Indonesia Cards and Payments – Opportunities and Risks to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Indonesia Cards and Payments Market Report Overview

The Indonesia cards and payments market size was valued at $51.4 billion in 2022 and is expected to achieve a CAGR of more than 14% during 2022-2026. Cash has traditionally been the preferred payment instrument in Indonesia accounting for more than 76% of total payment transaction volume in 2022e.

Indonesia Cards and Payments Market Outlook, 2022-2026 ($ Billion)

To gain more information on the Indonesia cards and payments market forecast, download a free report sample

The Indonesia cards and payments market research report provides detailed analysis of market trends in the Indonesia’ cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, mobile wallets, cards, credit transfers, direct debits, and cheques during the review-period.

| Market Size (2022) | $51.4 billion |

| CAGR | >14% |

| Forecast Period | 2022-2026 |

| Historical Period | 2018-2021 |

| Key Payment Instruments | Cash, Cards, Credit Transfers, Mobile Wallets, Direct Debits, and Cheques |

| Key Segments | Card-Based Payments, Merchant Acquiring, Ecommerce Payments, In-Store Payments, Buy Now Pay Later, Mobile Payments, P2p Payments, Bill Payments, and Alternative Payments. |

| Leading Players | BRI, BNI, Bank Mandiri, BCA, Maybank, CIMB, Bank Danamon Indonesia, United Overseas Bank, Bank Mega, GPN, Mastercard, JCB, Visa, and American Express. |

Indonesia Cards and Payments Market Dynamics

The government has introduced initiatives designed to boost the ecommerce market. In December 2022, the Ministry of Trade organized a National Online Shopping Day (Harbolnas) to encourage the use of ecommerce and boost domestic goods trade.

To increase the acceptance of electronic payments among merchants, in August 2019 the central bank launched QRIS. QRIS is a common standard for QR code payments that is designed to work across all electronic money apps, electronic wallets, and mobile banking services.

Indonesia Cards and Payments Market Segmentation by Payment Instruments

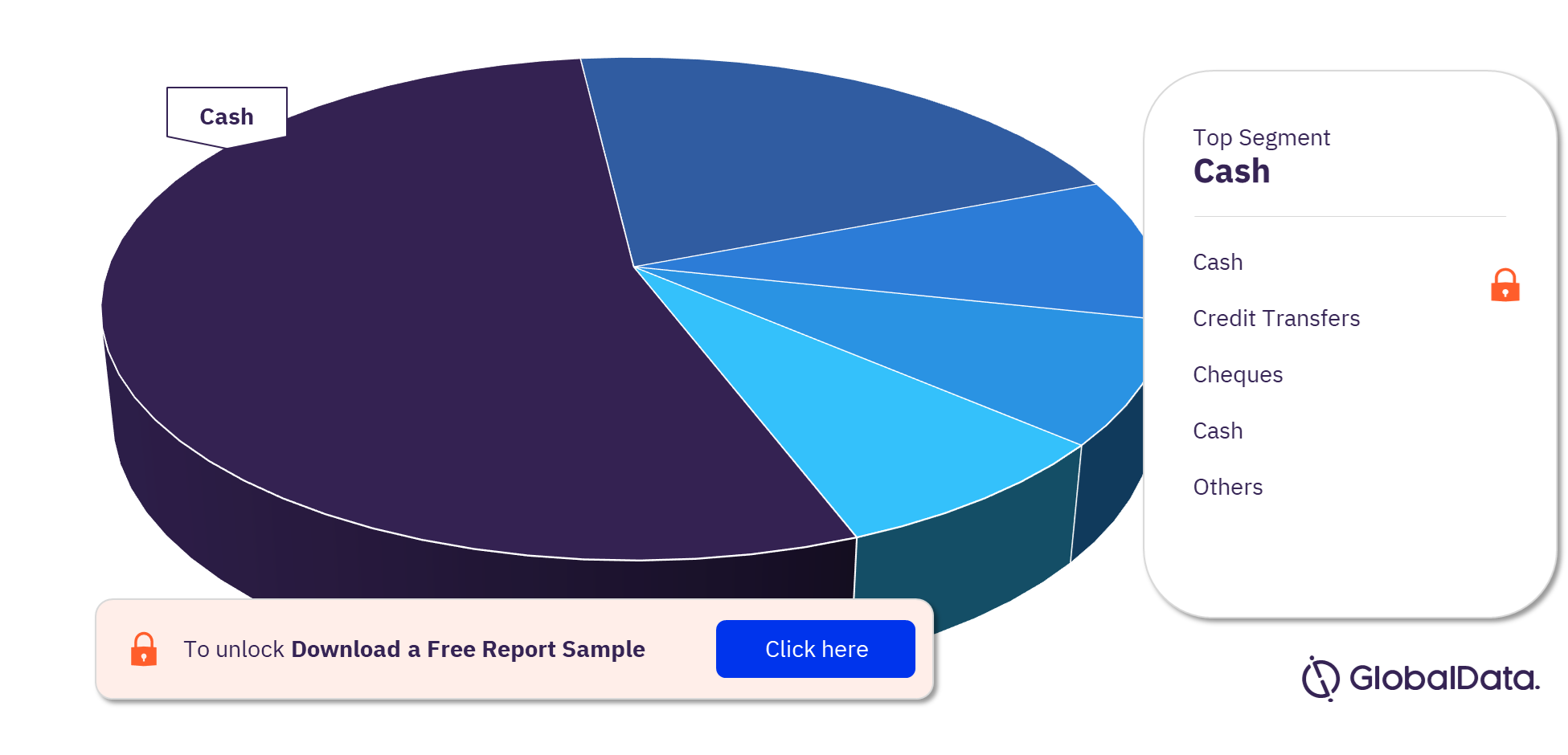

The key payment instruments in the Indonesia cards and payments market are cards, mobile wallets, credit transfers, cheques, cash, and direct debits. In 2022, cash is the dominant payment instrument in terms of transaction volume. Indonesia is a cash-based economy, mainly due to consumers’ traditional preference for cash and the country’s high unbanked population.

Indonesia Cards and Payments Market Analysis by Payment Instruments, 2022 (%)

For more payment instrument insights into the Indonesia cards and payments market, download a free report sample

Indonesia Cards and Payments Market Segments

The key segments in the Indonesia cards and payments market are card-based payments, merchant acquiring, ecommerce payments, in-store payments, buy now pay later, mobile payments, p2p payments, bill payments, and alternative payments.

Cash payments are set to decline in Indonesia, in line with the rising consumer preference for electronic payments. Card payments are gaining prominence in Indonesia, with the average individual holding more than four cards. The growth of card based payments has been supported by the increase in banking penetration in 2022.

Indonesia Cards and Payments Market - Competitive Landscape

Some of the leading players in the Indonesia cards and payments market are BRI, BNI, Bank Mandiri, BCA, Maybank, CIMB, Bank Danamon Indonesia, United Overseas Bank, Bank Mega, GPN, Mastercard, JCB, Visa, and American Express.

Segments Covered in the Report

Indonesia Cards and Payments Instruments Outlook (Value, $ Billion, 2018-2026)

- Cards

- Credit Transfers

- Cheques

- Cash

- Direct Debits

Indonesia Cards and Payments Market Segments Outlook (Value, $ Billion, 2018-2026)

- Card-Based Payments

- Merchant Acquiring

- Ecommerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

The report provides top-level market analysis, information and insights into the Indonesiaian cards and payments industry, including –

- Current and forecast values for each market in the Indonesiaian cards and payments industry, including debit, credit, and charge cards

- Detailed insights into payment instruments including cash, cards, credit transfers, direct debits, and cheques. It also, includes an overview of the country’s key alternative payment instruments.

- Ecommerce market analysis.

- Analysis of various market drivers and regulations governing the Indonesiaian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Indonesiaian cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Indonesiaian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Indonesiaian cards and payments industry.

- Assess the competitive dynamics in the Indonesiaian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Indonesia.

- Gain insights into key regulations governing the Indonesiaian cards and payments industry.

BNI

Bank Mandiri

BCA

Maybank

CIMB

Bank Danamon Indonesia

United Overseas Bank

Bank Mega

GPN

Mastercard

JCB

Visa

American Express.

Table of Contents

Frequently asked questions

-

What was the Indonesia cards and payments market size in 2022?

The cards and payments market size in Indonesia was valued at $51.4 billion in 2022.

-

What is the Indonesia cards and payments market growth rate?

The cards and payments market in Indonesia is expected to achieve a CAGR of more than 14% during 2022-2026.

-

What is the leading payment instrument in the Indonesia cards and payments market in 2022?

Cash is the leading payment instrument in terms of volume transactions in the Indonesia cards and payments market in 2022.

-

Who are the leading players in the Indonesia cards and payments market?

Some of the leading players in the Indonesia cards and payments market are BRI, BNI, Bank Mandiri, BCA, Maybank, CIMB, Bank Danamon Indonesia, United Overseas Bank, Bank Mega, GPN, Mastercard, JCB, Visa, and American Express.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports