Oceania Oil and Gas Upstream Development Trends and Forecast by Countries, Terrain, Facility Type and Companies, 2023-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Oceania Oil and Gas Upstream Development Trends and Forecast Overview

In Oceania, the crude, condensate, and natural gas production from active and planned fields is 3,070 thousand barrels of oil equivalent per day (mboed) in 2023. The outlook of this region is very stable. Despite the overall crude oil and condensate production forecast to decline over the forecast period. It will be compensated by the series of announced fields in Australia and Papua New Guinea, the two key producers in the region. Also, there are opportunities for future discoveries. The gentle growth in natural gas production is encouraging as the region countries to be a major player in the LNG market.

The Oceania oil and gas upstream development trends and forecast research report aids in keeping abreast of key upcoming production projects and facilitating decision-making based on strong oil and gas production data. The report also will enable the development of business strategies with the help of specific insights into the Oceania upstream sector.

| Crude, Condensate, and Natural Gas Production (2023) | 3,070 mboed |

| Key Countries | Australia, Papua New Guinea, Timor Sea Joint Petroleum Development Area |

| Key Field Terrains | Onshore, Shallow Water, and Deepwater |

| Key Facility Type | Subsea System Platform, Mobile Offshore Production Unit (MOPU), Fixed and Floating Production Unit (FPU), Floating Production Storage and Offloading (FPSO), Wellhead, and Fixed Platforms |

| Key Companies (Expenditure Outlook) | Santos Ltd., TotalEnergies SE, Exxon Mobil Corp, Kumul Petroleum Holdings Ltd., Shell plc, Galilee Energy Ltd., Twinza Oil Ltd., Beach Energy Ltd., Strike Energy Ltd., and Warrego Energy UK Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Download a Free Sample or Buy the Full Report for Additional Insights on the Oceania Oil and Gas Upstream Market Forecast

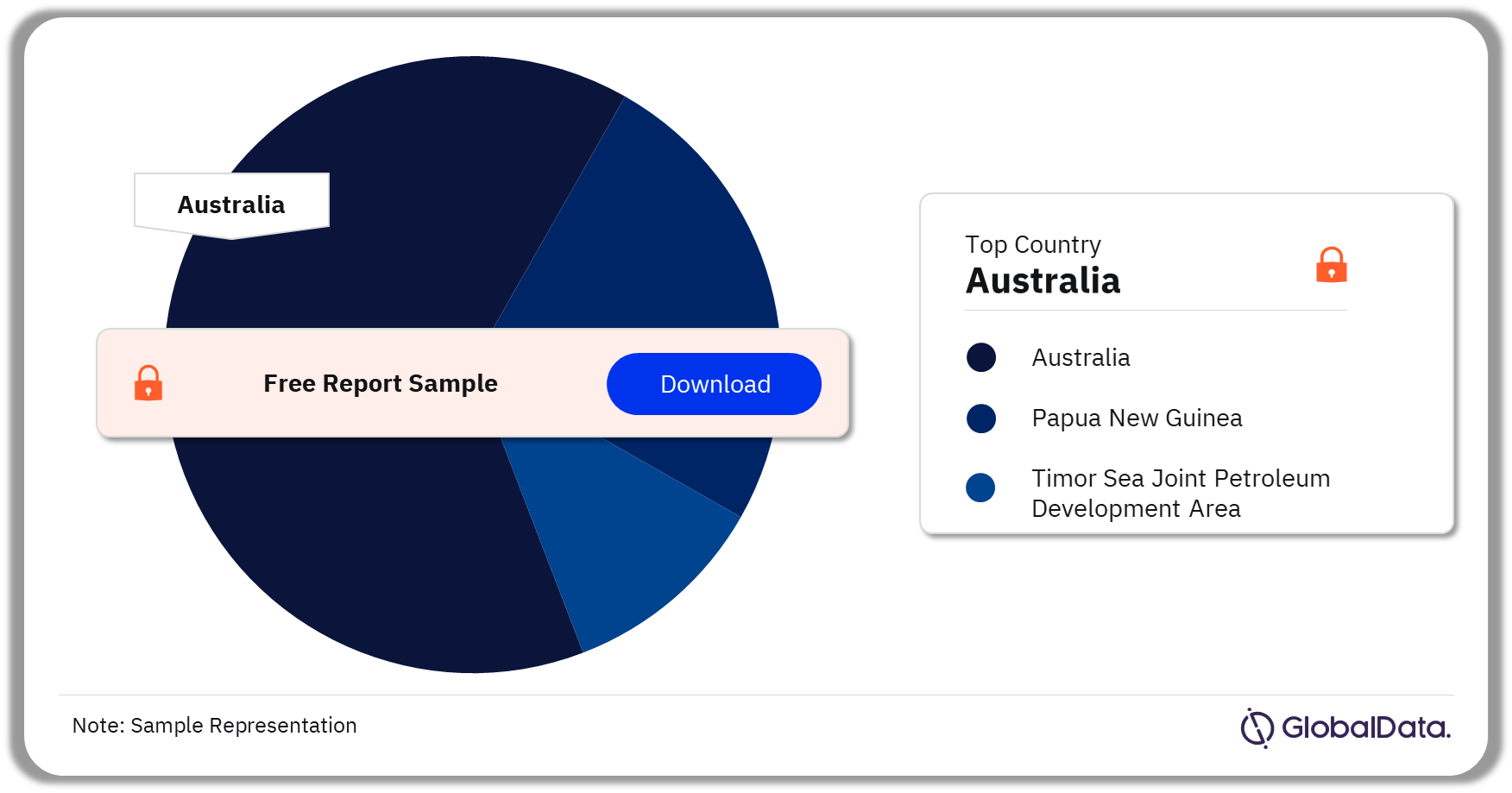

Oceania Oil and Gas New Project Expenditure Outlook by Countries

The key countries in Oceania’s oil and gas production include Australia, Papua New Guinea, Timor Sea Joint Petroleum Development Area. Australia is likely to dominate the market in terms of recoverable reserves. The high volumes of reserves in Australia are due to planned and announced projects such as Scarborough, Equus, and Crux. Furthermore, Australia is likely to account for more than 70% of the total capex to be spent on planned and announced projects during the projected period.

Oceania Oil and Gas New Project Expenditure Analysis by Country, 2023-2027 (%)

Download the Free Sample Report or Buy the Full Oceania Oil and Gas Production Outlook Report for Country-Wise Analysis

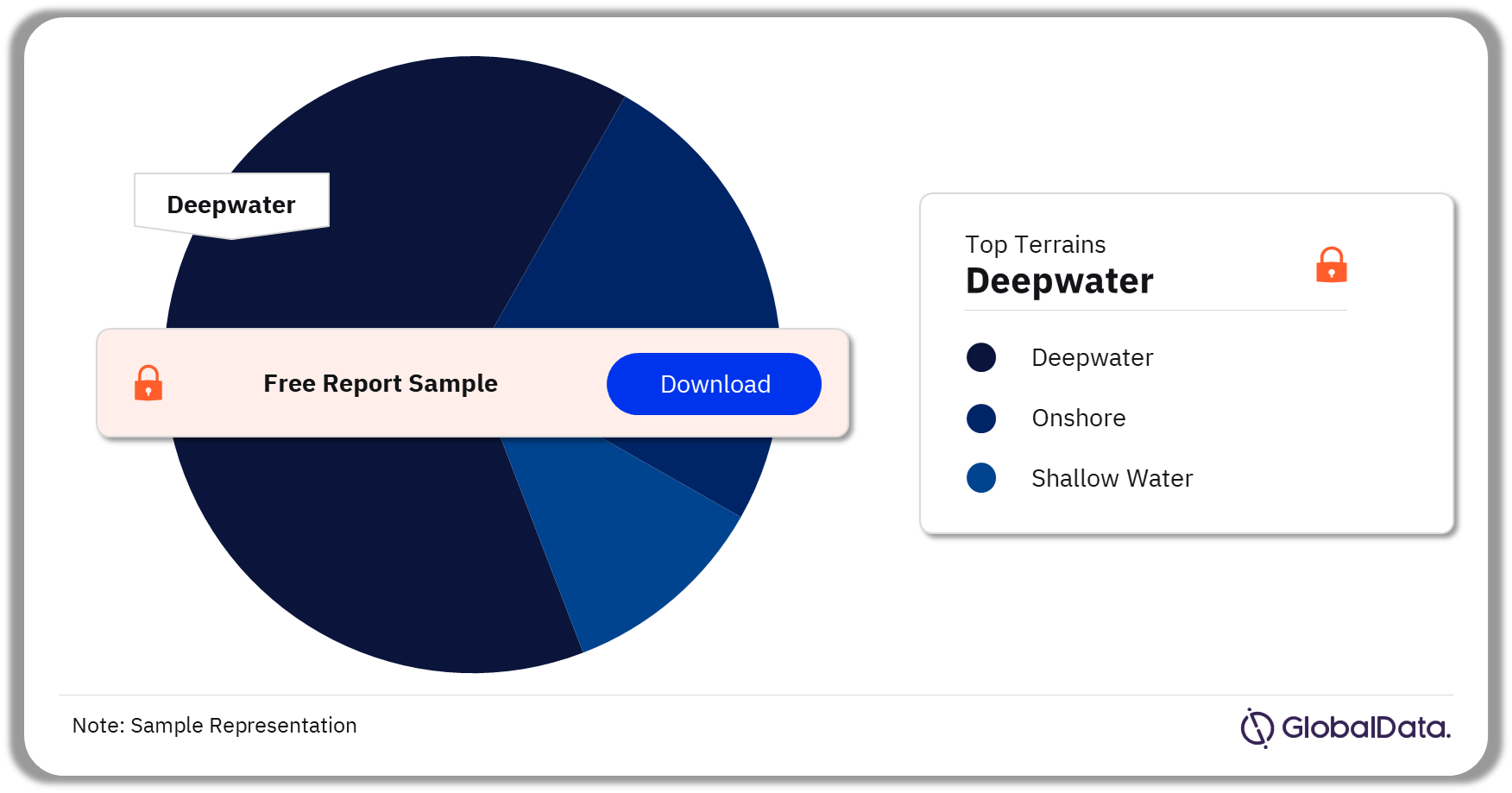

Oceania Oil and Gas New Project Expenditure Outlook by Terrains

The key terrains in the Oceania oil and gas upstream production are onshore, shallow water, and deepwater. The deepwater terrains accounted for the highest capex allocated for the development of the planned and announced projects expected to start operations during 2023-2027.

Capex Outlook of Oceania Oil and Gas Production by Terrains, 2023-2037 (%)

Download the Free Sample Report or Buy the Full Oceania Oil and Production Outlook Report for Terrain-Wise Analysis

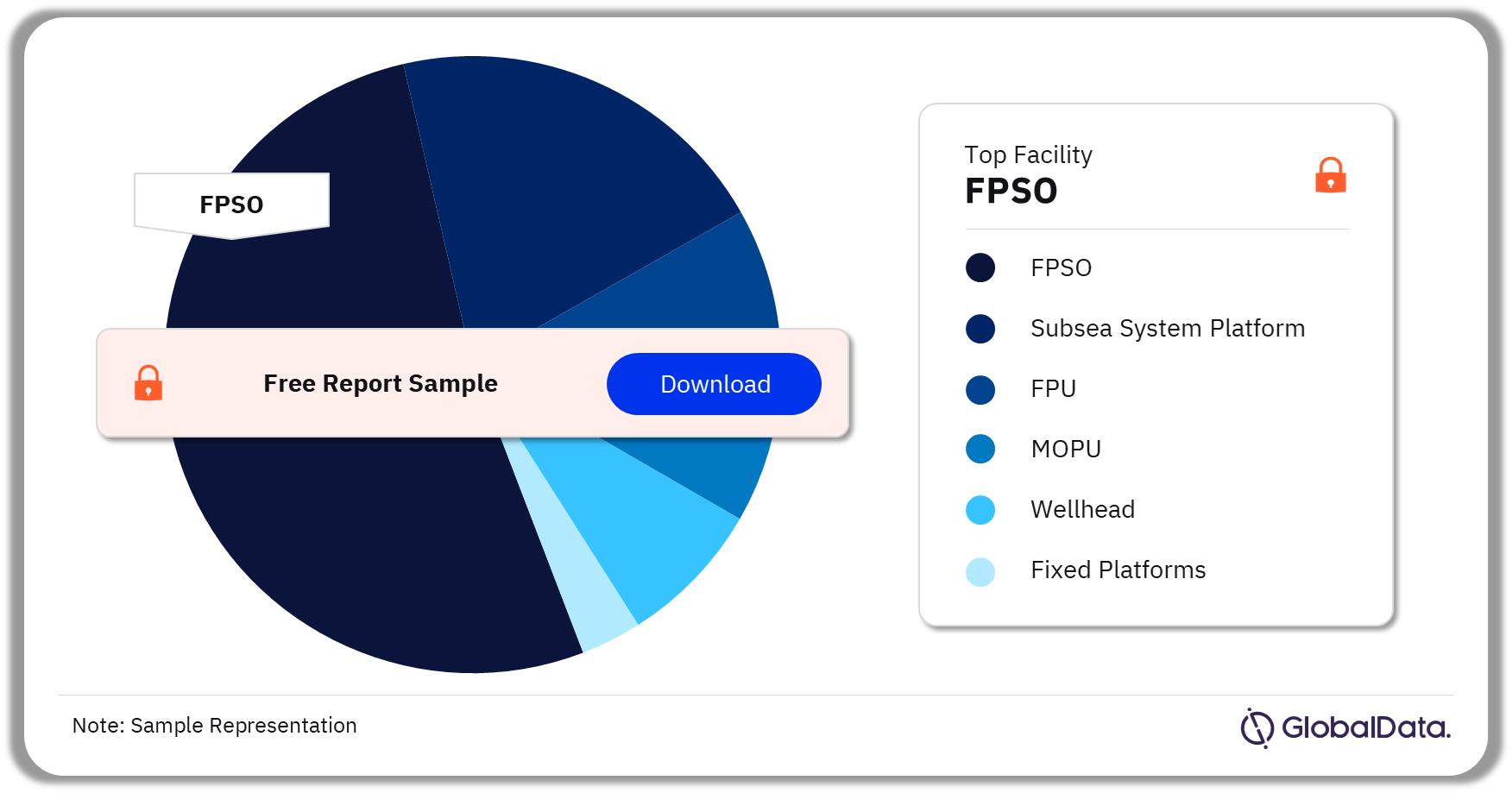

Oceania Oil and Gas New Project Expenditure Outlook by Facility Type

The key facility-type in the Oceania oil and gas production are subsea system platform, mobile offshore production unit (MOPU), fixed and floating production unit (FPU), floating production storage and offloading (FPSO), wellhead, and fixed platforms. Of the total proposed capex, the majority of the planned and announced projects starting operations during 2023–2027 are likely to use the FPSO platform, followed by the subsea system facilities.

Oceania Oil and Gas Upstream Production Analysis by Facility Type, 2023-2027 (%)

Download the Free Sample Report or Buy the Full Oceania Oil and Gas Production Outlook Report for Facility-Wise Analysis

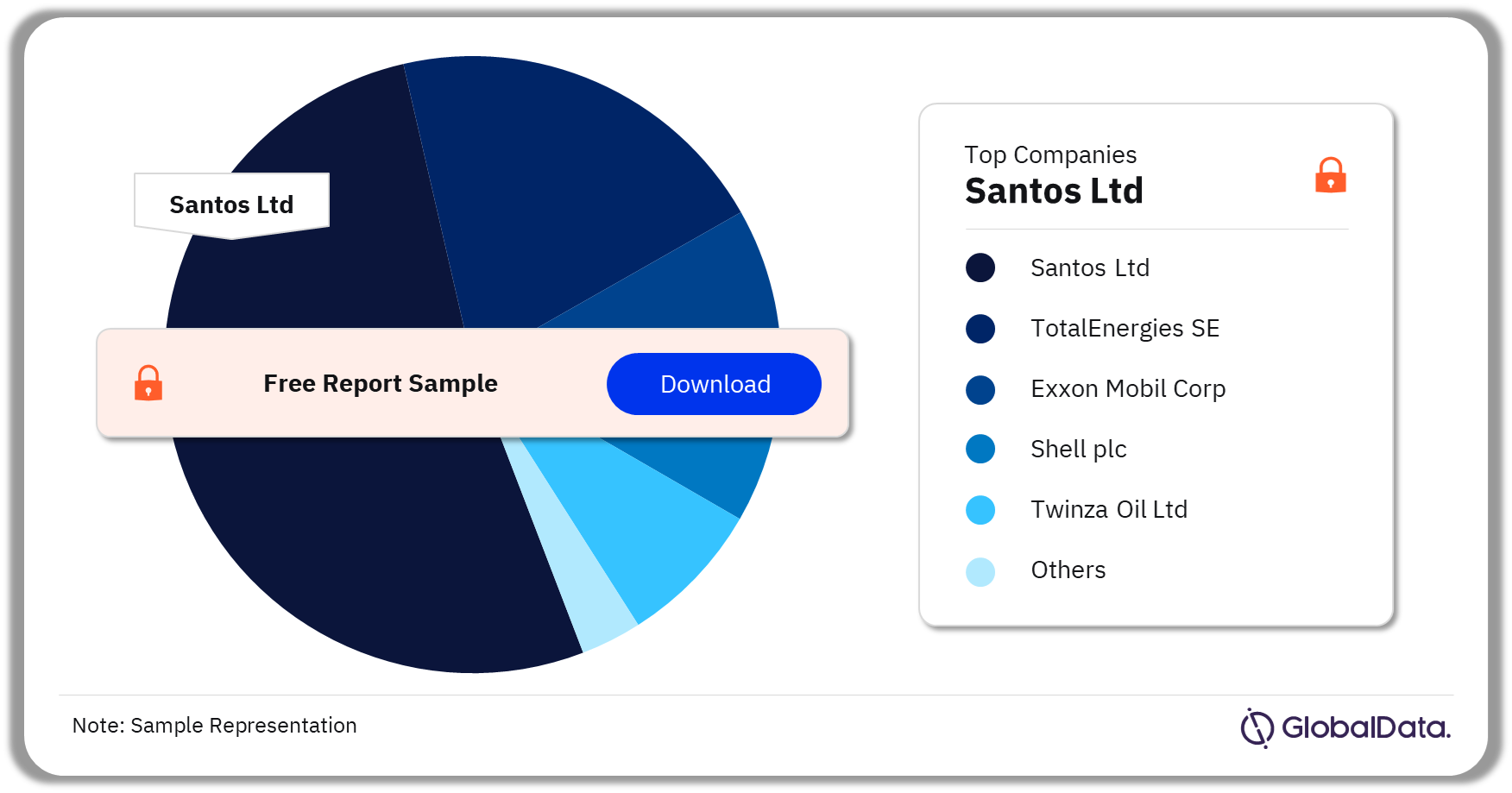

Oceania Oil and Gas New Project Expenditure– Competitive Landscape

The key companies in the Oceania oil and gas upstream production include Santos Ltd, TotalEnergies SE, Exxon Mobil Corp, Kumul Petroleum Holdings Ltd, Shell plc, Galilee Energy Ltd, Twinza Oil Ltd, Beach Energy Ltd, Strike Energy Ltd, and Warrego Energy UK Ltd. Santos Ltd is expected to be the top spender on its upcoming projects, followed by TotalEnergies SE and Exxon Mobil Corp.

Oceania Oil and Gas Upstream New Project Expenditure Analysis by Companies, 2023-2027 (%)

Download the Free Sample Report or Buy the Full Report for Insights into the Leading Companies in the Oceania Oil and Gas Production

Key Segments Covered in this Report.

Oceania Oil and Gas Upstream Development Trends and Forecast Outlook by Countries (%, 2023-2027)

- Australia

- Papua New Guinea

- Timor Sea Joint Petroleum Development Area

Oceania Oil and Gas Upstream Development Trends and Forecast Outlook by Terrains (%, 2023-2027)

- Onshore

- Shallow Water

- Deepwater

Oceania Oil and Gas Upstream Development Trends and Forecast Outlook by Facility Type (%, 2023-2027)

- Subsea System Platform

- Mobile Offshore Production Unit (MOPU)

- Fixed and Floating Production Unit (FPU)

- Floating Production Storage and Offloading (FPSO)

- Wellhead

- Fixed Platforms

Scope

- Oceania oil and gas production outlook by key countries, and key companies for the period 2023-2027

- Oceania new projects capital expenditure outlook by key countries, key companies, field terrain, and facility type for 2023-2027

- Major projects count by key countries, field terrain, and facility type

- Details of key upcoming crude and natural gas projects in the region

Reasons to Buy

- Understand Oceania’s oil and gas production outlook during the period 2023-2027

- Keep abreast of key upcoming production projects in Oceania during the outlook period.

- Facilitate decision-making on the basis of strong oil and gas production data.

- Develop business strategies with the help of specific insights on the Oceania upstream sector.

- Assess your competitor’s planned oil and gas production projects in the region.

Table of Contents

Table

Figures

Frequently asked questions

-

What is the crude, condensate, and natural gas production from active and planned fields in Oceania in 2023?

The crude, condensate, and natural gas production from active and planned fields in Oceania is 3,070 thousand barrels of oil equivalent per day (mboed) in 2023.

-

Which country is the leading producer of oil and gas in Oceania?

Australia is the leading producer of oil and gas in the Oceania region in 2023.

-

Which is the leading terrain type that will be used to develop the oil and gas projects in Oceania during 2023-2027?

Deepwater field terrain will be the most deployed field terrain for Oceania oil and gas upstream development projects during the forecast period.

-

Which is the leading facility type that will be used on the planned and announced projects in Oceania during 2023-2027?

About 71% out of the total proposed capex to be spent on the planned and announced projects will use FPSO platform.

-

Which are the leading companies involved in the Oceania oil and gas upcoming projects that are expected to start operations during 2023-2027?

Santos Ltd, TotalEnergies SE, Exxon Mobil Corp, Kumul Petroleum Holdings Ltd, Shell plc, Galilee Energy Ltd, Twinza Oil Ltd, Beach Energy Ltd, Strike Energy Ltd, and Warrego Energy UK Ltd are the key players in the Oceania oil and gas upstream development trends and forecast report.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.