Immuno-Oncology (IO) – Thematic Intelligence

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Immuno-Oncology Market’ report will allow you to –

- Obtain immuno-oncology market assessment and forecast across multiple regions

- Gain insight into promising early-stage approaches.

- Our indication specific forecast models answer questions such as –

-

- What is the target patient pool for cell & gene therapies in each cancer indication?

- Which patient groups are more likely to receive these therapies?

- What does the cell & gene therapy clinical stage pipeline look like in each cancer indication

- What is the anticipated breakdown between autologous and allogeneic cell therapies?

- When will cell & gene therapies launch in each market?

- What is the total market value projected for the forecast end, in 2028?

How is the ‘Immuno-Oncology Market’ report different from other reports in the market?

- Acquire in-depth analysis of the rapidly evolving IO landscape with Industry trends for each of the IO classes – including checkpoint modulators, cell therapies, bispecific antibodies, therapeutic vaccines, oncolytic viruses, and cytokines.

- Gain insights into market leaders and market challengers for each IO class, with an in-depth analysis of leading and emerging brands and companies.

- Analyze the IO pipeline, with emerging technologies, targets, and biomarkers identified along with IO clinical trial design and endpoints. The report also covers deals within the IO sector, including strategic partnerships, mergers, and acquisitions.

- Leverage the regulatory framework and reimbursement strategies for IO therapies across markets. Beyond reimbursement hurdles, other barriers to access to IO therapies are also explored.

- Identification of unmet clinical and commercial needs within the IO field and agents and strategies that may address these.

We recommend this valuable source of information to anyone involved in:

- Pharmaceutical companies

- Biotech

- CMOs and CDMOs

- Consulting Companies

- Technology Companies, Start-ups

- Professional Services (e.g., Investment, Equity Companies, Banks)

To Get a Snapshot of the Immuno-Oncology Market Report, download a free report sample

Immuno Oncology Market Thematic Intelligence Overview

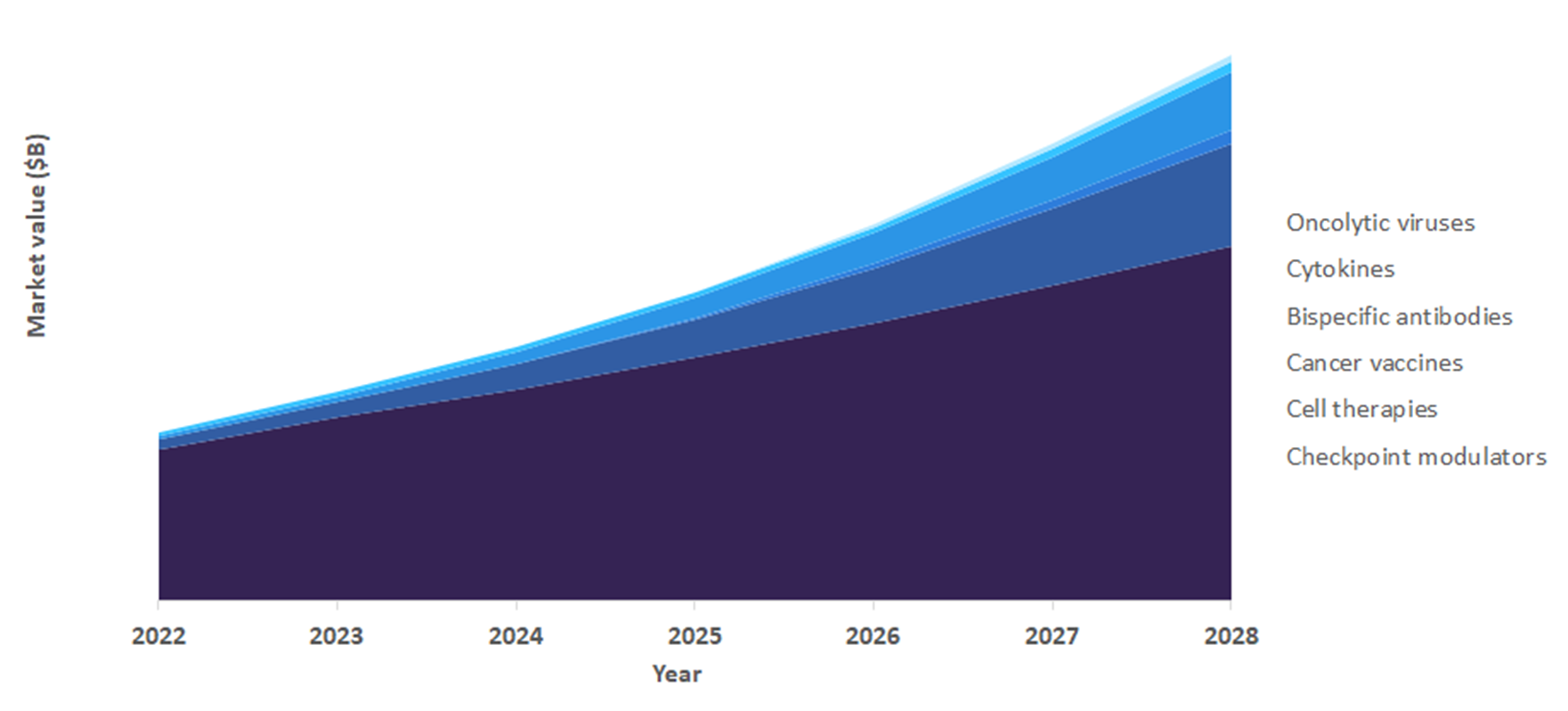

The immuno-oncology (IO) market size was valued at $48 billion in 2022 and is expected to grow at a CAGR of over 21% during 2022-2028. IO refers to the development of therapies that utilize the human body’s immune responses, both adaptive and innate, to target cancer. Most of the mechanisms involved in human immune responses revolve around priming and boosting the immune system via the stimulation of antigen-presenting cells, T-cells, or innate cells, reducing immunosuppression in the tumor environment by regulating inhibitory pathways, and enhancing adaptive or innate immunity. IO therapies differ from passive strategies that include administration of immune system components, which results in temporary anti-tumoral effects.

Immuno-Oncology Market Outlook, 2022-2028 ($ Billion)

For more insights on the immuno-oncology market forecast, download a free report sample

The immuno-oncology thematic research report gives an overview of key marketed and pipeline immuno-oncology drugs including classification of therapy and technologies, regulatory and market access details, and product & company profiles. It analyses the key dynamics of the IO market and provides the key industry drivers and challenges.

| Report Pages | 169 |

| Regions Covered | Global |

| Market Size (2022) | $48 Billion |

| CAGR (2022-2028) | >21% |

| Value Chain | Bispecific Antibodies, Oncolytic Viruses, Cell Therapies, Cancer Vaccines, Checkpoint Modulators, and Cytokines |

| Key Types (Marketed Products) | Cytokines, Bispecific Antibodies, Cancer Vaccines, Cell Therapies, Immune Checkpoint Inhibitor, and Oncolytic Viruses |

| Key Indication (Marketed Products) | Melanoma, Kidney Cancer, Liver Cancer, Non-Small Cell Lung Cancer (NSCLC), and Colorectal Cancer |

| Key Types (Pipeline Products) | Cell Therapies, Bispecific Antibodies, Cancer Vaccines, Checkpoint Modulators, Cytokines, and Oncolytic Viruses |

| Key Indication (Pipeline Products) | Solid Tumor, Non-Small Cell Lung Cancer (NSCLC), Gastric Cancer, Melanoma, and Colorectal Cancer |

| Leading Players | Novartis Merck & Co., Gilead Sciences, Roche, Bristol Myers Squibb, AstraZeneca, IQVIA, and Sanofi |

Immuno-Oncology Market - Trends and Opportunities

The bispecific antibody field has generated a lot of excitement in oncology, with additional BiTEs FDA-approved in the last year. Interest in the cancer vaccine field has also been reignited with the first positive data from an mRNA vaccine announced. In addition, the cell therapy field is impacting more indications and has offered curative options for some blood cancers. CAR-Ts have moved into earlier lines of therapy for non-Hodgkin’s lymphoma (NHL).

Bispecific antibodies are in the unique position to offer T-cell redirection in combination with checkpoint modulation, potentially addressing the T-cell exhaustion issue. Bispecific dual-targeting ICIs may prove to be more effective than using a combination of two ICIs. New ways to alter the tumor microenvironment to combat resistance to IO therapy is also one of the opportunities in the immuno-oncology market.

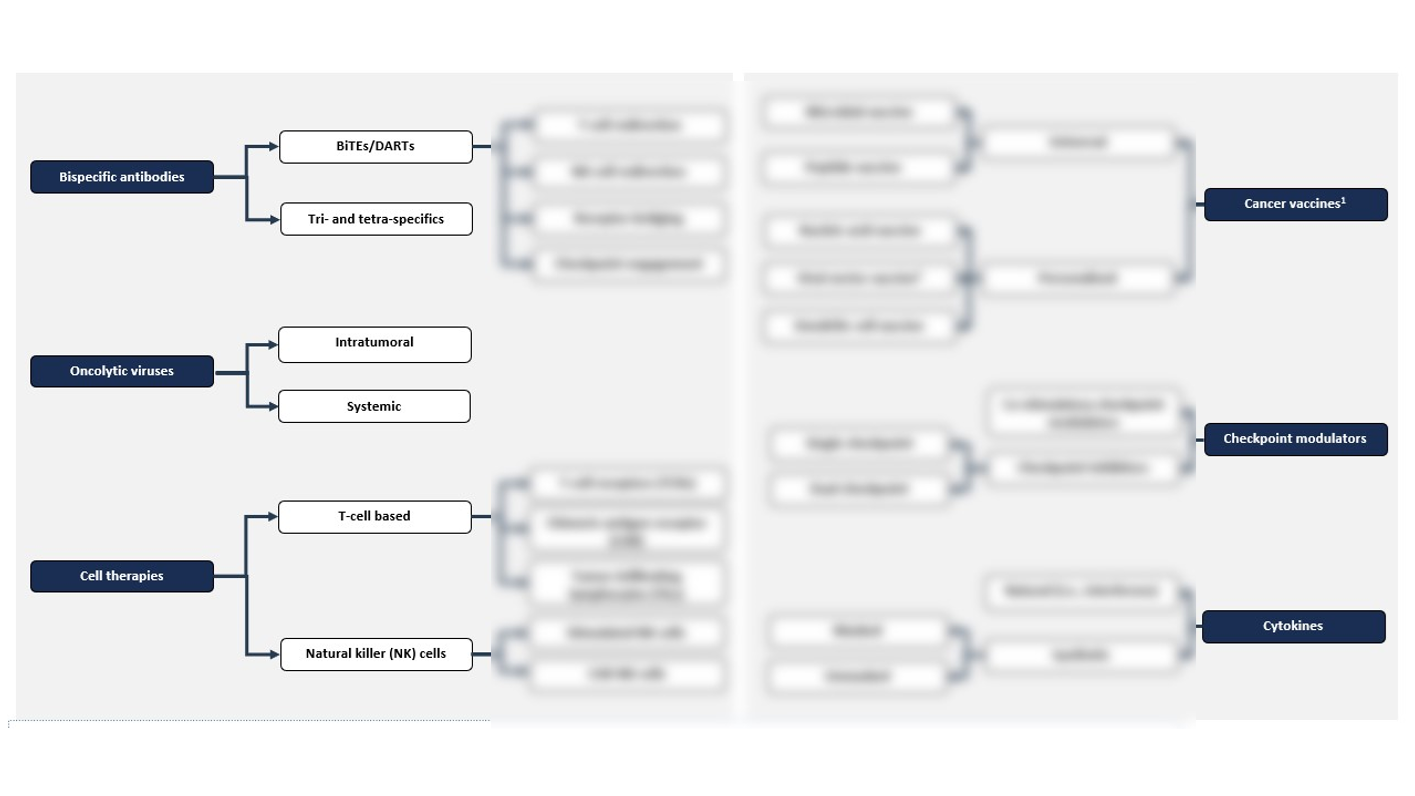

Immuno-Oncology - Value Chain Analysis

The immuno-oncology value chain consists of bispecific antibodies, oncolytic viruses, cell therapies, cancer vaccines, checkpoint modulators, and cytokines.

Bispecific Antibodies: They aim to bring two different cell or protein types into proximity to promote some biological function. Bispecific T-cell engagers are especially relevant to IO. The current leader in the bispecific antibody segment of IO is Amgen, which was the first company to launch an FDA-approved bispecific T-cell engager antibody (Blincyto) in an oncology indication.

Immuno-Oncology Value Chain Analysis

For more insights on the Immuno-Oncology value chain, download a free report sample

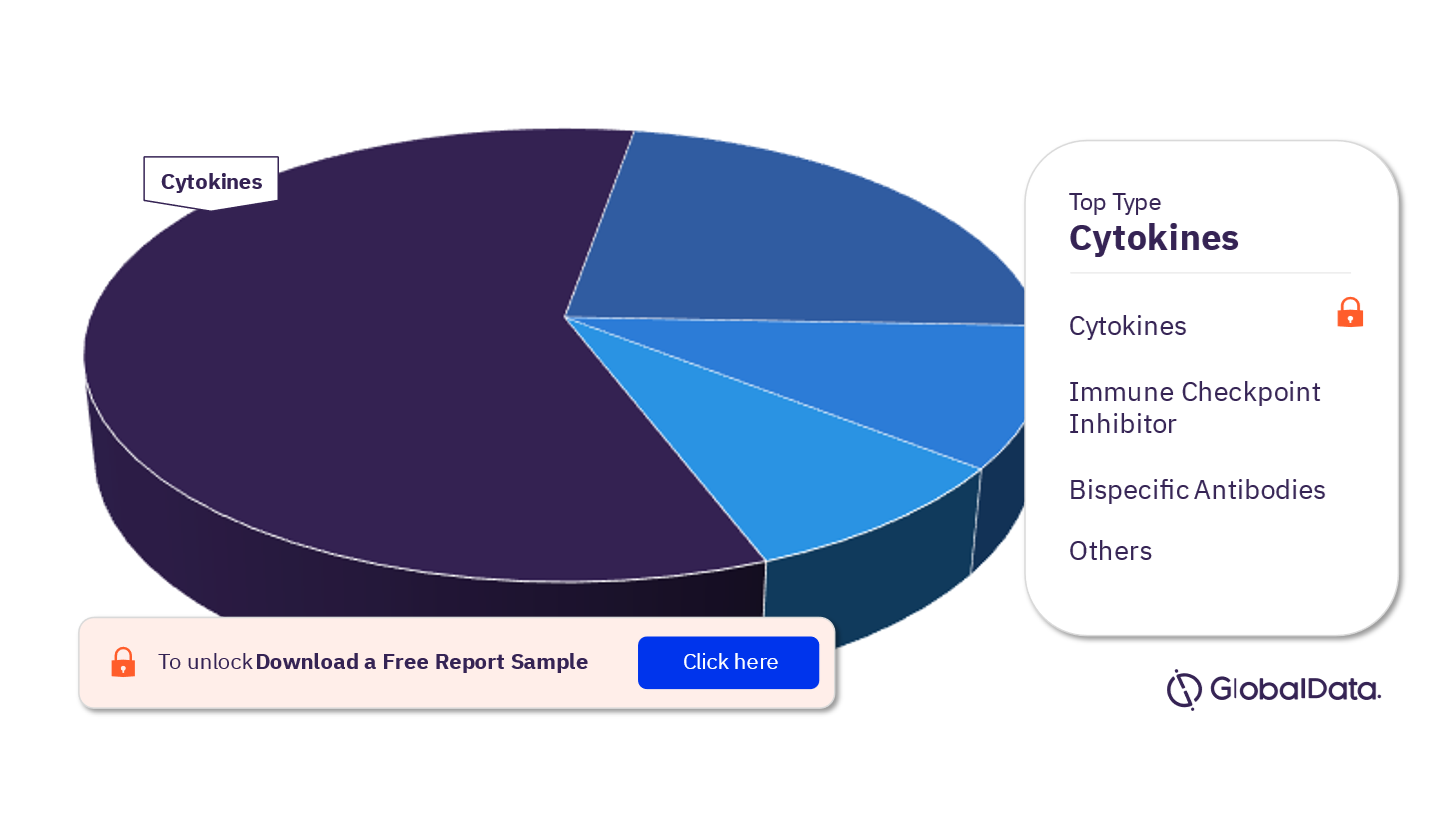

Immuno-Oncology Marketed Products Segmentation by Types

Cytokines, bispecific antibodies, cancer vaccines, cell therapies, immune checkpoint inhibitors, and oncolytic viruses are the key types of marketed immuno-oncology products in the 8MM. There are currently more than 70 marketed IO agents in the 8MM. Cytokine products lead the category in the immuno-oncology market.

Immuno-Oncology Marketed Products Analysis by Types, as of April 2023

For more insights on the types of marketed immuno-oncology products, download a free report sample

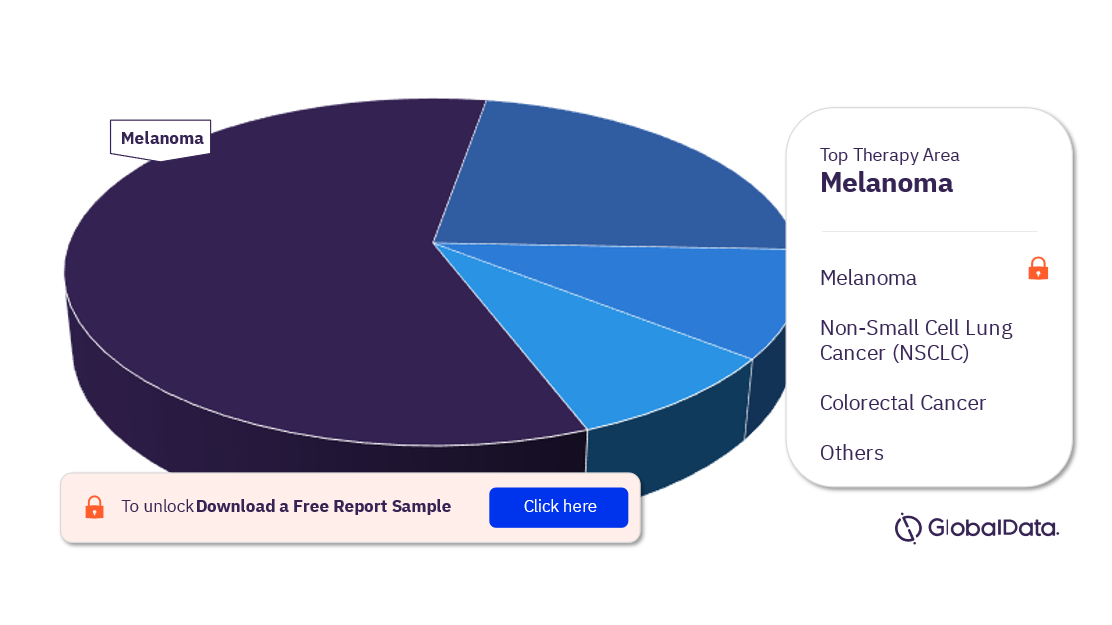

Immuno-Oncology Marketed Products Segmentation by Indication

Melanoma, kidney cancer, liver cancer, non-small cell lung cancer (NSCLC), and colorectal cancer are some of the key indications in the immuno-oncology marketed products in the 8MM. The indications with the most marketed IO agents in the 8MM are melanoma, kidney cancer, liver cancer, and NSCLC.

The majority of approved IO agents are available in China with more than 40 products available, followed by the US.

Immuno-Oncology Marketed Products Analysis by Indication, as of April 2023

For more insights on the marketed immuno-oncology products by indication, download a free report sample

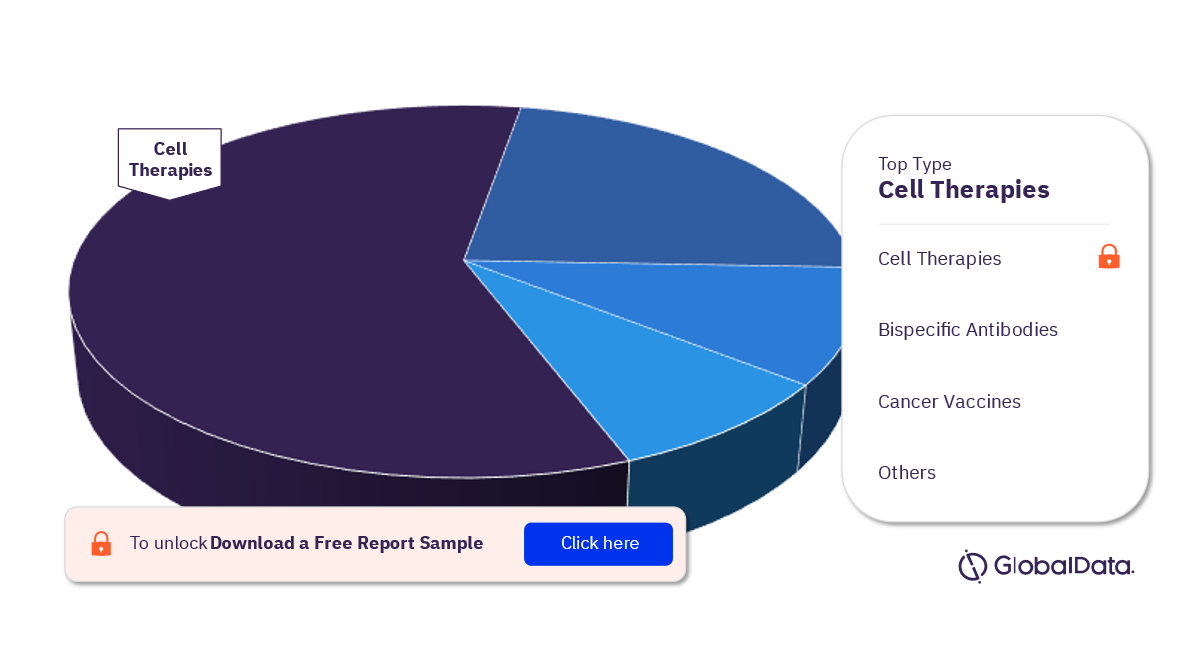

Immuno-Oncology Pipeline Products Segmentation by Types

Cell therapies, bispecific antibodies, cancer vaccines, checkpoint modulators, cytokines, and oncolytic viruses are the key types of immuno-oncology pipeline products. Cell therapies have the maximum number of pipeline products in the IO market.

Immuno-Oncology Pipeline Products Analysis by Types, as of April 2023

For more insights on the immuno-oncology pipeline products by type, download a free report sample

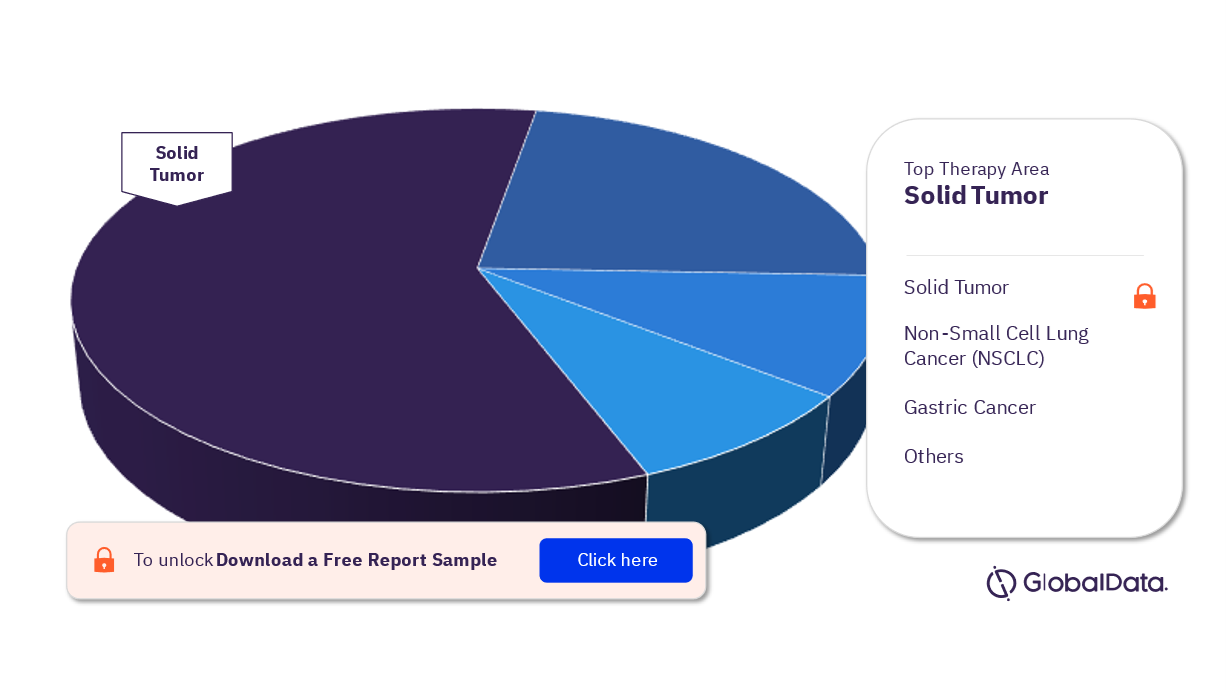

Immuno-Oncology Pipeline Products Segmentation by Indication

Solid tumor, non-small cell lung cancer (NSCLC), gastric cancer, melanoma, and colorectal cancer are some of the top indications in the immuno-oncology pipeline products market. Solid tumor has the majority number of pipeline products in the IO market.

Immuno-Oncology Pipeline Products Analysis by Indication, as of April 2023

For more insights on the immuno-oncology pipeline products by indication, download a free report sample

Immuno-Oncology - Leading Companies

Some of the leading companies making their mark within the immuno-oncology theme are Novartis Merck & Co., Gilead Sciences, Roche, Bristol Myers Squibb, AstraZeneca, IQVIA, and Sanofi among others.

Novartis: Headquartered in Basel, Switzerland, Novartis is a healthcare company that focuses on the discovery, development, manufacture, and marketing of prescription and generic pharmaceutical products and eye care products. It provides drugs for the treatment of cancer, cardiovascular diseases, dermatological conditions, neurological disorders, ophthalmic and respiratory diseases, immune disorders, and infections, among others.

Segments Covered in the Report

Immuno-Oncology Marketed Products Outlook by Types

- Cytokines

- Bispecific Antibodies

- Cancer Vaccines

- Cell Therapies

- Immune Checkpoint Inhibitors

- Oncolytic Viruses

Immuno-Oncology Marketed Products Outlook by Indication

- Melanoma

- Kidney Cancer

- Liver Cancer

- Non-Small Cell Lung Cancer (NSCLC)

- Colorectal Cancer

Pipeline Immuno-Oncology Products Outlook by Types

- Cell Therapies

- Bispecific Antibodies

- Cancer Vaccines

- Checkpoint Modulators

- Cytokines

- Oncolytic Viruses

Pipeline Immuno-Oncology Products Outlook by Indication

- Solid Tumor

- Non-Small Cell Lung Cancer (NSCLC)

- Gastric Cancer

- Melanoma

- Colorectal Cancer

Key Players

Novartis AGMerck & Co Inc

Gilead Sciences Inc

F. Hoffmann-La Roche Ltd

Bristol-Myers Squibb Co

AstraZeneca Plc

Sanofi

Amgen Inc

Dendron Inc

Daichi Sankyo Co Ltd

Legend Biotech Corp

Johnson and Johnson

Kite Pharma Inc

Regeneron Pharmaceuticals Inc

Genmab

Iovance Biotherapeutics Inc

Replimune Inc

VBI Vaccines Inc

Jounce Therapeutics Inc

Oncosec Medical Inc

Abbvie Inc

BionTech Co Ltd

Greenwich LifeSciences Inc

CRISPR Therapeutics, Inc

Allogene Therapeutics Inc

Xilio Therapeutics Inc

Candel Therapeutics Inc

Concentra Biosciences LLC

Table of Contents

Frequently asked questions

-

What was the immuno-oncology market size in 2022?

The immuno-oncology market size was valued at $48 billion in 2022

-

What is the immuno-oncology market growth rate?

The immuno-oncology market is expected to grow at a CAGR of more than 21% during 2022-2028.

-

What are the key components of the immuno-oncology value chain?

GlobalData’s immuno-oncology value chain is split into bispecific antibodies, oncolytic viruses, cell therapies, cancer vaccines, checkpoint modulators, and cytokines.

-

What are the key types of immuno-oncology marketed products in the 8MM?

Cytokines, bispecific antibodies, cancer vaccines, cell therapies, immune checkpoint inhibitors, and oncolytic viruses are the key types of immuno-oncology marketed products in the 8MM.

-

What are the key indications for immuno-oncology marketed products in the 8MM?

Melanoma, kidney cancer, liver cancer, non-small cell lung cancer (NSCLC), and colorectal cancer are some of the leading indications for immuno-oncology marketed products in the 8MM.

-

What are the key types of immuno-oncology pipeline products in the 8MM?

Cell therapies, Bispecific antibodies, cancer vaccines, checkpoint modulators, cytokines, and oncolytic viruses are the key types of immuno-oncology pipeline products in the 8MM.

-

What are the key indications in the immuno-oncology pipeline products market in the 8MM?

The solid tumor, non-small cell lung cancer (NSCLC), gastric cancer, melanoma, and colorectal cancer are some of the leading indications in the immuno-oncology pipeline products market in the 8MM.

-

Which are the leading companies in the immuno-oncology market?

Some of the leading companies making their mark within the immuno-oncology theme are Novartis Merck & Co., Gilead Sciences, Roche, Bristol Myers Squibb, AstraZeneca, IQVIA, and Sanofi among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pharmaceuticals reports