Singapore General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Singapore General Insurance Market Report Overview

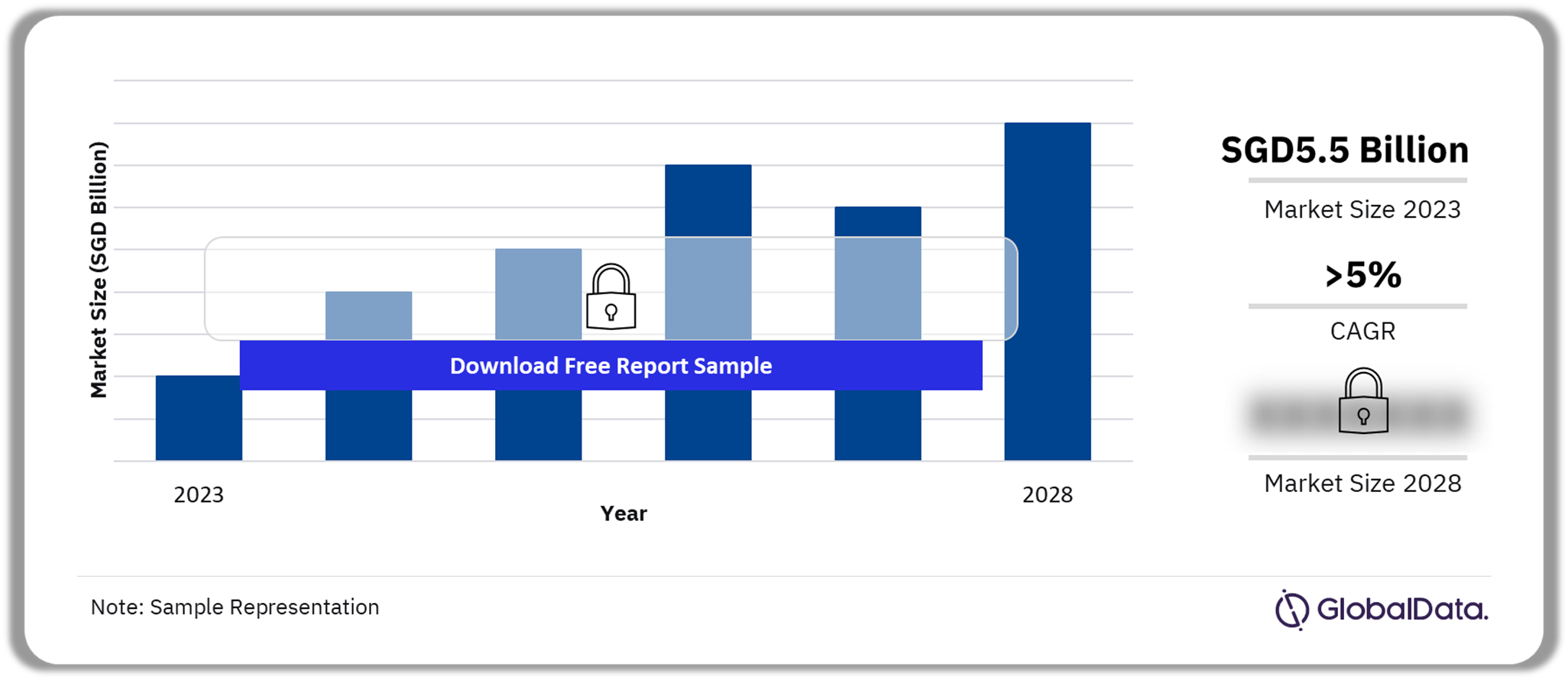

The gross written premium of the Singapore general insurance market was SGD5.5 billion ($4 billion) in 2023 and is expected to achieve a CAGR of more than 5% during 2024-2028. The Singapore general insurance market research report provides in-depth market analysis, including insights into the lines of business in the country’s general insurance industry. Furthermore, the report provides a detailed outlook by product category as well as values for key performance indicators, including gross written premium, penetration, and premium ceded and cession rates for the review and forecast periods.

Singapore General Insurance Market Outlook, 2023-2028 (SGD Billion)

Buy the Full Report to Gain More Information about the Singapore General Insurance Market Forecast

The Singapore general insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the Singaporean economy and demographics. It further evaluates the competitive landscape in the country, which entails segment dynamics, competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | SGD5.5 billion ($4 billion) |

| CAGR (2024-2028) | >5% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Lines of Business | · Property

· Motor · Liability · Financial Lines · MAT · General Insurance PA&H · Miscellaneous |

| Key Distribution Channels | · Direct from Insurers

· Banks · Insurance Brokers · Financial Advisors · Online Aggregators |

| Leading Companies | · Cigna Europe

· AIG · NTUC Income · Chubb · MSIG Insurance |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Singapore General Insurance Market Trends

EVs and microinsurance are a few of the recurring trends in the Singapore general insurance market.

- As part of its Green Plan, Singapore aims to transition completely to EVs by 2030. This is a driving factor for insurance companies to expand coverage.

- Evolution in the gig economy and addressing insurance requirements for migrant workers and the less represented workforce has enabled start-ups to enter the general insurance sphere.

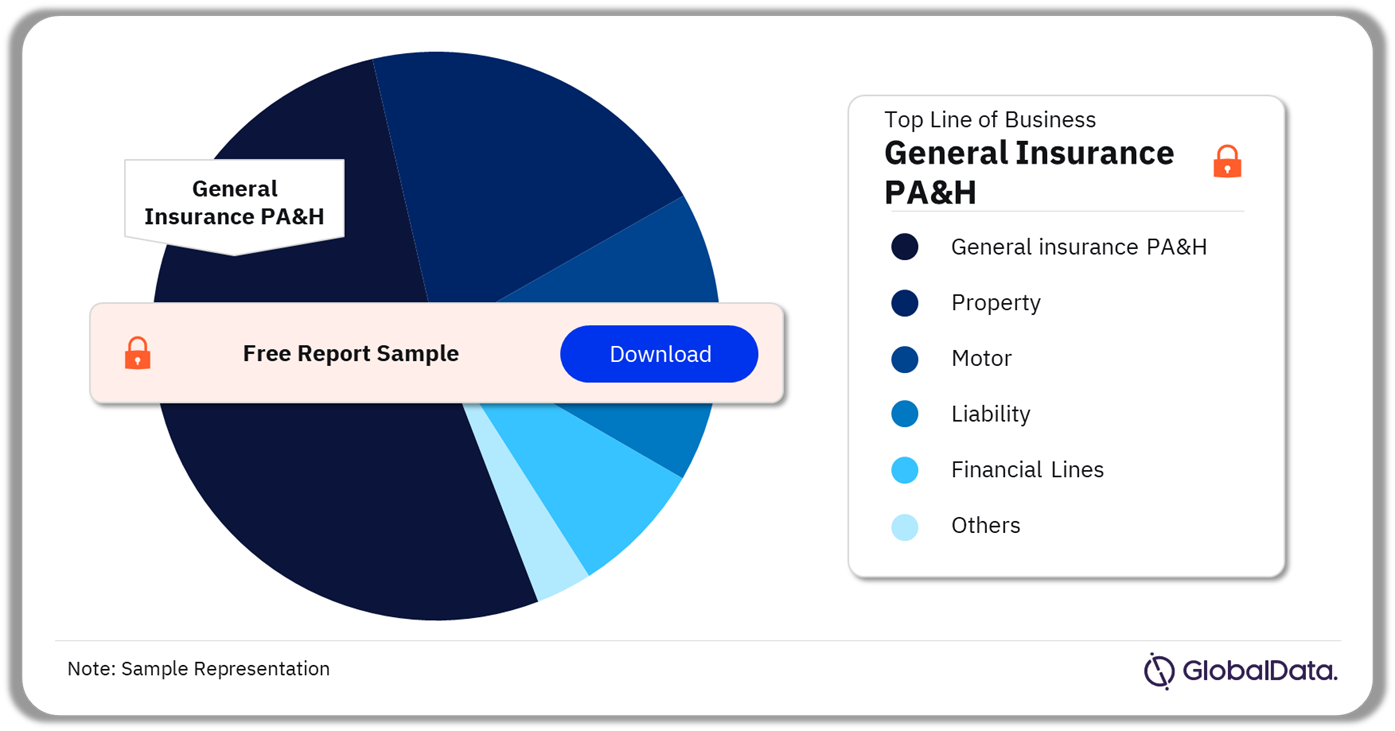

Singapore General Insurance Market Segmentation by Lines of Business

General insurance PA&H was the leading general insurance line of business in 2023

The key lines of business in the Singapore general insurance industry are property, motor, liability, financial lines, MAT, general insurance PA&H, and miscellaneous. Fire insurance is compulsory in Singapore when purchasing property from the Housing and Development Board (HDB) and taking out home loans. Fire insurance, in turn, drives the growth of property insurance in the country.

Singapore General Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Singapore General Insurance Market

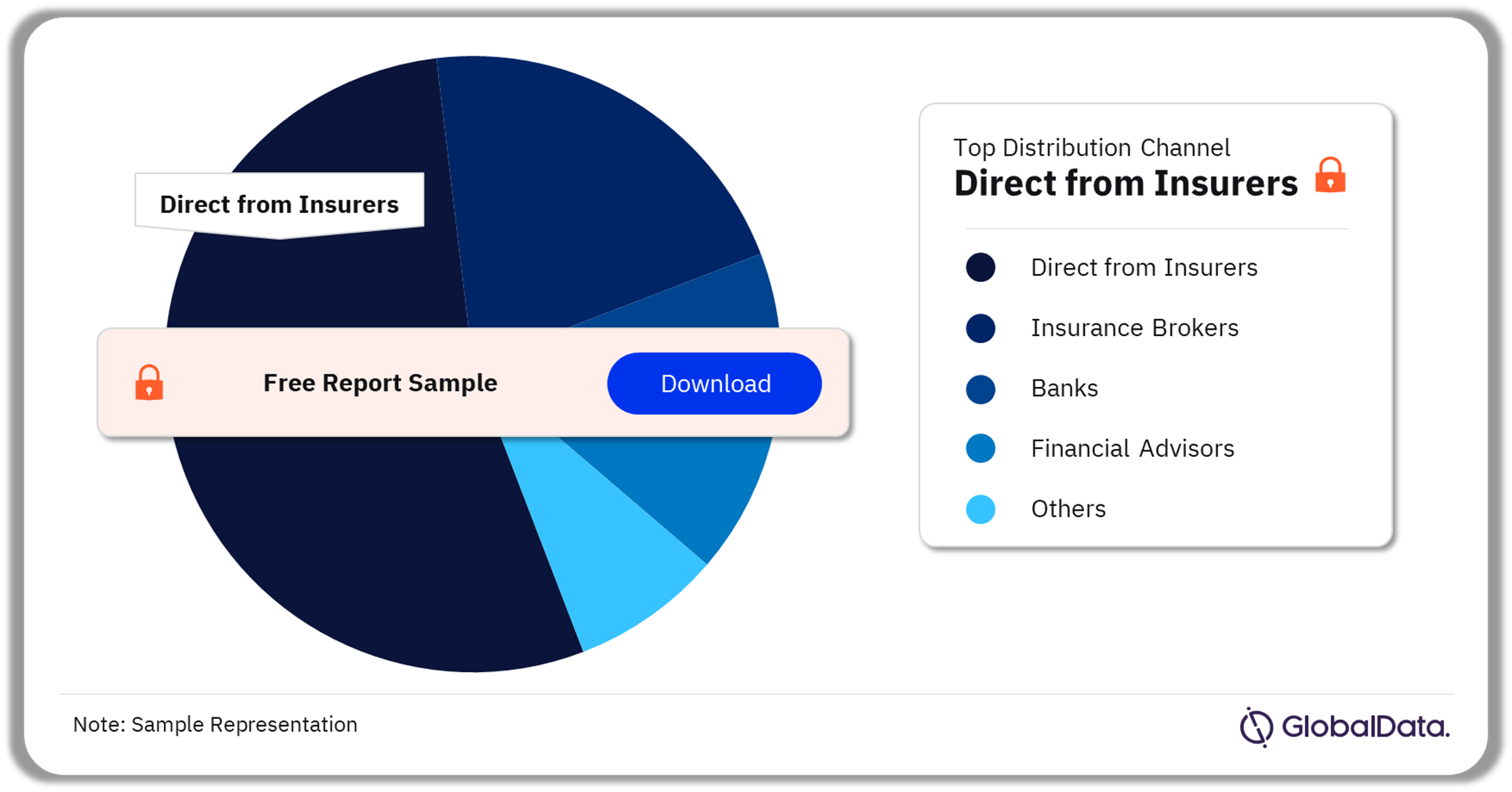

Singapore General Insurance Market Segmentation by Distribution Channels

Direct from insurers was the most preferred channel for purchasing homeowners insurance in 2023

A few of the key distribution channels in the Singapore general insurance industry are direct from insurers, insurance brokers, banks, online aggregators, and financial advisors, among others. In 2023, direct from insurers was the most preferred channel while purchasing motor insurance, followed by insurance brokers.

Singapore General Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for more Distribution Channel Insights into the Singapore General Insurance Market

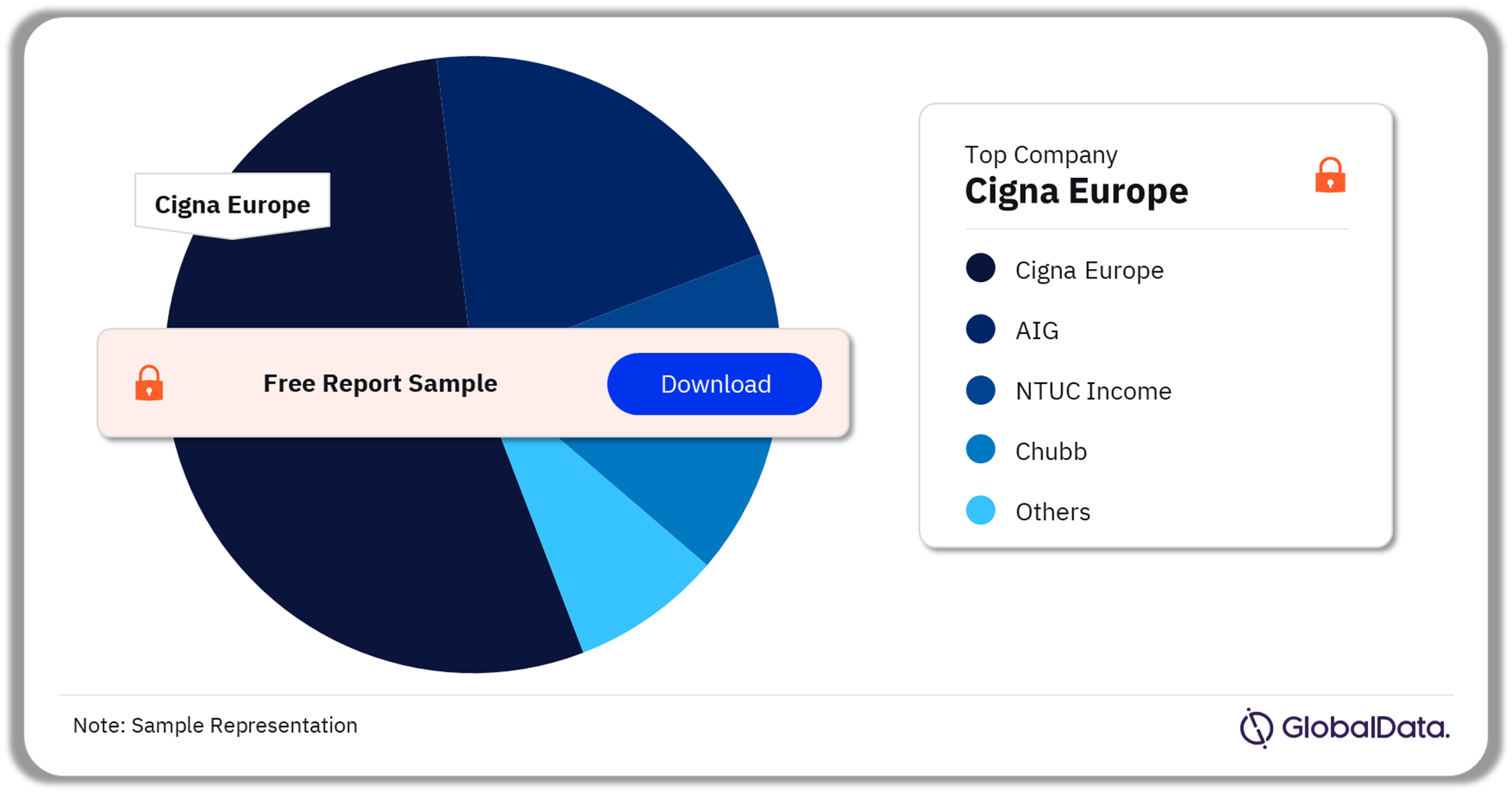

Singapore General Insurance Market - Competitive Landscape

Cigna was the largest general insurer in 2022

A few of the leading general insurance companies in Singapore are:

- Cigna Europe

- AIG

- NTUC Income

- Chubb

- MSIG Insurance

Cigna was the fastest-growing insurance company among the top 10 general insurers.

Singapore General Insurance Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Companies in the Singapore General Insurance Market

Singapore General Insurance Market - Latest Developments

- On November 9, 2023, the Monetary Authority of Singapore (MAS) published the Financial Action Task Force (FATF) statement for October 2023. The statement mandates financial institutions (FIs) to comply with new statements on a revised list of jurisdictions under increased monitoring to mitigate anti-money laundering or countering of terrorist financing (AML/CFT) obligations.

- On October 31, 2023, the Inland Revenue Authority of Singapore (IRAS) updated e-tax guides outlining changes in the taxation of insurers and entities in relation to the adoption of certain financial reporting standards.

Segments Covered in the Report

Singapore General Insurance Lines of Business Outlook (Value, SGD Billion, 2019-2028)

- Property

- Motor

- Liability

- Financial Lines

- MAT

- General Insurance PA&H

- Miscellaneous

Singapore General Insurance Distribution Channels Outlook (Value, SGD Billion, 2019-2028)

- Direct from Insurers

- Banks

- Insurance Brokers

- Financial Advisors

- Online Aggregators

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Singapore.

- Historical values for the Singapore general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Singapore and outlines the key regulations affecting them.

Key Highlights

Key insights and dynamics of Singapore’s general insurance segment.

- A comprehensive overview of Singapore’s economy, government initiatives, and investment opportunities.

- Singapore’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Singapore’s general insurance industry’s market structure giving details of lines of business.

- Singapore’s general reinsurance business’ market structure giving details of premium ceded along with cession rates.

- Distribution channels deployed by Singapore’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Singapore’s general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Singapore’s general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

MSIG

AIG

NTUC

Chubb

Berkshire Hathaway

Liberty Pte Limited

Ms. First Capital

Table of Contents

Frequently asked questions

-

What was the Singapore general insurance market gross written premium in 2023?

The gross written premium of the Singapore general insurance market was SGD5.5 billion ($4 billion) in 2023.

-

What will the Singapore general insurance market growth rate be during the forecast period?

The general insurance market in Singapore is expected to achieve a CAGR of more than 5% during 2024-2028.

-

Which line of business held the largest share of the Singapore general insurance market in 2023?

General insurance PA&H held the largest share of the Singapore general insurance market in 2023.

-

Which distribution channel held the highest share in the Singapore homeowners insurance market in 2023?

Direct from insurers was the leading channel for purchasing homeowners insurance in 2023.

-

Which are the key companies operating in the Singapore general insurance market?

A few of the leading general insurance companies in Singapore are Cigna Europe, AIG, NTUC Income, Chubb, and MSIG Insurance.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports