Missiles and Missile Defense Systems Market Size and Trend Analysis by Segments, Programs, Competitive Landscape and Forecast to 2033

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Missile Defense Systems Market Overview

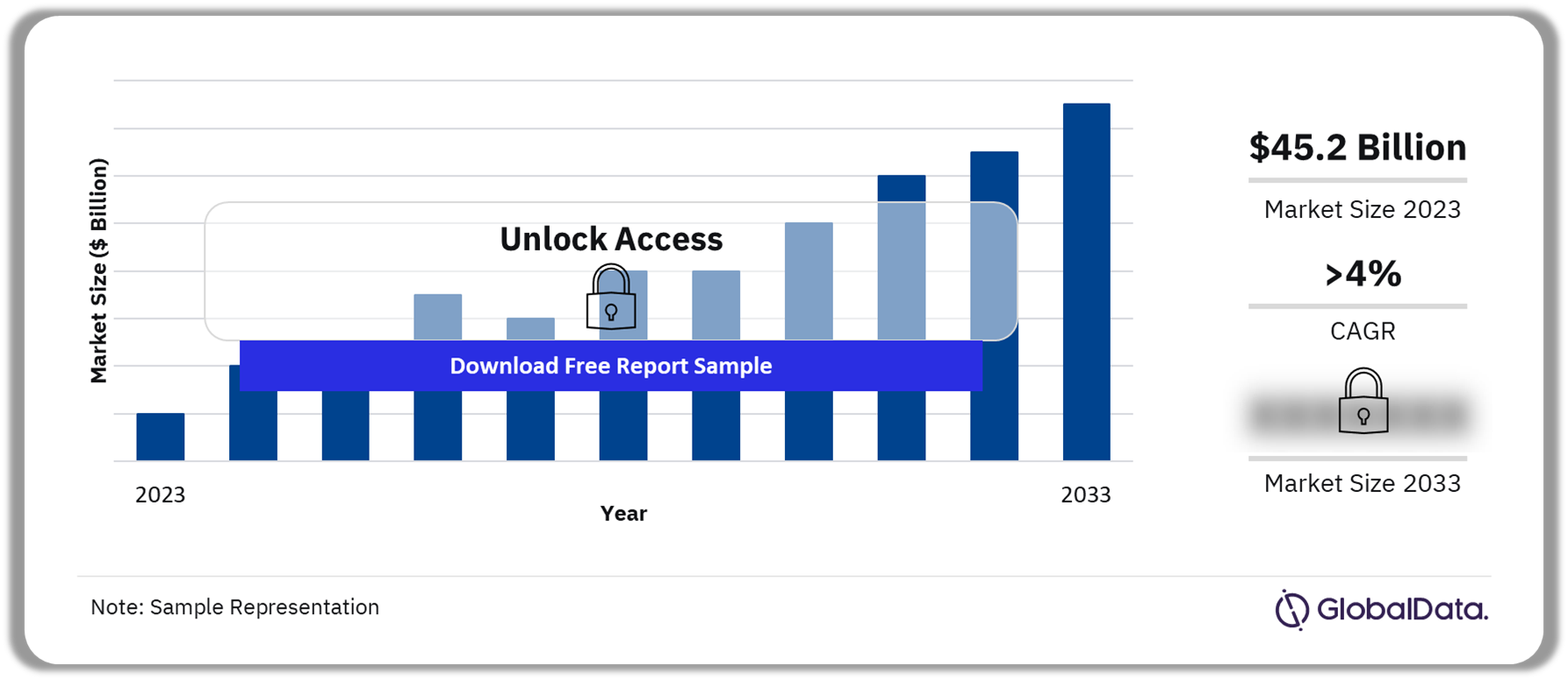

The global missiles and missile defense systems (MMDS) market is valued at $45.2 billion in 2023 and will grow at a compound annual growth rate (CAGR) of more than 4% during 2023-2033. The MMDS market will be driven by the rise in air defense modernization and advanced precision strike missile procurement programs by key defense spending countries, such as the US, Russia, China, India, Poland, and the UK, among others. The increased focus on the development and procurement of newer-generation missiles and sophisticated missile defense systems by key military powers is expected to further drive market growth over the forecast period.

Missiles and Missile Defense Systems Market Outlook 2023-2033 ($ Billion)

For more insights into the missiles and missile defense systems market forecast, download a free report sample

The missiles and missile defense systems market report covers industry analysis, including the key market drivers, trends, emerging technologies, and major challenges faced by industry participants. The MMDS market report also offers insights regarding key factors and government programs that are expected to influence the demand for the missiles and missile defense systems market over the forecast period.

| Market Size (2023) | $45.2 billion |

| CAGR (2023-2033) | >4% |

| Key Regions | · Europe

· Asia-Pacific · North America · Middle East · Africa · Latin America |

| Key Segments | · Missiles

· Missile Defense Systems |

| Leading Players | · RTX Corp (RTX)

· Lockheed Martin Corp · MBDA Holdings SAS · Almaz-Antey Concern · Northrop Grumman Corp · Bharat Dynamics Ltd · Others |

| Growth Drivers | · Proliferation of UAVs

· Policy shift by the US |

| Market Trends | · Rising demand for precision strike missiles

· Development and procurement of missiles with low IR signature and RCS |

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Missiles and Missile Defense Systems Market Dynamics

Over the last decade, militaries across the globe have realized the potential of UAVs in the rapidly evolving network centric battlefield. UAVs are extensively used in multiple military applications, including maritime and land border surveillance, electronic warfare, target tracking and designation, and precision strike. Besides these conventional roles UAVs can be remotely piloted and equipped with varying degrees of autonomy to undertake pre-programmed flight plans. The older air defense systems are less capable of tracking UAVs due to their compact size, low radar cross-section (RCS), and reduced IR signatures. Therefore, countries are focusing on developing advanced air defense systems to counter the growing threat of UAVs.

Several countries have also directed their efforts toward the R&D and procurement of advanced next-generation conventional land attack and anti-ship missiles, featuring low RCS and reduced IR signatures. This makes it harder for the enemy’s radar and electro-optical and infrared (EO/IR) sensors to detect and track these missiles. Low observable (LO) missiles enable armed forces to attack ground targets, with a reduced risk of being engaged by enemy defenses.

However, the high R&D costs associated with missile tech restrict market growth. The production of missiles involves the development of advanced materials, navigation and guidance systems, and propulsion and targeting technologies and creating new research centers, testing facilities and production facilities. To support MMDS research and manufacturing, OEMs must also establish a robust network of supply chain partners. Aside from these considerations, OEMs will also incur expenses of recruiting specialized labor to work on multiple projects simultaneously. Furthermore, they must also undertake independent R&D projects without government funding to develop key technologies in the respective domains. All these activities require extensive financial resources.

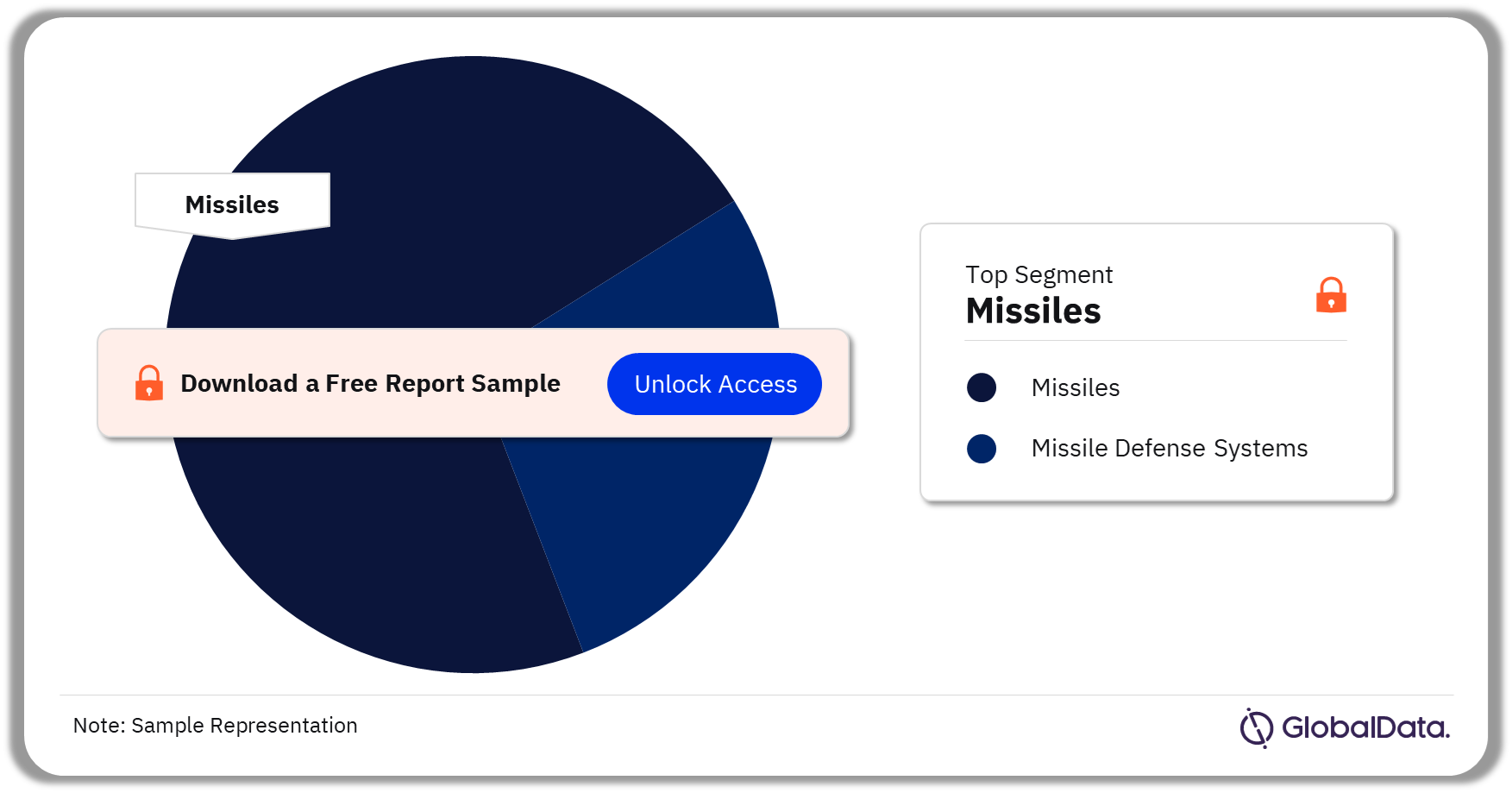

Missiles and Missile Defense Systems Market Segments

The key categories in the missiles and missile defense systems market are missiles and missile defense systems. The missiles segment is further categorized into strategic land-attack missiles, anti-ship missiles, anti-radiation missiles, conventional land-attack missiles, anti-air missiles, and anti-tank guided missiles (ATGM). Likewise, Platform Based MDS, and Missile Based CIWS are the two major categories of missile defense systems.

In 2023, the MMDS market is expected to be led by the missiles segment and is expected to continue doing so during the forecast period. The missiles segment will be driven by multiple high-value procurement programs worldwide and the rise in development & induction of low radar cross-section (RCS) missiles capable of operating at hypersonic speeds across militaries across the world.

Missiles and Missile Defense Systems Market Analysis by Segments, 2023 (%)

For more insights into the Missiles and Missile Defense Systems market segments, download a free sample

Missiles and Missile Defense Systems Market Segmentation by Region

The report analyzes the missiles and missile defense systems market across several regions including Europe, Asia-Pacific, North America, Middle East, Africa, and Latin America.

The MMDS market over the forecast period is expected to be led by Europe. The Russia-Ukraine conflict has increased demand for missile defense systems in the region, as several NATO countries are now focusing on improving their missile defense capabilities in the wake of the growing missile capabilities of Russia. This factor is expected to drive the MMDS market in the coming years. Ongoing partnerships among allied countries in Europe for the joint production and development of missiles is a key trend that will assist in cutting down on procurement costs through technology sharing.

Missiles and Missile Defense Systems Market Analysis by Region, 2023 (%)

For more regional insights, download a free sample report

Missiles and Missile Defense Systems Market - Competitive Landscape

Some of the major players in the MMDS market are RTX Corp (RTX), Lockheed Martin Corp, MBDA Holdings SAS, Almaz-Antey Concern, Northrop Grumman Corp, and Bharat Dynamics Ltd among others. MBDA’s revenue in Europe is mainly driven by the ongoing programs of HYDIS2 and AQUILA, a future hypersonic missile program undertaken by France, the United Kingdom, and Italy, along with the Future Cruise Anti-Ship Missile (FCASW), again driven by France and the United Kingdom.

Major Missiles and Missile Defense System Companies

For more information on the leading players in the Missiles and Missile Defense Systems market, download a free sample

Missiles and Missile Defense Systems Market Segmentation

- Missiles and Missile Defense Systems Market, by Segments

- Missiles

- Strategic Land-Attack Missiles

- Anti-Ship Missiles

- Anti-Radiation Missiles

- Conventional Land-Attack Missiles

- Anti-Air Missiles

- Anti-Tank Guided Missiles (ATGM)

- Missile Defense Systems

- Platform Based MDS

- Missile Based CIWS

- Missiles and Missile Defense Systems Market, by Region

- Europe

- Asia-Pacific

- North America

- Middle East

- Africa

- Latin America

Scope

In particular, the report provides an in-depth analysis of the following –

- Market size and drivers: Detailed analysis during 2022-2032, including the demand drivers and growth stimulators. It also provides a snapshot of the spending and modernization patterns of different regions around the world.

- Recent developments and industry challenges: Insights into technological developments and a detailed analysis of the existing missiles and missile defense systems projects being executed and planned worldwide. It also provides procurement trends and the challenges faced by industry participants.

- Regional highlights: Study of the key regional markets, providing a demand analysis of multiple missiles and missile defense systems segments.

- Major programs: Details of the key programs in each segment, which are expected to be executed during 2022-2032.

- Competitive landscape and strategic insights: analysis of the competitive landscape of the global missiles and missile defense systems market. It provides an overview of key players, their strategic initiatives, and financial analysis.

Key Highlights

• The global missiles and missile defense systems market is expected to grow at a CAGR of 4.2% over the forecast period.

• The global missiles and missile defense systems market is classified into two categories: missiles and missile defense systems

• Europe is expected to dominate the global missiles and missile defense systems market over the forecast period with a market share of 31.1%, followed by Asia-Pacific and North America.

• Missiles is expected to be the largest segment over the forecast period.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the missiles and missile defense systems over the next ten years.

- Gain an in-depth understanding of the underlying factors driving demand for different missiles and missile defense systems segments in the top spending countries across the world and identify the opportunities offered by each of them.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major countries that are driving the missiles and missile defense systems market, providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the defense ministries of different countries within the missiles and missile defense systems market.

- Make correct business decisions based on in-depth analysis of the competitive landscape consisting of detailed profiles of the top missiles and missile defense systems providers around the world. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Lockheed Martin Corp

MBDA Holdings SAS

China Precision Machinery Import-Export Corp

Almaz-Antey Concern

Northrop Grumman Corp

Bharat Dynamics Ltd

LIG Group

Defence Research and Development Organisation

Leidos Holdings Inc

Tactical Missiles Corporation

Brahmos Aerospace Pvt Ltd

Israel Aerospace Industries Ltd. Diehl Stiftung & Co KG

Kongsberg Gruppen ASA

Eurospike GmbH

The Boeing Co

China Aerospace Science and Technology Corp

Moscow Institute of Thermal Technology

BAE Systems Plc

The Boeing Co

Mitsubishi Heavy Industries Ltd

Elbit Systems Ltd

Saab AB

Table of Contents

Frequently asked questions

-

What is the missiles and missile defense systems market size in 2023?

The missiles and missile defense systems market in 2023 is valued at $45.2 billion.

-

What will be the MMDS market CAGR during 2023-2033?

The MMDS market will witness a CAGR of more than 4% during 2023-2033.

-

Which category dominated the missiles and missile defense systems market share in 2023?

The missiles segment is expected to hold the highest share of the missiles and missile defense systems market in 2023.

-

Which region will lead the missiles and missile defense systems market share in 2023?

Europe is anticipated to hold the largest revenue share of the MMDS market over 2023-2033.

-

Who are the leading players in the missiles and missile defense systems market?

RTX Corp (RTX), Lockheed Martin Corp, MBDA Holdings SAS, Almaz-Antey Concern, Northrop Grumman Corp, and Bharat Dynamics Ltd are some of the leading players in the missiles and missile defense systems market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports