Pharmaceutical Packaging Market Trends and Analysis by Material, Packaging Type, Distribution Channel and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

- Acquire a comprehensive insight into the current and future market conditions, allowing businesses to make informed decisions about market entry, product development, and investments.

- Access the capabilities of competitors to maintain a competitive edge in the market.

- Recognize different segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Predict shifts in market demand and tailor business development strategies.

- Determine potential regions and countries that offer growth opportunities.

How is our ‘Pharmaceutical Packaging’ report different from other reports in the market?

- The report offers a comprehensive analysis of the market size and forecast, measured in revenue ($Million) for 15 countries, with historical projections from 2020 to 2030.

- It includes a thorough segmentation by material including glass, plastic, paper & paperboard, metals, and rubber further segmented by packaging type including primary, primary outers, and transport packaging. In addition, it offers an additional segmentation by distribution channel including prescription drugs & over the counter drugs.

- The report provides a detailed examination of the value chain and technological trends in the pharmaceutical packaging market.

- The study highlights crucial factors influencing the market dynamics of the pharmaceutical packaging market space.

- The report covers mergers & acquisitions (M&A) and patent analysis.

- The competitive landscape of the market features heat-map analysis, a list of other competitors in the market, and a list of key vendors across the pharmaceutical packaging equipment types.

- Extensive company profiles for major vendors of the market, focusing on business overview, financial performance, SWOT analysis, key personnel, and strategic initiatives.

We recommend this valuable source of information to:

- Pharmaceutical Packaging Companies

- Drug Manufacturers

- Contract Manufacturers

- Raw Material Suppliers

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms

Get a Snapshot of the Pharmaceutical Packaging Market, Download a Free Report Sample

Pharmaceutical Packaging Market Report Overview

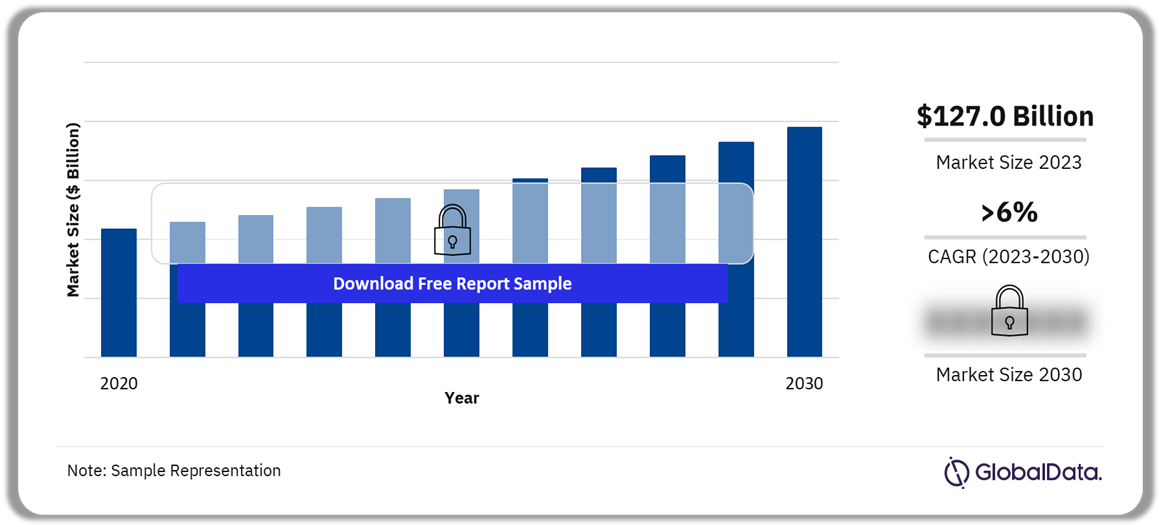

The pharmaceutical packaging market size revenue was valued at $127.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 6% over the forecast period. The market is primarily characterized by the increasing global demand for drugs, driven by the rising prevalence of chronic diseases and an aging population. The increasing investment in research & development of advanced medications for diseases such as Alzheimer’s, cancer, and diabetes further contributes significantly to this trend.

Chronic diseases represent a significant global health challenge, with projections indicating a nearly 99.5% increase in the number of individuals aged 50 and older affected by at least one chronic condition from 2020 to 2050, according to an NCBI (National Center for Biotechnology Information) journal article. The rising prevalence of chronic diseases underscores the need for a steady medication supply, fueling demand for pharmaceutical packaging. Tailored solutions are increasingly important, ensuring medication stability, safety, and ease of administration for various therapeutic needs in response to the complexities of chronic diseases.

Pharmaceutical Packaging Market Outlook, 2020–2030 ($Million)

Buy the Full Report for Additional Insights on the Pharmaceutical Packaging Market Forecast

The pharmaceutical packaging market growth is supported by increasing pharmaceutical production in emerging markets in Asia Pacific and North America. Economies such as China, India, and Mexico are expanding their production capabilities by improving proficiency in contract manufacturing for foreign as well as domestic players. In addition, rising direct foreign investment (FDI) facilitates technological advancements and infrastructure development, enhancing the efficiency and capacity of pharmaceutical packaging production.

The market dynamics are increasingly shaped by industry players’ heightened focus on environmental protection, aiming to reduce emissions across the value chain. Companies are working towards net zero emissions by reducing greenhouse gas (GHG) emissions throughout the supply chain. For instance, SCHOTT AG, a leading glass manufacturer, founded Alliance to Zero in collaboration with seven partner companies, a supply chain initiative aimed at developing circular solutions for a net-zero future. Companies are analyzing their Scope 1, 2, and 3 emissions, aiming to reduce them by adopting sustainable alternatives across the value chain while maintaining efficiency and productivity.

The rise in demand for generics, biosimilars, and vaccines globally, is supporting the growth of the corresponding packaging requirements. In addition, the industry is witnessing manufacturing advancements with the introduction of innovative solutions such as blow fill seal (BFS) vials, anti-counterfeit solutions, AI-equipped inspection, and smart packaging techniques. Some of the popular smart solutions in the market include active packaging, intelligent packaging, NFC tags, and radio-frequency identification (RFID) labeling.

| Market Size (2023) | $127.0 billion |

| CAGR (2023 – 2030) | >6% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Material Segment | Glass, Plastic, Paper & Paperboard, Metals, Rubber |

| Packaging Type Segment | Primary Packaging, Primary Outers, Transport Packaging |

| Distribution Channel | Prescription Drugs, Over-the-Counter Drugs |

| Geographies | North America, Europe, Asia Pacific, South & Central America, Middle East & Africa |

| Countries | US, Canada, Mexico, Germany, France, UK, Italy, Spain, Rest of Europe, China, India, Japan, South Korea, Rest of Asia Pacific, Brazil, Rest of South & Central America, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| Key Companies | Amcor plc, AptarGroup Inc., Becton, Dickinson and Company (BD), Berry Global Group Inc., Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., WestRock Company, CCL Industries Inc (CCL), and Nipro Corp. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

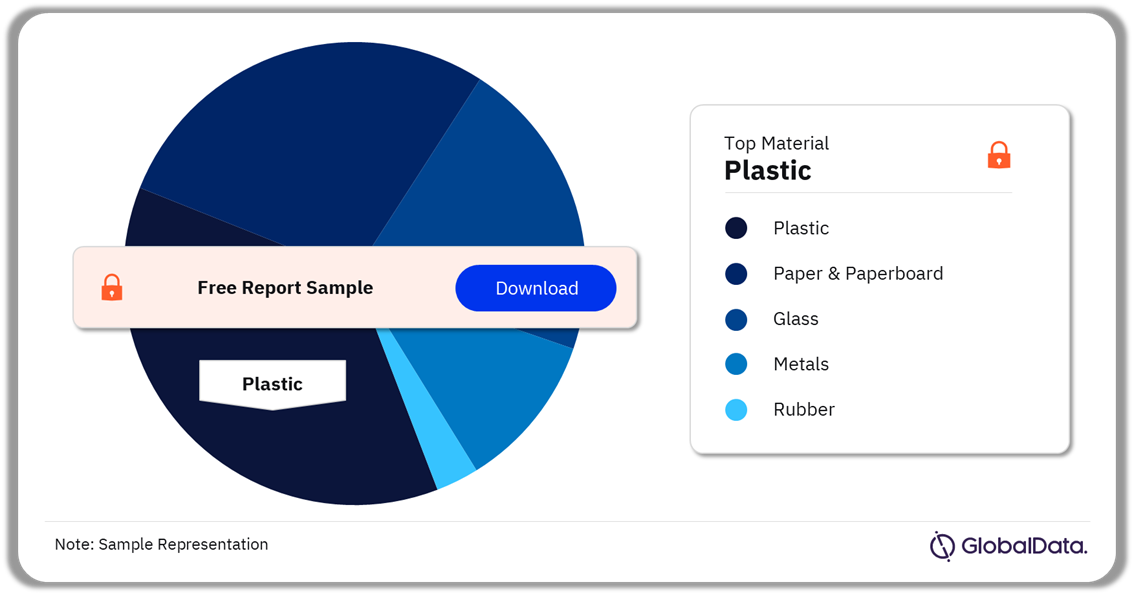

Pharmaceutical Packaging Market Segmentation by Material

In 2023, the plastics segment led the market with a maximum revenue share of more than 36%, supported by its wider application across the end-use market. Plastic is used in manufacturing various products across the pharmaceutical sector including bottles & containers, pouches, caps & closures, blister packs, and trays & separators. Its manufacturing advantages such as low cost and high availability further bolster this position.

The plastics segment is forecast to experience the second-fastest growth in the market, driven by innovations aligning with sustainability goals in response to changing environmental conditions. For instance, in August 2023, the BioICEP project, or “Bio-Innovation of a Circular Economy for Plastics” used three technologies to turn non-biodegradable plastics into new biobased materials to increase, enhance, and accelerate the degradation of plastic. The technology involved a triple-action depolymerization system which includes chemical disintegration processes, biocatalytic digestion, and microbial consortia.

Pharmaceutical Packaging Market Share by Material, 2023 (%)

Buy the Full Report for More Information on Pharmaceutical Packaging Market Material

The paper & paperboard segment is projected to witness the fastest growth with a CAGR of around 7% over the estimated period. This is due to the increasing focus on using more sustainable materials in industry. Moreover, paper and paperboard materials are utilized in primary outers and transport packaging, adapting to market demands for effective labeling and wrapping of pharmaceuticals to ensure safe usage and consumption in the end-use market.

The rising trend of contract manufacturing along with the increasing import & export of pharmaceutical drugs across the globe is driving the demand for paper & paperboard material. For instance, in January 2024, the Food and Drug Administration (FDA) allowed the US state of Florida to import medications from Canada due to the lower prices compared to the US. This significant policy shift is anticipated to affect drug price dynamics in US states, thereby further supporting the growth of packaging designed for long-term safety and transport.

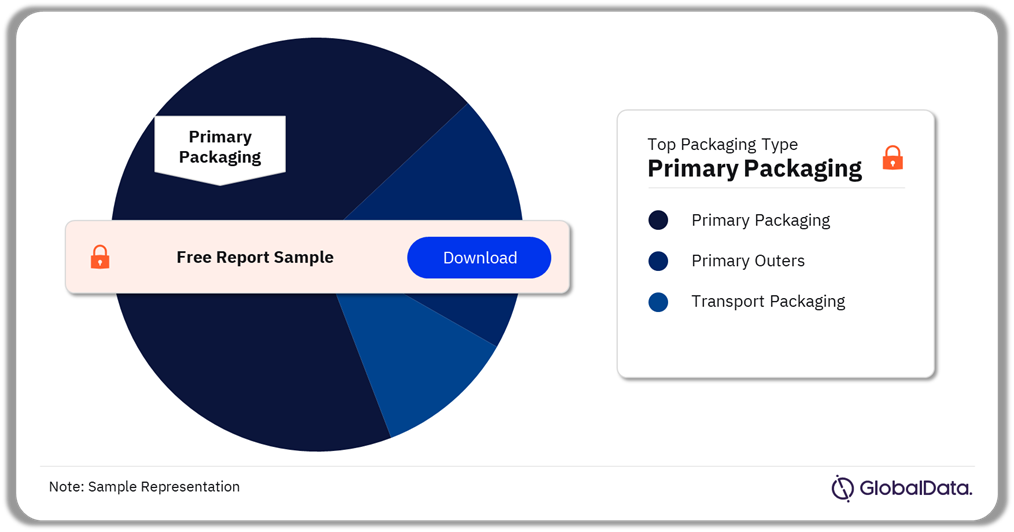

Pharmaceutical Packaging Market Segmentation by Packaging Type

Primary packaging type dominated the overall market with the maximum revenue share in 2023. The segment is further categorized as blister & strip packs, aerosols, bottles & containers, and vials & ampoules among others, with bottles and containers leading in 2023. The high share of this segment is driven by its critical role in direct drug contact. Primary packaging is required to be chemical resistant; thus, extensive R&D is required during the designing and testing phase.

Pharmaceutical Packaging Market Share by Packaging Type, 2023 (%)

Buy the Full Report for More Information on Pharmaceutical Packaging Market Packaging Type

The transport packaging segment is projected to exhibit the fastest growth with a CAGR of more than over 7% during the estimated timeframe. The segmental demand is significantly dependent on the growth of import and export activities across multinational distribution channels to meet the increasing demand for pharmaceutical products, particularly in low-income and underdeveloped countries.

For instance, India’s drug and pharmaceutical products exports grew by 125% from Rs. 90,415 Crore ($10.8 billion) in 2013-14 to Rs. 2,04,110 Crore ($24.4 billion) in 2022-23, according to the Ministry of Health and Family Welfare. The top five destinations are the US, South Africa, Belgium, Brazil, and the UK. The country is also one of the biggest suppliers of low-cost vaccines and generic medicine globally.

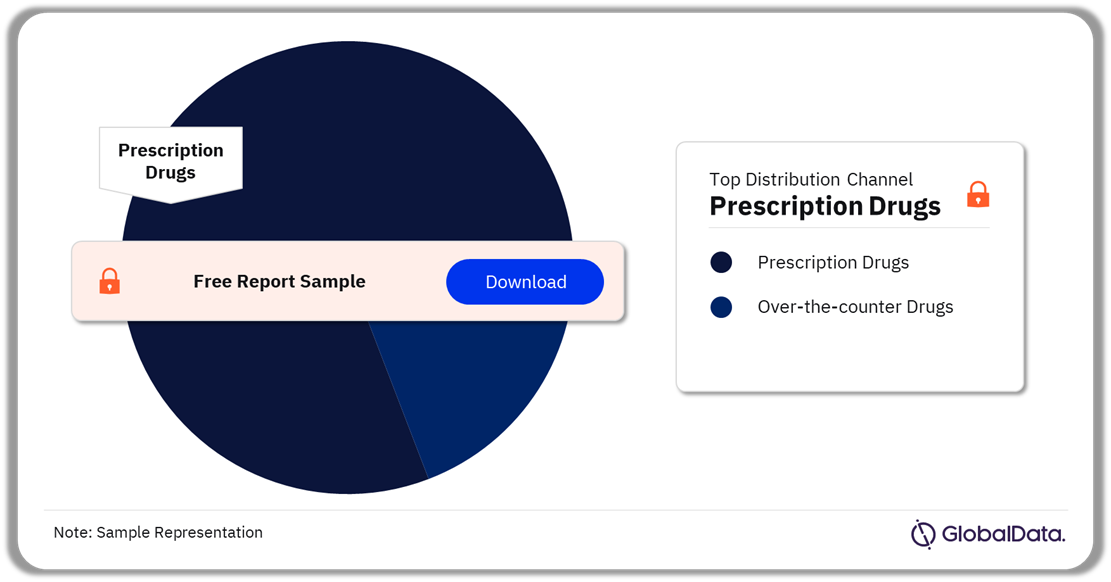

Pharmaceutical Packaging Market Segmentation by Distribution Channel

In 2023, the prescription drugs category led the market in terms of distribution channel-based segmentation. The segment is experiencing growth as numerous drugs are approved annually across various therapeutic areas, with many in the development pipeline. The rising geriatric population and increasing prevalence of long-term illness and mental health issues further fuel the pharmaceutical industry.

The surge in patients with chronic diseases necessitates consistent medical support for maintaining a normal life, thereby driving the global demand for the packaging of respective drugs. According to the World Health Organization (WHO), noncommunicable diseases (NCDs) kill 41 million people each year, equivalent to 74% of all deaths globally. In addition, according to the Centers for Disease Control and Prevention, chronic diseases cause 7 out of 10 deaths among Americans, further driving the need for packaging across various drug categories.

Pharmaceutical Packaging Market Share by Distribution Channel, 2023 (%)

Buy the Full Report for More Information on Pharmaceutical Packaging Market Distribution Channel

Based on the distribution channel, the over-the-counter drugs segment is anticipated to exhibit the highest growth over the estimated period. A change in consumer behavior with the increasing understanding of OTC drugs and self-medication supports a rise in the number of switches of drugs from Rx to OTC. Further innovation in OTC products is among the factors supporting the growth of this segment. Some of the prominent end-users for OTC drug packaging are Reckitt Benckiser Group PLC, Johnson & Johnson, GSK plc, and Omega Pharma Srl.

Pharmaceutical Packaging Market Analysis by Region

In 2023, North America led the market with a maximum revenue share of more than 36%. The presence of advanced manufacturing infrastructure in major countries including the US and Canada supports regional dominance. Furthermore, the presence of established vendors catering to the pharmaceutical sector including West Pharmaceutical Services, Inc., Berry Global Group Inc., and Aptar Group Inc., contributes to the market innovation, thus promoting healthy competition in the industry.

The US pharmaceutical packaging sector dominates the North American regional market with a revenue share of more than 88% in 2023. The increasing focus of pharmaceutical packaging companies on new product development and capacity expansion to meet evolving demands from the end-use market is driving market growth. For example, in February 2023, Nexus Pharmaceuticals, Inc. announced the launch of a new product line for manufacturing sterile vials to increase production capacity. The new product line includes 2ml amber vials, 10ml clear vials, and 20ml clear vials.

Pharmaceutical Packaging Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Pharmaceutical Packaging Market

In Europe, growth is attributed to a large customer base and the presence of leading pharmaceutical drug packaging manufacturers in the region’s major economies such as Germany, France, and the UK. Moreover, the presence of market participants with strong production bases and global distribution networks, including SCHOTT Pharma, Gerresheimer AG, and Mondi Plc further contributes to the regional market.

Asia Pacific pharmaceutical packaging market is projected to exhibit the fastest CAGR of 8.6% over the forecast period. The growing investments in the establishment of new production facilities in countries such as China, Japan, and India, which are major revenue contributors will contribute to this growth. Furthermore, India is expected to register the fastest growth in the region, growing at a CAGR of 10.5% over the forecast period.

Pharmaceutical Packaging Market – Competitive Landscape

The market is competitive with international companies offering advanced solutions across their wide network. The industry participants are investing in the development of advanced materials and technologies for manufacturing new-age solutions that can meet changing market requirements. Moreover, there is a concerted effort among industry vendors to adopt eco-friendly practices across their supply chains, from sourcing raw materials such as biodegradable plastics to distribution channels.

For instance, Chugai Pharmaceutical Co., Ltd. switched from conventional petroleum-derived virgin plastics to eco-friendly materials. This switch is primarily focused on four heavily used packaging types including press-through packs (PTP) for solid formulations packaging, aluminum pillows, syringe blister packs, and plastic bottles.

Continuous developments associated with manufacturing facilities, mergers & acquisitions, partnerships & collaborations, capacity expansion, and new product development are reshaping the competitive dynamics of the market. These strategic initiatives underscore the ongoing efforts to innovate and adapt, driving advancements in the industry.

Leading Companies in the Pharmaceutical Packaging Market

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- Berry Global Group Inc.

- Gerresheimer AG

- Amcor plc

- AptarGroup Inc.

- Becton Dickinson and Company (BD)

- WestRock Company

- Nipro Corp.

- CCL Industries Inc.

Other Pharmaceutical Packaging Market Vendors Mentioned

Sealed Air, UFlex Limited, Sonoco Products Company, Vetter Pharma International GmbH, Nelipak BV, and Wiicare.

Buy the Full Report to Know More About Leading Pharmaceutical Packaging Companies

Pharmaceutical Packaging Market Segments

GlobalData Plc has segmented the pharmaceutical packaging market report by material, packaging type, distribution channel, and region:

Pharmaceutical Packaging Market Material Outlook (Revenue, $Million, 2020–2030)

- Glass

- Plastic

- Paper & Paperboard

- Metals

- Rubber

Pharmaceutical Packaging Market Packaging Type Outlook (Revenue, $Million, 2020–2030)

- Primary Packaging

- Blister & Strip Packs

- Aerosols

- Bottles & Containers

- Vials & Ampoules

- Caps & Closures

- Tubes

- Pouches/Sachets

- Pre-Filled Inhalers

- Pre-Filled Syringes

- Cartridges

- Primary Outers

- Boxes & Cartons

- Labels & Wraps

- Trays & Separators

- Void-Fill and Temp Controlled Packaging

- Pouches & Bags

- Transport Packaging

Pharmaceutical Packaging Market Distribution Channel Outlook (Revenue, $Million, 2020–2030)

- Prescription Drugs

- Over-the-Counter Drugs

Pharmaceutical Packaging Market Regional Outlook (Revenue, $Million, 2020–2030)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

Scope

The market intelligence report provides an in-depth analysis of the following –

• This report provides overview and service addressable market for global pharmaceutical packaging market

• It identifies the key drivers and challenges impacting growth of the pharmaceutical packaging market over the next 12 to 24 months.

• It includes global revenue forecasts for the pharmaceutical packaging market and the list of latest M&A deals and patent activities.

• It covers detailed segmentation by material, packaging type, distribution channel, and region

Key Highlights

The pharmaceutical packaging market size revenue was valued at $127.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% over the forecast period. The pharmaceutical packaging market is primarily characterized by the increasing global demand for drugs, driven by rising prevalence of chronic diseases and an aging population.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global pharmaceutical packaging market by material, packaging type, distribution channel, regional segments, and key restraints in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s Forecast products, the report examines the drivers, challenges, trend analysis, technology trends in the pharmaceutical packaging market.

• Detailed segmentation by material – plastic, glass, paper & paperboard, metals, and rubber. Further, the report also highlights segmentation by packaging type, distribution channel, and region.

• The report includes around 200 charts and tables providing in-depth analysis of the market size, forecast, and supporting factors which are tailor-made for an executive-level audience, with enhanced presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in pharmaceutical packaging markets.

• The competitive section of the report helps in identifying the flagbearers, experimenters, contenders, and specialists based on their growth and innovation performance in the pharmaceutical packaging industry which will help stakeholders analyze competition penetration.

• The broad perspective of the report, coupled with comprehensive, actionable detail, will help pharmaceutical packaging vendors and other companies succeed in the growing pharmaceutical packaging market globally.

Key Players

SCHOTT AGWest Pharmaceutical Services, Inc.

Berry Global Group Inc.

Gerresheimer AG

Amcor plc

AptarGroup Inc.

Becton Dickinson and Company (BD)

WestRock Company

Nipro Corp.

CCL Industries Inc.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the pharmaceutical packaging market size in 2023?

The pharmaceutical packaging market size was valued at $127.0 billion in 2023.

-

What is the pharmaceutical packaging market growth rate?

The pharmaceutical packaging market is expected to grow at a CAGR of more than 6% during the forecast period.

-

What is the key pharmaceutical packaging market driver?

The pharmaceutical packaging market is primarily characterized by the increasing global demand for drugs, driven by the rising prevalence of chronic diseases and an aging population.

-

Which was the leading packaging type in the pharmaceutical packaging market in 2023?

The primary packaging accounted for the largest pharmaceutical packaging market share in 2023.

-

Which are the leading pharmaceutical packaging companies globally?

The leading pharmaceutical packaging companies are SCHOTT AG, West Pharmaceutical Services, Inc., Berry Global Group Inc. Gerresheimer AG, Amcor plc, AptarGroup Inc., Becton Dickinson and Company (BD), WestRock Company, Nipro Corp., Gerresheimer AG, and CCL Industries Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.