Innovation in Payments – Reward Programs, Payment Loyalty by Region and Consumer Attitudes

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Innovation in Payments Report Overview

Loyalty programs have developed from a simple, unique premise to complex, omnichannel, and personalized programs. Reward points are a key method providers use to attract new customers. Such programs encourage switching, cross-selling, and retention. Most reward programs are focused on either cashback or points.

The innovation in payments report covers the latest innovations by businesses in the payment sector pertaining to reward programs, payment loyalties by region, and consumer attitudes toward loyalty. Furthermore, this report explores trends and innovations in terms of the reward programs offered by banking and payment providers, including an exploration of the various approaches companies are taking across the world.

| Key Reward Types Gaining Traction Among Consumers | · Cashback Rewards

· Points Rewards · Low or Zero Introductory Rates · Discounts at Shops or On Fuel · Air Miles or Travel-Related Benefits · Premium Cards (Metal or Wooden Card) · Concierge Services |

|

| Key Regions for Payment Loyalties | · Americas

· Europe · Asia-Pacific |

|

| Key Banks or Companies | · Chase

· American Express · Citi · CapitalOne · Discover · Scotiabank · Bank of Montreal (BMO) · BBVA Bancomer · Santander · HSBC · Standard Chartered |

|

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. | |

Buy the Full Report for Additional Highlights on the Key Innovations in the Payments Industry or Download a Free Sample Report

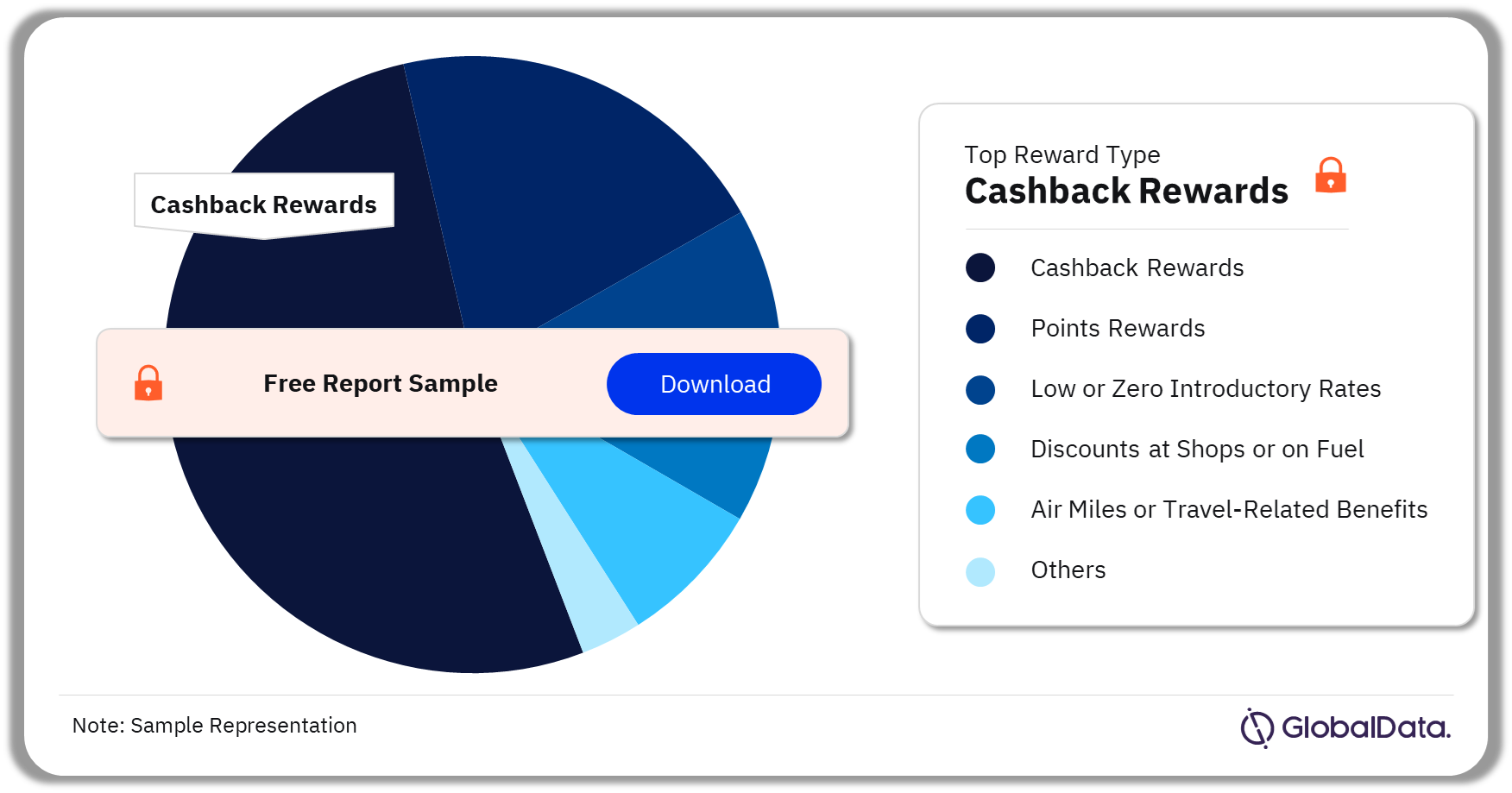

Innovation in Payments Industry Segmentation by Reward Types

The key reward types gaining traction among consumers are cashback rewards, points rewards, low or zero introductory rates, discounts at shops or on fuel, air miles or travel-related benefits, premium cards (metal or wooden cards), and concierge services among others. In 2022, cashback rewards emerged as the most attractive reward types among consumers either applying for or looking forward to owning their credit cards. The popularity of cashback rewards has impacted all age groups and across all affluence bands (retail, middle emerging affluent, mass affluent, and others) positively. This is also anticipated to accelerate innovation in the payments industry.

Innovation in Payments Industry Analysis by Reward Types, 2022 (%)

Download the Free Sample Report or Buy the Full Report for Insights into Reward Types in the Innovation in Payments Report

Innovation in Payment Loyalty by Region

The key regions looking forward to bringing a positive impact in the payments sector by continuously innovating as per the consumer needs are Asia-Pacific, the Americas, and Europe.

Payment Loyalty in the Americas: Some of the key countries in the region offering innovative payment offers on both credit and debit cards are the US, Canada, and Mexico. Travel benefits and cashback rewards are the most popular reward types in these economies. Companies or banks such as Citibank, Capital One, American Express, Bank of Montreal, and Scotiabank are coming up with new plans to engage existing consumers and attract new ones with their innovative payment programs and initiatives. For instance, Aeroplan is a reward program offered via TD Bank, CIBC, Royal Bank of Canada, and American Express in association with Air Canada, one of Canada’s largest airlines. This program offers reward points that can be redeemed for flights, accommodation, and car rentals at partner airlines, hotels, and car rental agencies.

Payment Loyalty in Europe: Cashback offers and partnerships with retailers are common rewards offered by credit cards in the UK. In many European markets, loyalty schemes are used to entice new customers and boost payment transactions. The rewards are essentially funded by the interchange fees received from transactions. Some of the key banks such as NatWest and Tesco Bank among others are introducing unique payment programs to strengthen their position in the market. For instance, NatWest payment card rewards mainly focus on cashback offers. The bank partners with several retailers to provide improved cashback rewards.

Payment Loyalty in Asia-Pacific: Most Australian issuers partner with airlines as part of their loyalty programs. In addition to loyalty point schemes, some payment card issuers offer direct cashback incentives. Furthermore, banks in Singapore provide a competitive market for credit card rewards. Banks offer a wide range of reward programs designed to attract different segments of the market. Furthermore, Indians have leapfrogged from payment cards to mobile wallet loyalty programs. For instance, one of the largest mobile wallets in India, Paytm offers a membership-based loyalty program known as Paytm First. In addition, PhonePe is a leading digital wallet and payment service based in India.

Download the Free Sample Report or Buy the Full Report for Regional Insights in the Innovation in Payments Report

Scope

Alternative payment methods have disrupted the payments space. To address such challenges, credit cards fees have been reduced across the world. However, these reductions mean that issuers have had to scale back their loyalty programs.

The COVID-19 pandemic heavily impacted the travel industry. Consumers who used to be frequent travelers dramatically reduced their spending on big-ticket items such as flight and hotel bookings, meaning that travel benefits became much less appealing.

Due to consumers switching providers repeatedly to maximize short-term benefits, issuers have attached conditions for releasing bonuses, such as reaching specific spending milestones on cards.

Key Highlights

- Alternative payment methods have disrupted the payment space. To address such challenges, credit card fees have been reduced across the world. However, these reductions mean that issuers have had to scale back their loyalty programs.

- The COVID-19 pandemic heavily impacted the travel industry. Consumers who used to be frequent travelers dramatically reduced their spending on big-ticket items such as flight and hotel bookings, meaning that travel benefits became much less appealing.

- Due to consumers switching providers repeatedly to maximize short-term benefits, issuers have attached conditions for releasing bonuses, such as reaching specific spending milestones on cards.

Reasons to Buy

- Understand current and future trends for card-based reward programs.

- Identify key players in the reward program space and learn about their offerings.

- Discover consumer preferences and attitudes towards reward programs using GlobalData surveying.

ANZ

Bank of Montreal

Barclaycard

BBVA

BNP Paribas

Citibank

Capital One

CBA

DBS

Discover

Costco

Chase

Delta

Google Pay

HSBC

ING

NAB

NatWest

OCBC

Paytm

PhonePe

Standard Chartered

Santander

Scotiabank

TD

Tesco Bank

Westpac

UniCredit

Deutschland Card

British Airways

Marriott

Southwest

United

Hyatt

Etihad

Finnair

Emirates

Iberia

Qantas

SAS

Singapore Airlines

Virgin Atlantic

Hilton

Radisson

Table of Contents

Frequently asked questions

-

Which reward type is the most popular among consumers across all age groups and affluence bands?

Cashback rewards emerged as the most attractive reward types among consumers either applying for or looking forward to owning their credit cards.

-

Which regions have the most innovations in the payments sector?

The Americas, Europe, and Asia-Pacific are some of the regions expecting innovation in the payments sector.

-

Which are some of the most innovative reward programs gaining traction in the payments sector?

Google Pay Rewards, PhonePe Rewards, Paytm First, DBS Rewards, BNP Paribas Premier Visa, UniCreditCard, Club de Recompensas HSBC, Puntos Bancomer, Capital One Venture Rewards, and Discover Cashback Bonus are some of the most popular innovative reward programs gaining traction in the payments sector.

-

Which are the leading players with attractive programs and initiatives for the payment sector?

Chase, American Express, Citi, CapitalOne, Discover, Scotiabank, Bank of Montreal (BMO), BBVA Bancomer, Santander, HSBC, Standard Chartered, NatWest, Tesco Bank, and Barclaycard are some of the leading banks or companies with attractive programs and initiatives for the payment sector.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports