Impact of Inflation on United Kingdom (UK) Insurance, 2023 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Impact of Inflation on UK Insurance Market Report Overview

In 2023, UK inflation dropped from 10.4% in January to 4.0% in December. Economic growth flatlined in the year, with the economy falling into recession in Q4 after two consecutive quarters of negative GDP growth. The top three financial concerns for UK insurance consumers are paying monthly bills, the overall impact of the cost-of-living crisis, and saving for a comfortable retirement.

The ‘Impact of Inflation on United Kingdom (UK) Insurance, 2023 Update’ report provides an in-depth analysis of the UK’s economic situation and its impact on the country’s insurance industry in 2023. It examines the changes in consumer behavior, identifying key opportunities for insurance companies going forward. The report also discusses the impact on claims and expenses across major lines of business in the UK insurance market.

| Key LoB | · Motor

· Property · Travel · Pet · Cyber · Liability |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for More Information on Inflation and its effect on the UK Insurance Market, Download a Free Report Sample

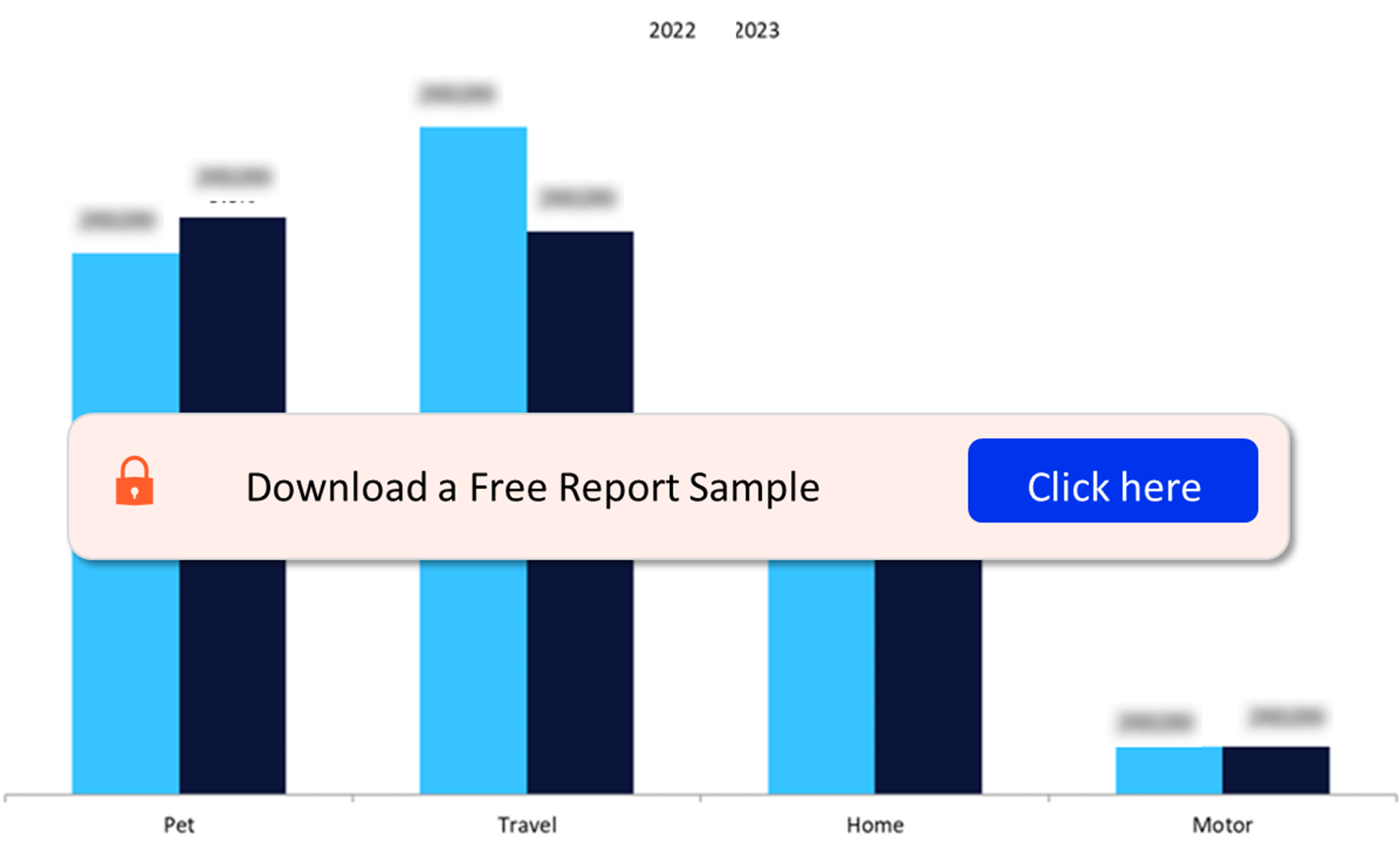

UK Insurance Market - Changing Customer and SME Behavior

Cancellations have been regular in 2023 due to the cost-of-living crisis. According to GlobalData’s 2023 UK Insurance Consumer Survey, just under 10% of pet and travel insurance customers canceled their insurance policy in 2023. These policies are generally considered, of the four primary personal lines products, to be the most expendable in tough economic periods. This trend is likely to continue into 2024 as the economy battles recession. However, fewer cancellations in the travel line will be due to greater travel freedoms in 2023 than the year before.

Furthermore, in the UK, SMEs are also heavily affected by the cost-of-living crisis, and this is similarly influencing their willingness to keep insurance policies. Policies that SMEs are least likely to consider switching or canceling are public liability, employers’ liability, professional indemnity, and property insurance. On a positive note, SMEs are more likely to auto-renew and spend less time comparing prices or seeking alternative providers than personal lines customers. Brokers are primarily responsible for the distribution of insurance products to SMEs, so the impetus falls on them to seek better deals for clients to provide better support through cheaper premiums, more appropriate cover levels, or value-added risk management services.

UK Consumers who Cancelled Their Policies as a Percentage of Current Policyholders, 2022-2023

Buy the Full Report for More Information on Changing Customer and SME Behavior in the UK Insurance Market, Download a Free Report Sample

UK Insurance Market Dynamics

Motor Insurance: Since the start of 2022, the rolling average also shows a decline in policies sold heading into 2023. Continually hiking premiums will eventually start to push consumers out of the market as car ownership costs become too exorbitant and drivers look to sell their vehicles. GlobalData’s 2023 UK Insurance Consumer Survey finds that almost a third of motor customers saw their premium increase by 21% or more in 2023. As motoring costs increase, a growing number of UK drivers are considering selling their vehicles. Moreover, the impact that spiraling claims have had on underwriting results and underlying profits in 2022 and 2023, premium increases are to be expected. Therefore, companies who can proactively ‘future-proof’ their supply chains and repair networks (especially given the rise of electric vehicles) and manage back-end costs more efficiently will be market leaders in the long run.

Property Insurance: According to GlobalData’s 2023 UK Insurance Consumer Survey, many home insurance customers saw significant increase in their premiums at renewal. This is primarily due to an increase in building costs which will inevitably be passed onto customers. Additionally, as operating costs increase and revenue slows, it is likely that more businesses will cancel property policies to reduce the possibility of insolvency. The same survey also reports that over 15% of respondents were not holding property insurance had canceled their cover due to the cost-of-living crisis.

Travel Insurance: Single-trip policies are becoming far more popular for consumers than multi-trip travel insurance policies, especially post the COVID-19 pandemic. Many consumers are unable to fully commit to annual policies, so a greater number are opting for single-trip cover. Also, research from UK provider Just Travel Cover in the summer of 2023 indicates that many consumers are increasingly putting off their purchase of travel insurance until much closer to their departure date. Counterintuitively, purchasing cover earlier would alleviate consumers’ worries about cancellations as their cover should reimburse their costs. Travel insurers should bank on this opportunity educating the customers the benefits of purchasing cover sooner rather than later to help cover for canceled trips.

Buy the Full Report for More Information on the UK Insurance Market Dynamics, Download a Free Report Sample

Reasons to Buy

The report provides:

- An understanding of the consumer challenges in the UK due to slow economic growth and disinflation in 2023.

- An overview of the factors influencing consumers to cancel insurance policies and the measures undertaken to avoid such actions.

- An understanding of the effects of inflation on market dynamics across key personal and commercial lines.

- Insights into the impact on claims and expenses across major lines of business.

Direct Line

By Miles

Aviva

Compare the Market

Go.Compare

Animal Friends

PayPal

Premium Credit Limited

RSA

Thatcham Research

Allianz

Zurich

Descartes

Table of Contents

Figures

Frequently asked questions

-

What are the major concerns surrounding UK insurance consumers?

The three financial concerns for UK insurance consumers are paying monthly bills, the overall impact of the cost-of-living crisis and saving for a comfortable retirement.

-

Which personal lines insurance products had the greatest number of cancellations in 2023?

Pet and travel insurance customers made the highest number of cancellations in 2023 due to cost-of-living crisis.

-

Which commercial line insurances were the most susceptible to cancellations in 2023?

Policies that SMEs are least likely to consider switching or canceling are public liability, employers’ liability, professional indemnity, and property insurance.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports