Netherlands Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Netherlands Construction Market Report Overview

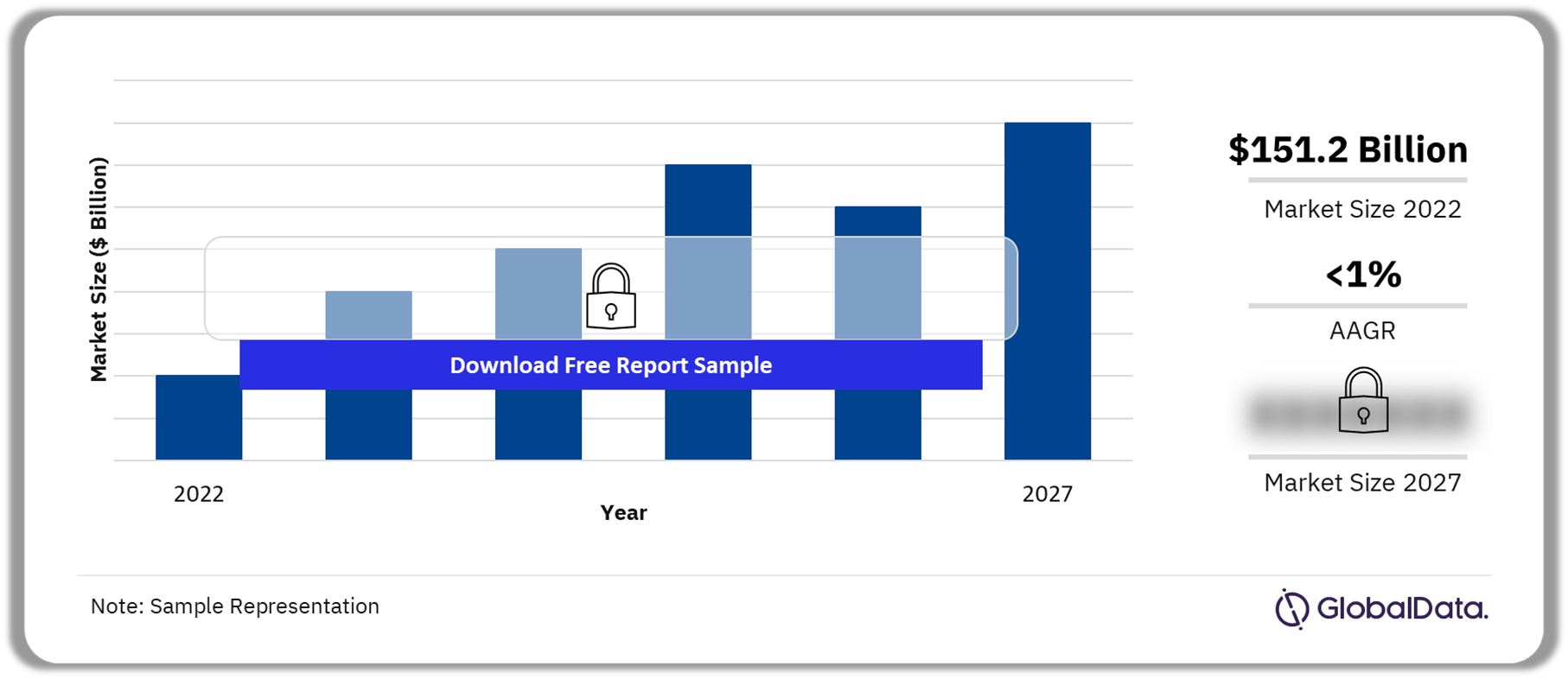

The Netherlands construction market size was $151.2 billion in 2022. The market is projected to achieve an AAGR of less than 1% during 2024-2027. Investments in transport and renewable energy infrastructure projects will drive the market growth during the forecast period.

Netherlands Construction Market Outlook, 2022-2027 ($ Billion)

Buy Full Report to Know More about the Netherlands Construction Market Forecast

The Netherlands construction market report has compiled data on various project types and construction activities across sectors. While discussing the construction projects, our analysts have elucidated the factors responsible for the developments. The report further analyzes the top construction projects in the Netherlands from pre-planning to execution, along with the emerging market trends. In addition, the report provides an overview of the latest developments in the Netherlands construction market.

| Market Size (2022) | $151.2 billion |

| AAGR (2024-2027) | <1% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Sectors | · Commercial Construction

· Industrial Construction · Infrastructure Construction · Energy and Utilities Construction · Institutional Construction · Residential Construction |

| Key Contractors | · Mitsubishi Group

· Ronesans Holding AS · BESIX Group SA · Dura Vermeer Groep NV · Royal Boskalis Westminster NV |

| Key Consultants | · Fugro NV

· BLIX Consultancy BV · Pondera Consult BV · Royal HaskoningDHV · Tetra Tech Inc |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Netherlands Construction Market Segmentation by Sectors

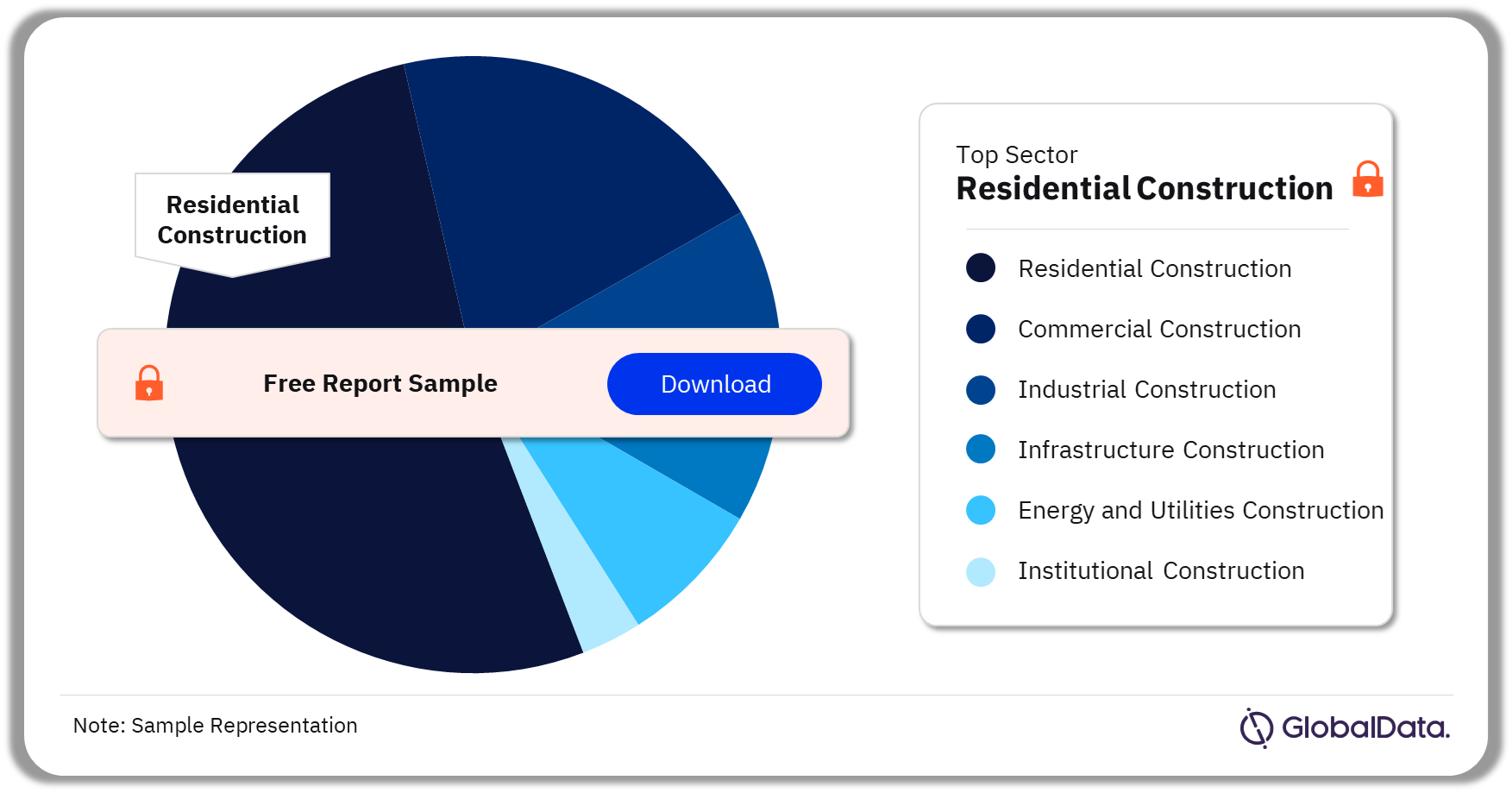

Residential construction was the leading sector in the Netherlands construction market in 2022

The key sectors in the Netherlands construction market are commercial construction, industrial construction, infrastructure construction, energy and utilities construction, institutional construction, and residential construction.

Commercial construction: The project types in this sector include leisure and hospitality buildings, office buildings, outdoor leisure facilities, retail buildings, and other commercial construction. An increase in commercial and tourism businesses, along with a rise in office-building activity, will support the commercial sector’s growth over the forecast period.

Industrial construction: The project types in this sector include chemical and pharmaceutical plants, manufacturing plants, metal and material production and processing plants, and waste processing plants. An increase in investment and developments in manufacturing plants will support the industrial sector output in the coming years.

Infrastructure construction: The project types in this sector include rail infrastructure, road infrastructure, and other infrastructure projects. Government investments in expanding rail and road networks will drive the infrastructure construction sector growth in the coming years. The sector output will also be affected by the government’s long-term plans to develop regional connectivity through public and private investment.

Energy and utilities construction: The project types in this sector include electricity and power, oil and gas, telecommunications, sewage infrastructure, and water infrastructure. Plans to increase the share of renewable energy in the Netherlands by 2030 will drive the sector growth in the coming years.

Institutional construction: The project types in this sector include educational buildings, healthcare buildings, institutional buildings, research facilities, and religious buildings. Public and private sector investments in healthcare, education, and research will aid in the institutional construction sector growth during the forecast period.

Residential construction: The project types in this sector include single-family housing and multi-family housing. In the long term, the government’s commitment to provide affordable housing to the increasing population will drive the residential construction sector growth.

Netherlands Construction Market Analysis by Sectors, 2022 (%)

Buy Full Report for more Sector Insights into the Netherlands Construction Market

Netherlands Construction Market - Competitive Landscape

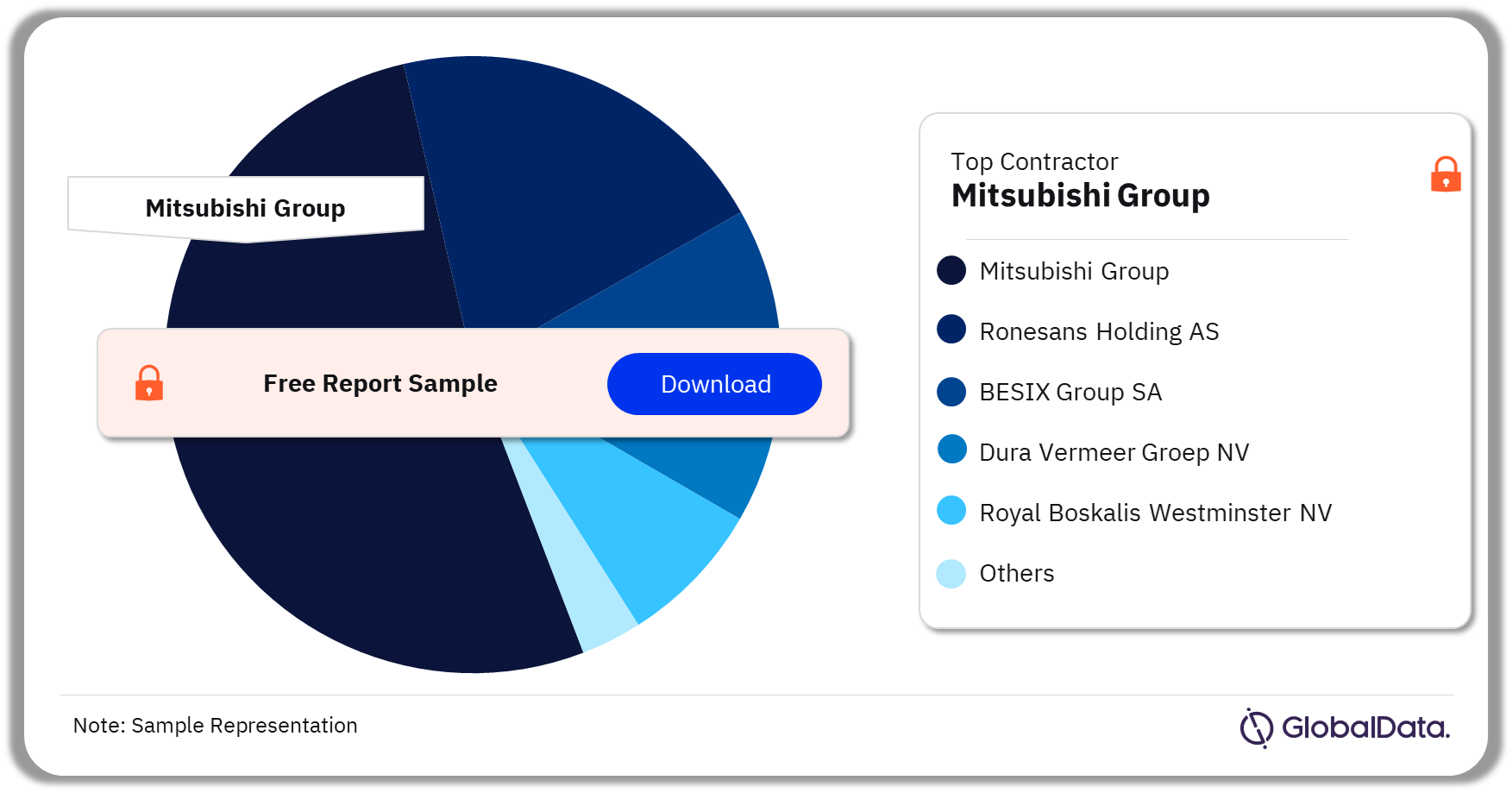

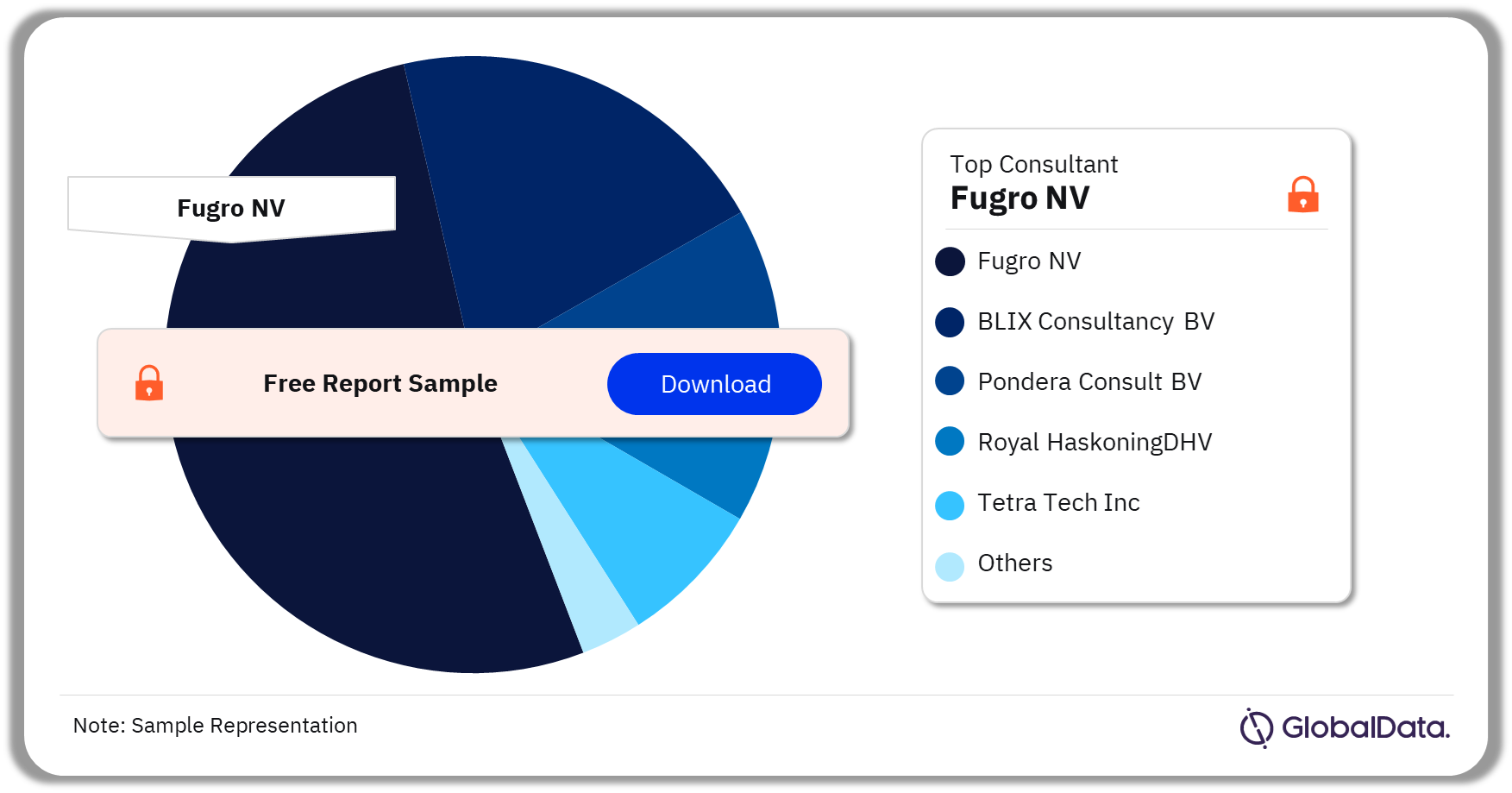

Mitsubishi Group was the leading contractor and Fugro NV was the leading consultant in the Netherlands construction market in 2022

A few of the leading contractors in the Netherlands construction market are:

- Mitsubishi Group

- Ronesans Holding AS

- BESIX Group SA

- Dura Vermeer Groep NV

- Royal Boskalis Westminster NV

Domestic contractors account for a majority share of the project pipeline in the Netherlands construction market.

Netherlands Construction Market Analysis by Contractors, 2022 (%)

Buy the Full Report to Know More about the Contractors in the Netherlands Construction Market

A few of the leading consultants in the Netherlands construction market are:

- Fugro NV

- BLIX Consultancy BV

- Pondera Consult BV

- Royal HaskoningDHV

- Tetra Tech Inc

Consultants with headquarters within the Netherlands are involved in most of the project pipeline by value.

Netherlands Construction Market Analysis by Consultants, 2022 (%)

Buy the Full Report to Know More about Consultants in the Netherlands Construction Market

Netherlands Construction Market - Latest Developments

- Among the largest commercial projects currently in the pipeline is the Middenmeer Data Center Campus project, which includes the construction of data centers.

- The largest industrial project in the pipeline is the Porthos Carbon Capture and Storage project, which involves the construction of a carbon capture and storage (CCS) system, buildings, storage tanks, compressor site at Maasvlakte, a control room, and other related facilities.

Segments Covered in the Report

Netherlands Construction Sectors Outlook (Value, $ Billion, 2018-2027)

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Energy and Utilities Construction

- Institutional Construction

- Residential Construction

Scope

This report provides:

- A comprehensive analysis of the construction industry in the Netherlands.

- Historical and forecast valuations of the construction industry in the Netherlands, featuring details of key growth drivers.

- Segmentation by sector and sub-sector.

- Analysis of the mega-project pipeline, including breakdowns by development stage across all sectors and projected spending on projects in the existing pipeline.

- Listings of major projects, in addition to details of leading contractors and consultants.

Reasons to Buy

- Identify and evaluate market opportunities using GlobalData’s standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with over 600 time-series data forecasts.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData’s critical and actionable insight.

- Assess business risks, including cost, regulatory, and competitive pressures.

- Evaluate competitive risk and success factors.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Netherlands construction market size in 2022?

The construction market size in the Netherlands was $151.2 billion in 2022.

-

What is the Netherlands construction market growth rate?

The construction market in the Netherlands is projected to achieve an AAGR of less than 1% during 2024-2027.

-

Which was the leading sector in the Netherlands construction market in 2022?

Residential construction was the leading sector in the Dutch construction market in 2022.

-

Which are the leading contractors in the Netherlands construction market?

A few of the leading contractors in the Dutch construction market are Mitsubishi Group, Ronesans Holding AS, BESIX Group SA, Dura Vermeer Groep NV, and Royal Boskalis Westminster NV.

-

Which are the leading consultants in the Netherlands construction market?

A few of the leading consultants in the Netherlands construction market are Fugro NV, BLIX Consultancy BV, Pondera Consult BV, Royal HaskoningDHV, and Tetra Tech Inc.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.