Inflation in Consumer Goods – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Inflation in Consumer Goods Report Overview

Inflation is expected to remain volatile during the decade due to several macroeconomic issues. Inflation saw a sharp increase across key markets in 2021 as lockdowns eased putting pressure on services and supply chains to readjust to a change in the pace of consumption. In 2022, inflationary pressure was intensified by Russia’s invasion of Ukraine, creating shortages of key commodities including gas, driving energy prices. However, from 2023 to 2024 the inflation rate will steady as consumers cut their consumption due to being more budget constrained.

Inflation in Consumer Goods Theme Outlook

This report provides an overview of the inflation theme, the causes, the current macroeconomic climate and outlook, and inflation’s impact on consumer goods businesses and consumers.

| Key Factors Aiding Companies Cope with Inflation | Supply Chain Disruptions, Labor Shortages, Changes in Consumer Behavior, Interest Rates, And Government Policies |

| Key Companies | Nestle SA, PepsiCo Inc, Unilever Plc, the Coca-Cola Co, and Diageo Plc |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Inflation in Consumer Goods – Key Factors Aiding Companies Cope with Inflation

Some key factors transforming how companies cope with inflation are supply chain disruptions, labor shortages, changes in consumer behavior, interest rates, and government policies.

Supply chain disruptions: Inflation is often caused by supply chain disruptions, such as raw material shortages and transportation delays. These disruptions can cause prices to rise and make it difficult for companies to obtain the resources they need to manufacture their products, forcing companies to reassess their supply chains and find ways to mitigate the impact of these disruptions.

Government policies: Government policies can also impact how companies deal with inflation. For example, changes to trade policies or taxes can affect the cost of raw materials and ultimately impact prices, so companies may need to adjust their strategies to account for these changes.

Changes in consumer behavior: Consumers are also changing the way they shop and buy products. Many are now more price-sensitive and are looking for bargains and discounts which could involve switching to alternative brands, encouraging companies to adapt by offering promotions and sales to attract customers.

Buy the Full Report or Download a Free Sample Report for Additional Insights on Key Factors Enabling Companies to Cope with Inflation

Inflation in Consumer Goods – Current Economic Climate

Inflation will remain volatile this decade as macroeconomic issues persist. However, from 2023 to 2024 the inflation rate will steady as consumers cut their consumption due to being more budget-constrained.

GDP in key markets is strong for industrial and manufacturing economies. Large industrial and manufacturing economies such as India and China are unsurprisingly expected to record the fastest GDP growth from 2023 to 2024 as these countries have rapidly rebounded from stalled activity during the pandemic.

Labor shortages have also been a key driver of inflation. The scarcity of labor has been one of the key factors driving inflation alongside raw material and energy shortages. North America, Europe, and Japan have suffered the most from labor shortages due to their aging populations and, in some cases, the disrupted flow of foreign workers. In most top Western economies, employment levels have remained neutral or increased since before the pandemic, meaning there are fewer people seeking jobs compared to those in Asia where employment levels were falling. The labor cost index has also seen significant increases, revealing high demand for workers as employers increase wages to encourage new recruits.

Download the Free Sample Report or Buy the Full Report for More Insights on the Current Economic Climate in the Inflation in Consumer Goods Theme

Inflation in Consumer Goods – Signals

The inflation in consumer goods thematic report provides detailed insights on key signals including company filings analysis, news analysis, and social media analytics.

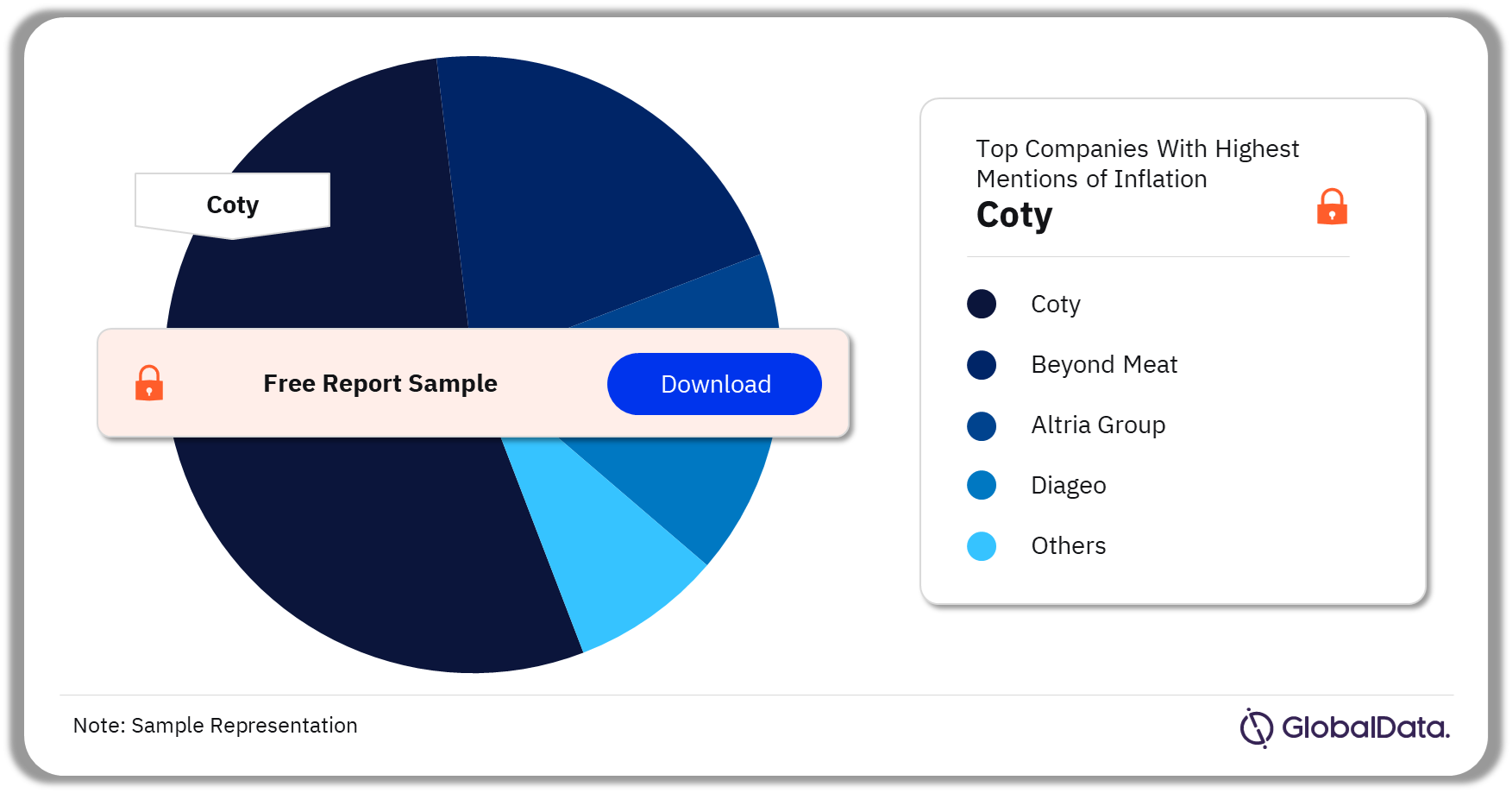

Company Filings Analysis: The number of companies mentioning inflation in their filings was at its highest in the latter three quarters of 2022 as companies began to realize the extent of inflation’s impact on their operations. Coty mentioned inflation more than any consumer goods company. Coty’s recent strong financial performance is being driven by ‘hi-lo’ consumption patterns. Consumers are upping their spending on small luxuries such as makeup while larger expenditures have been compromised because of inflationary pressure. The top 10 consumer goods companies with the highest number of mentions of inflation in 2022 were Coty, Beyond Meat, Altria Group, Diageo, Modelez International, Revlon, Brown-Forman, Unilever, International Flavors & Fragrances, and Keurig Dr Pepper among others.

Top 10 Consumer Goods Companies by Number of Mentions of Inflation, 2022 (%)

Download the Free Sample or Buy the Full Report for More Information on Company Filings Analysis in the Inflation in Consumer Goods Theme

Inflation in Consumer Goods – Key Companies

The consumer goods companies with the greatest exposure to the global macro-outlook theme are mainly food and beverage companies including Nestle SA, PepsiCo Inc, Unilever Plc, the Coca-Cola Co, and Diageo Plc. All major consumer goods companies have raised prices, but they have found alternative ways to drive value for their customers.

Nestle SA: In 2022 Nestlé announced it would be cutting SKUs that were underperforming to cope with cost pressures and supply chain disruption so that it could put greater focus on its core SKUs. At its most recent investors seminar in November 2022, it announced a value creation model to drive growth digitalization and development of its nutrition and health portfolio through Nestlé Health Science. The company announced organic sales growth of 8.3% in 2022 although its profit margins dropped despite several price hikes announced in 2022 and more expected in 2023.

Key Companies in the Inflation in Consumer Goods Theme

Buy the Full Report or Download the Free Sample to Know More About the Key Companies in the Inflation in Consumer Goods Theme

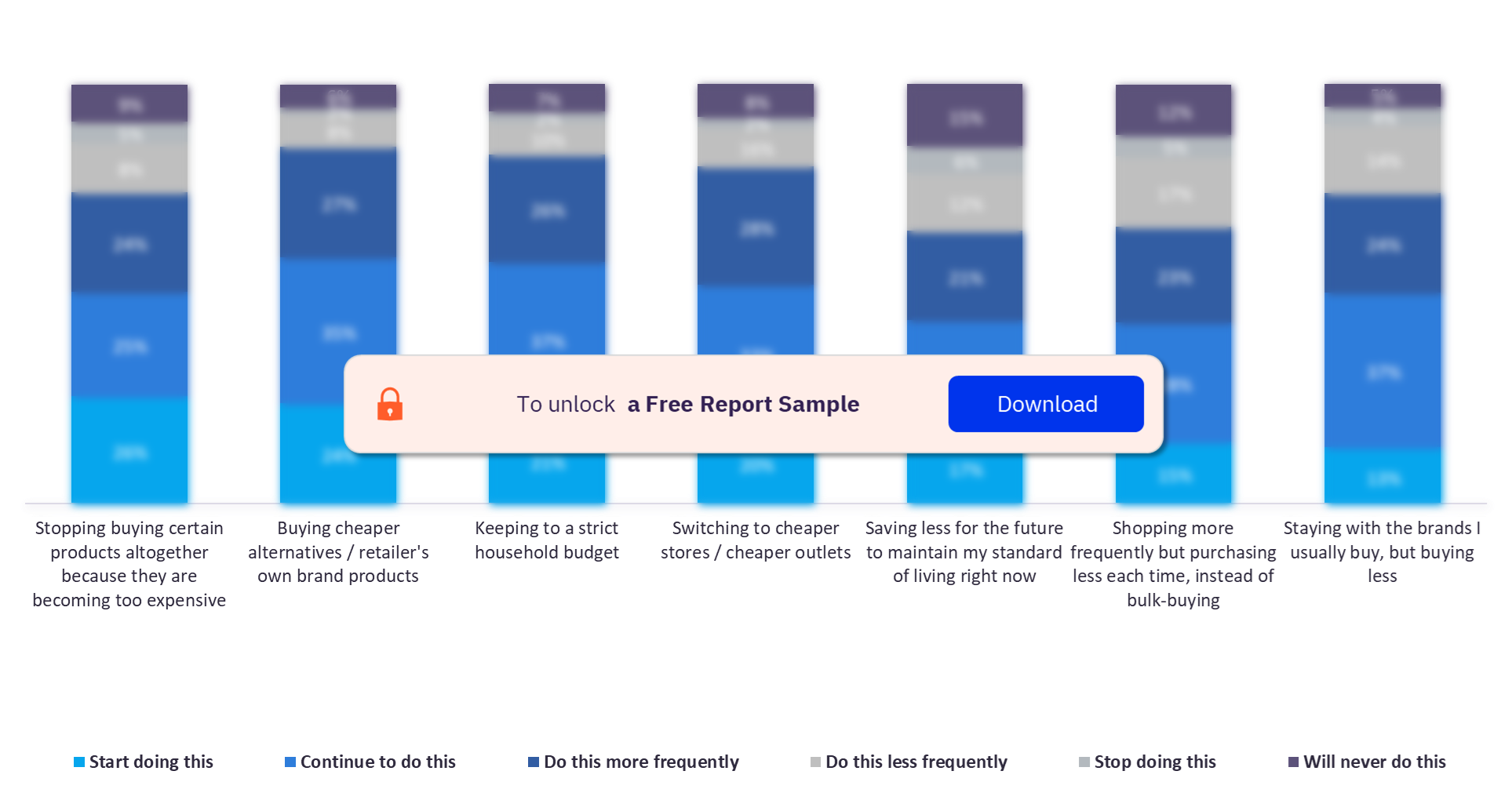

Inflation in Consumer Goods – Consumer Impact

Increasing product prices, surging value ranges, and streamlining the supply chain are the most promising factors for companies to combat inflation. Business priorities to combat inflation are often detrimental to consumers. Consumers across all demographics are concerned about the impact of inflation on their household budget. This has further led consumers to switch to cheaper alternatives to align with strict household budgets. Consumers are actively reassessing purchasing priorities. This has further changed the purchasing behavior of consumers toward the brands. One of the most common moves is buying cheaper product alternatives or retailer’s own-brand products, aiming to shop what they want but maintaining their overall spending. The rise of private-label products will continue, as retailers innovate their own-brand ranges to compete through quality and accessibility.

Key Factors Influencing Consumer Purchasing Behavior in Inflation in Consumer Goods Theme

Buy the Full Report or Download the Free Sample to Know More About the Key Consumer Purchasing Behavior in the Inflation in Consumer Goods Theme

Inflation in Consumer Goods – Pricing Trends

For both the UK and US markets, food and non-alcoholic beverages saw the biggest increases in average product price online over the 12 months. The raw materials used to make goods in these sectors have been particularly vulnerable to inflation, driven by factors such as the Ukraine war and climate change. Despite ingredient shortage pressures in alcoholic beverages, price changes were comparatively steady across all three markets, suggesting eased demand due to a global health trend toward moderated consumption. Cosmetics, toiletries, and household products have lower consumption levels than food and beverage products but have not been immune to price increases as long ingredient lists leave these sectors vulnerable to inflation.

Pricing Trends in Inflation in Consumer Goods Theme

Buy the Full Report or Download the Free Sample to Know More About the Key Pricing Trends in the Inflation in Consumer Goods Theme

Scope

- Although there can be no real winners in inflation, there are several factors shaping how consumers goods companies cope including supply chain disruption, labor shortages, changes in consumer behavior, interest rates, and government policies.

- Inflation is easing but will remain volatile for the rest of the decade with a recession looming after 2023.

- Brands continue to drive value despite rising costs, and digitalization investment will alleviate cost pressures.

Key Highlights

- Although there can be no real winners in inflation, several factors shape how consumer goods companies cope, including supply chain disruption, labor shortages, changes in consumer behavior, interest rates, and government policies.

- Inflation is easing but will remain volatile for the rest of the decade with a recession looming after 2023.

Reasons to Buy

- Gain insight into the factors driving inflation

- Identify how consumer goods companies are coping with and responding to inflation.

- Discover how consumers are changing their behavior patterns in response to inflation.

- Understand where the inflation theme is headed beyond 2023.

pepsico

unilever

coca cola

diageo

Table of Contents

Frequently asked questions

-

What are the key factors aiding companies cope with inflation?

Some key factors transforming how companies cope with inflation are supply chain disruptions, labor shortages, changes in consumer behavior, interest rates, and government policies.

-

Which were the Top 10 consumer goods companies with the highest number of mentions of inflation in 2022?

The top 10 consumer goods companies with the highest number of mentions of inflation in 2022 were Coty, Beyond Meat, Altria Group, Diageo, Modelez International, Revlon, Brown-Forman, Unilever, International Flavors & Fragrances, and Keurig Dr Pepper among others in 2022.

-

Which are the key companies in the inflation in the consumer goods theme?

Nestle SA, PepsiCo Inc, Unilever Plc, the Coca-Cola Co, and Diageo Plc are some of the key companies in the inflation in the consumer goods theme.

-

Which sector witnessed the highest increases in price for both the UK and US markets?

For both the UK and US markets, food and non-alcoholic beverages saw the biggest increases in average product price online over the 12 months.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Consumer Goods reports