Industrial Minerals Market Size, Share, Trends and Analysis by Region, Commodity, End-Use and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Industrial Minerals’ report can help you:

- Analyze the market size with a breakdown provided by 14 commodities, key end-uses, and regions/countries

- Map the primary features of the value chain and key stakeholders involved within it

- Evaluate potential growth opportunities in different commodity and end-use segments supported by comprehensive qualitative commentary

- Foresee possible changing dynamics of the sector and align business strategies to capitalize on them

- List of major active and upcoming mining projects

How is our ‘Industrial Minerals’ report different from other reports in the market?

- The report presents a holistic view of the market in terms of demand while highlighting market segmentation based on commodity, end-use, and region from 2020 to 2030 in terms of volume (Thousand Tonnes)

- Detailed segmentation by commodity – Barite, Bentonite, Boron, Diatomite, Dolomite, Feldspar, Fluorspar, Graphite, Gypsum and Anhydrite, Kaolin, Limestone, Phosphate Rock, Potash, and Salt

- The report highlights segmentation at end-use level – Construction & Material, Chemical, Ceramic & Glass, and Others

- The report depicts a brief overview of the technological trends of the sector. In addition, key variables influencing the market growth over the forecast period are analyzed to present a detailed outlay of the market conditions.

- The regional section of the study is further bifurcated at a country level covering key trends, activities, end-use updates, companies, and demand projections.

- Competitive landscape of the market provides a compressive overview of the value chain capturing key developments and their impact on the industry, company ranking analysis, and list of equipment suppliers.

- Detailed company profiles for key vendors of the market with a focus on business overview, financial performance, product benchmarking, and strategic initiatives.

We recommend this valuable source of information to anyone involved in:

- Mining/Construction/Chemical/Glass/Ceramic Companies

- Mining Equipment and Plant Suppliers

- Engineering and Construction Contractors

- Consultants and Analysts

- Equity Partners

- Venture Capital Firms

To Get a Snapshot of the Industrial Minerals Market Report, Download a Free Report Sample

Industrial Minerals Market Overview

The industrial minerals market volumetric demand is projected to reach 2,377.7 million tonnes in 2023, registering a compounded annual growth rate (CAGR) of 2.8% from 2023 to 2030. The expansion in the global construction sector especially surrounding infrastructural development is projected to drive market growth over the forecast period.

Industrial minerals consumption patterns are primarily dependent on the movement of the global construction sector owing to its primary share in 2022 within the global volumetric demand. In 2023, the sluggish growth of the global construction sector is expected primarily due to the downturns across advanced economies. However, the momentum is expected to pick up in 2024 with an annual average growth rate (AAGR) estimated at 3.9% from 2024 to 2027.

Industrial Minerals Market Outlook, 2020-2030 (Million Tonnes)

View Sample Report for Additional Insights on Industrial Minerals Market Forecast, Download a Free Report Sample

The industrial minerals market expanded by 1.1% in 2022 backed by the growth in demand from the construction and chemical sectors. During this same time period, the global construction sector rose by 2.1% in real terms and the chemical sector observed an uptick of 2.3%. Although, in 2023, the construction industry growth is expected to remain sluggish, including China, the global industry will expand by just 0.8%, and excluding China the industry is predicted to contract by 0.1%. The gloomy outlook reflects the weak economic backdrop, and additional challenges specific to the global construction industry, notably high construction material costs and labor shortages.

Moreover, in the chemical sector as well, marginal deceleration is predicted in 2023 owing to the weak economic conditions across developed economies. In addition, the changing geopolitical dynamics especially related to oil and gas trade around the globe are likely to further hamper the confidence levels of the market participants over the short-term period.

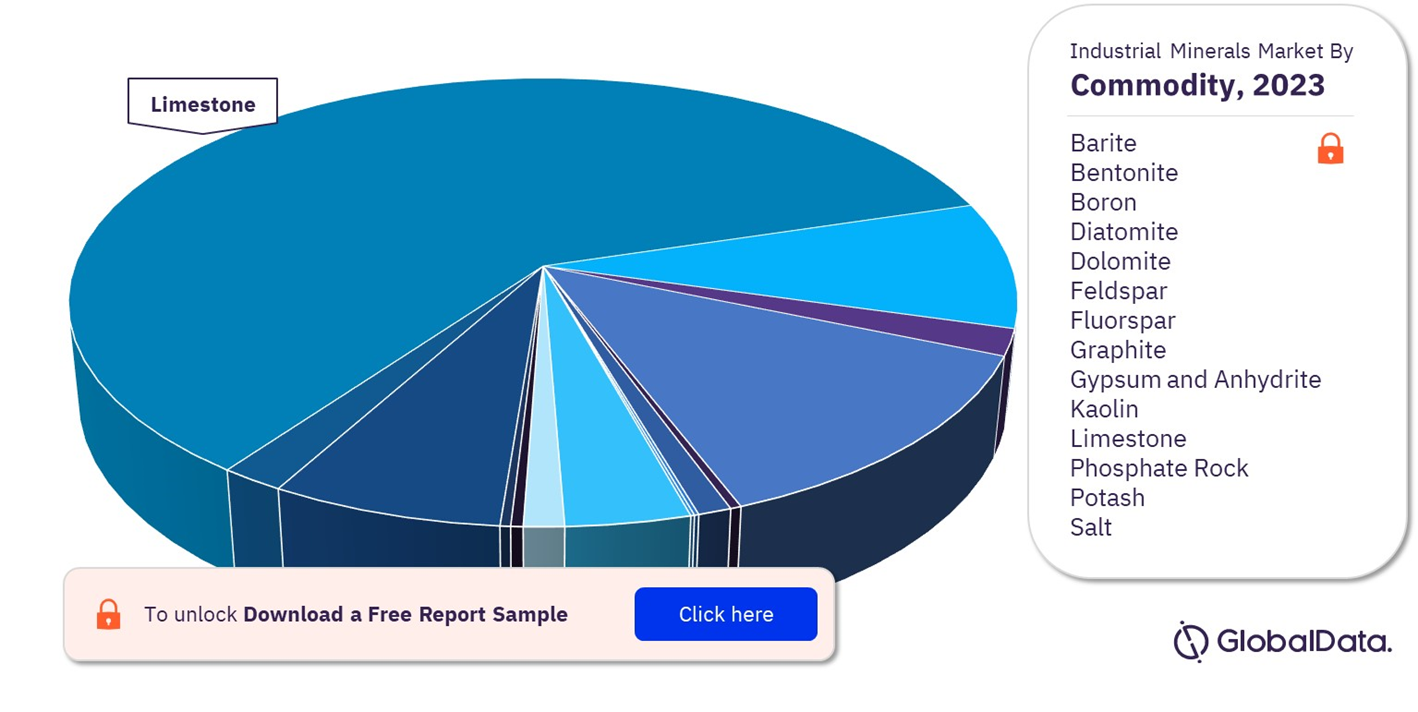

Industrial Minerals Market Segmentation by Commodity

The commodity segment comprises 14 minerals including barite, bentonite, boron, diatomite, dolomite, feldspar, fluorspar, graphite, gypsum and anhydrite, kaolin, limestone, phosphate rock, potash, and salt. Among these aforementioned categories, the limestone section is estimated to dominate the volumetric demand in 2023. The limestone segment will remain the dominant segment over the forecast period with marginal share loss expected by 2030.

Industrial Minerals Market Share by Commodity, 2023 (%)

Fetch sample PDF for Segment-Specific Revenues and Shares, Download a Free Report Sample

The second largest segment within the commodity category is salt in 2023. The use of this commodity for deicing purposes coupled with its usage in the chemical manufacturing vertical is anticipated to drive the segmental growth over the forecast period.

The phosphate rock category is poised to become the third-largest commodity category in 2023. However, this segment is predicted to expand at a low compounded annual growth rate of 1.4% from 2023 to 2030. The primary reason for this sluggish growth is the disruption of the supply chain, ongoing geo-political conflicts, and the increasing popularity of natural way of farming.

The usage of gypsum and anhydrite minerals in processed and unprocessed forms especially in the construction sector is directly aiding the segmental growth over the past few years. This trend is likely to continue with the predicted recovery of the construction sector in 2024.

Dolomite is the next category accounting for a single digit share in the global market space in 2023 This mineral expanded at 1.1% in 2023 as compared to the previous year, primarily boosted by steady demand from the construction vertical.

Industrial Minerals Market Segmentation by End-Use

The end-use category of the industrial minerals market comprises of construction & material, chemical, ceramic & glass, and others. Among these end-use segments, the construction & material vertical is anticipated to capture the largest volumetric share in 2023. The average consumption of industrial minerals within the construction & material end-use sector is the highest as compared to its counterparts. For instance, as per the stats published by the European Union, an average house comprises more than 150 tonnes of industrial minerals. This trend is anticipated to progress further with the increasing emphasis on climate-friendly materials for construction.

Industrial Minerals Market Share by End-Use, 2023 (%)

Industrial Minerals Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The chemical segment accounted for a generous global volumetric demand share in 2023. The usage of the commodity in the manufacturing of different base chemicals, agrochemicals, retardants, absorbents, paints & coatings, adhesives & sealants, among others is likely to drive the segmental growth over the forecast period.

The ceramic & glass category directly or indirectly employs the usage of industrial minerals in processed or unprocessed forms. The segment is predicted to grow at a stable compounded annual growth rate of 2.4% in terms of volume from 2023 to 2030. The rising prominence of glass wall facades in commercial spaces is expected to positively aid segmental growth over the forecast period.

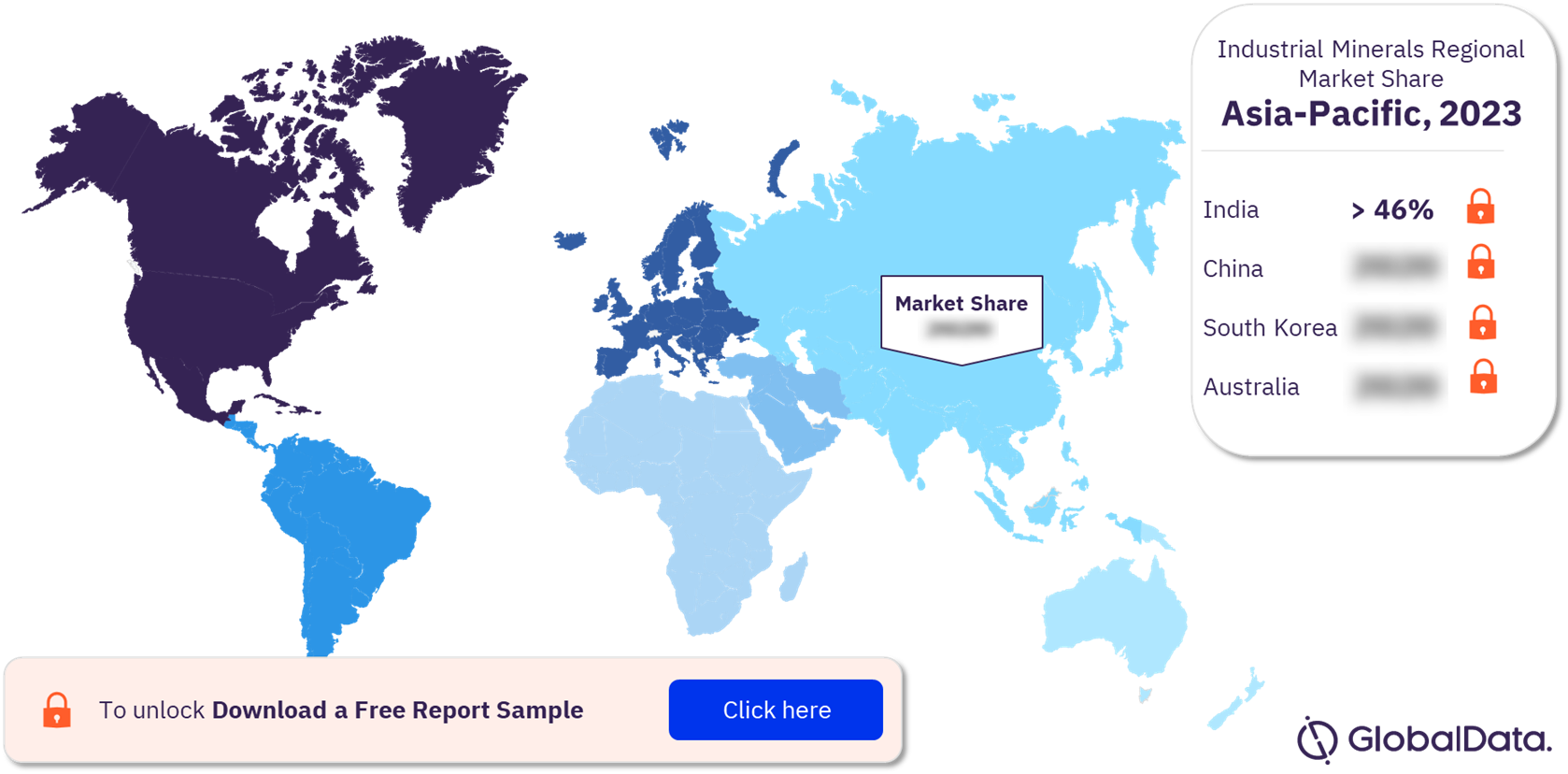

Industrial Minerals Market Analysis by Region

The Asia Pacific region registered a majority of global volumetric demand share in 2023. The regional growth prospects showcase strong consumption rate for these commodities particularly in the construction vertical. The region is the largest construction sector in the world and thus, the movement of this vertical is anticipated to directly deliver the growth for the industrial minerals market over the forecast period.

China, India, Australia, and South Korea are among the leading countries in the Asia Pacific region. These four countries have a combined three-fourth of the regional share in 2023. Among these, India is estimated to remain the key center of demand for industrial minerals over the forecast period owing to the rapidly expanding domestic construction sector.

Asia-Pacific Industrial Minerals Market Share by Country, 2023 (%)

View Sample Report for Additional Industrial Minerals Market Insights, Download a Free Report Sample

North America is poised to remain the second largest region in 2023. The regional demand traits are widely influenced by the US owing to its significant regional share in terms of volume over the aforementioned timeline. The US construction activities are predicted to register sluggish growth in 2023 owing rise in construction costs, interest rates, and cost of living.

The Europe region is expected to expand at a slowest compounded annual growth rate (CAGR) of 1.1% from 2023 to 2030. The primary reason for this stagnant growth is the ongoing conflict between Russia and Ukraine which has directly increased the energy cost in the region coupled with a disrupted supply of ceramic minerals. Ukraine is considered a key source of ceramic minerals and an important trade partner for the ceramic industries of Spain, Turkey, Italy, and others. The ongoing conflict has upset the confidence level of the ceramic vendors leading to a price war to secure the commodity supply.

The Middle East & Africa region is predicted to register the second-highest compounded annual growth rate of 2.9% over the forecast period. The regional dynamics are anticipated to be supported by the GCC construction vertical. The arrival and launching of new mega projects in the region are likely to generate stable demand for industrial minerals over the forecast period.

Central & South America is the smallest regional market with primary demand generated from Brazil. However, the economic slowdown in Brazil and remaining regional countries with rising inflation costs is expected to remain a key restraint for the growth of industrial minerals over the forecast period.

Industrial Minerals Market – Competitive Landscape

The industrial minerals market is highly competitive especially at the regional level. The low cost and high volume of this commodity often restraint its trade movement and directly promotes the usage of local minerals. However, the majority of the vendors present in this market are integrated from mining operations to manufacturing of finished product used across different end-use verticals.

The industrial minerals world is observing market consolidation at a regional level. For instance, in October 2022, KaMin LLC a renowned vendor that mines, manufactures, and distributes a wide variety of minerals and related solutions acquired BASF’s kaolin business segment in the US. The acquisition includes four production sites, two processing facilities, and mines.

Leading Players in the Industrial Minerals Market

- The Mosaic Co

- Yara International ASA

- Israel Corporation Ltd

- Saudi Arabian Mining Co

- Nutrien Ltd

- Holcim Ltd

- CRH Plc

- Vulcan Materials Co

- UltraTech Cement Ltd

- CEMEX SAB de CV

- Imerys SA

- K+S AG

- SCR-Sibelco NV

- Compagnie de Saint-Gobain

- Syrah Resources Ltd

Other Industrial Minerals Market Vendors Mentioned

WA Kaolin Ltd, Thiele Kaolin Company, KaMin LLC, Gypsum Resources Materials, Ashapura Group, Quarzwerke GmbH, Boral Ltd, Knauf Group, and many more.

To Know More About Leading Industrial Minerals Market Players, Download a Free Report Sample

Industrial Minerals Market Research Scope

| Market Size in 2023 | 2,377.7 Million Tonnes |

| Market Size in 2030 | 2,909.8 Million Tonnes |

| CAGR | 2.8% from 2023 to 2030 |

| Forecast Period | 2023-2030 |

| Historic Data | 2020 – 2022 |

| Report Scope & Coverage | Industry overview, volume forecast, regional analysis, competitive landscape, company profiles, growth trends |

| Commodity Segment | Barite, Bentonite, Boron, Diatomite, Dolomite, Feldspar, Fluorspar, Graphite, Gypsum And Anhydrite, Kaolin, Limestone, Phosphate Rock, Potash, and Salt |

| End-Use Segment | Construction & Material, Chemical, Ceramic & Glass, and Others |

| Regional Segment | North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

| Country Segment | US, Canada, Germany, France, UK, Spain, Russia, China, India, Australia, South Korea, Brazil, Saudi Arabia, South Africa |

| Key Companies | The Mosaic Co, Yara International ASA, Israel Corporation Ltd, Saudi Arabian Mining Co, Nutrien Ltd, Holcim Ltd, CRH Plc, Vulcan Materials Co, UltraTech Cement Ltd, CEMEX SAB de CV, Imerys SA, K+S AG, SCR-Sibelco NV, Compagnie de Saint-Gobain, Syrah Resources Ltd |

Industrial Minerals Market Segments and Scope

GlobalData Plc has segmented the industrial minerals market report by commodity, end-use, and region:

Industrial Minerals Commodity Outlook (Volume, Thousand Tonnes, 2020-2030)

- Barite

- Bentonite

- Boron

- Diatomite

- Dolomite

- Feldspar

- Fluorspar

- Graphite

- Gypsum and Anhydrite

- Kaolin

- Limestone

- Phosphate Rock

- Potash

- Salt

Industrial Minerals End-Use Outlook (Volume, Thousand Tonnes, 2020-2030)

- Construction & Material

- Chemical

- Ceramic & Glass

- Others

Industrial Minerals Regional Outlook (Volume, Thousand Tonnes, 2020-2030)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Key Players

The Mosaic CoYara International ASA

Israel Corporation Ltd

Saudi Arabian Mining Co

Nutrien Ltd

Holcim Ltd

CRH Plc

Vulcan Materials Co

UltraTech Cement Ltd

CEMEX SAB de CV

Imerys SA

K+S AG

SCR-Sibelco NV

Compagnie de Saint-Gobain

Syrah Resources Ltd

Table of Contents

Figures

Frequently asked questions

-

What will be the industrial minerals market size in 2023?

The industrial minerals market size globally will reach 2,377.7 Million Tonnes in 2023.

-

What is the industrial minerals market growth rate?

The industrial minerals market is expected to grow at a CAGR of 2.8% over the forecast period (2023-2030).

-

What are the key industrial minerals market drivers?

The expansion of the construction sector with a focus on infrastructural development and the growing chemical manufacturing vertical are anticipated to remain key drivers for industrial minerals market growth over the forecast period.

-

What are the key industrial minerals market segments?

Commodity Segments: Barite, Bentonite, Boron, Diatomite, Dolomite, Feldspar, Fluorspar, Graphite, Gypsum and Anhydrite, Kaolin, Limestone, Phosphate Rock, Potash, and Salt

End-Use Segments: Construction & Material, Chemical, Ceramic & Glass, and Others

-

Which are the leading industrial minerals companies?

The leading industrial minerals companies are The Mosaic Co, KaMin LLC, Imerys, Sibelco, Quarzwerke GmbH, Thiele Kaolin Company, I-Minerals Inc., Gypsum Resources Materials, Ashapura Group, Clariant, Ma’aden, Omya AG, Minerals Technologies Inc., Vulcan Materials Company, and CRH Americas Materials, Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.