Online Food Delivery Market Size, Share, Trends, and Analysis by Service, Outlet, Region, and Segment Forecast to 2028

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Online Food Delivery’ report can help:

- Gain valuable insights into both present and future market conditions, empowering businesses to make informed decisions regarding market entry, product development, and investment strategies

- Assess competitors’ strengths and capabilities to maintain a competitive edge in the market

- Identify segments and analyze the roles of different stakeholders throughout the entire value chain

- Anticipate shifts in demand and adapt business development strategies accordingly

- Identify potential regions and countries for identifying growth opportunities

How is our ‘Online Food Delivery’ report different from other reports in the market?

- The report presents in-depth market sizing and forecast at a segment level for more than 15 countries including historical and forecast analysis for the period 2018-2028 for market assessment.

- Detailed segmentation by:

- Service – Outlet-to-Consumer and Platform-to-Consumer

- Outlet – Restaurant, Retail, Mobile Operator, and Pub, Club, & Bar

- Region – North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

- The report covers key market drivers and challenges impacting the online food delivery market.

- The report covers a Mergers & Acquisitions (M&A), Venture Finance, Patent Analytics, and Social Media activities dashboard.

- The competitive landscape includes competitive positioning of key companies and company share analysis in the online food delivery market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

- Competitive profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest online food delivery trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Companies Offering Online Food Delivery Services/Solutions

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms

Get a Snapshot of the Online Food Delivery Market

Online Food Delivery Market Report Overview

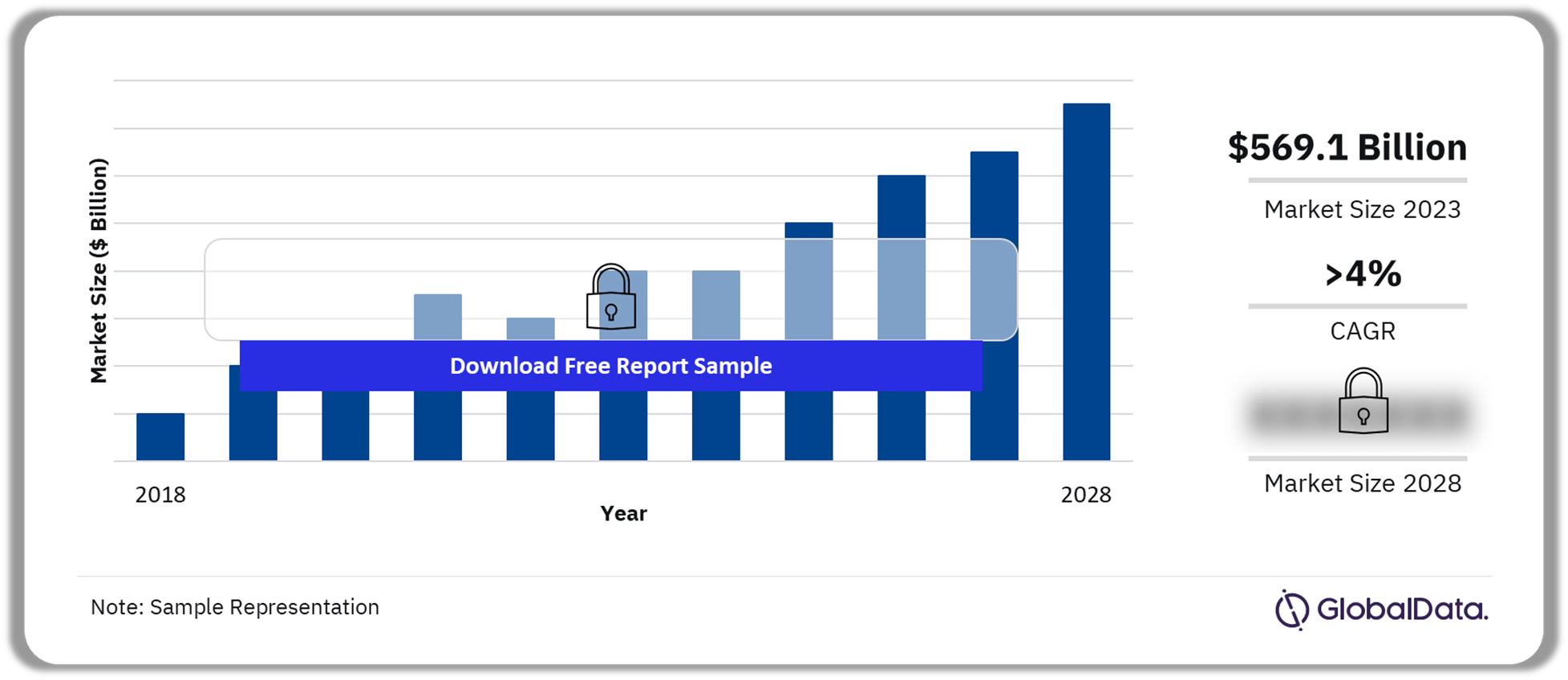

The online food delivery market size revenue was valued at $569.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 4% over the forecast period. The increasing smartphone penetration coupled with widespread access to internet connectivity is set to significantly boost the adoption of online food delivery services. Further, technological advancements such as AI-driven recommendations, diverse payment methods, and real-time order tracking are expected to enhance user experience thereby promoting growth over the forecast period.

The market is witnessing a rising inclination towards healthier and more sustainable meal options, propelled by consumers’ heightened awareness of dietary choices which has led to an increasing demand for plant-based and organic foods. The growth of the online food delivery sector is anticipated to be fueled by consumers’ growing preference for health-conscious options that offer the convenience of home delivery.

Online Food Delivery Market Outlook, 2018-2028 ($Billion)

Buy the Full Report for Additional Insights on the Online Food Delivery Market Forecast

Cloud kitchens, alternatively termed ghost kitchens or dark kitchens, represent a disruptive model in the food delivery ecosystem. These kitchens are dedicated to fulfilling online orders exclusively, negating the necessity for physical dine-in spaces. Cloud kitchens streamline costs, improve operational efficiency, and empower restaurants to broaden their reach without the requirement for traditional brick-and-mortar establishments.

Furthermore, several platforms have added a variety of other services to their range of meal delivery. These include pet food, grocery, and alcohol among others. By diversifying their service offerings, platforms ensure they remain adaptable and capable of meeting the evolving needs of consumers. With time, more creative services will be available in the industry, further embedding online food ordering as a key aspect of modern lifestyles.

The online food delivery sector has experienced impressive expansion in recent years, driven by the convenience it provides to consumers. Nonetheless, this growth has introduced several challenges, with one of the most notable being the management of a large volume of orders. The task of ensuring that every order is accurately prepared, securely packaged, and delivered promptly presents a significant challenge for meal delivery companies. Poor management of orders can result in lost deliveries, which can be frustrating for both customers and restaurants. Solving this challenge is important to retain customer loyalty of online food delivery companies within the very stiff competition that exists in the market today.

| Market Size (2023) | $569.1 billion |

| CAGR (2024-2028) | >4% |

| Forecast Period | 2024-2028 |

| Historic Data | 2018-2023 |

| Report Scope & Coverage | Revenue Forecast, Competitive Landscape, Company Profiling, Growth Trends |

| Service | Outlet-to-Consumer, Platform-to-Consumer |

| Outlet Segment | Restaurant, Retail, Mobile Operator, and Pub, Club, & Bar |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries | US, Canada, UK, Germany, France, China, Japan, India, Brazil, Mexico, Colombia, South Africa, Saudi Arabia, UAE |

| Key Companies | Microsoft Corp., Alphabet Inc., International Business Machines Corp., Samsung Electronics Co Ltd., Intel Corp, Qualcomm Inc., Apple Inc., Amazon.com Inc., Cisco Systems Inc., Salesforce Inc. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

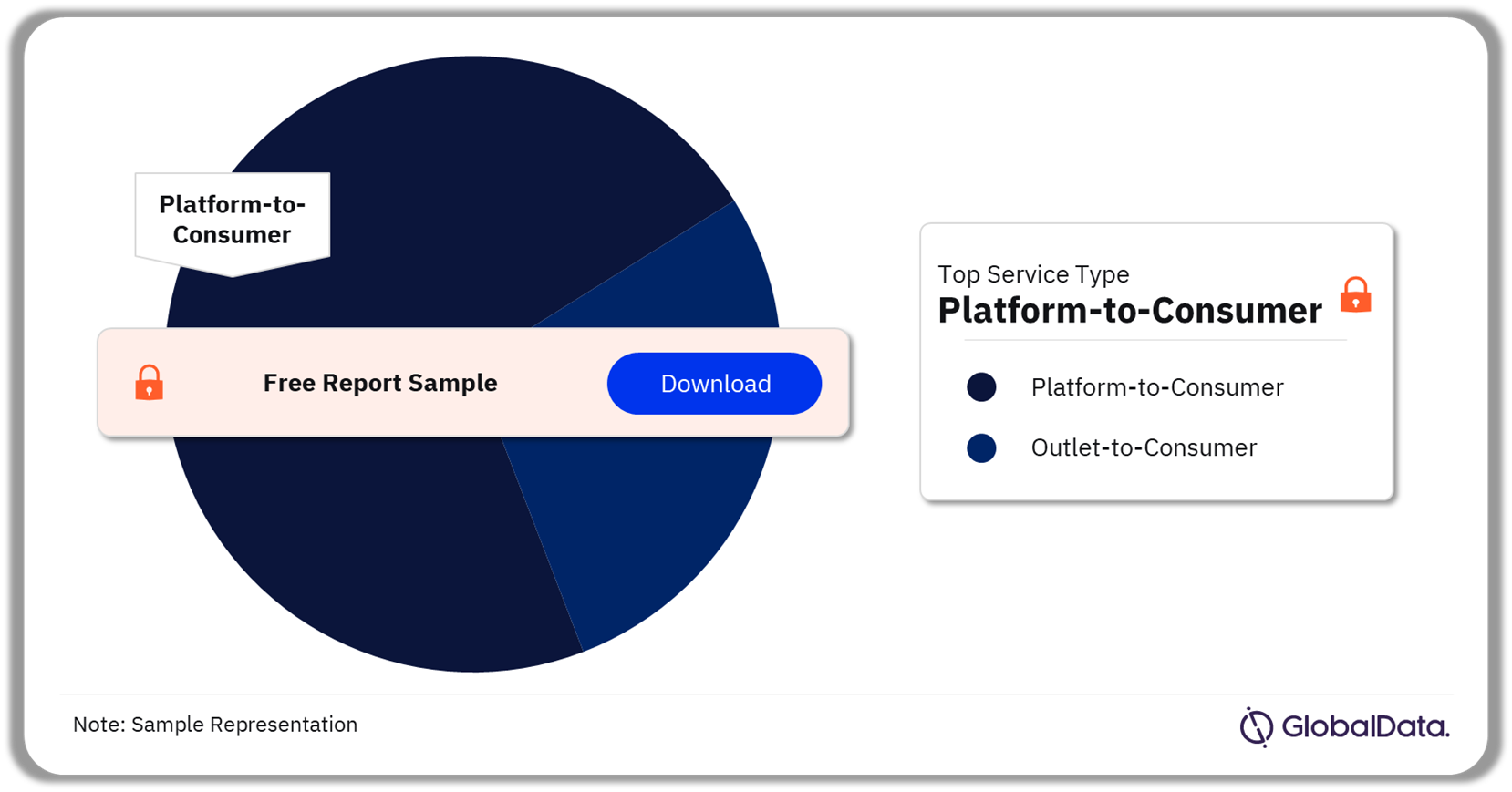

Online Food Delivery Market Segmentation by Service Type

The market by service is segregated into platform-to-consumer and outlet-to-consumer segments. The platform-to-consumer segment, which is the largest of the two, is projected to capture more than 85% of the market by 2028. Innovative and easy-to-use food aggregator applications have revolutionized the meal delivery process. Intuitive interfaces enable customers to explore restaurant options, personalize orders, and complete payments smoothly. Tech-enabled driver networks ensure effective last-mile delivery, improving convenience for both consumers and restaurants.

To entice and retain customers, meal aggregator platforms frequently provide competitive prices and discounts. They use their relationships with restaurants to secure deals and provide promotions, lowering the cost for consumers ordering meals online. Also, several meal aggregator platforms provide customer loyalty programs that incentivize frequent orders, motivating customers to use the platform regularly.

Online Food Delivery Market Share by Service Type, 2023 (%)

Buy the Full Report for More Information on Online Food Delivery Market by Service Type

Technological advancements are empowering meal aggregator companies to provide effective services to customers. Emerging technologies such as artificial intelligence help online food delivery businesses enhance their customer experiences via the use of chatbots. Chatbots enable meal aggregator companies to maintain communication with their customers, and promptly address their inquiries, thereby enhancing loyalty, nurturing customer relationships, and increasing sales.

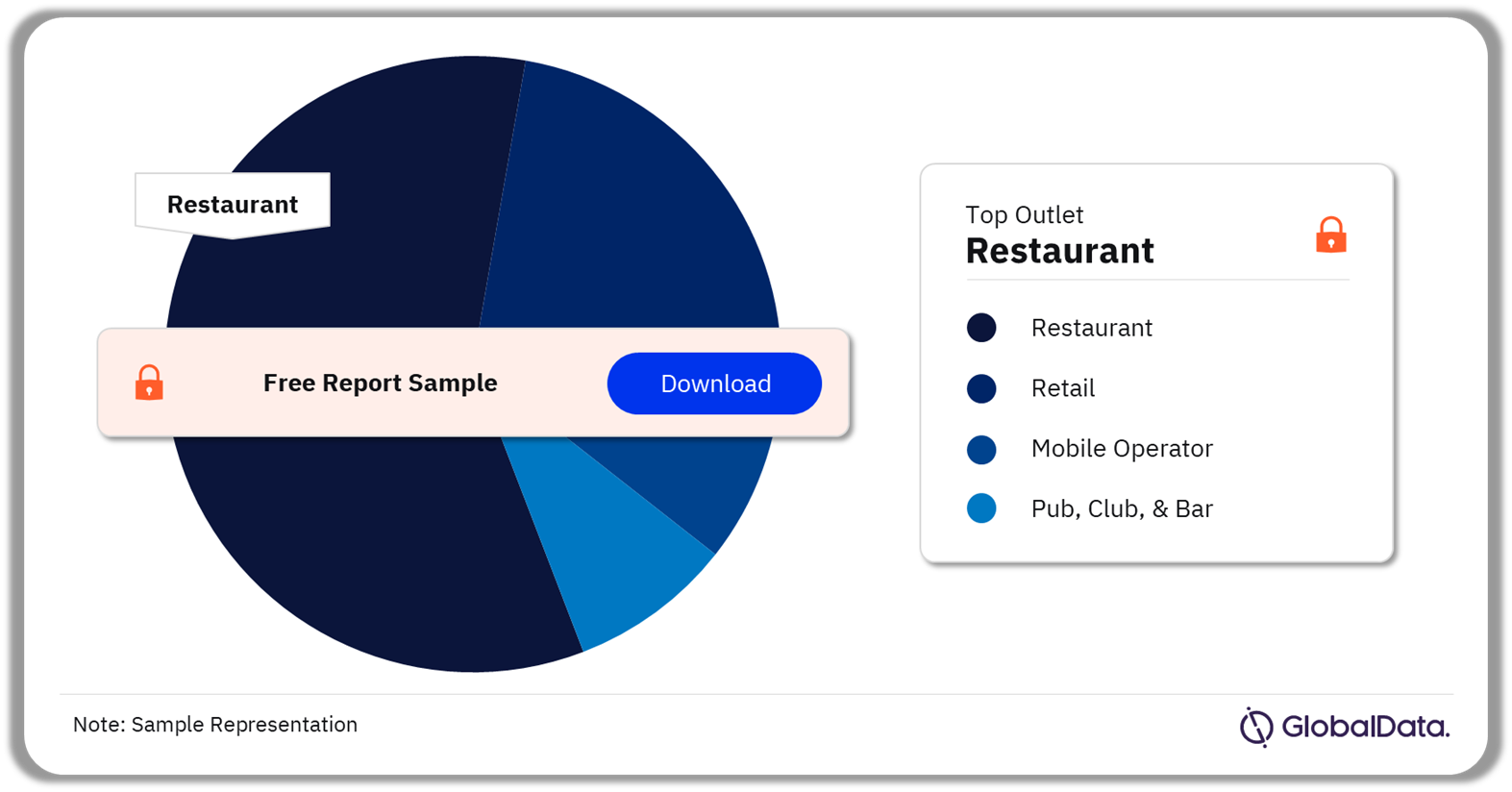

Online Food Delivery Market Segmentation by Outlet Type

Online food delivery services are primarily catered through four outlet types, restaurant, retail, mobile operator, and pub, club, & bar. The restaurant segment currently dominates the market, holding over 95% share. It is expected to further solidify its position, capturing more than 98% of the market by 2028. During the forecast period, the segment is expected to witness steady growth, exceeding a CAGR of 4%.

Convenience, a variety of cuisine options, busy schedules, and discount offers are key factors driving the growth of the restaurant segment. Additionally, during COVID-19 lockdowns, restaurants utilized online services to cater to consumers’ desire for home-cooked meals, thereby fueling segment growth. The concept of ‘cocooning,’ which refers to consumers’ preference to stay home rather than go out, has also influenced the restaurant business, prompting them to meet the online meal delivery demands of such consumers.

Online Food Delivery Market Share by Outlet Type, 2023 (%)

Buy the Full Report for More Information on Online Food Delivery Market Outlet Types

The restaurant segment encompasses full-service restaurants, quick-service restaurants, and cafes, it offers a diverse range of menu choices, which attract a wider customer base, resulting in more online orders. Also, well-known restaurants often have a strong reputation that draws customers to their delivery services.

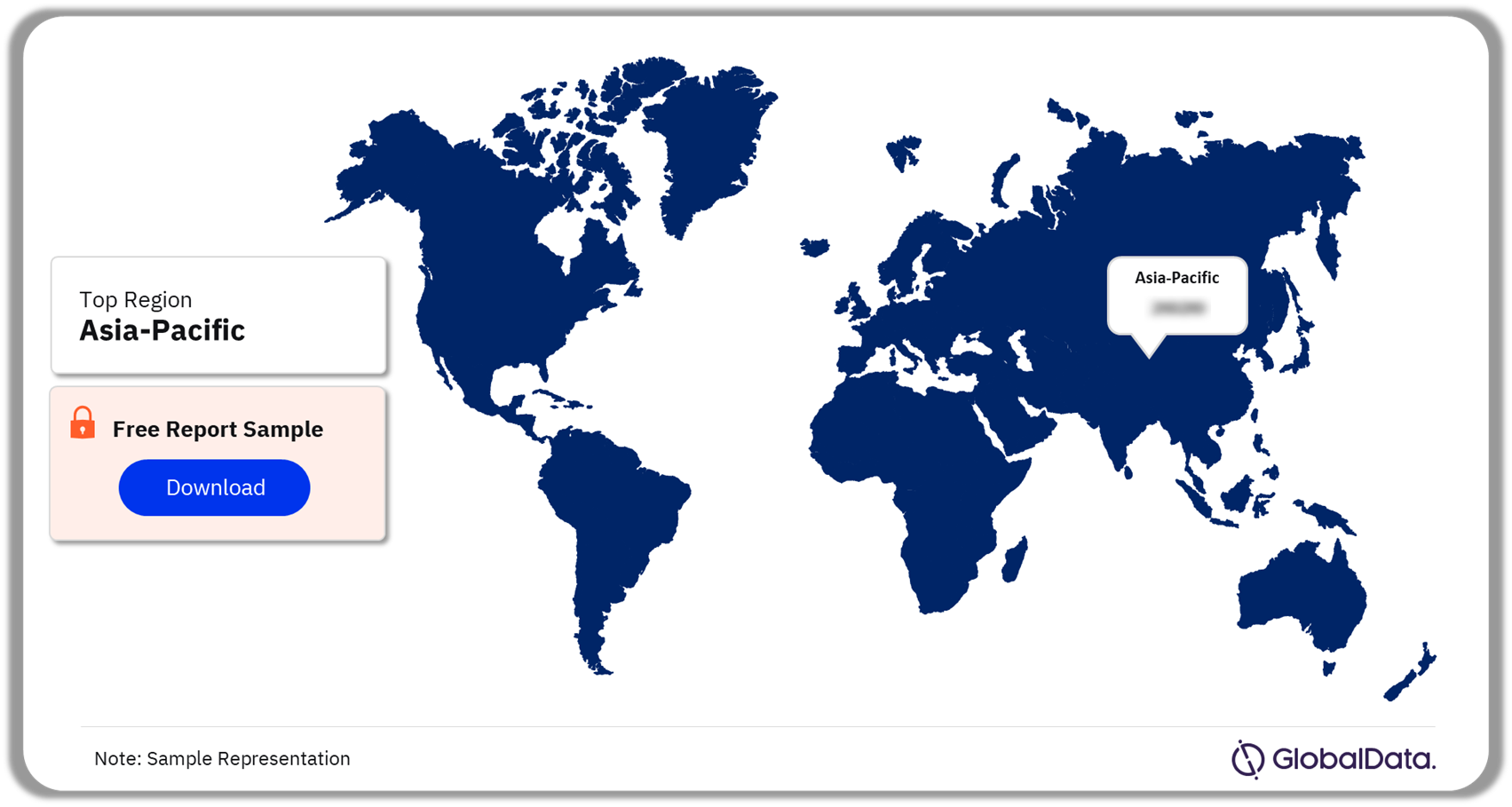

Online Food Delivery Market Analysis by Region

Asia Pacific’s online food delivery market value was the highest in 2023, capturing over 55% of the overall market size. China led the regional market, accounting for over 75% of the online food delivery market in 2023. A large base of young working population leading busy lifestyles are increasingly looking for convenient meal options, including meal delivery services. The Chinese market is led by local companies such as Meituan and Ele.me which has the advantage of efficient logistics networks, extensive partnerships with restaurants, and user-friendly interfaces.

The Asia-Pacific region boasts numerous emerging economies, including China, India, Indonesia, Thailand, the Philippines, and Vietnam. The region’s economic growth is supported by favorable demographics, a growing consumer class, urbanization, rapid technological adoption, and digital transformation. These factors are contributing to increased consumer spending power, which is a key driver of growth in the online food delivery market.

Online Food Delivery Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Online Food Delivery Market

The growing middle class in Asia Pacific nations is anticipated to enjoy greater disposable incomes, potentially resulting in increased expenditure on meal delivery services. Further, major food aggregator platforms are extending their reach in Asia Pacific, venturing into new markets, and providing a broader array of services. This expansion is poised to aid further market expansion in the region.

Online Food Delivery Market – Competitive Landscape

The online food delivery sector is characterized by significant fragmentation, indicating the stiff competition between companies to gain market share. Changing consumer preferences, technological advancements, and the rise of new business models have all contributed to fueling this competition. Many venture capital firms are making substantial investments in innovative online food delivery startups that boast cutting-edge expertise.

In March 2024, Wonder Group Inc., a US-based restaurant that primarily focuses on delivery-based services, raised $700 million. The capital raised will be used to support expansion, research, and development, and drive unit economics. This includes accelerating the expansion of Wonder’s physical retail locations, investing in research and development focusing on areas including faster cook times, software enhancements, new menu items, new chefs, and new restaurant partnerships, and investing in proprietary technology to drive operational efficiencies.

The M&A activities in the meal delivery sector remain vibrant, with companies vying for dominance. With the expansion of the food delivery service market, there might be an increase in strategic maneuvers, partnerships, and consolidation. The competition to meet consumer demands is ongoing, and M&A engagements will continue to influence the industry’s trajectory.

In March 2024, Uber Eats Japan collaborated with Cartken and Mitsubishi Electric to automate its meal delivery services. Cartken is a robotics company that designs robots and operates using AI technology. Similarly, in February 2024, DoorDash partnered up with Giant Eagle, a US-based supermarket chain to deliver daily staples and groceries in less than an hour.

The key companies leading the online food delivery market include McDonald’s Corp., and Yum! Brands, Inc., Restaurant Brands International, Domino’s Pizza Inc., Starbucks Corp., Uber Eats, DoorDash Inc., GrubHub Inc., Zomato Ltd., and Just Eat Takeawaycom N.V., among others.

Leading Companies in the Online Food Delivery Market

- McDonald’s Corp.

- Yum! Brands, Inc.

- Restaurant Brands International

- Domino’s Pizza Inc.

- Starbucks Corp.

- Uber Eats

- DoorDash Inc.

- GrubHub Inc.

- Zomato Ltd.

- Just Eat Takeawaycom N.V.

Other Online Food Delivery Market Vendors Mentioned

Bloomin’ Brands Inc., Anheuser-Busch InBev N.V., Spur Corporation Ltd., Famous Brands Ltd., Minor International PCL, Deliveroo, Swiggy (Bundl Technologies), and Wendy’s among others.

Buy the Full Report to Know More About Leading Online Food Delivery Companies

Online Food Delivery Market Segments

GlobalData Plc has segmented the online food delivery market report by service, outlet, and region:

Online Food Delivery Market Service Outlook (Revenue, $Million, 2018-2028)

- Outlet-to-Consumer

- Platform-to-Consumer

Online Food Delivery Market Outlet Outlook (Revenue, $Million, 2018-2028)

- Restaurant

- Retail

- Mobile Operator

- Pub, Club, & Bar

Online Food Delivery Market Regional Outlook (Revenue, $Million, 2018-2028)

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Colombia

- Rest of Latin America

- Middle East & Africa

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Rest of Middle East & Africa

Scope

This report provides overview and service addressable market for online food delivery.

It identifies the key trends impacting growth of the market over the next 12 to 24 months, split into four categories: technology trends, macroeconomic trends, consumer trends and regulatory trends.

It includes global market forecasts for the online food delivery industry and analysis of patents and company filings trends.

It contains details of M&A and VF deals in the online food delivery space.

The detailed value chain consists of five main aspects: food and drinks suppliers, food and drinks vendors, marketing team, payment solutions, and online food delivery aggregators.

Key Highlights

The online food delivery market size revenue was valued at $569.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% over the forecast period. Online food delivery refers to the process of ordering food from a website, a mobile application, or other devices. Food delivery can either be ready-to-eat meals from a restaurant, a ghost kitchen (a food preparation and cooking facility created for the making delivery-only meals), a home kitchen, or ingredients to use for preparing food later, such as groceries from a store, or in the form of meal kits. The food delivery platform can be built by companies in-house or they can use a third-party service.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global Online food delivery market, service type, outlet type, key vendor outlook, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in online food delivery markets.

With more than 50 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in online food delivery markets.

The broad perspective of the report coupled with comprehensive, actionable detail will help online food delivery players, investors, and other stakeholders succeed in the growing online food delivery market globally.

Key Players

McDonald's Corp.Yum! Brands

Starbucks Corporation

Restaurant Brands International

Domino's Pizza Inc.

Zomato

Uber Eats

DoorDash

Meituan

Bundl Technologies (Swiggy)

Deliveroo

Just Eat

Table of Contents

Table

Figures

Frequently asked questions

-

What was the online food delivery market size in 2023?

The online food delivery market size was valued at $569.1 billion in 2023.

-

What is the online food delivery market growth rate?

The online food delivery market is expected to grow at a CAGR of more than 4% during the forecast period.

-

What is the key online food delivery market drivers?

The growing penetration of smartphones and the Internet coupled with the increasingly busy lifestyles of consumers is boosting the demand for convenient food options, thereby driving the overall market.

-

Which was the leading service type segment in the online food delivery market in 2023?

Platform-to-consumer accounted for the largest online food delivery market share in 2023.

-

Which was the leading outlet type segment in the online food delivery market in 2023?

Restaurant accounted for the largest online food delivery market share in 2023.

-

Which was the leading region in the online food delivery market in 2023?

Asia-Pacific accounted for the largest online food delivery market share in 2023.

-

Which are the leading Online Food Delivery companies globally?

The leading online food delivery companies are McDonald’s Corp., Yum! Brands, Inc., Restaurant Brands International, Domino’s Pizza Inc., Starbucks Corp., Uber Eats, DoorDash Inc., GrubHub Inc., Zomato Ltd., and Just Eat Takeawaycom N.V.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports