Internet of Things (IoT) in Financial Services – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Internet of Things (IoT) in Financial Services Thematic Report Overview

The Internet of Things is reaching maturity with IoT-related deals and patent activity across the financial services sector declining since 2021. But the progress of IoT in financial services depends on the ability of tech companies to create new devices with smooth user experiences and the ability of financial services companies to comply with data handling laws. The primary driving force behind the adoption of IoT in financial services has been the development of consumer electronics devices by big tech companies like Apple, Google, and Samsung. Financial services companies can embed applications such as payment gateways and health-tracking apps into the interfaces of these devices and gain valuable insights from the data they collect.

The Internet of Things (IoT) in Financial Services thematic intelligence report assesses how IoT, combined with other emerging technologies, can be used across the financial services value chain. It provides an overview of the current landscape. The report also includes key players and highlights opportunities for the use of IoT in the future. The report provides an industry-specific analysis based on GlobalData databases and surveys.

| Report Pages | 77 |

| Regions Covered | Global |

| Market Size (2019) | $23.6 Billion |

| CAGR (2019-2027) | >13% |

| Forecast Period | 2023-2027 |

| Historical Period | 2015-2022 |

| Value Chain | · Physical Layer

· Connectivity Layer · Data Layer · Apps Layer · Services Layer |

| Leading Adopters | · ABN AMRO

· Allianz · Aviva |

| Specialist IoT Vendors | · Armis

· Diebold Nixdorf · FINN |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

IoT in Financial Services – Industry Analysis

IoT software will be the largest revenue segment by 2027.

The IoT market across the financial services sector was valued at $23.6 billion in 2019. The market is expected to achieve a CAGR of more than 13% during 2019-2027. The IoT software will be followed by IoT hardware as the second-largest revenue segment by 2027. Financial services companies will account for a larger share of the software segment than the hardware segment since the majority of NFC-enabled payments occur via smartphones and smartwatches.

Global IoT Revenue across the Financial Services Sector, 2019-2027 ($ Billion)

Buy the Full Report for More Industry Insights into the IoT in Financial Services Market Forecast

IoT in Financial Services - Value Chain Analysis

IoT adopters only realize the value of the application layer in the IoT value chain.

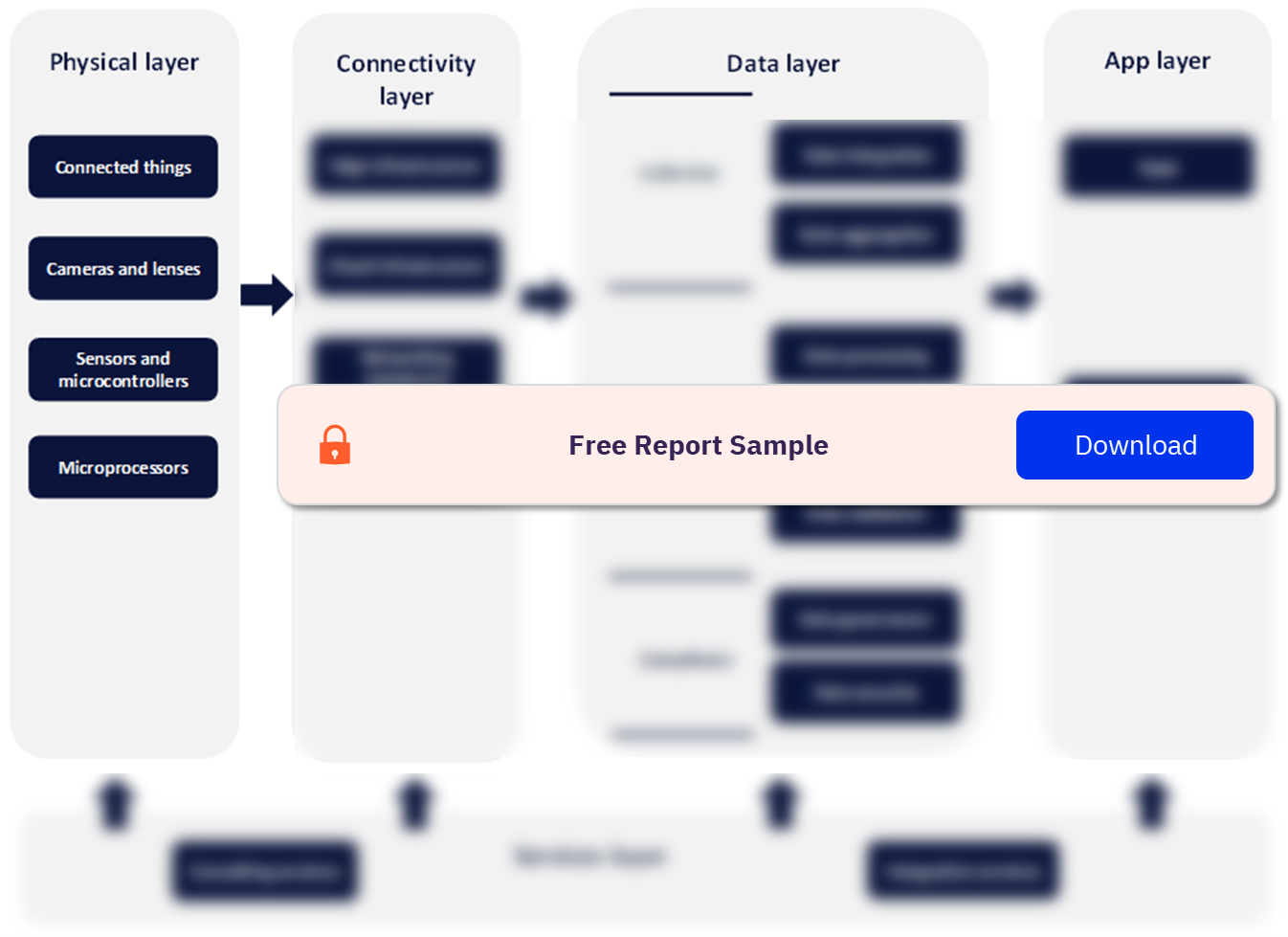

The IoT value chain is split into five layers, namely physical, connectivity, data, apps, and services.

Physical layer: This layer can be further subdivided into connected things, cameras and lenses, sensors and microcontrollers, and microprocessors. Most connected devices such as smartphones, tablets, and laptops have a physical dimension controlled by humans. In the IoT, most such connected things will be run by other connected things. For manufacturers of other devices such as washing machines, door locks, and light bulbs, among others, the challenge is whether they can retain the bulk of the added value during the transition to IoT. Their use of the data collected by various embedded chips, sensors, antennae, and beacons is also in question. Some industry profits will likely be siphoned out by technology companies that increasingly provide IoT solutions as a service.

IoT Value Chain Analysis

Buy the Full Report for More Value Chain Insights into IoT in the Financial Services Market

Leading IoT Adopters

Allianz has become a leader in medical IoT.

Some of the leading financial services companies currently deploying IoT are:

- ABN AMRO

- Allianz

- Aviva

Specialist IoT Vendors

Some of the specialist IoT vendors in the financial services sector are:

- Armis

- Diebold Nixdorf

- FINN

Buy Full Report to Know More About the Leading IoT Adopters and Vendors

Payments Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

The risk screen ranks companies within a particular sector based on overall investment risk.

Payments Sector Scorecard – Thematic Screen

Buy Full Report to Know More about the Sector Scorecards

IoT in Financial Services Sector Scorecard also includes:

- Retail banking sector scorecard

- Life insurance sector scorecard

- Non-life insurance sector scorecard

Scope

• Interactions between customers and connected devices yield two primary business avenues for financial services companies. The first is the ability to embed products and services into user interfaces and applications, ultimately boosting revenue. The second is the treasure trove of customer insights that can be extracted from user-generated data and the subsequent opportunities for more nuanced personalization.

• Software will be the largest IoT revenue segment in the financial services sector, accounting for 34.9% of revenue in 2027.

• US companies dominate IoT-related patent publications in the financial services sector, filing over twice as many patents as China from January 2003 to September 2023.

Key Highlights

- Interactions between customers and connected devices yield two primary business avenues for financial services companies. The first is the ability to embed products and services into user interfaces and applications, ultimately boosting revenue. The second is the treasure trove of customer insights that can be extracted from user-generated data and the subsequent opportunities for more nuanced personalization.

- Software will be the largest IoT revenue segment in the financial services sector.

- US companies dominate IoT-related patent publications in the financial services sector, filing over twice as many patents as China from January 2003 to September 2023.

Reasons to Buy

- Access market size and growth forecasts for IoT in financial services.

- Identify IoT leaders and laggards across payments, retail banking, life insurance, and non-life insurance.

- Understand the key challenges facing the financial services sector and how IoT addresses these challenges.

- Access primary research case study examples of IoT vendors and investment in the financial services sector.

- Understand IoT adoption using alternative datasets and analysis showing M&A activity, mentions of IoT technologies in company filings, and IoT hiring trends in the financial services sector.

Allianz

Armis

Aviva

AXA

Citi

Diebold Nixdorf

FINN

FloodFlash

Hippo

Honey

HSB

ieDigital

JPMorgan Chase

Kontakt.io

Lemonade

Mastercard

Metromile

Microsoft

Octo

Ping An Insurance

Sberbank

Standard Chartered

Swiss Re

Visa

Wells Fargo

Table of Contents

Frequently asked questions

-

What was the size of the IoT market across financial services in 2019?

The IoT market across the financial services sector was valued at $23.6 billion in 2019.

-

What is the IoT market growth rate?

The IoT market is expected to grow at a CAGR of more than 13% during 2019-2027.

-

Who are the leading adopters currently deploying IoT?

Some of the leading financial services companies currently deploying IoT are ABN AMRO, Allianz, and Aviva.

-

Who are the leading specialist IoT vendors in the financial services sector?

Some of the leading specialist IoT vendors in the financial services sector are Armis, Diebold Nixdorf, and FINN.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports