Internet of Things (IoT) in Defense – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Internet of Things (IoT) in Defense Thematic Report Overview

The applications of IoT in defense are wide-ranging and include health monitoring, augmented reality (AR) remote training, gaining situational awareness using drones, vehicle management, target recognition, and many more. For instance, smart sensors can be used on military equipment to give data on their health and whether maintenance is needed. This helps reduce operating costs and downtime for military equipment as the sensor can predict when a breakdown is imminent. However, the proliferation of IoT has also brought up security concerns. Interoperability and increased information sharing make cybersecurity more of a threat, as there are increased access points for hackers, and the interconnected nature of IoT means any attack could have devastating consequences.

The Internet of Things (IoT) in Defense thematic intelligence report assesses how IoT, combined with other emerging technologies, can be used across the defense value chain. It provides an overview of the current landscape. The report also includes key players and highlights opportunities for the use of IoT in the future. The report provides an industry-specific analysis based on GlobalData databases and surveys.

| Report Pages | 48 |

| Regions Covered | Global |

| Value Chain | · Physical Layer

· Connectivity Layer · Data Layer · Apps Layer · Services Layer |

| Leading IoT Adopters | · BAE Systems

· Leidos · Lockheed Martin |

| Specialist IoT Vendors | · Anduril

· Elbit Systems · IBM |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

IoT in Defense – Industry Analysis

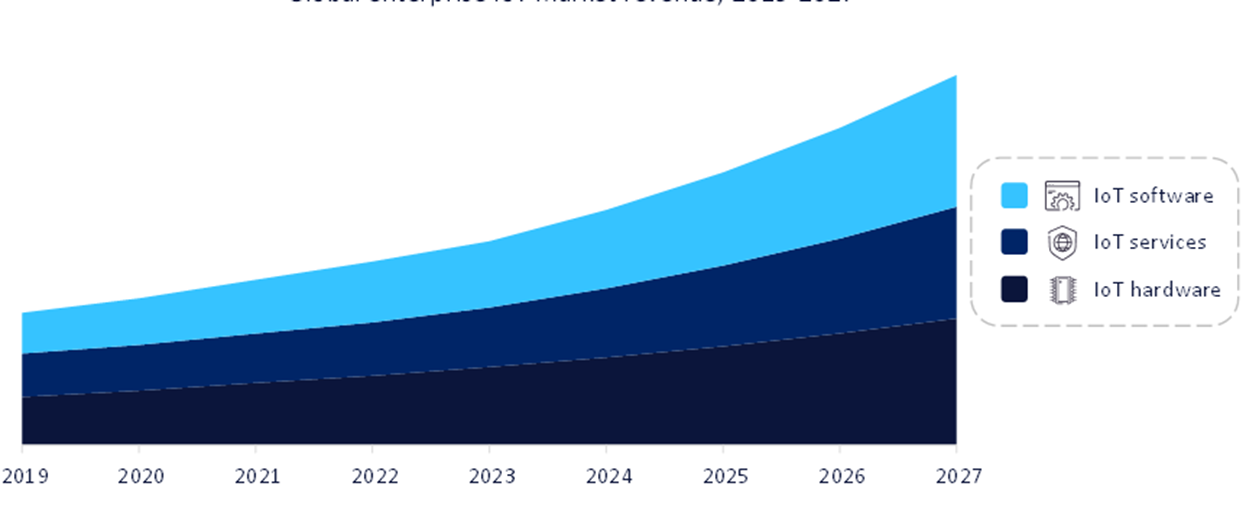

Global enterprise IoT market revenue is expected to reach $1.2 trillion by 2027, with strong growth expected across all major industries. IoT software is predicted to grow at a CAGR of more than 16% between 2022 and 2027, while IoT hardware is predicted to have the slowest growth between 2022 and 2027, growing at a CAGR of more than 12%.

The Internet of Things (IoT) in Defense industry analysis also covers:

- Signals

- Mergers and acquisitions

- Patent trends

- Company filing trends

- Hiring trends

Global Enterprise IoT Market Revenue, 2019-2027 ($ Trillion)

Buy the Full Report for More Industry Insights into the IoT in Defense Market Forecast

IoT in Defense - Value Chain Analysis

The IoT value chain is split into five layers, namely physical, connectivity, data, apps, and services.

Physical layer: This layer can be further subdivided into connected things, cameras and lenses, sensors and microcontrollers, and microprocessors. Today, most connected devices—such as smartphones, tablets, and laptops—have a physical dimension controlled by humans. In the IoT, most connected things will be run by other connected things. For manufacturers of washing machines, door locks, light bulbs, aircraft engines, or cars, the key question is not whether their things should be connected to the internet—that is a given. Instead, the challenge is whether they can retain the bulk of the added value during the transition to IoT and how they can use the data collected by various embedded chips, sensors, antennae, and beacons. Some industry profits will likely be siphoned out by technology companies that increasingly provide IoT solutions as a service.

IoT Value Chain Analysis

Buy the Full Report for More Value Chain Insights into IoT in the Defense Market

IoT in Defense – Competitive Landscape

Leading IoT Adopters in the Defense Sector

Some of the leading defense companies currently deploying IoT are:

- BAE Systems

- Leidos

- Lockheed Martin

Specialist IoT Vendors in the Defense Sector

Some of the specialist IoT vendors in the defense sector are:

- Anduril

- Elbit Systems

- IBM

Buy the Full Report to Know More About the Leading IoT Adopters and Vendors

Consumer Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Consumer Sector Scorecard – Thematic Screen

Buy the Full Report to Know More about the Sector Scorecards

Scope

- The key defense challenges that forces and defense sector suppliers face are covered.

- The investment opportunities for armed forces, suppliers, and institutional investors, across the whole military IoT value chain are covered.

- Highlights from the development programs currently being undertaken by various military organizations and defense companies.

Key Highlights

- Studies of emerging technological trends and their broader impact on the defense market.

- Analysis of the various IoT-related programs and projects currently under development, as well as the impact of emerging technologies such as artificial intelligence on the future outlook of the military IoT theme.

Reasons to Buy

- Determine potential investment companies based on trend analysis and market projections.

- Gaining an understanding of the market challenges and opportunities surrounding the military IoT theme.

- Understanding how spending on military IoT and related segments will fit into the overall market and which spending areas are being prioritized.

Airbus

Anduril

AT&T

Atos

BAE Systems

Black River Systems

Boeing

DXC Technology

Elbit Systems

Fujitsu

General Dynamics

Getac

Honeywell

IBM

L3Harris

Leidos

Leonardo

Lockheed Martin

Microsoft

Northrop Grumman

Palantir

Qinetiq

Rafael

Renesas

Rostec

RTX

Shield AI

Sopra Steria

Systel

Teledyne

Thales

Table of Contents

Frequently asked questions

-

What was the global enterprise IoT market revenue in 2019?

Global enterprise IoT market revenues was $438.5 billion in 2019.

-

What are the key components of the IoT value chain?

The IoT value chain is split into five layers, namely physical, connectivity, data, apps, and services.

-

Who are the leading adopters currently deploying IoT?

Some of the leading defense companies currently deploying IoT are BAE Systems, Leidos, and Lockheed Martin among others.

-

Who are the leading specialist IoT vendors in the defense sector?

Some of the leading specialist IoT vendors in the defense sector are Anduril, Elbit Systems, and IBM among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports