Remote Patient Monitoring Devices Market Size, Share, Trends and Analysis by Region, Device, Key Players and Segment Forecast to 2033

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Remote Patient Monitoring Devices’ report can help:

- In evaluating the regulatory landscape of the industry while highlighting key aspects of different regional authorities

- Comprehensive coverage of the technological trends through the Industry 4.0 lens

- In-depth view of market dynamics with dedicated sections on key drivers and challenges

- Potential growth opportunities in terms of revenue ($Million)

- Foresee shifts in the medical/healthcare landscape and align business strategies to capitalize on them

- Investigate the demand potential using market size revenue from 2022 to 2033

- Explore the market share of key players in different device categories

How is our ‘Remote Patient Monitoring Devices’ report different from other reports in the market?

- The report investigates the global remote patient monitoring devices sector in terms of revenue based on device type and region.

- The study entails a summarization of key factors or variables responsible for assisting market growth soon.

- Detailed segmentation by device type– Implantable Remote Patient Monitoring Devices (implantable cardioverter defibrillators and pacemaker)- and External Remote Patient Monitoring Devices (specialized monitoring devices and vital signs monitoring devices)

- Detailed segmentation by region– North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa

- With more than 100+ charts and tables, the report is designed with an easy digestible qualitative content.

- The key market participants operating within this market and their respective profiles are laid out with dedicated sections on company overview, financials, products & services, and key personnel.

We recommend this valuable source of information to:

- Medical Device Companies

- Health Tech Companies

- Tech Startups

- Researchers and Academics

- Consulting Firms

- Venture Capital/Equity Firms

Get a Snapshot of the Remote Patient Monitoring Devices Market, Download a Free Report Sample

Remote Patient Monitoring (RPM) Devices Market Report Overview

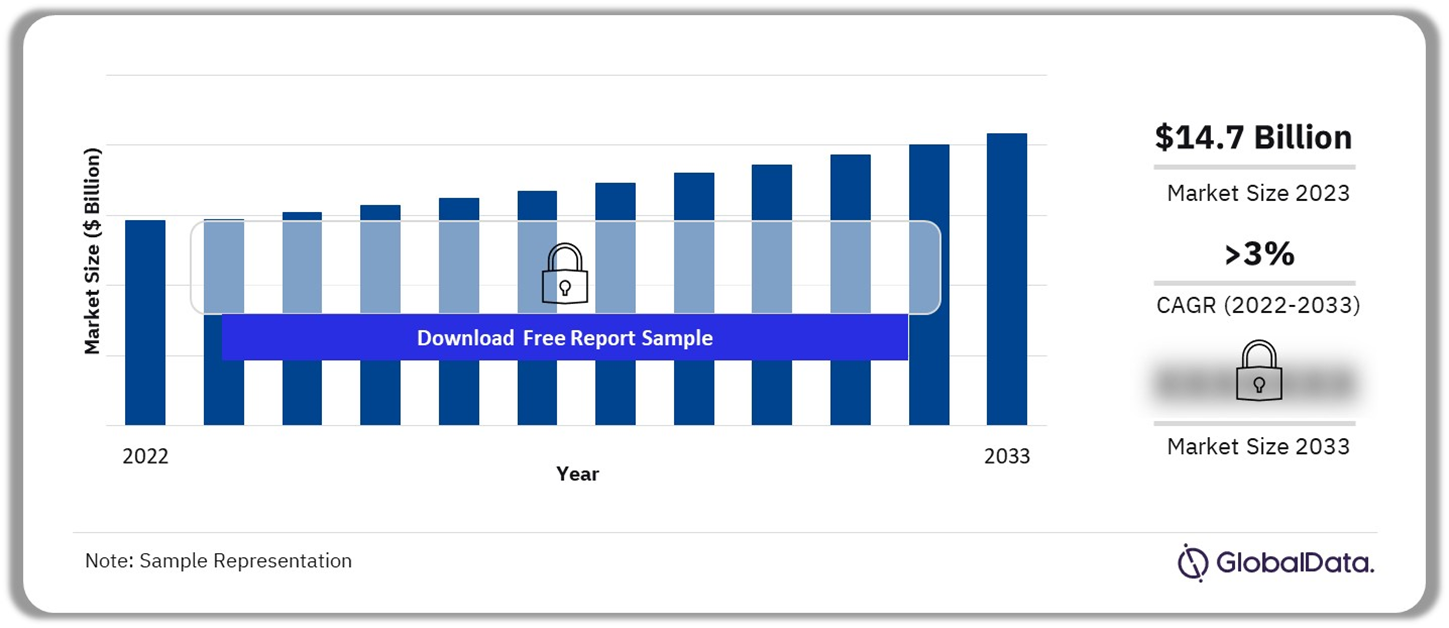

The remote patient monitoring devices market size revenue was valued at $14.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of more than 3% over the forecast period. The emphasis on patient-centric healthcare covering personalized treatment plans, improved engagement, preventive care, and early detection is anticipated to drive market growth over the predicted timeline.

The RPM devices market is set to play a pivotal role in achieving this transition by enabling consumers to proactively participate in overseeing their treatment. Prioritizing patient needs results in increased user-friendliness and greater patient outcomes. This improves adherence to monitoring protocols and ultimately leads to better health results through tailored interventions for effective management of chronic conditions and early detection of health issues, thereby reducing healthcare costs.

Remote Patient Monitoring Devices Market Outlook, 2022-2033 ($Billion)

Buy the Full Report for Additional Insights on the Remote Patient Monitoring Devices Market Forecast

The overall market is poised to observe stable growth over the predicted timeline aided by the expanding geriatric population around the globe. As per the United Nations report released in January 2023, the number of elderly people above 65 years is set to double by 2050 reaching 1.6 billion. The prevailing trend toward prolonging life expectancy continues to exert significant influence among individuals, thus promoting the demand for devices for daily health monitoring.

Continuous advancements in device technology are reshaping the remote patient monitoring market, improving precision and accessibility for healthcare providers and patients alike. An example is Abbott’s groundbreaking leadless pacemaker technology, unveiled in July 2023. The device is smaller than a AAA battery, facilitating beat-to-beat wireless communication and synchronization. This innovation offers a minimally invasive option that transforms treatment for a broader spectrum of patients.

Another key factor that is anticipated to propel the industry’s growth is the surging monetary investments. Real-time communication, remote data monitoring, and secure transmission of patient information are some of the key factors driving new investment in this sector. Niterra’s entry into healthcare through collaboration with Vivalink emphasizes telemedicine and personalized care, aiming to redefine healthcare delivery.

| Market Size (2023) | $14.7 billion |

| CAGR | >3% |

| Forecast Period | 2022-2033 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Device Segment | Implantable RPM, External RPM |

| Geographies | North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

| Countries | US, Canada, Mexico, Germany, UK, France, Italy, Spain, United Kingdom, Russia, Austria, Belgium, Czech Republic, Denmark, Greece, Finland, Hungary, Ireland, Netherlands, Norway, Poland, Portugal, Sweden, Switzerland, Turkey, China, Japan, India, Australia, New Zealand, South Korea, Taiwan, Argentina, Brazil, Chile, South Africa, Saudi Arabia, Israel, Egypt, United Arab Emirates |

| Key Companies | Medtronic Plc, Abbott Laboratories, Koninklijke Philips N.V., Nihon Kohden Corp., DexCom Inc., GE HealthCare Technologies Inc., Masimo Corp., Nonin Medical Inc., and Smiths Medical |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Remote Patient Monitoring Devices Segmentation by Device Type

The device-based segmentation includes implantable RPM and external RPM. The overall revenue share by device type was dominated by the implantable RPM group in 2023, which is expected to continue its dominance over the predicted timeline. This segment group is further broken down into implantable cardioverter defibrillators (ICD) and pacemakers. Pacemakers, constituting the larger share, are anticipated to exhibit a higher compound annual growth rate (CAGR) in the forecast period, driven by advancements in compact device technology.

For instance, in July 2023, Adventist Health Hanford in California, US, started offering the world’s smallest pacemaker which is one-tenth the size of traditional instruments. This innovation delivers advanced pacing technology while minimalizing the chest scars in the patients.

The ICD segment, although accounting for a smaller revenue share, is poised to showcase steady growth over the projected timeframe. The growth of this segment is primarily attributed to the launch and development of new products with higher efficiency and delivery performance. For example, in October 2023, Medtronic plc, a prominent leader in healthcare technology, obtained FDA approval for its extravascular ICD, aimed at treating rapid heart rhythms that can lead to sudden cardiac arrest. The Aurora EV-ICD system represents a pioneering breakthrough, providing the life-saving features of traditional transvenous ICDs.

Remote Patient Monitoring Devices Market Share by Device Type, 2023 (%)

Buy the Full Report for More Information on Remote Patient Monitoring Devices Market Device Type

The external RPM segment is further categorized into specialized and vital monitoring devices. Among these two sub-segments, the vital monitoring devices are set to register the fastest compound annual growth rate (CAGR) of over 3% over the forecast period, aided by growing demand for oximeters. The wrist pulse oximeters are increasingly gaining prominence owing to their wireless capabilities providing an easy method to track oxygen saturation levels in the blood with high accuracy and reliability.

Within vital monitoring devices, the thermometers are poised to remain the largest sub-segment from 2023 to 2033. This segment observed a sudden surge in demand during the pandemic and post-pandemic era. However, its overall revenue declined in 2023 owing to the normalizing situation across the globe.

On the other hand, specialized monitoring devices are further categorized into blood glucose meters, external cardio remote monitors, portable capnography, and portable polysomnography systems. The blood glucose sub-segment remained the largest category as of 2023 and is predicted to continue its dominance over the forecast period owing to the rising diabetic population around the globe. According to a medical study published in the Lancet in June 2023, diabetic cases worldwide are set to double over the next 30 years.

The fastest growing segment within specialized monitoring devices is the external cardio remote monitors. External cardio remote monitors are a crucial instrument for capturing ECG data. Thus, its growth dynamics are directly influenced by the number of cardio patients. As per the data released by the World Heart Federation in April 2023, more than half a billion global population is affected by cardiovascular diseases.

Remote Patient Monitoring Devices Market Analysis by Region

North America emerged as the largest regional market of RPM devices globally in terms of revenue in 2023, which can be attributed to the advanced healthcare infrastructure coupled with the rise in chronic diseases. The US, which is a dominant regional market, has half of its population suffering from nearly one chronic disease and every 1 out of 10 citizens is affected by diabetes (type 2) as per the data revealed by the U.S. Department of Health & Human Services. Such demographics directly contribute to propelling the market growth of disease monitor devices.

Europe emerged as the second-largest revenue-generating region in 2023. Renowned for its technological advancements and substantial investments, Europe has positioned itself as a pivotal market for RPM devices, offering the potential to enhance healthcare outcomes, reduce hospitalizations, and control healthcare expenditure. Further supporting growth, and increased investment in research and development is evident in the region. For example, in November 2023, Sweden-based startup Acorai secured over $2.4 million in funding from the European Innovation Council (EIC) to advance the trial of its heart monitoring device, aiding the startup in approaching clinical validation trials.

Remote Patient Monitoring Devices Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Remote Patient Monitoring Devices Market

Asia Pacific is the third-largest market in 2023 and is poised to witness stable growth shortly. The region’s growing economic prosperity is paving the way for advancements in healthcare development. Japan is anticipated to emerge among the key regional markets for RPM devices owing to its aging domestic population. As per the data released by the Japanese government over 10% of its population is 80 years and older. Similarly, over 29% of its population falls in the segment of 65 years and older. Similar cases of the aging population are observed in neighboring countries including China, Singapore, Taiwan, and South Korea.

The Middle East & Africa along with South & Central America together accounted for a revenue share of over 9% in 2023. Both regional markets are in the developing phase with gradual improvement in the local healthcare infrastructure. Enhancement of patient care and support management of chronic diseases is likely to remain a key driver over the forecast period. The regulators in the UAE are exploring new avenues of development for remote patient monitoring. For example, the Dubai Health Authority (DHA) announced a collaboration with a local start-up to deploy non-evasive medical devices linked to smartphones or tablets for elderly patient health monitoring.

Remote Patient Monitoring Devices Market – Competitive Landscape

The competitive landscape of RPM devices is shaped by innovation and the development of new products, driving competition among key vendors across various segments and domains. Strategic partnerships play a crucial role in advancing the RPM device market, as demonstrated by GE Healthcare and Biofourmis’ collaboration in February 2024 to enhance post-hospital care, aiming to provide accessible at-home care and promote remote management through clinical-grade wearable devices.

Another key trend is the increasing introduction of at-home patient monitoring services by industry participants. For instance, in September 2023, US-based Montage Health introduced at-home monitoring services for patients with chronic diseases. The initial focus of this service is on congestive heart failure, hypertension, and type 2 diabetes, with plans for future expansion.

Leading Companies in the Remote Patient Monitoring Devices Market

- Medtronic Plc

- Boston Scientific Corp.

- Abbott Laboratories

- Dexcom, Inc.

- CONTEC MEDICAL SYSTEMS CO., LTD.

- Beijing Choice Electronic Tech Co.

- Nihon Kohden Corp.

- Koninklijke Philips N.V.

- DexCom Inc.

- Natus Medical Inc. (ArchiMed SAS)

- Masimo Corp.

- Nonin Medical Inc.

Other Remote Patient Monitoring Devices Market Vendors Mentioned

Medical International Research Srl and Biotronik SE & Co KG

Buy the Full Report to Know More About Leading Remote Patient Monitoring Devices Companies

Remote Patient Monitoring Devices Market Segments

GlobalData Plc has segmented the remote patient monitoring devices market report by device type and region:

Remote Patient Monitoring Devices Market Device Type Outlook (Revenue, $Million, 2022-2033)

- Implantable Remote Patient Monitoring Devices

- Implantable Cardioverter Defibrillators (ICDs)

- Pacemakers

- External Remote Patient Monitoring Devices

- Specialized Monitoring Devices

- Blood Glucose

- External Cardiology Remote Monitors

- Portable Capnography

- Portable Polysomnography Systems

- Vital Signs Monitoring Devices

- Thermometers

- Wrist Pulse Oximeters

- Peak Flow Meters

- Portable and Handheld Spirometers

- Specialized Monitoring Devices

Remote Patient Monitoring Devices Market Regional Outlook (Revenue, $Million, 2022-2033)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- United Kingdom

- Russia

- Austria

- Belgium

- Czech Republic

- Denmark

- Greece

- Finland

- Hungary

- Ireland

- Netherlands

- Norway

- Poland

- Portugal

- Sweden

- Switzerland

- Turkey

- Asia Pacific

- China

- Japan

- India

- Australia

- New Zealand

- South Korea

- Taiwan

- South and Central America

- Argentina

- Brazil

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- Israel

- Egypt

- United Arab Emirates

Key Highlights

The global Remote Patient Monitoring Devices market size was valued at $14,575 million in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.29% during 2022-2033. The key to the growth has been the rising incidence of chronic ailments and the focus on patient-centered medical services like personalized treatment strategies and enhanced patient involvement, combined with the progress in remote monitoring technologies, the market is anticipated to witness expansion. Moreover, the market is expected to experience accelerated growth due to strategic partnerships, mergers, and acquisitions.

Key Players

Medtronic PlcBoston Scientific Corp

Abbott Laboratories

Biotronik SE & Co KG

Dexcom, Inc

CONTEC MEDICAL SYSTEMS CO.,LTD

Beijing Choice Electronic Tech Co

Nihon Kohden Corp

Koninklijke Philips N.V

DexCom Inc

Natus Medical Inc (ArchiMed SAS)

Masimo Corp

Nonin Medical Inc

Medical International Research Srl

Table of Contents

Table

Figures

Frequently asked questions

-

What was the remote patient monitoring devices market size in 2023?

The remote patient monitoring devices market size was valued at $14.7 billion in 2023.

-

What is the remote patient monitoring devices market growth rate?

The remote patient monitoring devices market is expected to grow at a CAGR of more than 3% during the forecast period.

-

What is the key remote patient monitoring devices market driver?

The remote patient monitoring devices market growth is primarily driven by the increasing prevalence of chronic diseases.

-

Which was the leading device segment in the remote patient monitoring devices market in 2023?

The implantable remote patient monitoring devices accounted for the largest device type market share in 2023.

-

Which are the leading remote patient monitoring device companies globally?

The leading remote patient monitoring devices companies are Medtronic Plc, Abbott Laboratories, Koninklijke Philips N.V., Nihon Kohden Corp., DexCom Inc., GE HealthCare Technologies Inc., Masimo Corp., Nonin Medical Inc., and Smiths Medical.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Remote Patient Monitoring reports