Indonesia Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Reasons to buy the ‘Indonesia Construction’ market sizing report:

- Get a comprehensive analysis of the construction industry in Indonesia.

- Access the historical and forecast valuations of the Indonesian construction industry along with details of key growth drivers.

- Identify the sectors and sub-sectors within the Indonesian construction market.

- Analyze the mega-project pipeline, including breakdowns by development stage across all sectors.

- Assess the projected spending on projects in the existing pipeline.

- Learn about the major projects in the Indonesian construction market, in addition to details of leading contractors and consultants.

How is our ‘Indonesia Construction’ report unique from other reports in the market?

- Identify and evaluate market opportunities using GlobalData’s standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with over 600 time-series data forecasts.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData’s critical and actionable insight.

- Assess business risks, including cost, regulatory, and competitive pressures.

- Evaluate competitive risk and success factors.

We recommend this valuable source of information to anyone involved in:

- Contractors Including Civil Works, Electrical, HVAC, and Others

- Consultants/Designers

- Building Material Merchants/Players

- Construction Equipment Suppliers

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC Firms/Portfolio Managers/Buy-side Firms/Insurance Companies

- M&A/Investment, Management Consultants, and Consulting Firms

Get a Snapshot of the Indonesia Construction Market Report

Indonesia Construction Market Overview

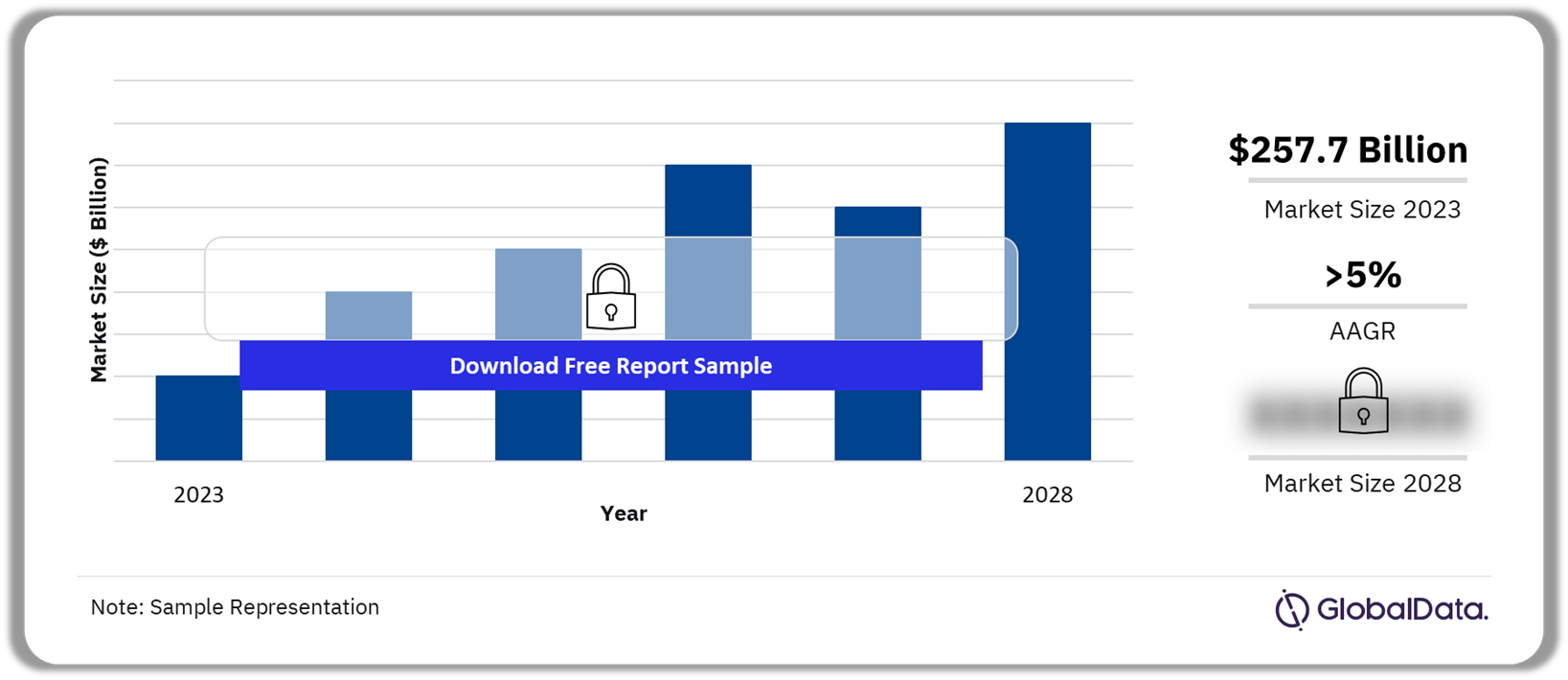

The Indonesia construction market size was $257.7 billion in 2023. The market will achieve an AAGR of more than 5% during 2025-2028. The continued investments in the transport and energy sector will drive the market growth during the forecast period. The government’s plan to achieve an annual production capacity of 600,000 Electric Vehicles (EVs) by 2030 will also support the market growth. Furthermore, the Indonesian government’s plan to reduce greenhouse gas emissions and transition from coal to clean energy will boost the construction market during the projected period.

Indonesia Construction Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report to Know More about the Indonesia Construction Market Forecast

The Indonesia construction market research report gives a comprehensive understanding of project types and construction activities in the country. It analyzes the mega-project pipeline, focusing on development stages, participants, and listings of major projects in the pipeline. The market report further discusses the key sectors in the construction market and their growth drivers. Along with reviewing the details of the construction projects, our analysts have elaborated on emerging trends and assessed key risks and opportunities that will influence the Indonesian construction market growth in the coming years.

| Market Size (2023) | $257.7 billion |

| AAGR (2025-2028) | >5% |

| Forecast Period | 2023-2028 |

| Historical Period | 2019-2022 |

| Key Sectors | · Commercial Construction

· Industrial Construction · Infrastructure Construction · Energy and Utilities Construction · Institutional Construction · Residential Construction |

| Key Contractors | · PT Wijaya Karya (Persero) Tbk

· PT PP (Persero) Tbk · PT Adhi Karya (Persero) Tbk · PT Hutama Karya (Persero) · China State Construction Engineering Corp Ltd |

| Key Consultants | · Egis Group

· AECOM · PT. Virama Karya (Persero) · John Wood Group Plc · PT Synergy Engineering |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Indonesia Construction Market Segmentation by Sectors

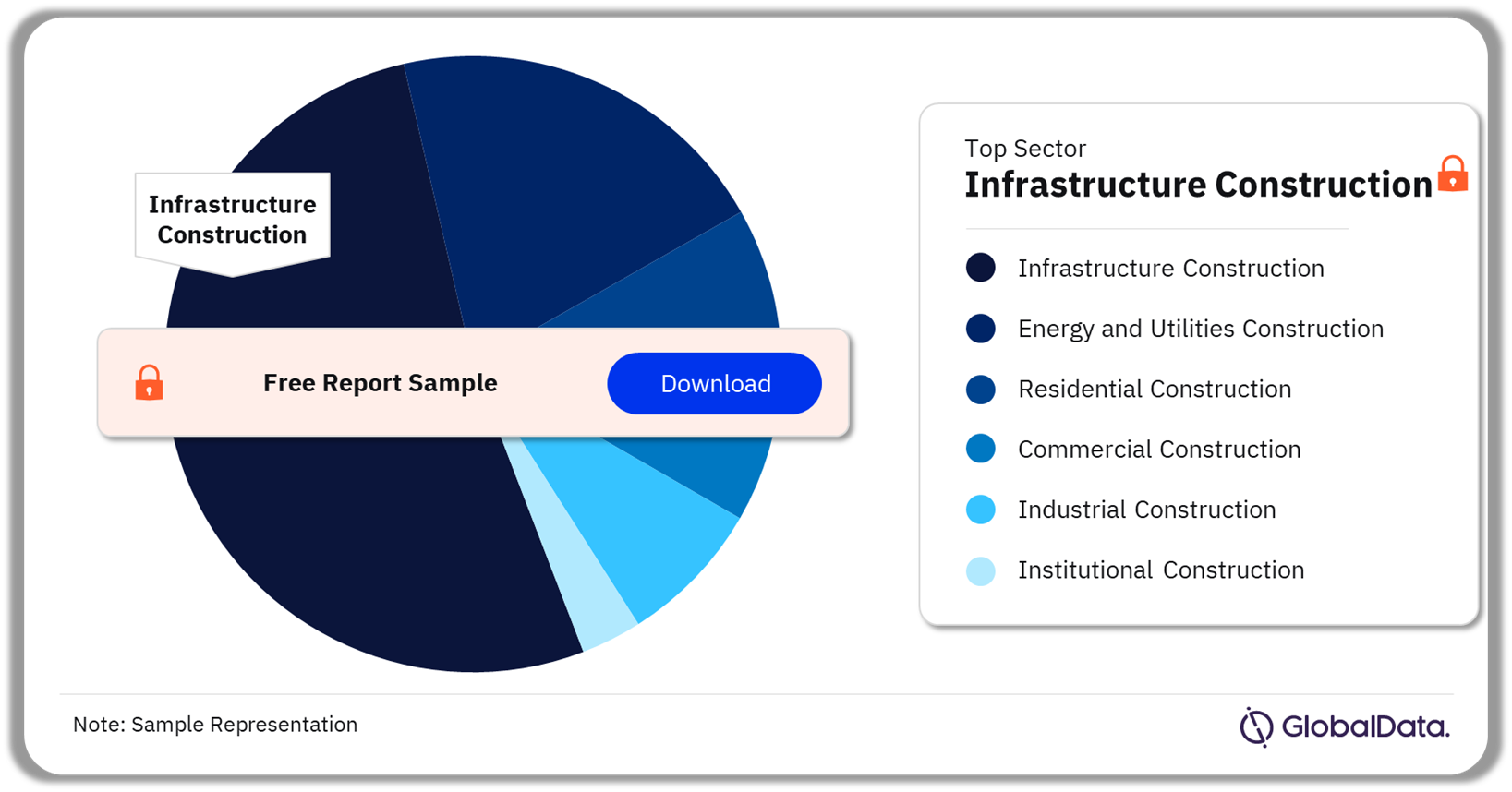

Infrastructure construction sector accounted for the highest Indonesian construction market share in 2023

The key sectors in the Indonesian construction market are commercial construction, industrial construction, infrastructure construction, energy and utilities construction, institutional construction, and residential construction.

Infrastructure construction: The project types in this sector include rail infrastructure, road infrastructure, and other infrastructure projects. The government investment in transport projects to improve regional connectivity will mainly support the infrastructure sector’s output during the forecast period.

Energy and utilities construction: The project types in this sector include electricity and power, oil and gas, telecommunications, sewage infrastructure, and water infrastructure. The investment in renewable energy, oil and gas, and telecommunication projects will drive the sector growth during 2025-2028.

Residential construction: The project types in this sector include single-family housing and multi-family housing. The government’s plan to construct five million housing units by 2027 will support the residential sector output over the forecast period.

Commercial construction: The project types in this sector include leisure and hospitality buildings, office buildings, outdoor leisure facilities, retail buildings, and other commercial construction. The improvement in tourism activity, coupled with investment in leisure and hospitality, office, retail, and data center projects will be mainly responsible for the sector’s growth.

Industrial construction: The project types in this sector include chemical and pharmaceutical plants, manufacturing plants, metal and material production and processing plants, and waste processing plants. Rising domestic and foreign investment, coupled with the government’s focus on attracting foreign investors will drive the sector’s growth during the forecast period.

Institutional construction: The project types in this sector include educational buildings, healthcare buildings, institutional buildings, research facilities, and religious buildings. The government’s focus on the health and education sectors by investment in health, education, and research projects will fuel the growth of the institutional construction sector during the forecast period.

Indonesia Construction Market Analysis by Sectors, 2023 (%)

Buy the Full Report for more Sector Insights into the Indonesia Construction Market

Indonesia Construction Market - Competitive Landscape

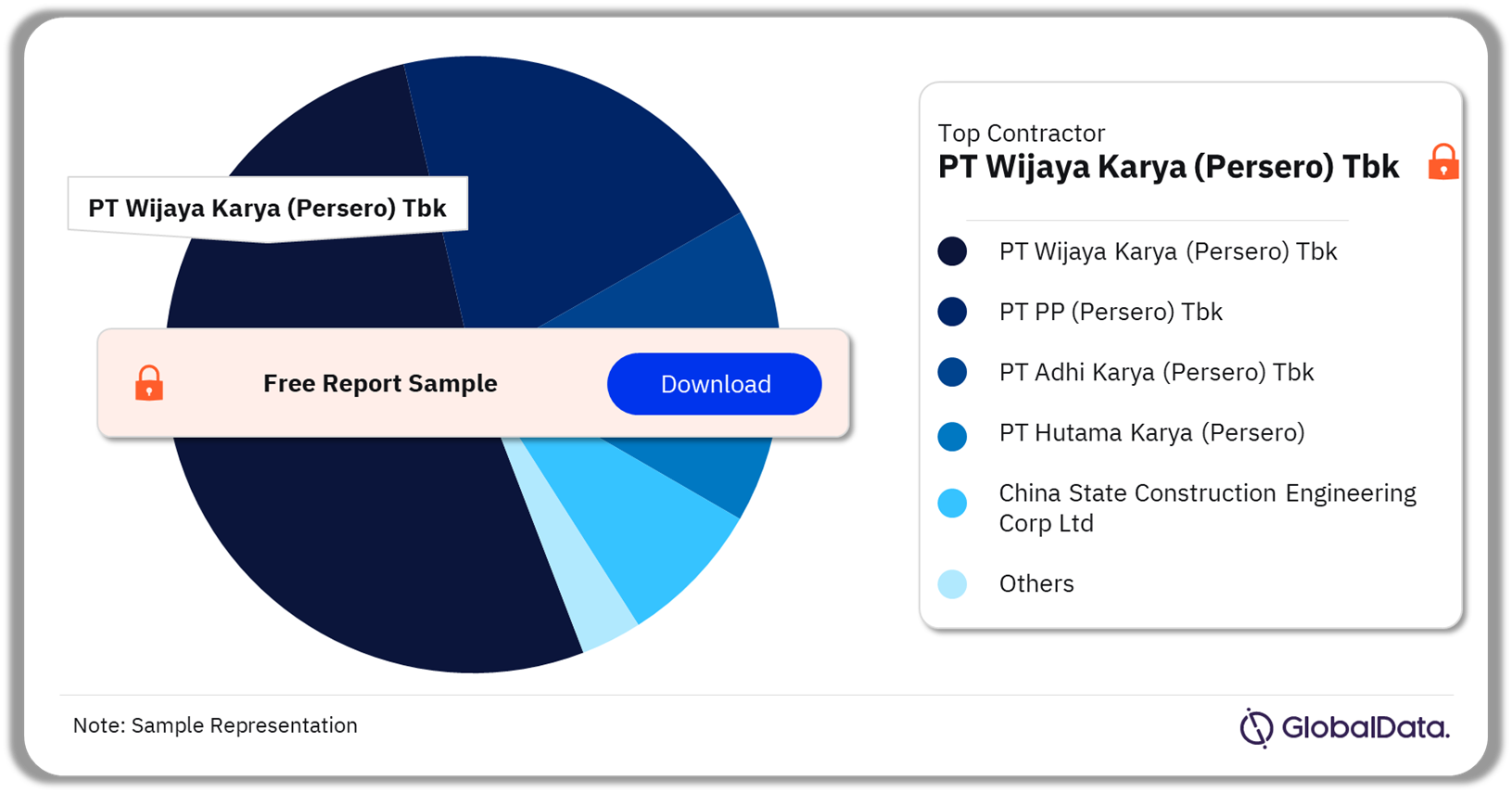

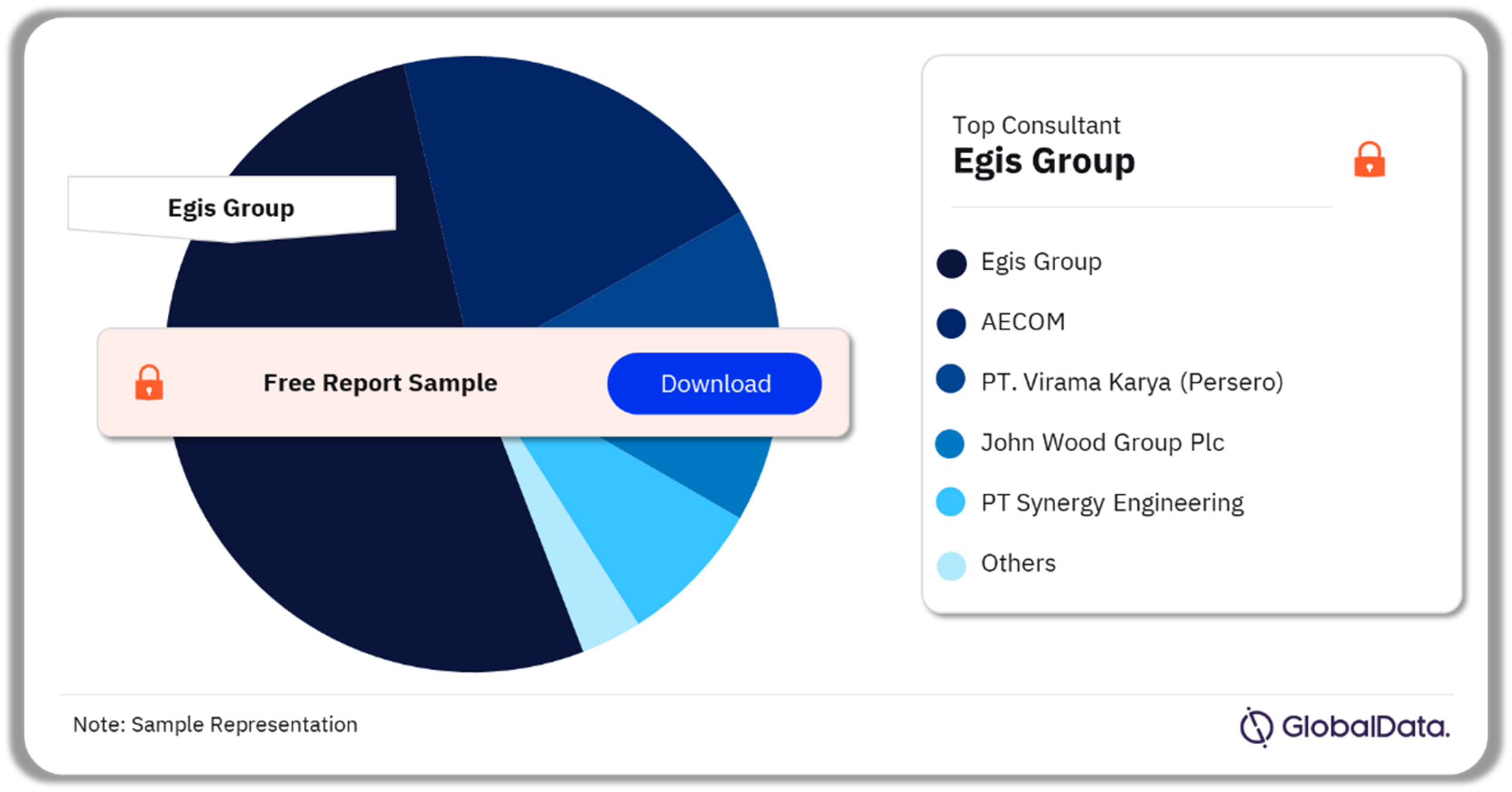

PT Wijaya Karya (Persero) Tbk emerged as the leading contractor and Egis Group as the leading consultant in the Indonesia construction market in 2023

A few of the leading contractors in the Indonesia construction market are:

- PT Wijaya Karya (Persero) Tbk

- PT PP (Persero) Tbk

- PT Adhi Karya (Persero) Tbk

- PT Hutama Karya (Persero)

- China State Construction Engineering Corp Ltd

Domestic contractors account for most of the project pipeline in the Indonesian construction market.

Indonesia Construction Market Analysis by Contractors, 2023 (%)

Buy the Full Report to Know More about the Contractors in the Indonesia Construction Market

A few of the leading consultants in the Indonesia construction market are:

- Egis Group

- AECOM

- Virama Karya (Persero)

- John Wood Group Plc

- PT Synergy Engineering

Consultants with headquarters outside Indonesia are involved in most of the project pipeline by value.

Indonesia Construction Market Analysis by Consultants, 2023 (%)

Buy the Full Report to Know More about Consultants in the Indonesia Construction Market

Indonesia Construction Market - Latest Developments

- In September 2023, the Indonesian state utility Perusahaan Listrik Negara (PLN) announced an anticipated investment of approximately IDR2.6 quadrillion ($172 billion) to build 31.6GW of renewable power capacity between 2024 and 2033 and to have constructed 60GW by 2040.

- In January 2024, PT Chandra Asri Pacific Tbk announced it plans to develop an Chlor Alkali-Ethylene Dichloride plant in Cilegon that will produce key raw materials for electric vehicles. The construction of the project is expected to commence in the first half of 2024 and is expected to be completed by the end of 2027.

Segments Covered in the Report

Indonesia Construction Sectors Outlook (Value, $ Billion, 2019-2028)

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Energy and Utilities Construction

- Institutional Construction

- Residential Construction

Table of Contents

Table

Figures

Frequently asked questions

-

What was the construction market size in Indonesia in 2023?

The construction market size in Indonesia was $257.7 billion in 2023.

-

What will the Indonesia construction market growth rate be during the forecast period?

The construction market in Indonesia is projected to achieve an AAGR of more than 5% during 2025-2028.

-

Which sector accounted for the highest share of the Indonesia construction market in 2023?

The infrstructure construction sector accounted for the highest market share in the Indonesian construction market in 2023.

-

Which are the leading contractors in the Indonesian construction market?

A few of the leading contractors in the Indonesian construction market are PT Wijaya Karya (Persero) Tbk, PT PP (Persero) Tbk, PT Adhi Karya (Persero) Tbk, PT Hutama Karya (Persero), and China State Construction Engineering Corp Ltd, among others.

-

Which are the leading consultants in the Indonesian construction market?

A few of the leading consultants in the Indonesian construction market are Egis Group, AECOM, PT. Virama Karya (Persero), John Wood Group Plc, and PT Synergy Engineering, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.