Naval Vessels and Surface Combatants Market Size and Trend Analysis by Segments, Programs, Competitive Landscape and Forecast to 2033

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing in-depth insights from the ‘Naval Vessels and Surface Combatants Market’ report will help you:

- Gain access to a detailed Excel pack in addition to the main report, providing defense expenditure breakdown for the naval vessels and surface combatants market categorized in terms of region, country, ship type, units, programs, and suppliers to 2033.

- Understand the current market dynamics with a complete 360-degree overview.

- Identify the key market drivers, challenges, as well as the recent trends and technological developments.

- Analyze the business strategies such as merger & acquisition (M&A), patent updates, and demand projections in the market.

- Identify the potential segments & regions within the naval vessels and surface combatants market to make investment decisions on time

- Analyze the company profile of key vendors operating within the marketspace.

How is the ‘Naval Vessels and Surface Combatants Market’ report different from other reports in the market?

- The report offers an analysis of major regions in the industry including North America, Europe, APAC, MEA, and South & Central America (SCA).

- The report provides coverage of more than 20 countries (Germany, the UK, India, Japan, Australia, Indonesia, France, Italy, Russia, Spain, Turkey, and the Rest of Europe).

- It offers dashboard analytics for M&A, social media analytics, and patent analytics

- The report provides in-depth qualitative coverage of region-wise company market share and key vendor profiles.

- It evaluates the key porters, technological trends, and DROs in the industry.

- It highlights the naval combat vessel and surface combatant’s revenue opportunity & forecasts by ship type and region & country.

We recommend this valuable source of information to anyone involved in:

- Defense Startups

- Original Equipment Manufacturers (OEMs)

- Defense Planners and Naval Vessels Integrators

- Venture Capital Firms

- Government Agencies

- Head of Marketing, Head of Sales, CEOs, and Senior Executives.

Concerned stakeholders can utilize the report for project details, growth rate, and market size to identify and fund high potential startups.

To Get a Snapshot of the Naval Vessels and Surface Combatants Market Report, Download a Free Report Sample

Naval Vessels and Surface Combatants Market Report Overview

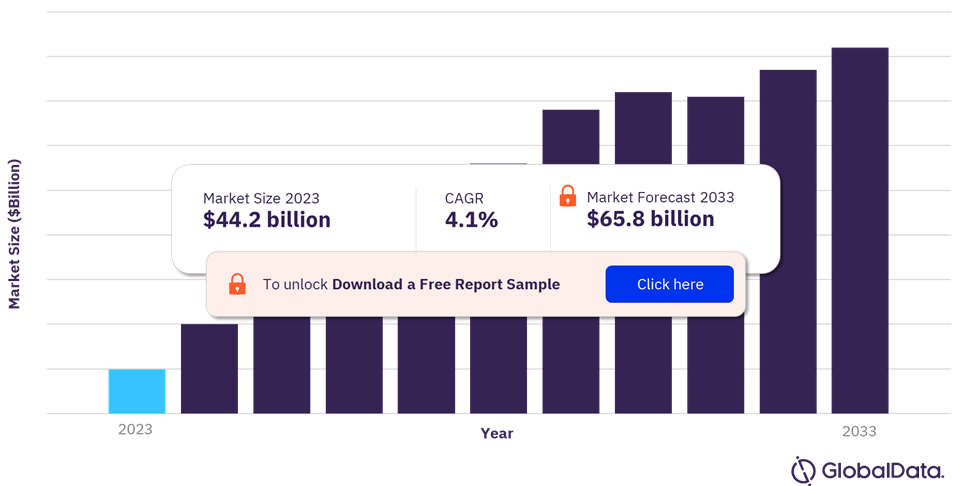

The naval vessels and surface combatants market size is valued at US$44.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% during 2023-2033. Various countries across the globe are focusing on indigenous development and maintenance of their naval vessels to reduce their dependency on imports. Indigenously built ships can be customized, maintained, repaired, and overhauled in a domestic facility without depending on a foreign supplier for spare parts and other accessories and will drive the naval vessels and surface combatants market growth over the forecast period.

Naval Vessels and Surface Combatants Market Outlook, 2023-2033 ($ billion)

View Sample Report for Additional Insights on the Naval Vessels and Surface Combatants Market Forecast, Download a Free Report Sample

Vendors are now under greater pressure to offer an experience that is unique for each customer. The infusion of advanced digital technologies such as high-speed processors, combat management systems, and data links along with increased automation and sensor fusion has led to higher development and manufacturing costs. However, these technologies have led to significant enhancement of the combat performance of naval vessels and surface combatants. As more and more countries invest in developing their navies, the marine industry is expected to see an uptick in the number of orders for naval vessels and surface combatants.

According to GlobalData estimates, the naval vessels and surface combatants industry will grow from US$44.2 billion in 2023 to US$65.8 billion in 2033 at a CAGR of 4.1% from 2023 to 2033. Maritime security threats, territorial disputes, and naval modernization initiatives are factors anticipated to augment market growth over the next ten years. Additionally, product enhancement offered by companies to increase modularity in naval vessels is expected to reduce lifecycle costs, thereby promoting the adoption of modern products.

The use of 3D printing is another technological innovation revolutionizing the naval vessels and surface combatants industry. A report published in July 2022 suggested that the US Navy’s amphibious assault ship USS Essex was equipped with a 3D printer. The use of additive manufacturing is expected to allow the chip crew to quickly crank out replacement parts for drones and save time & money. Additionally, the use of robotics is expected to aid the development of weapon launch systems and other equipment used for naval combat.

The naval vessels and surface combatants market research report provides an executive-level overview of the current naval vessels and surface combatants market worldwide, with detailed forecasts of key indicators up to 2033. Published annually, the report provides a detailed analysis of the near-term opportunities, competitive dynamics, and evolution of demand by ship type, across key regional and country markets. The study also captures a detailed overview of key dynamics including technology, and market driver trends, among others with their current as well as the expected impact on the overall naval vessels and surface combatants demand. The report will also include an Excel pack providing defense expenditure breakdown for naval vessels and surface combatants market categorized in terms of region, country, types of naval vessels and surface combatants, units, programs, and suppliers.

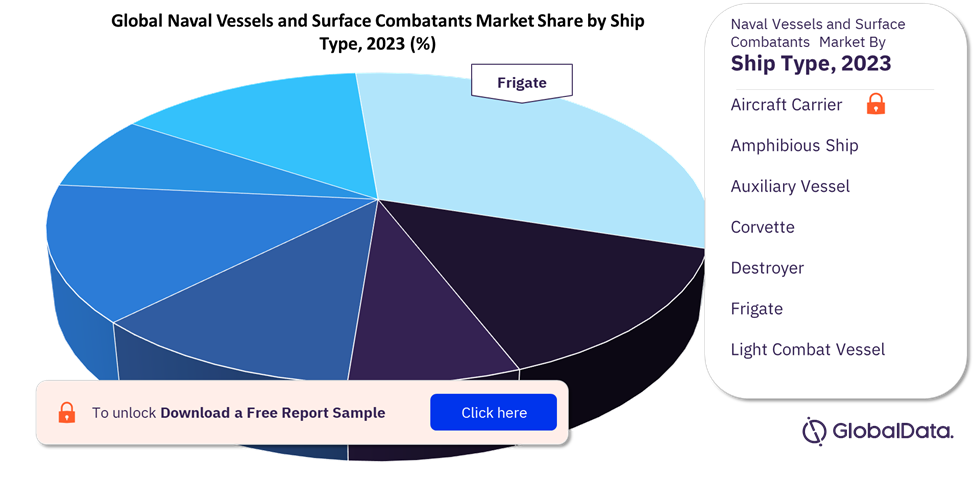

Naval Vessels and Surface Combatants Market Segmentation by Ship Type

Ship types covered under naval vessels and surface combatants include aircraft carrier, amphibious ship, auxiliary vessel, corvette, destroyer, frigate, and light combat vessel. The frigate is anticipated to be the largest segment in the naval vessels and surface combatants market between 2023 and 2033. Driven by several high-value procurement programs worldwide, including the US Navy’s Constellation-class program, Canadian Navy’s ‘Canadian Surface Combatant’ program, Australian Navy’s Hunter-class (SEA 5000) program, the Royal Navy’s Type 26 Global Combat Ship, and the German Navy’s MKS 180 Multirole Combat Ship, among others. The frigates segment is expected to account for revenue share exceeding 20% of the total market over the forecast period.

Fetch Sample PDF for Naval Vessels and Surface Combatants Segment-Specific Revenues and Shares, Download a Free Report Sample

With a share of over 10% in 2023, the light combat vessel segment is anticipated to contribute a significant revenue share in the global market. An increasing demand to secure key maritime trade routes and territorial waters from piracy, smuggling, human trafficking, and illegal migration is expected to drive the procurement of light combat vessels over the forecast period. The auxiliary vessel segment is also projected to record a modest growth over the next ten years.

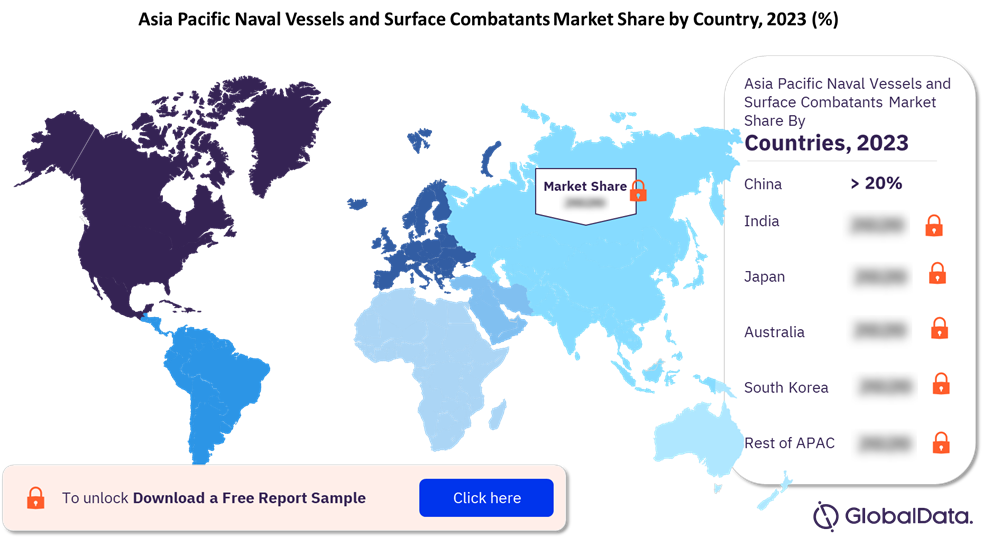

Naval Vessels and Surface Combatants Market Analysis by Region

The Asia-Pacific revenue share is expected to surpass 25% of the naval vessels and surface combatants’ market by 2033. Ongoing naval modernization initiatives for procurement of new naval platforms for replacing the aging vessels are expected to drive the regional market growth over the forecast period. Furthermore, the growth in the Asia-Pacific market is also attributed to the current geopolitical tensions and maritime territorial disputes among countries such as China, India, Vietnam, Japan, South Korea, and Taiwan.

View Sample Report for Additional Naval Vessels and Surface Combatants Market Insights, Download a Free Report Sample

Countries in the Latin American region encounter minimal external threat. However, expenditure in the region is primarily driven by the ongoing arms race among the countries to project maritime supremacy, as well as the need to safeguard offshore oil reserves and maritime interests within their territories. Peru is expected to hold the highest market share in the region over the forecast period. The Peruvian Navy is tasked with the patrol and surveillance of its territorial waters, including rivers, lakes, and in the Pacific Ocean up to 200 nautical miles from its coastlines. However, the navy is concerned about the obsolescence of most of its in-service fleet of naval vessels, thereby significantly degrading its operational capability.

Naval Vessels and Surface Combatants Market – Competitive Landscape

Competition in the naval vessels and surface combatants industry is characterized by the presence of regional market leaders. Companies operating in the market have strong hold in their respective regions. For instance, Huntington Ingalls Industries has a strong old in the North American market, whereas the European market is dominated by United Shipbuilding Corporation. Companies such as Fincantieri S.p.A, and Naval Group have a widespread geographical presence, capturing considerable market share in more than one region.

Long term contracts with government agencies is a major modus operandi to sustain market competition for companies operating in the naval vessels and surface combatants market. For instance, Mitsubishi Heavy Industries, one of the leading companies in the Asia Pacific market, will build the 30DX Multi-Mission Frigates for Japan Maritime Self-Defense Force during this decade. Similarly, programs undertaken by the Naval Group include contracts for Frégate Européen Multimissions (FREMM) and FTI- intermediate frigates for the French Navy and Belharraclass Frigate, and Gowind-class corvettes for the Hellenic Navy over the forecast period.

Leading Players in the Naval Vessels and Surface Combatants Market

- BAE Systems Plc

- China State Shipbuilding Corp Ltd

- Damen Shipyards Group

- Fincantieri SpA

- Huntington Ingalls Industries Inc

- Lockheed Martin Corp

- Mitsubishi Heavy Industries Ltd

- Naval Group

- ThyssenKrupp AG

- United Shipbuilding Corp

Other Naval Vessels and Surface Combatants Market Vendors Mentioned

Abu Dhabi Ship Building, Alexandria Shipyard, Arsenal de Guerra do Rio de Janeiro (AMRJ), ASMAR Shipbuilding & Ship Repair Company, Cochin Shipyard Ltd, COTECMAR, Daewoo Shipbuilding and Marine Engineering Co Ltd, Eastern Shipbuilding Group, General Dynamics Corp, Gölcük Naval Shipyard, Navantia SA, NVL Group, and Seaspan

To Know More About Leading Naval Vessels and Surface Combatants Market Players, Download a Free Report Sample

Naval Vessels and Surface Combatants Market Research Scope

| Market Size (2023) | US$44.2 billion |

| Market Size (2033) | US$65.8 billion |

| CAGR (2023-2033) | 4.1% |

| Forecast Period | 2023-2033 |

| Actual Data | 2023 |

| Report Scope & Coverage | Revenue Forecast, Company Market Share, and Growth Trends |

| Ship Type Segment | Aircraft Carrier, Amphibious Ship, Auxiliary Vessel, Corvette, Destroyer, Frigate, and Light Combat Vessel |

| Key Companies | BAE Systems Plc, China State Shipbuilding Corp Ltd, Damen Shipyards Group, Fincantieri SpA,

Huntington Ingalls Industries Inc, Lockheed Martin Corp, Mitsubishi Heavy Industries Ltd, Naval Group, ThyssenKrupp AG, and United Shipbuilding Corp |

Naval Vessels and Surface Combatants Market Segments

GlobalData Plc has segmented the naval vessels and surface combatants market report by ship type and region:

Naval Vessels and Surface Combatants Ship Type Outlook (Revenue, USD Million, 2023-2033)

- Aircraft Carrier

- Amphibious Ship

- Auxiliary Vessel

- Corvette

- Destroyer

- Frigate

- Light Combat Vessel

Naval Vessels and Surface Combatants Regional Outlook (Revenue, USD Million, 2023-2033)

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Russia

- Spain

- Turkey

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- South Korea

- Taiwan

- Rest of Asia Pacific

- Central & South America

- Brazil

- Mexico

- Peru

- Rest of Central & South America

- Middle East & Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Morocco

- Iran

- Rest of Middle East & Africa

Reasons to Buy

- The report will also include an Excel pack providing defense expenditure breakdown for naval vessels and surface combatants market categorized in terms of region, country, types of naval vessels and surface combatants, units, programs, and suppliers.

- This market intelligence report offers a thorough, forward-looking analysis of the global naval vessels and surface combatants market, ship type, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in naval vessels and surface combatants market.

- The report also highlights key ship segments (Aircraft Carrier, Amphibious Ship, Auxiliary Vessel, Corvette, Destroyer, Frigate, and Light Combat Vessel)

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in naval vessels and surface combatants market.

- The broad perspective of the report coupled with comprehensive, actionable detail will help naval vessels and surface combatants stakeholders, service providers, and other naval vessels and surface combatants players succeed in growing the naval vessels and surface combatants market globally.

Key Players

• BAE Systems Plc• China State Shipbuilding Corp Ltd

• Damen Shipyards Group

• Fincantieri SpA

• Huntington Ingalls Industries Inc

• Lockheed Martin Corp

• Mitsubishi Heavy Industries Ltd

• Naval Group

• ThyssenKrupp AG

• United Shipbuilding Corp

Table of Contents

Table

Figures

Frequently asked questions

-

What was the naval vessels and surface combatants market size in 2023?

The naval vessels and surface combatants market size was valued at US$44.2 billion in 2023.

-

What will be the naval vessels and surface combatants market size in 2023?

The naval vessels and surface combatants market size is forecasted to reach US$65.8 billion by 2033.

-

What is the naval vessels and surface combatants market growth rate?

The naval vessels and surface combatants market is expected to grow at a CAGR of 4.1% during the forecast period (2023-2033).

-

What are the key naval vessels and surface combatants market drivers?

An increase in maritime security threats, territorial disputes, and naval modernization initiatives are anticipated to drive naval vessels and surface combatants market growth.

-

What are the key naval vessels and surface combatants market segments?

Ship Type Segments: Aircraft Carrier, Amphibious Ship, Auxiliary Vessel, Corvette, Destroyer, Frigate, and Light Combat Vessel

-

Which are the leading naval vessels and surface combatants companies globally?

Some of the leading naval vessels and surface combatants companies are BAE Systems Plc, China State Shipbuilding Corp Ltd, Damen Shipyards Group, Fincantieri SpA, Huntington Ingalls Industries Inc, Lockheed Martin Corp, Mitsubishi Heavy Industries Ltd, Naval Group, ThyssenKrupp AG, and United Shipbuilding Corp, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports