Mexico Sports Broadcasting Media (Television and Telecommunications) Landscape

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Mexico Sports Broadcasting Media Market Overview

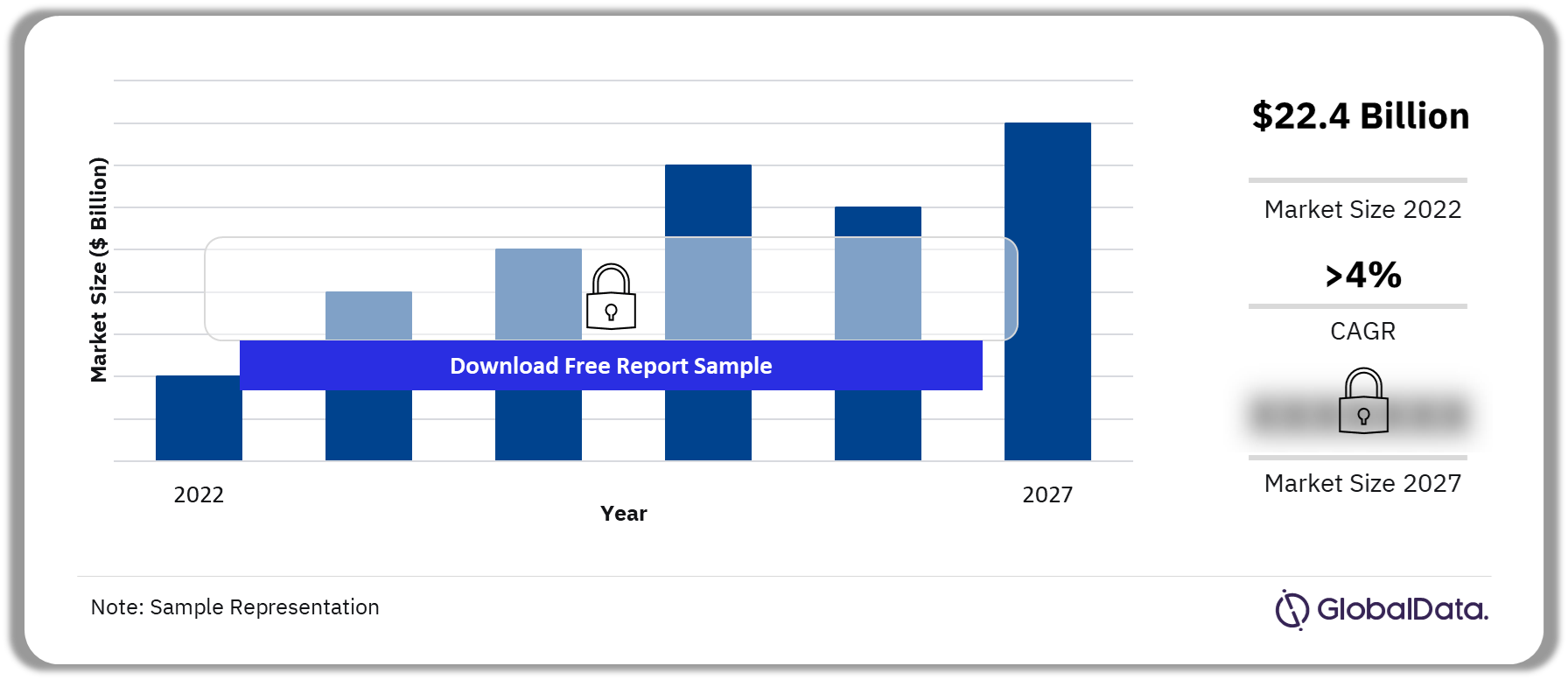

The Mexico telecom and pay-TV services market size was estimated at $22.4 billion in 2022 and is expected to witness a CAGR of more than 4% during the forecast period, supported by contributions from mobile data and fixed broadband segments.

Mexico Sports Broadcasting Media Market Outlook 2022-2027 ($ Billion)

Buy the Full Report to Know More About the Mexico Sports Broadcasting Media Market Forecast, Download a Free Report Sample

The Mexico sports broadcasting media market research report provides an overview of the television and telecommunications market in relation to sports broadcasting in Mexico today, with top-level data and detailed forecasts of key indicators up to 2027. The report analyses the television, mobile handset, and residential fixed-line broadband sectors, as well as a review of major sports media rights.

| Market Size (2022) | $22.4 Billion |

| CAGR (2022-2027) | >4% |

| Forecast Period | 2022-2027 |

| Key Broadcasters | · TV Azteca

· ESPN · Claro Sports · Grupo Televisa · Fox Sports · Paramount Global |

| Key Sectors | · TV Services

· SVOD Services · Mobile Services · Fixed Broadband Services |

| Leading Players | · America Movil

· Grupo Televisa · AT&T · Megacable · Others |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Mexico Sports Broadcasting Media Market Broadcasters

The key broadcasters in the Mexico sports broadcasting media market are TV Azteca, ESPN, Claro Sports, Grupo Televisa, Fox Sports and Paramount Global among others.

TV Azteca: It is a Mexico-based company engaged in the production, broadcasting, and marketing of free-to-air television shows and selling advertising spots. TV Azteca owns and operates four television channels in Mexico – Azteca Uno, Azteca 7, adn40 and a+ – that air diverse programming genres, such as live entertainment, reality, sports, musical, variety and talent shows, series, and newscasts in Spanish. The company also owns Azteca Digital, which operates several online platforms and social networks in Mexico., and soccer team Mazatlán Futbol Club, which plays in Liga MX, the top-tier of Mexican soccer.

Mexico Sports Broadcasting Media Market Analysis, by Broadcasters

Buy the Full Report to Know More About Mexico Sports Broadcasters

Mexico Sports Broadcasting Media Market Segmentation by Sectors

The key sectors in the Mexico sports broadcasting media industry are TV services, subscription video-on-demand (SVOD) services, mobile services, and fixed broadband services.

TV services: The television household penetration rate in Mexico is high. Over the 2022-2027 forecast period, the television household penetration will increase marginally. Pay-TV household penetration in Mexico stood at more than 49% in 2022.

SVOD services market: SVOD subscriptions will continue to grow over the 2022-2027 forecast period, supported by the popularization of on-demand content and the emergence of new commercial platforms in the SVOD market. Increased broadband adoption, both fixed and mobile, and the development of partnerships with telcos and traditional pay-TV players, will also help to drive continued growth in the market.

Buy the Full Report to Know More About the Sectors in the Mexico Sports Broadcasting Media Market

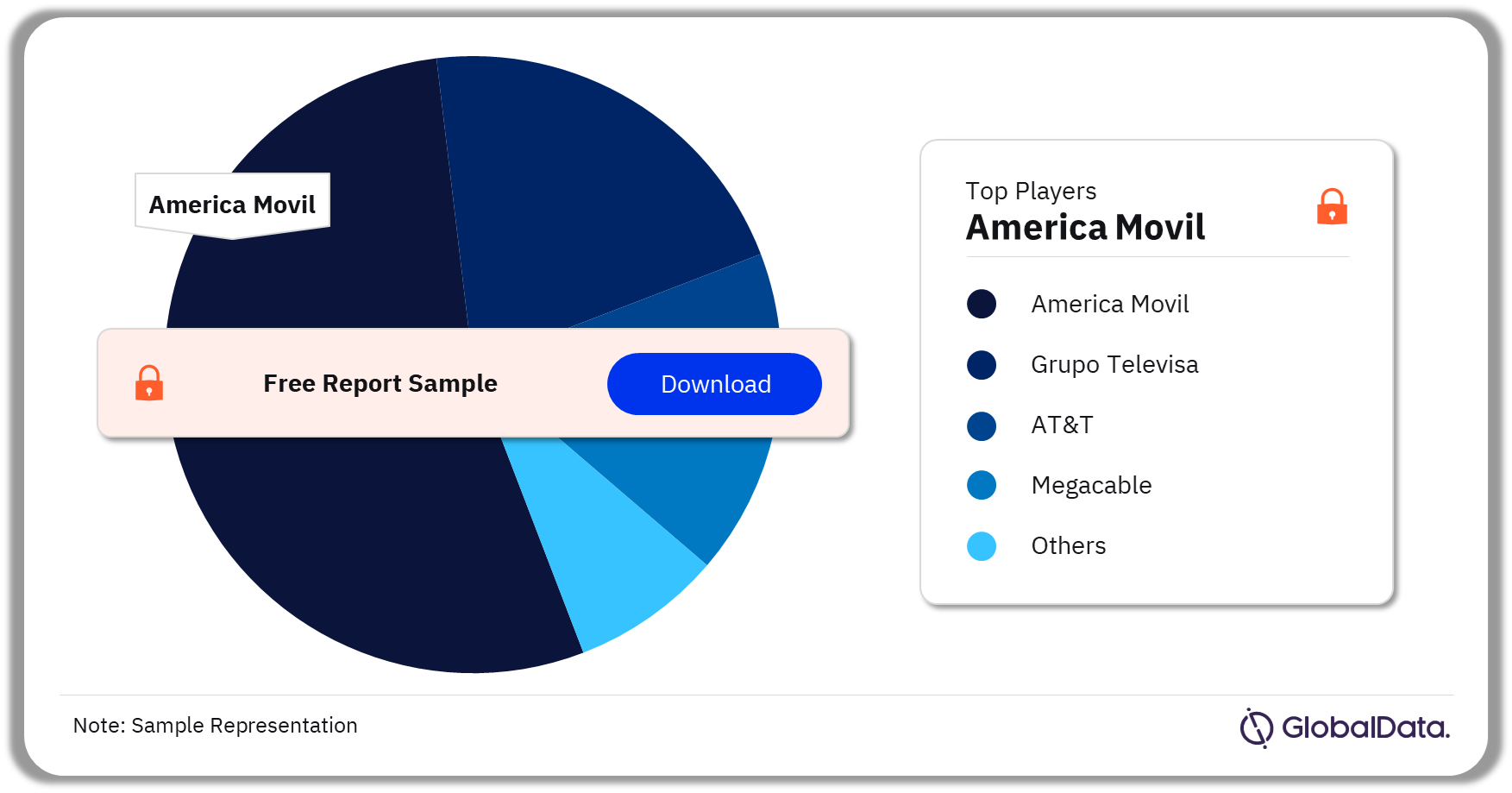

Mexico Sports Broadcasting Media Market - Competitive Landscape

Some of the leading players in the Mexico sports broadcasting media market are:

- America Movil

- Grupo Televisa

- AT&T

- Megacable

America Movil’s mobile subsidiary Telcel led the mobile market in Mexico in 2022. The operator’s position in the mobile market during the forecast period will be supported by its strong foothold in both prepaid and postpaid segments and a strong focus on expanding its 5G mobile network.

Mexico Sports Broadcasting Media Mobile Market Analysis by Players, 2022 (%)

Buy the Full Report to Know More About the Players in the Mexico Sports Broadcasting Media Market

Segments Covered in the Report

Mexico Sports Broadcasting Media Sectors Outlook

- TV Services

- SVOD Services

- Mobile Services

- Fixed Broadband Services

Scope

By the end of 2022, an estimated 18.0 million subscribers used pay-TV services in Mexico, a decrease of 104,000 from 2021.

The Mexican pay-TV market is relatively concentrated, with leading operator Grupo Televisa, including its direct-to-home (DTH) satellite television unit Sky and cable properties, accounting for 60.0% of the market at the end of 2022.

Mexico had an estimated 17.7 million SVOD accounts at the end of 2022, an increase of 1.7 million or 10.6% from 2021.

Total mobile subscriptions in Mexico reached an estimated 137.2 million in 2022. Over the next five years, total mobile subscriptions will grow at a CAGR of 3.4% with mobile network operators (MNOs) adding a combined 25.1 million subscriptions and bringing the country’s total mobile subscriptions to 162.3 million in 2027.

Total fixed broadband lines in Mexico will increase from 27.0 million in 2022 to 35.3 million by the end of 2027, supported by ongoing investments in network infrastructure by operators.

Key Highlights

Cable TV overtook direct-to-home (DTH) satellite TV in 2022 to become the main pay-TV platform, with 8.1 million subscriptions, and will continue to grow over the forecast period, reaching 8.9 million in 2027.

Increased broadband adoption, both fixed and mobile, and the development of partnerships with telcos and traditional pay-TV players, will help to drive continued growth in the market.

4G is the leading mobile technology accounting for 74.2% of the total mobile subscriptions in 2022, and will remain the main mobile technology over the 2022-27 forecast period.

Fiber overtook cable during 2022 to become the main fixed broadband technology, holding a 37.0% subscription share by the end of the year.

Reasons to Buy

- This Sports Broadcasting Media Report offers a thorough, forward-looking analysis of the Mexico television and telecommunications markets, and service providers in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the Mexico pay-TV, SVOD, mobile handset, and residential fixed broadband markets, including the evolution of service provider market shares.

- With 23 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

AT&T

Claro Sports

ESPN

Fox Sports

Grupo Televisa

Megacable

Movistar

Netflix

Paramount

Sky

Telcel

Telefonica

TelevisaUnivision

Telmex

TV Azteca

Table of Contents

Frequently asked questions

-

What was the Mexico telecom and pay-TV services market size in 2022?

The telecom and pay-TV services market size in Mexico was estimated at $22.4 billion in 2022.

-

What is the Mexico telecom and pay-TV services market growth rate?

The Mexico telecom and pay-TV services market is expected to witness a CAGR of more than 4% during 2022-2027.

-

Who are the key broadcasters in the Mexico sports broadcasting media market?

The key broadcasters in the Mexico sports broadcasting media market are TV Azteca, ESPN, Claro Sports, and Grupo Televisa.

-

Which are the key sectors in the Mexico sports broadcasting media market?

The key sectors in the Mexico sports broadcasting media market are TV services, mobile services, SVOD services, and fixed broadband services.

-

Who are the leading players in the Mexico sports broadcasting media market?

Some of the leading players in the Mexico sports broadcasting media market are America Movil, Grupo Televisa, AT&T, Megacable, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.