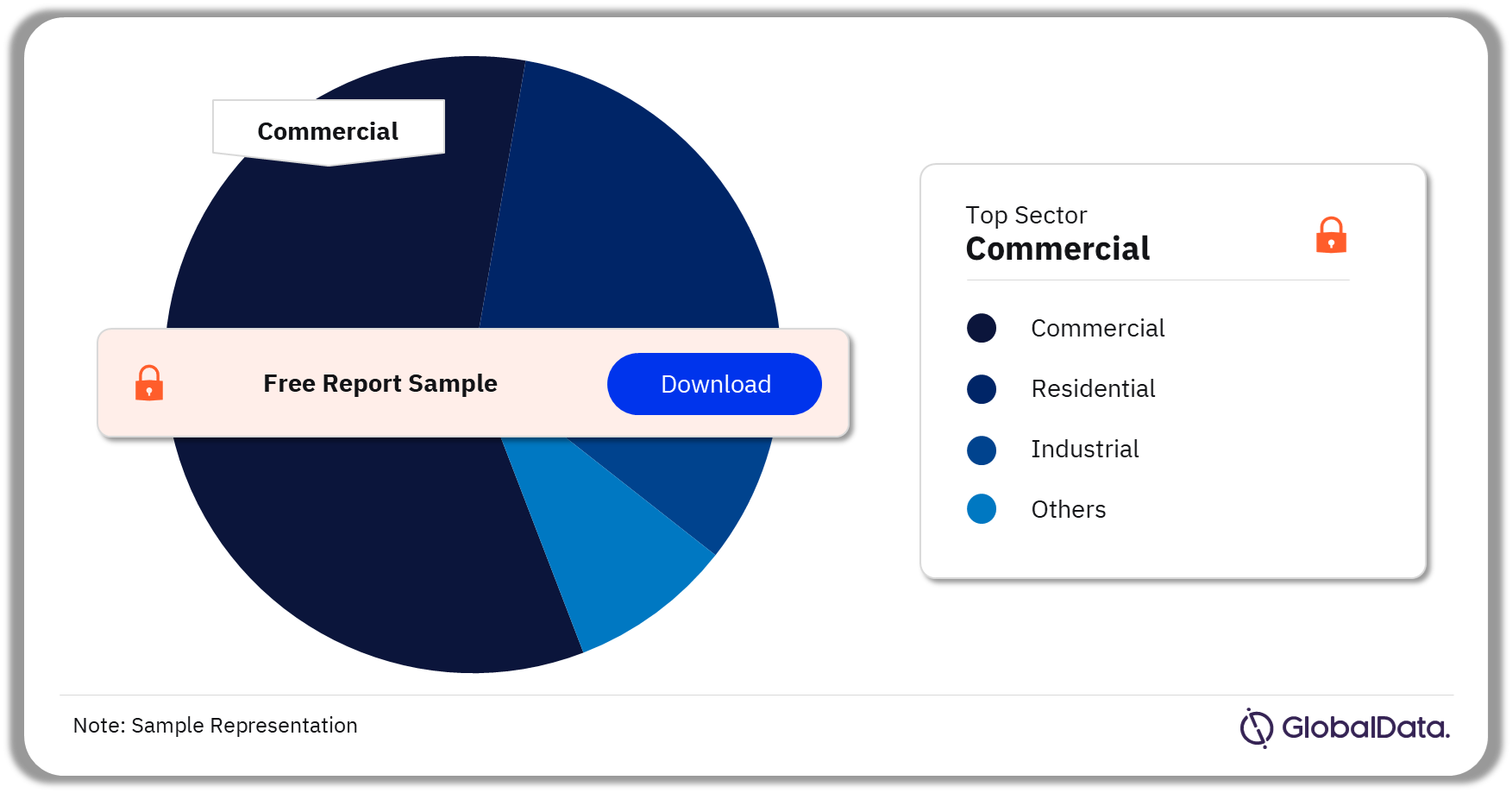

The UAE Power Market Segmentation by Sectors

The key sectors in the power market in the UAE are industrial, residential, and commercial. In 2023, the commercial sector had the largest share in the UAE’s power consumption market.

The United Arab Emirates (UAE) Power Market Analysis by Sectors

Buy the Full Report to Get More Sectoral Insights into the UAE Power Market

The UAE Power Market – Deal Types

The key deal types in the UAE power market are acquisitions, partnerships, debt offerings, venture financing, and equity offerings. In 2023, both acquisitions and partnerships had an equal share of the total number of deals.

Buy the Full Report to Get More Deal Insights into the UAE Power Market

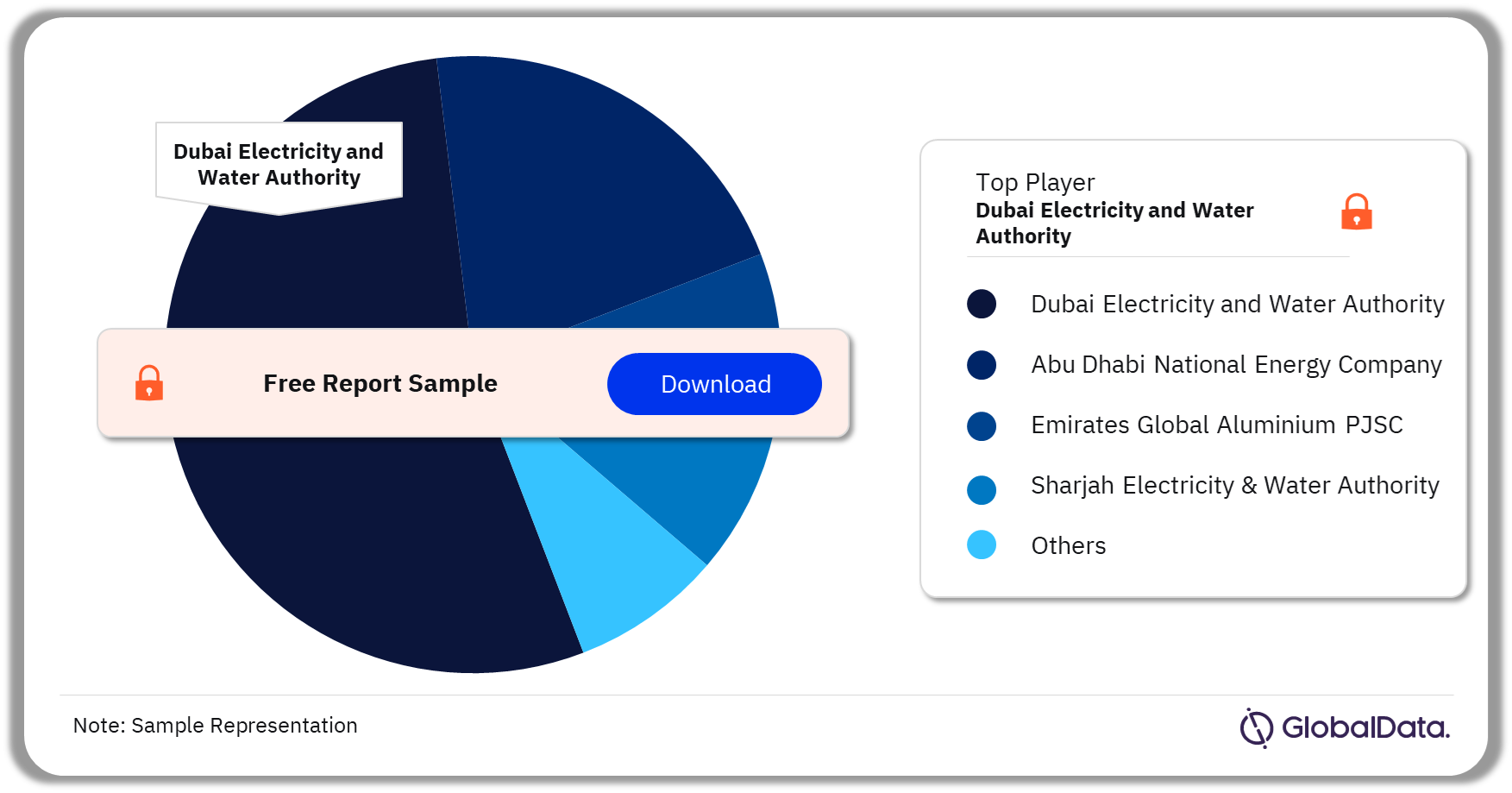

The United Arab Emirates (UAE) Power Market - Competitive Landscape

A few of the leading players in the UAE power market are Dubai Electricity and Water Authority, Abu Dhabi National Energy Company, Emirates Global Aluminium PJSC, and Sharjah Electricity & Water Authority among others.

Dubai Electricity and Water Authority: The company provides electricity and water services in the Emirate of Dubai. It operates and maintains power stations, desalination plants, aquifers, power and water transmission lines, and power and water distribution networks in the Emirate. The authority also provides various services, including bill payment, a smart collection platform, EV charger card services, electricity and water management, energy audits, clearance certificate services, and tariff calculators.

Abu Dhabi National Energy Company: It is a subsidiary of Abu Dhabi Power Corporation an energy and water company. Its operations include strategic power generation and water desalination assets. The company also operates upstream and midstream oil and gas businesses. It also includes midstream gas storage, oil and gas processing, and transportation. The company generates electricity through plants in Ghana, India, Saudi Arabia, Morocco, and the US. TAQA serves power, oil and gas, and water industries.

The UAE Power Market Analysis by Companies

Buy the Full Report to Get More Sector Insights into the UAE Power Market

Scope

The report provides:

- Snapshot of the country’s power sector across parameters – macroeconomics, supply security, generation infrastructure, transmission infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential of the power sector.

- Statistics for installed capacity, generation, and consumption from 2015 to 2023, and forecast to 2035.

- Capacity, generation, and major power plants by technology.

- Data on leading active and upcoming power plants.

- Information on transmission and distribution infrastructure, and electricity imports and exports.

- Policy and regulatory framework governing the market.

- Detailed analysis of top market participants, including market share analysis and SWOT analysis.

Reasons to Buy

- Identify opportunities and plan strategies by having a strong understanding of the investment opportunities in the country’s power sector.

- Identify key factors driving investment opportunities in the country’s power sector.

- Facilitate decision-making based on strong historical and forecast data.

- Develop strategies based on the latest regulatory events.

- Position yourself to gain the maximum advantage of the industry’s growth potential.

- Identify key partners and business development avenues.

- Identify key strengths and weaknesses of important market participants.

- Respond to your competitors’ business structure, strategy, and prospects.

Abu Dhabi National Energy Co

Emirates Global Aluminium PJSC

Sharjah Electricity & Water Authority

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total installed capacity in the power market in the UAE in 2023?

The total installed capacity in the power market in the UAE was 51.2 GW in 2023.

-

What will the installed capacity of the UAE power market growth rate be during 2023–2035?

The installed capacity of the UAE power market will achieve a CAGR of less than 3% during the forecast period.

-

What are the key sectors in the United Arab Emirates power market?

The key sectors in the United Arab Emirates power market are the industrial, residential, commercial, and others.

-

Who are the leading players in the UAE power market?

A few of the leading players in the United Arab Emirates (UAE) power market are Dubai Electricity and Water Authority, Abu Dhabi National Energy Company, Emirates Global Aluminium PJSC, and Sharjah Electricity & Water Authority among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.