Israel Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Israel Defense Market Report Overview

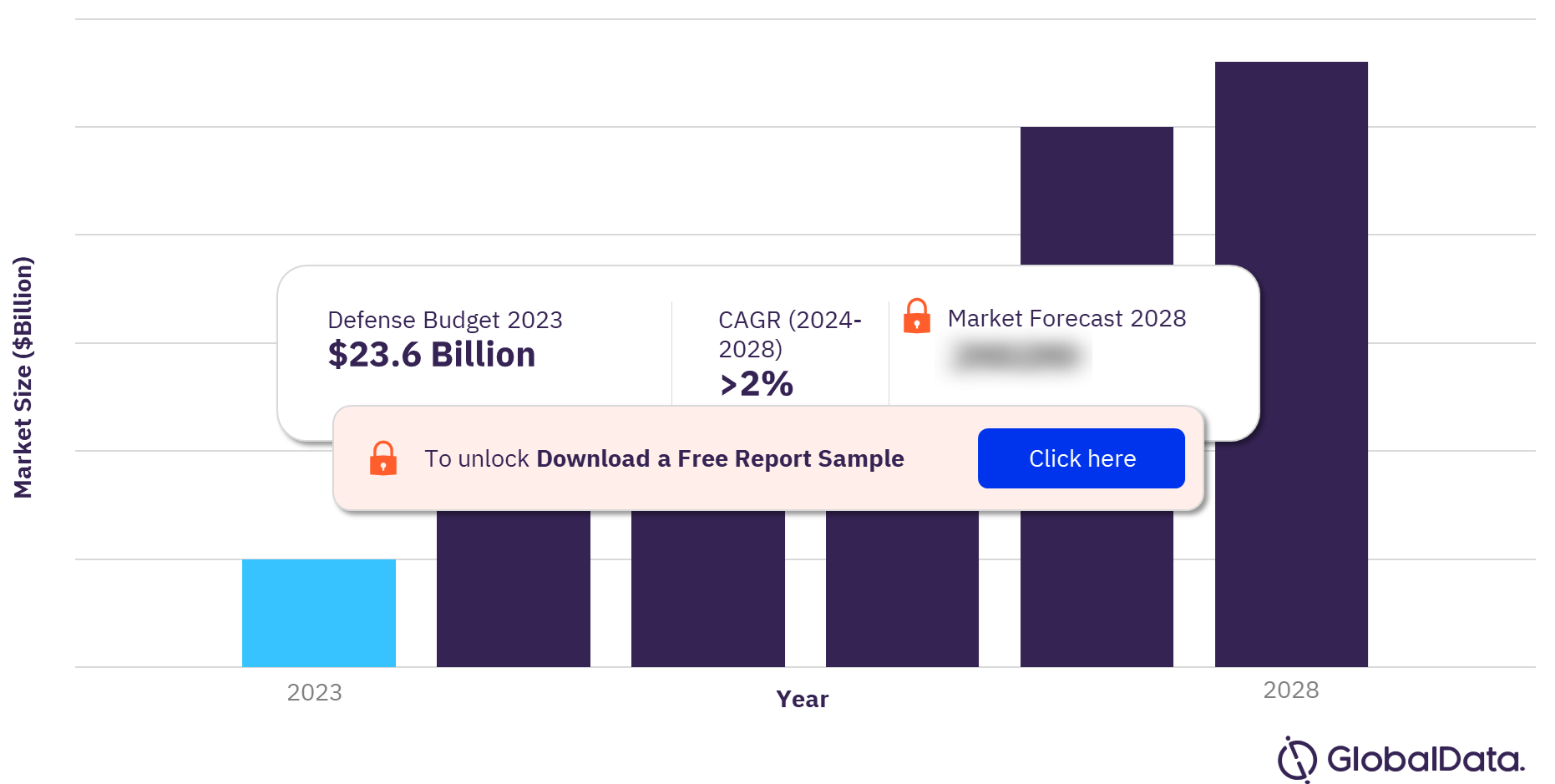

The Israel defense budget inclusive of US aid is estimated to be $23.6 billion in 2023 and is expected to achieve a CAGR of more than 2% during 2024-2028. Over the forecast period, Israeli defense expenditure is anticipated to benefit from an overall improvement in the country’s economy and political stability. As the third largest defense market in the Middle East, after Saudi Arabia and the UAE, Israel is a lucrative defense market.

Israel Defense Market Outlook, 2023-2028 ($ Billion)

To gain more information about the Israel defense market forecast, download a free report sample

The Israel defense market research report provides the market size forecast and the projected growth rate for the next five years. The report covers industry analysis including the key market drivers, emerging technology trends, and major challenges faced by market participants. It also offers insights regarding key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Defense Budget 2023 (inclusive of US aid) | $23.6 billion |

| CAGR (2024-2028) | >2% |

| Forecast Period | 2024-2028 |

| Historic Period | 2019-2023 |

| Key Sectors | · Military Fixed-Wing Aircraft

· Missiles And Missile Defense Systems · Submarines · Military Rotorcraft · Military Land Vehicles · Electronic Warfare · Artillery · Naval Vessels and Surface Combatants · Military Fixed-Wing Aircraft |

| Leading Companies | · Israel Aerospace Industries Ltd

· Rafael Advanced Defense Systems Ltd · Cellebrite Ltd · Bet Shemesh Engines Holdings (1997) Ltd · FMS Enterprises Migun Ltd · Ashot Ashkelon Industries Ltd. · TAT Technologies Ltd · IMCO Industries Ltd · ORBIT Communication Systems Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Israel Defense Market Drivers

Qualitative Military Edge (QME), Border dispute with Palestine, Conflict with Iran, and Threats from terrorist groups, are some of the significant Israel defense market drivers. Israel faces a myriad of security risks from hostile neighbors and a multitude of active terrorist networks along its frontiers. The country maintains a relatively small standing military force, which is attributed to its relatively small population base. As a result, Israel’s survival is dependent on its ability to maintain a significant degree of QME over its adversaries.

Furthermore, Israel and Iran have shared a mutually hostile relationship for over three decades. The ties have deteriorated considerably in the last few years, with both countries becoming involved in a series of conflicts and covert operations against each other. Having severed all diplomatic and commercial ties with Israel, the Islamic government of Iran refuses to acknowledge the legitimacy of Israel as a country.

Israel Military Doctrines and Defense Strategies

Israeli defense doctrine is the mission of the Israeli Defense Forces (IDF) to safeguard territorial integrity, defend the existence and sovereignty of Israel and defend Israeli citizens, and fight against all forms of terrorism which may pose a threat to routine life.

The key premises of the Israeli security concept include maintaining extended periods of security calm. The Israeli defense doctrine calls for the Israeli defense forces to be capable of maintaining extended periods of peace, and to enable the development of science, society, and the economy in addition to enhancing the military’s preparedness to face war or any emergency for which its services could be called upon.

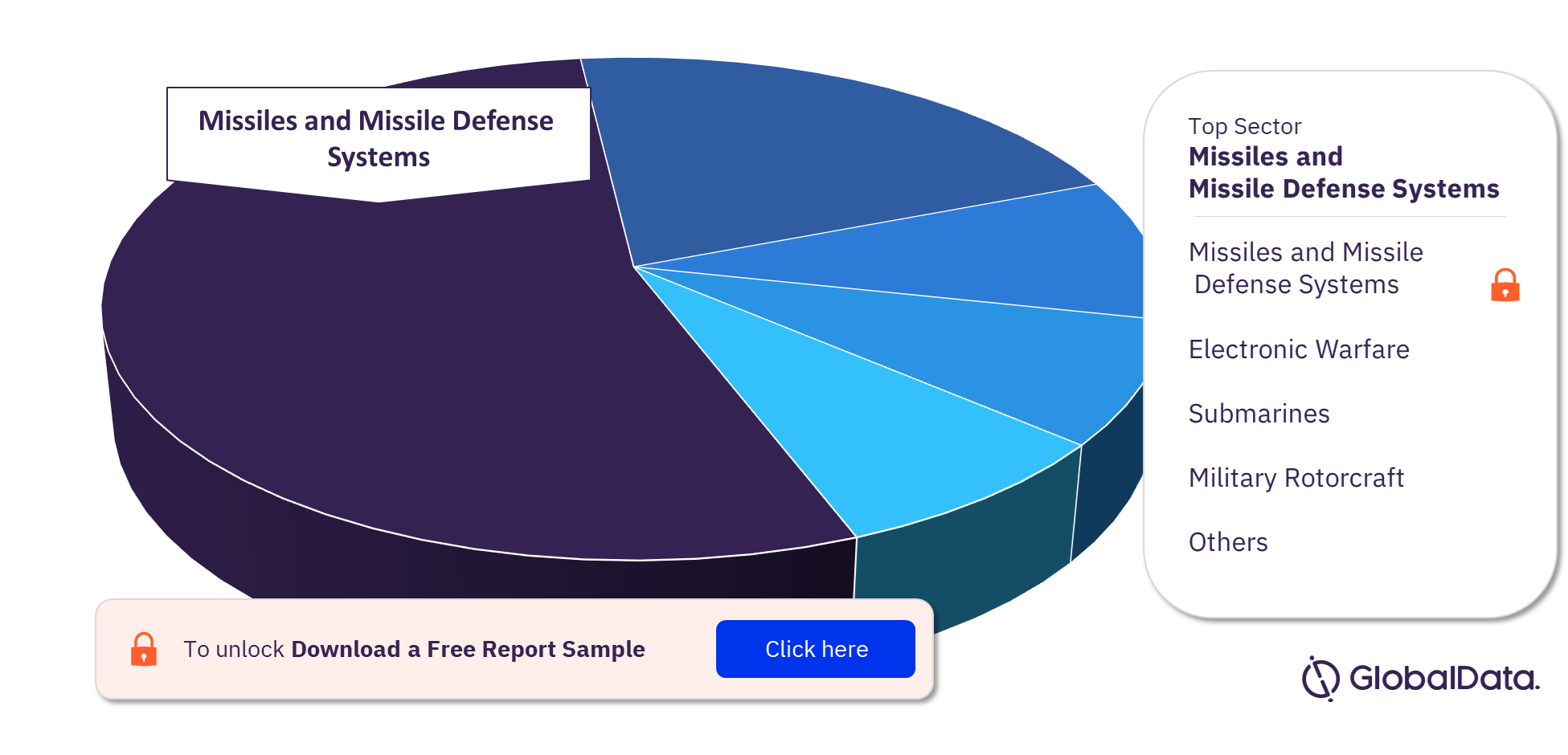

Israel Defense Market Segmentation by Sectors

The key sectors in the Israel defense market are military fixed-wing aircraft, missiles and missile defense systems, submarines, military rotorcraft, military land vehicles, electronic warfare, artillery, naval vessels and surface combatants, and military fixed-wing aircraft, among others. Missiles and missile defense systems is the largest sector in 2023. Platform-based missile defense systems feature as the single largest sub-sector, accounting for a significant value over 2023–28. Israel and the US have co-developed an entire family of Arrow missile defense systems, encompassing the Arrow 1, Arrow 2 (Block-2, Block-3, Block-4, and Block-5), Arrow 3, and the Arrow 4 missile defense system, in addition to the David’s Sling missile defense system.

Israel Defense Market Analysis by Sectors, 2023 (%)

For more sector insights into the Israel defense market, download a free report sample

Israel Defense Market - Competitive Landscape

Some of the leading defense companies in Israel are Israel Aerospace Industries Ltd, Rafael Advanced Defense Systems Ltd, Cellebrite Ltd, Bet Shemesh Engines Holdings (1997) Ltd, FMS Enterprises Migun Ltd, Ashot Ashkelon Industries Ltd., TAT Technologies Ltd, IMCO Industries Ltd, and ORBIT Communication Systems Ltd.

Segments Covered in the Report

Israel Defense Sectors Outlook (Value, US$ Billion, 2019-2028)

- Military Fixed-Wing Aircraft

- Missiles And Missile Defense Systems

- Submarines

- Military Rotorcraft

- Military Land Vehicles

- Electronic Warfare

- Artillery

- Naval Vessels and Surface Combatants

- Military Fixed-Wing Aircraft

Scope

This report offers detailed analysis of Israel defense market with market size forecasts covering the next five years. This report will also analyze factors that influence demand for the industry, key market trends, and challenges faced by industry participants.

It provides an in-depth analysis of the following –

- Israel defense budget: detailed analysis of Israel 2023 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Regulation: the procurement policy and process is explained. This is coupled with an analysis of Israel military doctrine and strategy to provide a comprehensive overview of Israel military procurement regulation.

- Security Environment: political alliances and perceived security threats to Israel are examined; there help to explain trends in spending and modernisation.

- Import and Export Dynamics: analysis of prevalent trends in the country’s imports and exports over the last five years

- Competitive landscape and strategic insights: analysis of the competitive landscape of Israel’s defense industry.

Key Highlights

• Drivers of Defense expenditure include Hostile neighbors, coupled with terror threats, spur defense spending

• Major ongoing procurement program include procurement of F-35A/F-35I Lightning II/Adir,Darkar Class Submar, CH-53K King Stallion

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Israel defense market over the next five years

- Gain in-depth understanding about the underlying factors driving demand for different defense and internal security segments in the French market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Israel defense market providing a clear picture about future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Israel government.

- Make correct business decisions based on in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contract awarded, and financial analysis, wherever available.

Table of Contents

Frequently asked questions

-

What was the Israel defense budget in 2023?

The Israel defense budget inclusive of US aid is estimated to be $23.6 billion in 2023.

-

What is the growth rate of Israel defense budget?

The defense budget in Israel is expected to increase at a CAGR of more than 2% during 2024-2028.

-

Which are the key drivers supporting the growth of Israel defense market?

Qualitative Military Edge (QME) is one of the key factors driving Israel’s defense market.

-

Which sector accounted for the largest Israel defense market?

Missiles and missile defense systems is the largest sector in Israel in 2023.

-

Who are the major players operating in the Israel defense market?

Some of the leading companies in the Israel defense market are Israel Aerospace Industries Ltd, Rafael Advanced Defense Systems Ltd, Cellebrite Ltd, Bet Shemesh Engines Holdings (1997) Ltd, FMS Enterprises Migun Ltd, Ashot Ashkelon Industries Ltd., TAT Technologies Ltd, IMCO Industries Ltd, and ORBIT Communication Systems Ltd.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports