Netherlands Healthcare (Pharma and Medical Devices) Market Analysis, Regulatory, Reimbursement and Competitive Landscape

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Netherlands Healthcare Market Overview

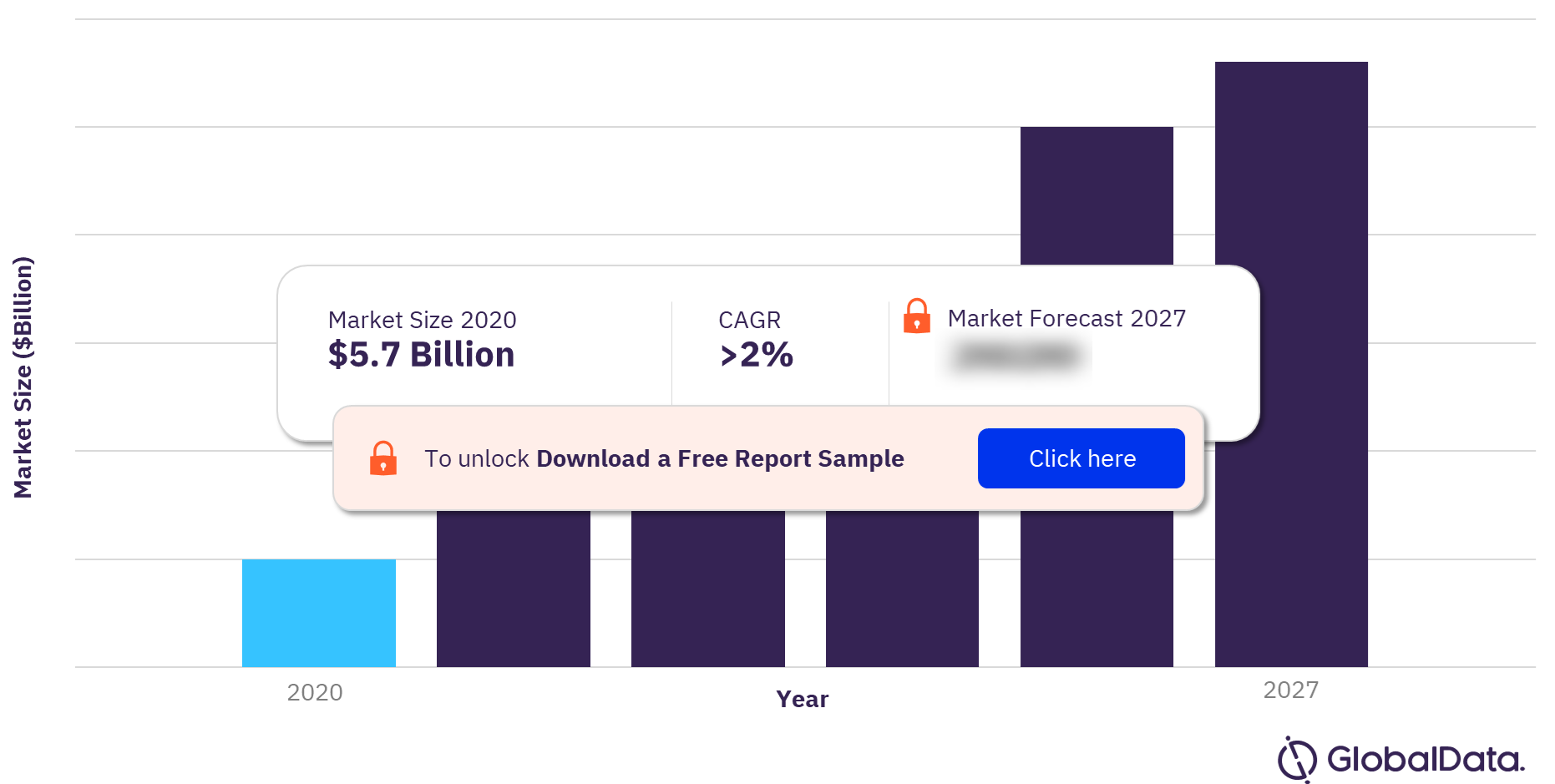

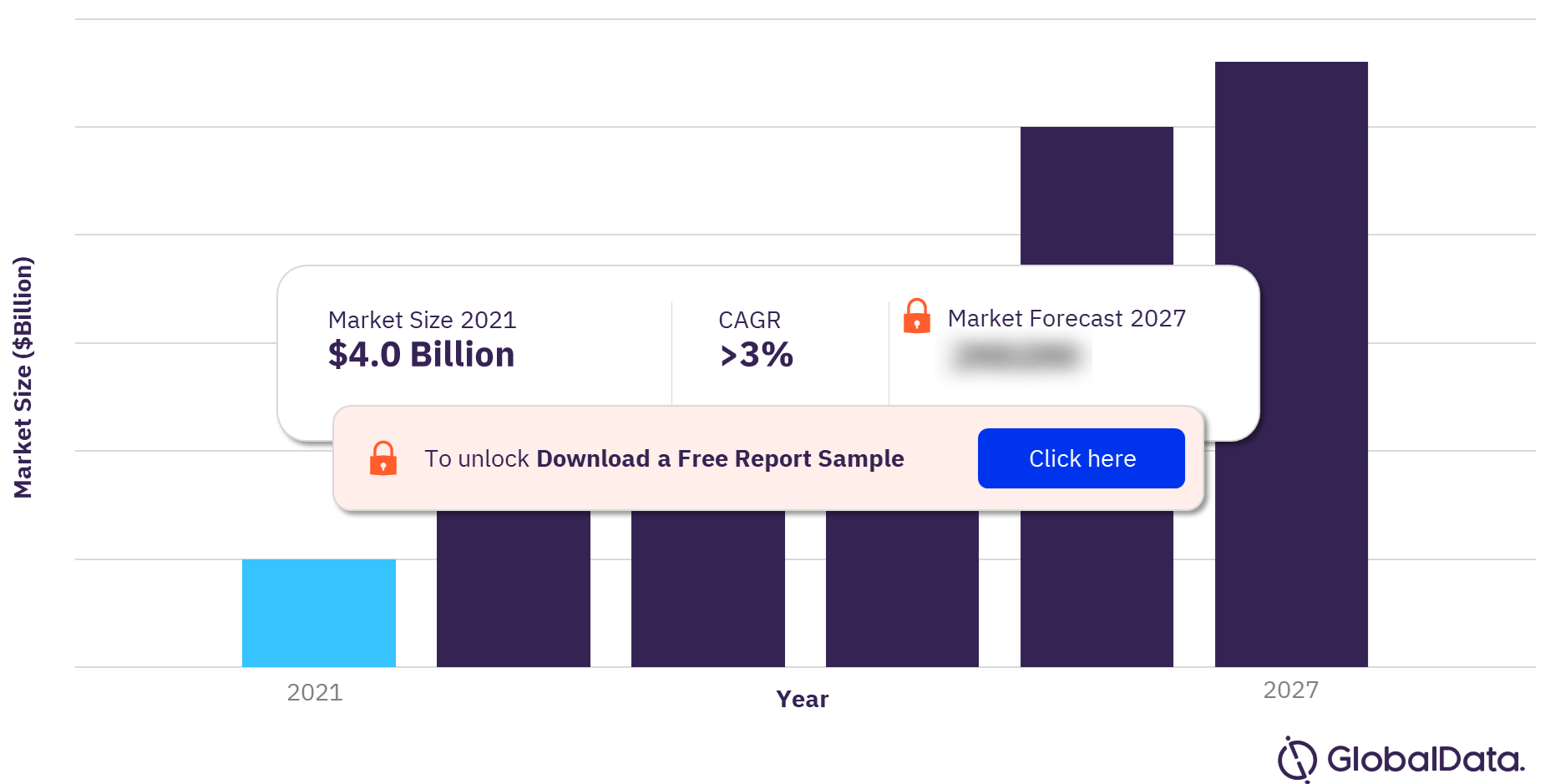

The Dutch pharmaceutical market size was $5.7 billion and is expected to grow at a CAGR of more than 2% during 2022-2027. The Dutch medical devices market was valued at $4.0 billion in 2021 and is expected to grow at a CAGR of more than 3% during 2022-2027. In 2022, the Dutch government invested $325 million in preclinical cancer treatment development. The government intends to promote the expansion of the Dutch National Growth Fund in order to provide biotechnology with specific capabilities that will speed up the development of oncology prospects. In 2021, the Netherlands developed a Personal Health Train platform that provides access to health data for researchers and innovators in the field of healthcare. It allows for limited data access while following privacy laws to promote patient participation.

The Dutch pharmaceutical market offers great opportunities for pharmaceutical companies owing to the country’s enhanced investments in the R&D sector. The growth of the pharmaceutical market is attributed to the increased usage of medications for the treatment of chronic diseases due to the country’s aging demographics.

Netherlands Pharmaceutical Market Outlook

To gain more information on the Netherlands pharmaceutical market forecast, download a free report sample

Netherlands Medical Devices Market Outlook

To gain more information on the Netherlands medical devices market forecast, download a free report sample

The Netherlands healthcare market research report is an essential source of information on the analysis of the healthcare, regulatory, and reimbursement landscape in the Netherlands. It identifies the key trends in the country’s healthcare market and provides insights into its demographic, regulatory, and reimbursement landscape, and healthcare infrastructure. Most importantly, the report provides valuable insights into the trends and segmentation of its pharmaceutical and medical device markets.

Netherlands Pharmaceuticals Market Report Overview

| Market Size (2020) | $5.7 billion |

| CAGR (2022-2027) | >2% |

| Key Segments | Generics, Biologics, Biosimilars, and Over-the-Counter (OTC) Medicines |

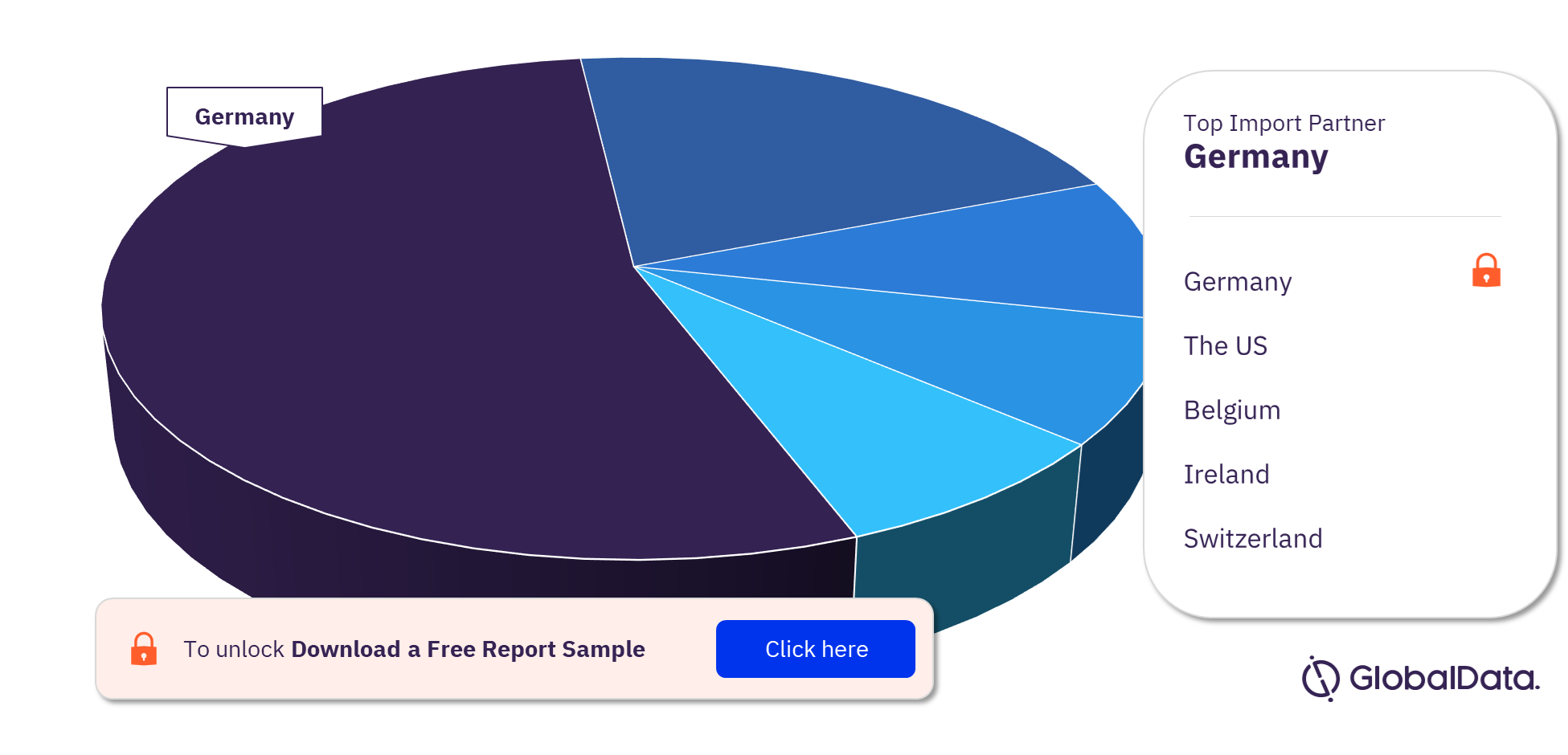

| Key Import Partners | Germany, the US, Belgium, Ireland, and Switzerland |

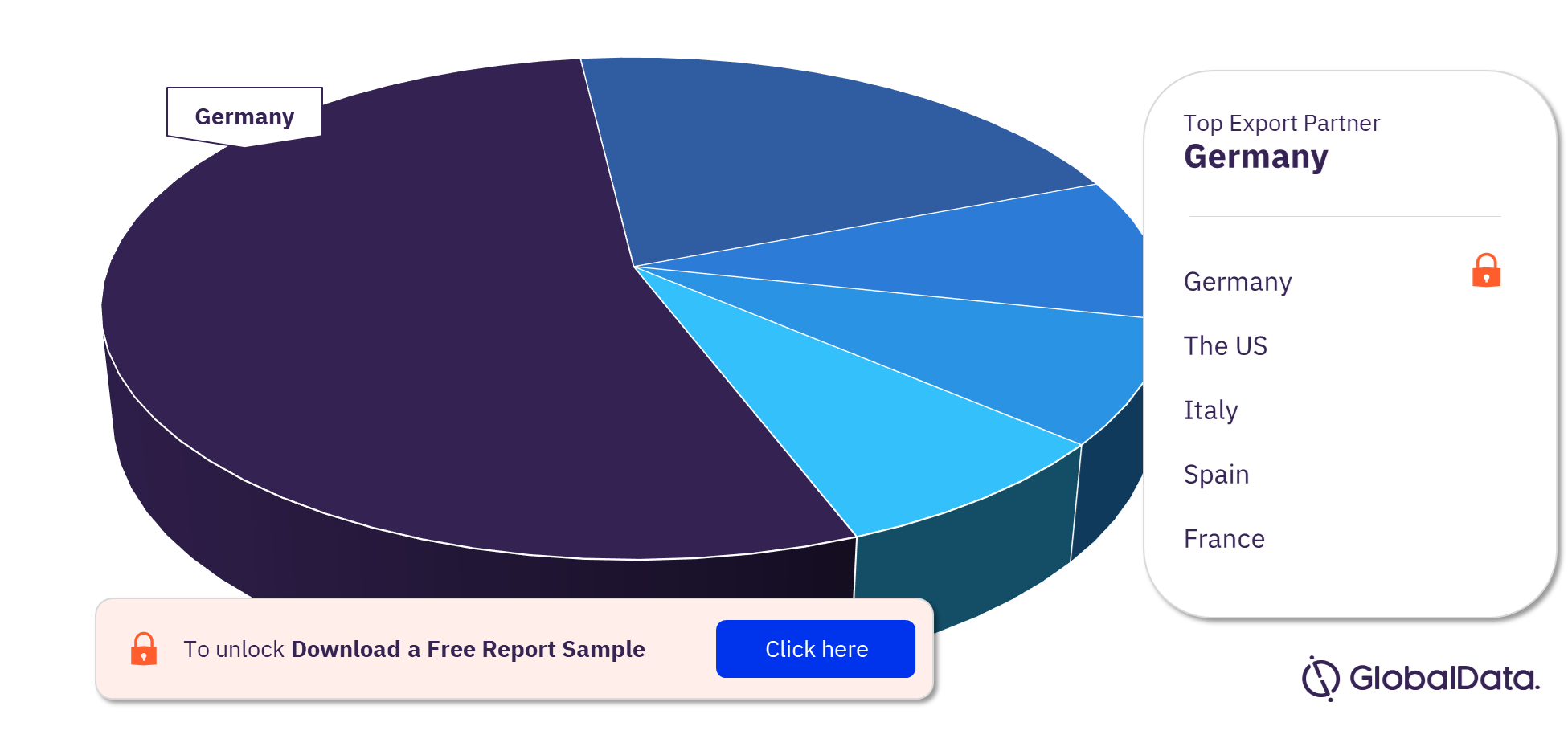

| Key Export Partners | Germany, the US, Italy, Spain, and France |

| Leading Players | Sanofi, Pfizer, GlaxoSmithKline (GSK), Novartis, and Pharming Group NV |

Netherlands Medical Devices Market Report Overview

| Market Size (2021) | $4.0 billion |

| CAGR (2022-2027) | >3% |

| Key Segments | Hospital Supplies, Wound Care Management, Cardiovascular Devices, Orthopedic Devices, General Surgery Devices, and Others |

| Leading Players | Fresenius SE & Co., Abbott, Siemens Healthineers, GE Healthcare, and Qiagen |

Netherlands Pharmaceuticals Market Segmentation by Import and Export Partners

The key import partners of the Netherlands pharmaceuticals market are Germany, the US, Belgium, Ireland, and Switzerland. Germany accounts for the highest percentage of the import business. The key export partners of the Netherlands pharmaceuticals market are Germany, the US, Italy, Spain, and France. Germany also accounts for the highest percentage of the export business.

Netherlands Pharmaceuticals Market Analysis by Import Partners

For more import partner insights into the Netherlands pharmaceuticals market, download a free report sample

Netherlands Pharmaceuticals Market Analysis by Export Partners

For more export partner insights into the Netherlands pharmaceuticals market, download a free report sample

Netherlands Pharmaceuticals Market Segments

The key segments in the Netherlands pharmaceuticals market are generics, biologics, biosimilars, and over-the-counter (OTC) medicines. In September 2022, Synthon, a generic drug producer based in the Netherlands, succeeded in a jurisdiction claim for marketing authorization of a drug sold under the brand name Copaxone against Teva. The drug is used for the treatment of multiple sclerosis.

Netherlands Pharmaceuticals Market – Competitive Landscape

The leading players in the Netherlands pharmaceuticals market are Sanofi, Pfizer, GlaxoSmithKline (GSK), Novartis, and Pharming Group NV. Pfizer was the leading player among them in terms of net sales value.

Netherlands Pharmaceuticals Market Analysis by Players

To know more about leading players in the Netherlands pharmaceuticals market, download a free report sample

Netherlands Medical Devices Market Segments

The key segments in the Netherlands medical devices market are hospital supplies, wound care management, cardiovascular devices, orthopedic devices, general surgery devices, and others. In 2021, hospital supplies had the highest share in the Netherlands medical devices market.

Netherlands Medical Devices Market Analysis by Segments

For more segment insights into the Netherlands medical devices market, download a free report sample

Netherlands Medical Devices Market – Competitive Landscape

The major players in the medical devices market of the Netherlands are Fresenius SE & Co., Abbott, Siemens Healthineers, GE Healthcare, and Qiagen. Fresenius SE & Co. had the highest share in the Netherlands devices market.

Netherlands Medical Devices Market Analysis by Players

To know more about leading players in the Netherlands medical devices market, download a free report sample

Reasons to Buy

This report will enhance your decision-making capability by allowing you to:

- Develop business strategies by understanding the trends shaping and driving the Netherlands healthcare market

- Drive revenues by understanding the key trends, reimbursement and regulatory policies, pharmaceutical market segments, and companies likely to impact the Netherlands healthcare market in the future

- Formulate effective sales and marketing strategies by understanding the competitive landscape and analyzing competitors’ performance

- Organize your sales and marketing efforts by identifying the market categories and segments that present the most opportunities for consolidation, investment, and strategic partnership

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Netherlands pharmaceuticals market size in 2020?

The pharmaceutical market size in the Netherlands was valued at $5.7 billion in 2020.

-

What is the Netherlands pharmaceuticals market growth rate?

The Netherlands pharmaceutical market is expected to grow at a CAGR of more than 2% during 2022-2027.

-

What are the key segments in the Netherlands pharmaceuticals market?

The key segments in the Netherlands pharmaceuticals market are generics, biologics, biosimilars, and over-the-counter (OTC) medicines.

-

Who are the key import and export partners in the Netherlands pharmaceuticals market?

The key import partners of the Netherlands pharmaceuticals market are Germany, the US, Belgium, Ireland, and Switzerland. The key export partners of the Netherlands are Germany, the US, Italy, Spain, and France.

-

Who are the leading players in the Netherlands pharmaceuticals market?

The leading players in the Netherlands pharmaceuticals market are Sanofi, Pfizer, GlaxoSmithKline (GSK), Novartis, and Pharming Group NV.

-

What was the Netherlands medical devices market size in 2021?

The medical devices market size in the Netherlands was valued at $4.0 billion in 2021.

-

What is the Netherlands medical devices market growth rate?

The medical devices market in the Netherlands is expected to achieve a CAGR of more than 3% during 2022-2027.

-

What are the key segments in the Netherlands medical devices market?

The key segments in the Netherlands medical devices market are hospital supplies, wound care management, cardiovascular devices, orthopedic devices, general surgery devices, and others.

-

Who are the leading players in the Netherlands medical devices market?

The leading players in the Netherlands medical devices market are Fresenius SE & Co., Abbott, Siemens Healthineers, GE Healthcare, and Qiagen.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pharmaceuticals reports