Rare Earth Metals Market Size, Share, Trends, and Analysis by Region, Product, Application and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Rare Earth Metals’ report can help you:

- Market size detailing based on key product segments, application categories, and regional movement

- Mapping the entire ecosystem of the value chain and the stages associated with it

- Evaluating potential growth opportunities in different product and application segments supported by comprehensive qualitative commentary

- Foresee possible changing dynamics of the sector and align business strategies to capitalize on them

- List of major active and upcoming rare earth mining projects

How is our ‘Rare Earth Metals’ report different from other reports in the market?

- The report captures current and futuristic demand for these rare earth metals across key sectors and countries/regions from 2020 to 2030 in terms of volume (Tonnes)

- Detailed segmentation by product – Cerium, Lanthanum, Neodymium, Praseodymium, Dysprosium, Samarium, and Others

- The report also highlights segmentation at the application level – Magnets, Catalysts, Polishing Powders, Batteries, and Others

- The study encompasses the identification of the key variables or factors responsible for influencing the market dynamics of the global rare earth metals market space. These factors are bifurcated based on their positive and negative attributes into the drivers and restraints.

- The timeline of the market is covered to provide a historical context to this study including the discovery years of the different elements and respective developmental eras.

- Competitive landscape of the market provides a compressive overview of the value chain capturing key developments and their impact on the industry, deals by geography, and a list of equipment suppliers.

- Detailed company profiles for key vendors of the market with a focus on business overview, financial performance, mines & projects, and key personnel.

We recommend this valuable source of information to anyone involved in:

- Mining Companies

- Mining Equipment and Plant Suppliers

- Engineering and Construction Contractors

- Magnet Producers

- Consultants and Analysts

To Get a Snapshot of the Rare Earth Metals Market Report, Download a Free Report Sample

Rare Earth Metals Market Report Overview

The global rare earth metals market volumetric demand is projected to reach around 193.3 thousand Tonnes in 2023, registering a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The growing dependency of the modern tech world on rare earth and its associated products is estimated to drive growth over the forecast period.

Rare earth metals are present everywhere around us from a smartphone to our vehicles, and this commodity is a backbone for the developments made in the last five decades. The rising public consensus to use clean energy sources and limit the usage of fossil fuels is projected to aid the rare earth metals sector growth over the predicted timeline.

Rare Earth Metals Market Outlook, 2020-2030 (Thousand Tonnes)

View Sample Report for Additional Insights on the Rare Earth Metals Market Forecast, Download a Free Report Sample

The global rare earth metals sector in the post-COVID era remained under the intense pressure of logistics issues, price volatility, labor challenges, and evolving geopolitical scenarios. The demand-related trends showcased a healthy uptick from a variety of application sectors including magnets, catalysts, polishing powders, and batteries. However, with the weak macroeconomic conditions and surging inflation, the demand dynamics in 2023 are predicted to slow down as compared to the previous year.

There are various reasons why inflation has remained high, including unexpectedly long lags, pent-up demand/stimulus overhang, overheating in labor markets, and profiteering by companies to take advantage of unusual circumstances. These ongoing challenges are difficult to tame and thus, are likely to impact the overall momentum of the rare earth metals sector in 2023.

| Market Size (2023) | 193.3 Thousand Tonnes |

| CAGR (2023-2030) | 4.2% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Volume Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Product Segment | Cerium, Lanthanum, Neodymium, Praseodymium, Dysprosium, Samarium, and Others |

| Application Segment | Magnets, Catalysts, Polishing Powders, Batteries, and Others |

| Regional Segment | China, Japan & Other Asia, US, Europe, and Rest of the World |

| Key Companies | MP Materials Corp, Hastings Technology Metals Ltd, Lynas Rare Earths Ltd, Alkane Resources Ltd, Arafura Rare Earths Ltd, Northern Minerals Ltd, Vital Metals Ltd, Peak Rare Earths Ltd, Shenghe Resources Holding Co Ltd, China Northern Rare Earth Group High-Tech Co Ltd, China Rare Earth Resources and Technology Co Ltd, Jiangxi Copper Co Ltd, Ucore Rare Metals Inc, NioCorp Developments Ltd, and Rare Element Resources Ltd |

Rare Earth Metals Market Segmentation by Product

The product segment covers cerium, lanthanum, neodymium, praseodymium, dysprosium, samarium, and others. Among these product categories, cerium is projected to account for the largest volumetric share followed by lanthanum, neodymium, and others in 2023. Cerium owing to its wide applications and ductile nature finds its end-usage in a variety of sectors including automotive, oil & gas, healthcare & medical, electrical & electronics, and others.

Rare Earth Metals Market Share by Product, 2023 (%)

Fetch Sample PDF for Segment-Specific Revenues and Shares, Download a Free Report Sample

The Lanthanum product series accounted for the second-largest volumetric share in 2023. The product segment is estimated to register a compound annual growth rate (CAGR) of 3.8% owing to its increasing prominence in battery electrode manufacturing. With the rising momentum of electrified vehicles, the demand factors for lanthanum are likely to remain stable over the forecast period.

Neodymium is one of the fastest-growing product categories and is projected to capture the third position in terms of volumetric share within the rare earth metals market in 2023. The product is deployed in the manufacturing of magnets including low and high performance and is an integral part of the modern-day technology assembly from automotive vehicles to fighter jets. The demand dynamics of this product segment are estimated to remain strong as the sales of electric vehicles continue to flourish across the globe.

Praseodymium, dysprosium, and samarium combined volumetric share in 2023 remained below 5.0%. These product categories are generally used in alloy form mixed with other metals and thus often account for a small volumetric share. However, their exceptional characteristics made them the ideal choice for high-performance applications in the aerospace & defense sector.

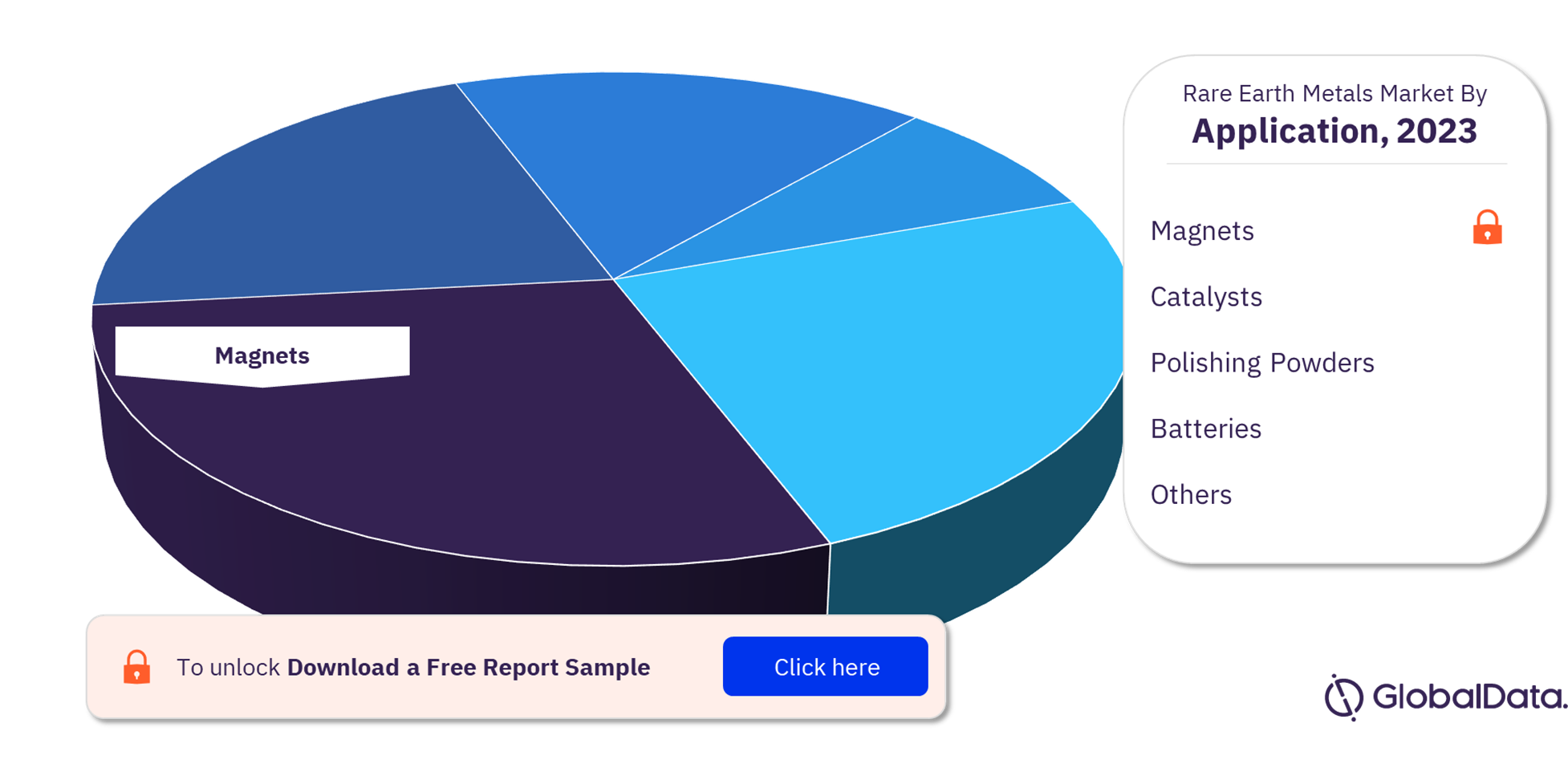

Rare Earth Metals Market Segmentation by Application

The application section of the global rare earth metal market includes magnets, catalysts, polishing powders, batteries, and others. Among these, the magnets application segment is poised to control a dominant volumetric share in 2023. This category is also predicted to depict the fastest compound annual growth rate (CAGR) over the forecast period. The growing prominence of the magnets made from rare earth, especially in the electric vehicles industry is anticipated to remain a key driver for the segmental growth over the near future.

Rare Earth Metals Market Share by Application, 2023 (%)

Rare Earth Metals Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

Catalysts turned out to be the second-largest application category in 2023. However, this application category is expected to observe sluggish growth over the predicted timeline. The primary reason behind the slowdown in the growth is primarily due to the increased focus on clean or renewable sources of energy generation.

Polishing powders combined with batteries accounted for a volumetric share of more than 25.0% in 2023. These application segments are likely to flourish at a steady rate and thereby, creating a healthy avenue for the usage of rare earth metals in a wide range of applications. The demand from the semiconductor and electric vehicles end-use sectors for polishing powders and batteries is anticipated to remain high which in turn will drive the segmental growth over the nearby timeline.

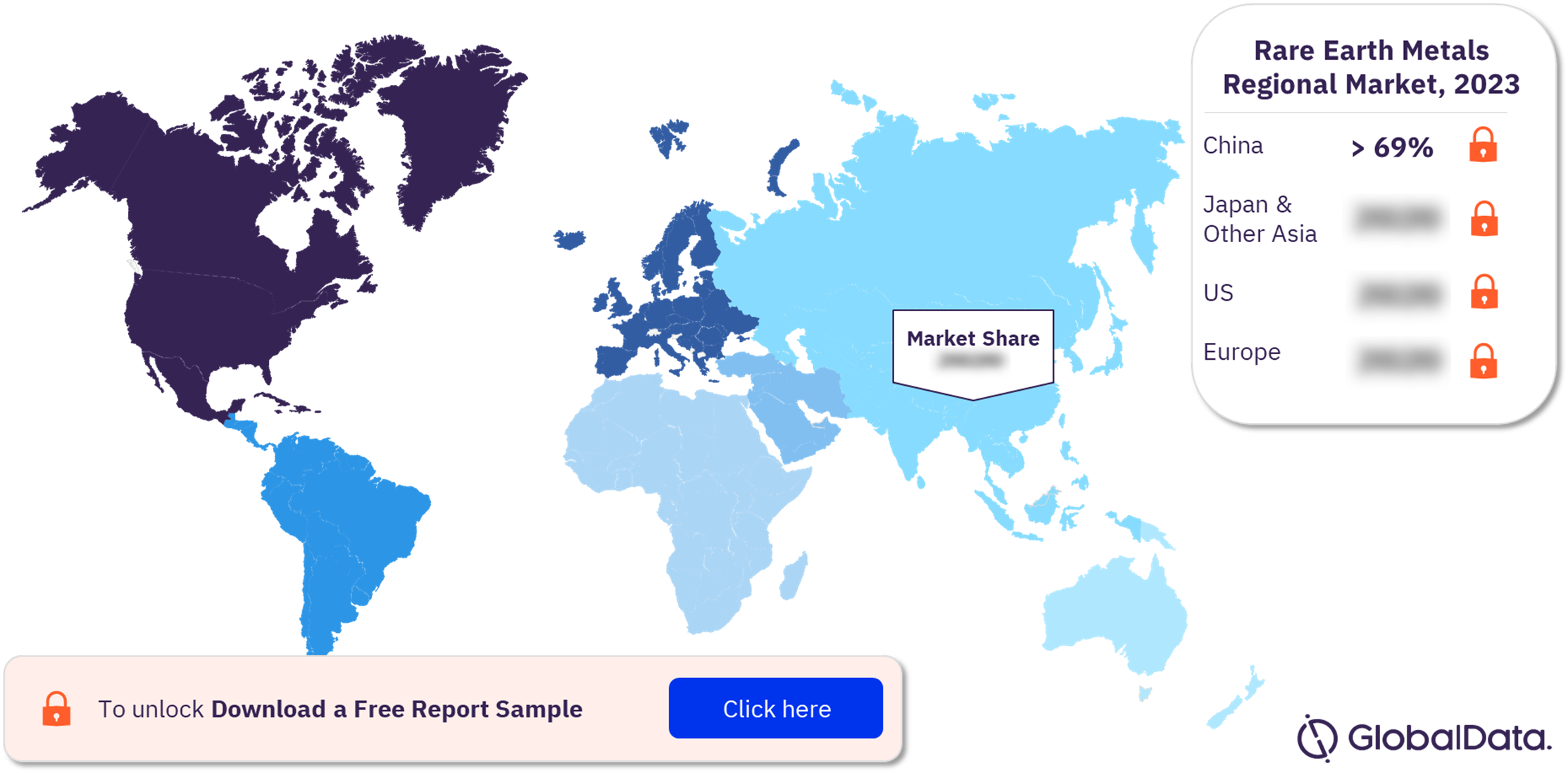

Rare Earth Metals Market Analysis by Region

The rare earth metals demand trends are largely concentrated within the four regions/countries owing to their technical or metallurgical capabilities to transform metals to final component or application products. Within these dynamics of consumption, China is the dominant force with a volumetric share of more than 69.0% in 2023.

China has vertically integrated itself from mining of raw materials to processing to refining to product manufacturing and finally to assembly of the final end-usage. For instance, China has a global magnet manufacturing share of more than 90.0% as per the data released by the European Raw Materials Alliance. The country is anticipated to remain a key player as well as a consumer of the product over the forecast period.

Rare Earth Metals Market Share by Region, 2023 (%)

View Sample Report for Additional Rare Earth Metals Market Insights, Download a Free Report Sample

Japan & Other Asia region accounted for the second largest share in 2023. This region is also projected showcase the fastest compound annual growth rate (CAGR) over the forecast period. This trend is mainly due to the increasing industrial activities in developing countries like India, Vietnam, and Thailand, among others.

The US is the third largest consumer of rare earth metals post China and Japan & Other Asia region. The country is a hub of aerospace & defense technology which are among the key end-use sectors of rare earth metals. However, the overall growth in the country is likely to remain at a lower end as compared to other regional counterparts owing to its dependency on China for processed raw materials. Few of the domestic vendors like MP Materials are attempting to create a complete magnetic supply chain system in the country from mining to final magnet product.

Rare Earth Metals Market - Competitive Landscape

The rare earth metals market space is primarily dominated by China-based vendors owing to their strong integrated supply chain. These vendors have a direct presence in the upstream, midstream, and downstream of the rare earth metals market operations.

In 2021, the government of China merged its three rare earth-producing companies to form a rare earth giant conglomerate and the second-largest rare earth mining company in the world. This recently formed China Rare Earth group after the merger of three SOEs effectively accounts for nearly 60% to 70% of the domestic heavy rare earth metal production.

The remaining world is attempting to create its own sustainable value chain system by adopting deal strategies. This has led to an increase in equity offerings, asset transactions, and acquisitions. For instance, in June 2023, Alvo Minerals acquired the Bluebush Rare Element project in the Central Brazil area. This was an asset transaction deal with an aim to further solidify the presence of Alvo Minerals within the South America regional mining sector.

Leading Players in the Rare Earth Metals Market

- MP Materials Corp

- Hastings Technology Metals Ltd

- Lynas Rare Earths Ltd

- Alkane Resources Ltd

- Arafura Rare Earths Ltd

- Northern Minerals Ltd

- Vital Metals Ltd

- Peak Rare Earths Ltd

- Shenghe Resources Holding Co Ltd

- China Northern Rare Earth Group High-Tech Co Ltd

- China Rare Earth Resources and Technology Co Ltd

- Jiangxi Copper Co Ltd

- Ucore Rare Metals Inc

- NioCorp Developments Ltd

- Rare Element Resources Ltd

Other Rare Earth Metals Market Vendors Mentioned

Avalon Advanced Materials Inc, Rainbow Rare Earths Ltd, IREL (India) Ltd, Managem Group SA, Sevredmet, Leading Edge Materials Corp, Pensana Plc, Search Minerals Inc, Mont Strategies Inc., Hudson Resources Inc, Commerce Resources Corp.

To Know More About Leading Rare Earth Metals Market Players, Download a Free Report Sample

Rare Earth Metals Market Segments and Scope

GlobalData Plc has segmented the rare earth metals market report by product, application, and region:

Rare Earth Metals Market Product Outlook (Volume, Tonnes, 2020-2030)

- Neodymium

- Praseodymium

- Dysprosium

- Samarium

- Lanthanum

- Cerium

- Others

Rare Earth Metals Market Application Outlook (Volume, Tonnes, 2020-2030)

- Magnets

- Catalysts

- Polishing Powders

- Batteries

- Others

Rare Earth Metals Market Regional Outlook (Volume, Tonnes, 2020-2030)

- China

- Japan & Other Asia

- US

- Europe

- Rest of the World

Scope

The market intelligence report provides an in-depth analysis of the following –

• Rare earth metals market outlook: analysis as well as historical figures and forecasts of volume opportunities from the product, application, and regional segments

• The competitive landscape: an examination of the positioning of leading players in the rare earth metals market

• Company Analysis: analysis of the market position of leading providers in the rare earth metals market

• Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

According to GlobalData estimates, the rare earth metals market will be evaluated at 193.3 thousand tonnes in 2023 and is expected to grow at a CAGR of 4.2% over the forecast period (2023-2030). The rising popularity of these minerals in the development of clean and sustainable technologies is expected to aid the market growth over the near term.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global rare earth metals market by product, application, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions, drivers, deals, strategic initiatives and trend analysis in rare earth metals markets.

- Detailed segmentation by product – Cerium, Lanthanum, Neodymium, Praseodymium, Dysprosium, Samarium, and Others. Further, the report also highlights segmentation at application level – Magnets, Catalysts, Polishing Powders, Batteries, and Others.

- The report includes 30+ charts and tables providing in-depth analysis of the market size, forecast and supporting factors which are tailor-made for an executive-level audience, with enhanced presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in Rare Earth Metals market.

- The report evaluates the entire value chain of the rare earth metals market space while highlighting the key players of the industry.

- The report offers a list of key upcoming projects bifurcated by region. In addition, the supply or production related trends are presented for key countries or regions.

Key Players

The Mosaic CoKaMin LLC

Imerys

Sibelco

Quarzwerke GmbH

Thiele Kaolin Company

I-Minerals Inc.

Gypsum Resources Materials

Ashapura Group

Clariant

Ma’aden

Omya AG

Minerals Technologies Inc.

Vulcan Materials Company

CRH Americas Materials, Inc.

Table of Contents

Figures

Frequently asked questions

-

What was the rare earth metals market size in 2023?

The rare earth metals market size globally will be evaluated at 193.3 thousand Tonnes in 2023.

-

What is the rare earth metals market growth rate?

The rare earth metals market is expected to grow at a CAGR of 4.2% over the forecast period (2023-2030).

-

What are the key rare earth metals market drivers?

The expansion of the electrical vehicles manufacturing and the increasing installations of wind turbines are anticipated to remain key drivers for rare earth metals market growth over the forecast period.

-

What are the key rare earth metals market segments?

Product Segments: Cerium, Lanthanum, Neodymium, Praseodymium, Dysprosium, Samarium, and Others.

Application Segments: Magnets, Catalysts, Polishing Powders, Batteries, and Others.

-

Which are the leading rare earth metals companies globally?

The key vendors in the global rare earth metals market are MP Materials Corp, Hastings Technology Metals Ltd, Lynas Rare Earths Ltd, Alkane Resources Ltd, Arafura Rare Earths Ltd, Northern Minerals Ltd, Vital Metals Ltd, Peak Rare Earths Ltd, Shenghe Resources Holding Co Ltd, China Northern Rare Earth Group High-Tech Co Ltd, China Rare Earth Resources and Technology Co Ltd, Jiangxi Copper Co Ltd, Ucore Rare Metals Inc, NioCorp Developments Ltd, and Rare Element Resources Ltd.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.