Mammography Equipment Market Size by Segments, Share, Regulatory, Reimbursement, Installed Base and Forecast to 2033

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Mammography Equipment Market Insights

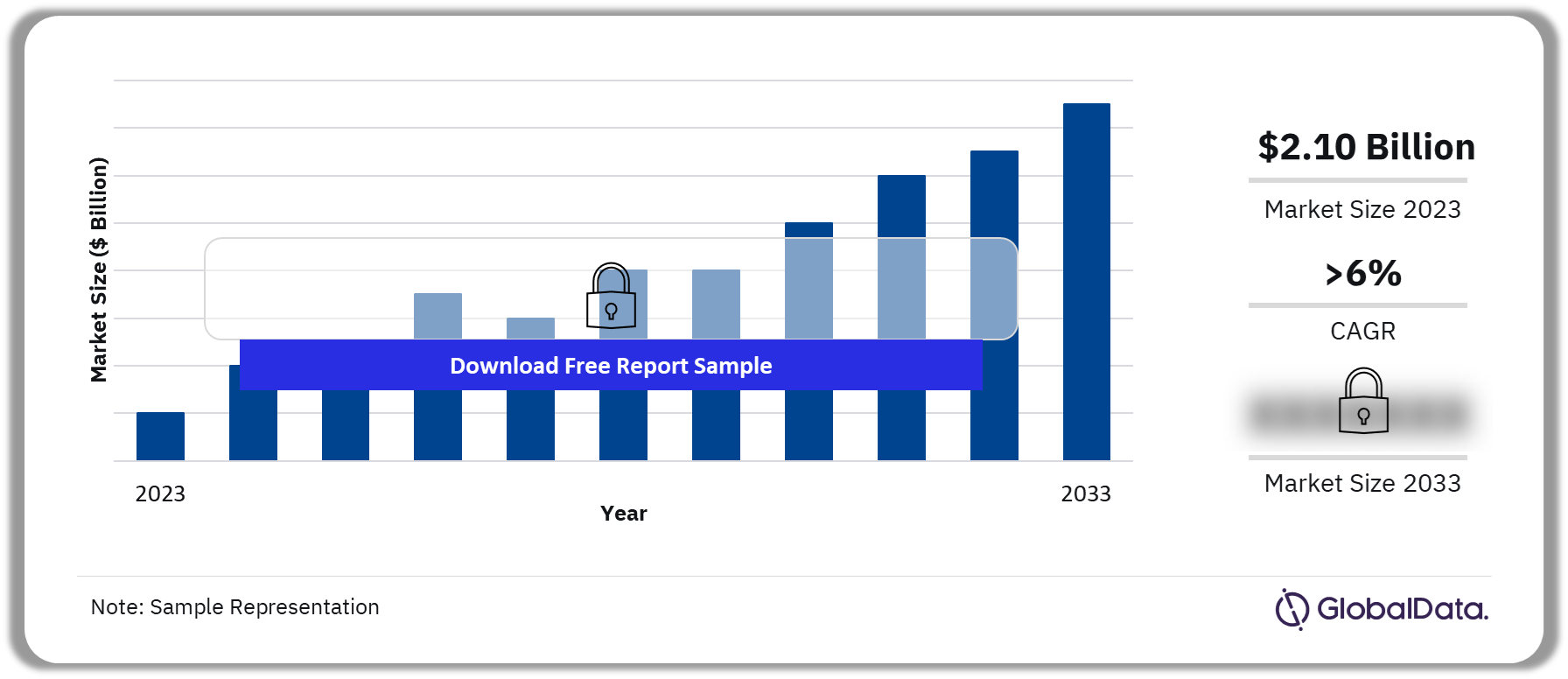

The Mammography Equipment market size was estimated at $2.10 billion in 2023 and is forecast to grow at a CAGR of more than 6% during the forecast period. Mammography systems are used to detect breast cancer, either for screenings or diagnostic procedures. Screenings are important for the early detection of breast cancer. Diagnostic procedures are recommended for patients with suspicious symptoms and are more in-depth than regular screenings.

Mammography Equipment Market Outlook 2023-2033 ($ Billion)

Buy the Full Report for more Insights on Mammography Equipment Market Forecast Download our free sample report

The Mammography Equipment market research report has been created to understand market behavior, which will help identify quantitative market trends in the diagnostic imaging therapeutic area. It discusses in detail the impact of COVID-19 on the Mammography Equipment market for the year 2020 and beyond. The report has extensively covered pipeline products and technologies, which will help in identifying companies with the most robust pipeline. This, in turn, will assist in predictive analysis for designing in-licensing and out-licensing strategies.

| Market Size (2023) | $2.10 billion |

| CAGR (2023-2033) | >6% |

| Forecast Period | 2023-2033 |

| Historic Period | 2015-2022 |

| Key Companies | Siemens Healthineers AG, Philips Healthcare, Hologic Inc, GE Healthcare Technologies Inc, Fujifilm Holdings Corp, and Others. |

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before purchasing this report. |

Growing breast cancer screening initiatives will accelerate the Mammography Equipment market growth.

- The market has shifted away from film-screen mammography and will continue to favor computer-based imaging modalities. The 3D imaging capabilities offered by breast tomosynthesis will drive the market throughout the forecast period.

- Retrofit systems, which offer a more affordable option for upgrading 2D systems, will also continue to experience higher sales. Early detection and treatment remain infinitely more affordable for healthcare providers and patients than the alternative, resulting, in the growing demand for the Mammography Equipment market.

Download the report sample at: https://www.globaldata.com/store/talk-to-us/?report=1923324

Mammography Equipment Market Segmentation

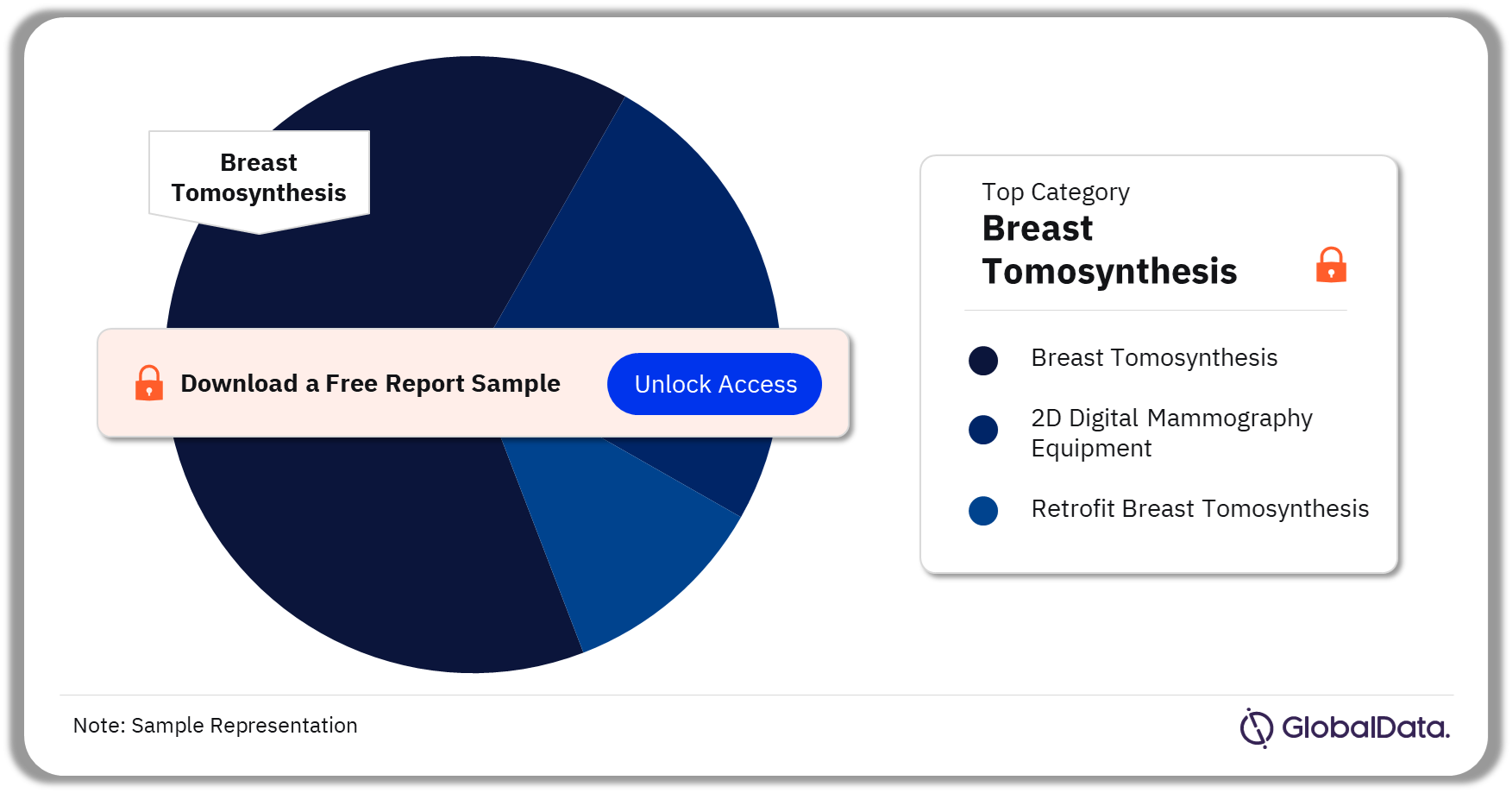

| Key Categories | 2D Digital Mammography Equipment, Breast Tomosynthesis, and Retrofit Breast Tomosynthesis |

| Key Regions | Asia-Pacific, Europe, Middle East and Africa, North America, and South and Central America |

The Breast Tomosynthesis category accounted for the largest revenue in 2023.

- In 2022, the Breast Tomosynthesis category emerged as the market leader with the highest revenue. These are imaging machines that move around the breast in an arc to generate 3D images. These systems provide an in-depth view of the breast, minimizing artifacts and the chance of false results.

- Although X-ray-based systems are still the standard for mammography, manufacturers that are looking to cut down on radiation dose are developing other breast tomosynthesis technologies using ultrasound imaging.

Mammography Equipment Market Category Insights, 2023 (%)

Buy the Full Report to Learn More About the Mammography Equipment Market Segments Request Free Report Sample

North America emerged as the largest regional contributor in 2023, followed by Europe.

- The number of Mammography Systems installed in North America is also expected to grow due to the rise in Hospitals and Diagnostic imaging centers numbers and women’s health initiatives.

- The attractive capabilities of Digital Breast Tomosynthesis (DBT) has led to many install bases shifting towards this technology, either through the investment in new machines or retrofits.

Mammography Equipment Market Regional Insights, 2023 (%)

Buy the Full Report for More Regional Insights into the Mammography Equipment Market Request Free Report Sample

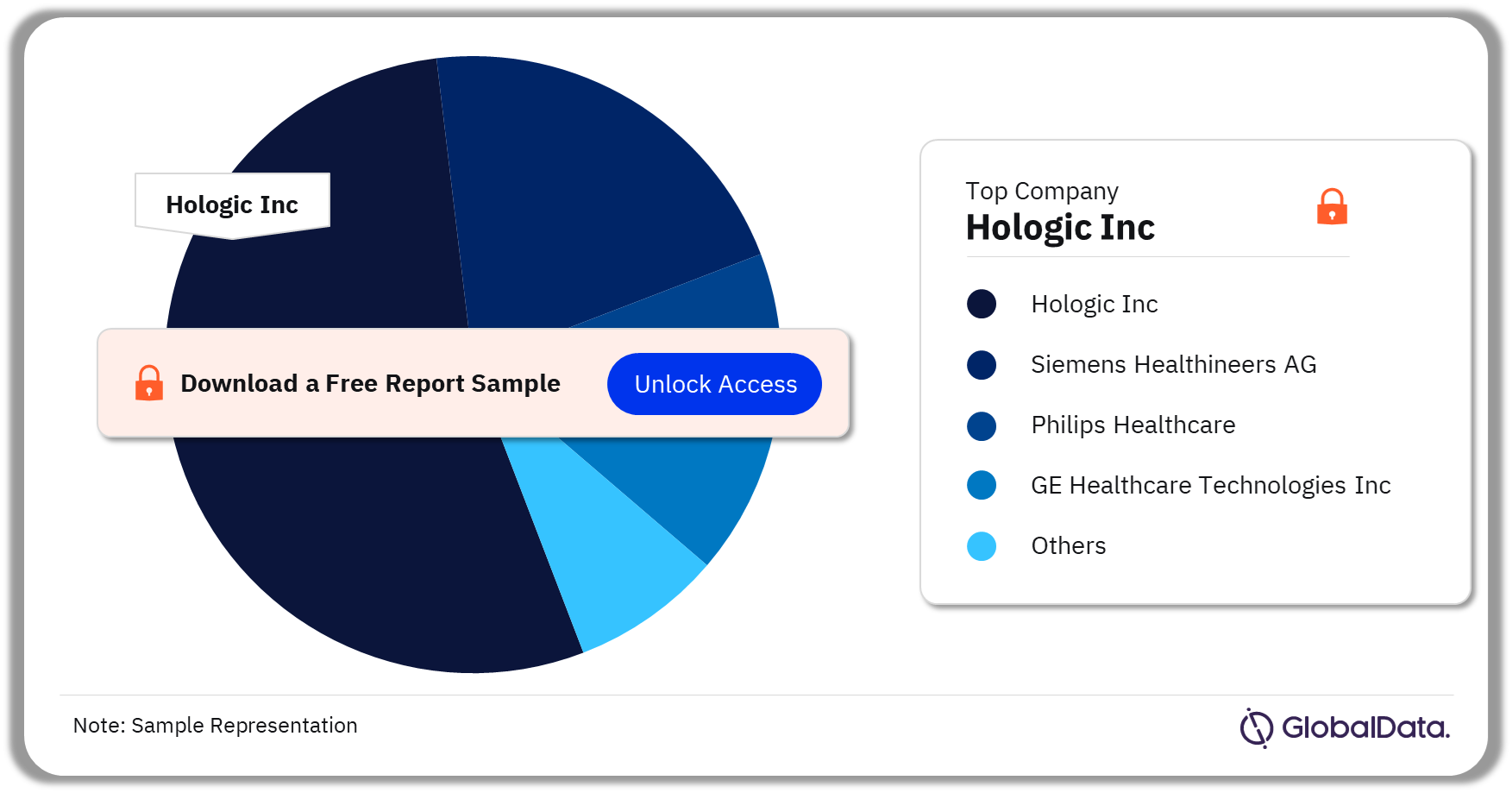

Hologic Inc led the Mammography Equipment market share in 2023.

- Some of the leading companies in the Mammography Equipment market are Siemens Healthineers AG, Philips Healthcare, Hologic Inc, GE Healthcare Technologies Inc, Fujifilm Holdings Corp, and Others.

- In 2023, Hologic Inc. emerged as the market leader by implementing strategies like the innovation of newer technology and penetrating new and emerging markets.

Mammography Equipment Market Company Insights, 2023 (%)

Download Free Report Sample at: https://www.globaldata.com/store/talk-to-us/?report=1923324

Key Inclusions in the Report

Currently marketed Mammography Equipment and evolving competitive landscape –

Insightful review of the key industry trends.

Annualized total Mammography Equipment market revenue by segment and market outlooks from 2015-2033.

Market level data on units, average selling prices and market values.

Global, Regional, and Country level market specific insights –

– Qualitative market-specific information is available with global trends further broken down into regional trends. In addition, GlobalData analysts provide unique country-specific insights on the market.

– SWOT analysis for the Mammography Equipment market.

– Competitive dynamics insights and trends provided for the Mammography Equipment market.

Drive the understanding of the market by getting the veritable big picture including an overview of the healthcare system. In addition, the Market Access segment allows you to delve deeper into market dynamics with information on reimbursement policies and the regulatory landscape.

Country-specific overview of the healthcare system.

Country-specific reimbursement policies.

Country-specific medtech regulatory landscape.

Robust methodologies and sources enable the model to provide an extensive and accurate overview of the market. Demand and supply-side primary sources are integrated within the syndicated models, including Key Opinion Leaders. In addition, real-world data sources are leveraged to determine market trends; these include government procedure databases, hospital purchasing databases, and proprietary online databases.

Companies covered: Siemens Healthineers AG, Philips Healthcare, Hologic Inc, GE Healthcare Technologies Inc, Fujifilm Holdings Corp, and Others.

Countries covered: United States, United Kingdom, Germany, France, Italy, Spain, Brazil, China, India, Russia, Japan, Australia, Canada, Mexico, South Korea, Denmark, Ireland, Netherlands, New Zealand, South Africa, Sweden, Switzerland, Austria, Belgium, Finland, Israel, Norway, Poland, Portugal, Taiwan, Czech Republic, Greece, Hungary, Turkey, Egypt, Saudi Arabia, United Arab Emirates, Argentina, and Chile.

Scope

This Market Model gives important, expert insight you won’t find in any other source. The model illustrates qualitative and quantitative trends within the specified market. This model is required reading for –

- CMO executives who must have a deep understanding of the Mammography Equipment marketplace to make strategic planning and investment decisions.

- Sourcing and procurement executives must understand crucial components of the supply base to make decisions about supplier selection and management.

- Private equity investors who need a deeper understanding of the market to identify and value potential investment targets.

Reasons to Buy

The model will enable you to –

- Understand the impact of COVID-19 on the Mammography Equipment market.

- Develop and design your in-licensing and out-licensing strategies through a review of pipeline products and technologies, and by identifying the companies with the most robust pipeline.

- Develop business strategies by understanding the trends shaping and driving the Mammography Equipment market.

- Drive revenues by understanding the key trends, innovative products and technologies, market segments, and companies likely to impact the Mammography Equipment market in the future.

- Formulate effective sales and marketing strategies by understanding the competitive landscape and by analyzing the company’s share of market leaders.

- Identify emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage.

- Track device sales in the global and country-specific Mammography Equipment market from 2015-2033.

- Organize your sales and marketing efforts by identifying the market categories and segments that present maximum opportunities for consolidations, investments, and strategic partnerships.

Philips Healthcare

Hologic Inc

GE Healthcare Technologies Inc

Fujifilm Holdings Corp

Others

Frequently asked questions

-

What was the Mammography Equipment market size in 2023?

The Mammography Equipment market size was estimated at $2.10 billion in 2023.

-

What will be the Mammography Equipment market growth during the forecast period?

The Mammography Equipment market is forecast to grow at a CAGR of more than 6% during 2023 and 2033.

-

Which was the leading category of the Mammography Equipment market in 2023?

Breast Tomosynthesis was the leading category of the Mammography Equipment market in 2023.

-

Which region accounted for the highest revenue in the Mammography Equipment market in 2023?

North America accounted for the largest regional revenue in the Mammography Equipment market in 2023.

-

Who are the leading Mammography Equipment market players?

Siemens Healthineers AG, Philips Healthcare, Hologic Inc., GE Healthcare Technologies Inc, and Fujifilm Holdings Corp among others, are the leading Mammography Equipment market players.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Mammography Equipment reports