Singapore Retail Banking Analysis by Consumer Profiles, 2022 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Singapore Retail Banking Analysis Report Overview

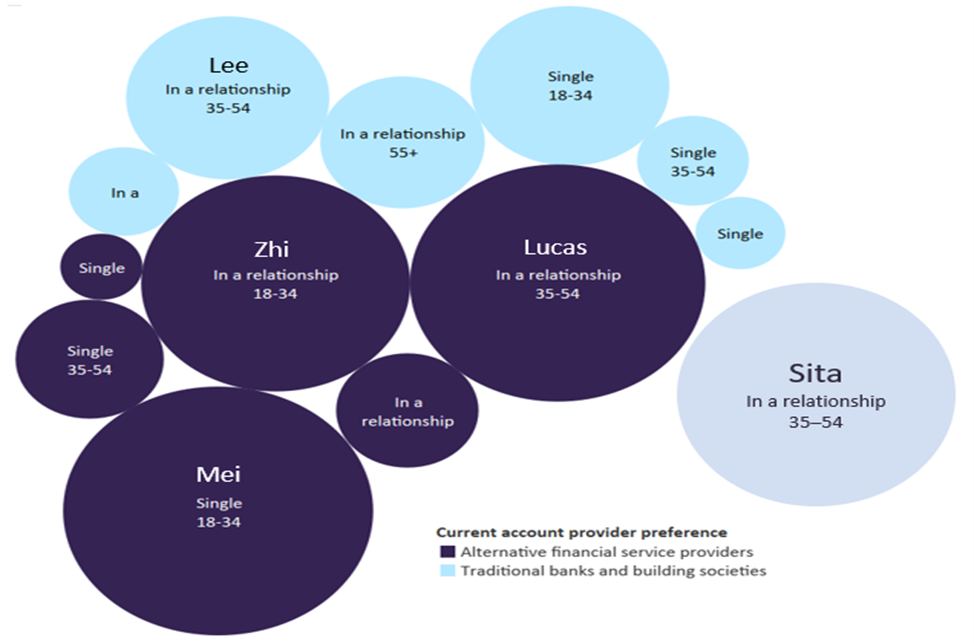

A few personas have been created through a cluster analysis of GlobalData’s 2022 Financial Services Consumer Survey to understand Singaporean survey respondents and their attitudes, preferences, and unmet needs from their main providers. The personas have been created using three core attributes which are age, marital status, and their financial services provider type preference, i.e. traditional banks and credit unions or alternative providers such as digital challenger banks, big tech companies, fintech companies, digital wallets, and retailers. The personas give a comprehensive view of how a person in this group views their financial life, considering their detailed demographic information, impending life events, unmet needs and frustrations, and opinions and preferences in banking, particularly in terms of their attitudes toward digital banks and non-bank financial services providers.

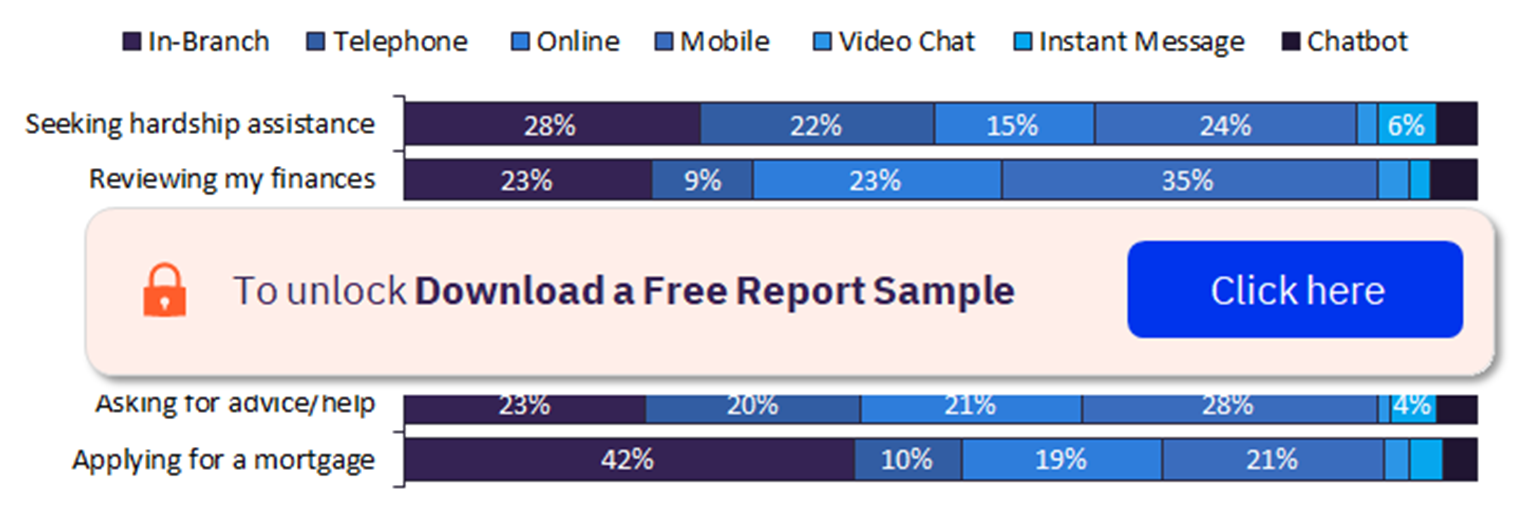

Based on the consumer profiles covered in the report, a few general results can be gleaned. For example, most customers conduct their banking digitally either on a mobile app or on a provider’s website. However, despite the digitization of retail banking, consumers generally still hold a reasonably strong preference for the use of branches when it comes to major tasks such as applying for a mortgage. This report helps foster an understanding of the preferences and usage patterns of unique demographics.

GlobalData Personas

To know more about the customer personas in the Singapore retail banking market, download a free report sample

Singapore Retail Banking - Customer Personas

The key customer personas in the Singapore retail banking sector are Older Gen Z, Younger Millennial, Older Millennial, Older Gen X, and small business owner.

Older Gen Z: She is a young graduate who was fortunate enough to have support from wealthy parents despite being in a low-paying job herself. She primarily interacts with her bank via digital channels, which bleeds into a preference for alternative digital-only providers. She believes they offer better rates and services than traditional providers. Despite this preference, she still uses a traditional provider for her main account. However, she is thinking about switching to a digital-only provider given they could help her save and invest.

Younger Millennial: She is in her late 20s with a stable well-paying position at the company she works for. Her own home provides her with a certain degree of financial stability that has been interrupted by the recent birth of her first child. She is unsure how becoming a parent is going to affect her finances down the line. Furthermore, she and her partner are also unsure as to whether they want a second child, which is another source of financial uncertainty. The younger millennial has a marked preference for digital alternative providers as she has been dissatisfied with the speed of traditional providers’ digital problem resolution.

Singapore Retail Banking – Channel Preferences for Banking Activities

The key channel preferences in the retail banking market in Singapore are in-branch, telephone, online, mobile, video chat, instant message, and chatbot. Older Gen Z is by and large satisfied with her bank’s digital services, even though she wishes that it would better integrate its different channels. She mostly uses online and mobile banking. Hence, better integration between these services would do much to address her concern.

Singapore Retail Banking Market Analysis, by Channel Preferences of Older Gen Z

To know more about the channel preferences of older gen Z in the Singapore retail banking market, download a free report sample

Singapore Retail Banking Market Report Overview

| Customer Personas | Older Gen Z, Younger Millennial, Older Millennial, Older Gen X, and Small Business Owner |

| Channel Preferences | In-Branch, Telephone, Online, Mobile, Video Chat, Instant Message, and Chatbot |

Segments Covered in the Report

Customer Personas

- Older Gen Z

- Younger Millennial

- Older Millennial

- Older Gen X

- SME Owner

Channel Preferences

- In-Branch

- Telephone

- Online

- Mobile

- Video Chat

- Instant Message

- Chatbot

Reasons to Buy

- Understand how consumer preferences vary between different types of consumers.

- Access the latest consumer survey data on channel behavior, provider preferences, and product holdings.

- Identify the areas for improvement that matter to particular consumers.

- Benefit from the provision of actionable steps that can help your business target specific customer profiles.

Table of Contents

Frequently asked questions

-

What are the key customer personas in the Singapore retail banking sector?

The key customer personas in the Singapore retail banking sector are Older Gen Z, Younger Millennial, Older Millennial, Older Gen X, and small business owner.

-

What are the key channel preferences in the retail banking market?

The key channel preferences in the retail banking market in Singapore are in-branch, telephone, online, mobile, video chat, instant message, and chatbot.

-

Why does the older gen Z use digital channels?

The older gen Z primarily interacts with her bank via digital channels, which bleeds into a preference for alternative digital-only providers. Moreover, she believes that they offer better rates and services than traditional providers.

-

What is the channel preference of the younger millennials?

The younger millennial has a marked preference for digital alternative providers as she has been dissatisfied with the speed of traditional providers’ digital problem resolution.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports