Singapore Wealth Management – High Net Worth (HNW) Investors

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Singapore Wealth Management High Net Worth Investors Market Overview

Men continue to dominate Singapore’s HNW population, accounting for 84.2% of HNW individuals. However, we expect the proportion of females to grow as more women enter high-ranking positions in major corporations and engage in entrepreneurial endeavors. The Singapore wealth management market report sizes the opportunity within Singapore’s wealth market and analyzes the investment preferences, service requirements, and portfolio allocations of the country’s HNW investors.

Singapore Wealth Management Market Dynamics

The vast majority of HNW individuals in Singapore have accumulated their wealth either through earned income or entrepreneurship. Entrepreneurial income is also becoming a growing source of wealth generation. According to data from the Accounting and Corporate Regulatory Authority, as of November 2022, 405,057 companies were registered in the city-state – a year-on-year increase of 4.3%.

The inheritor market is currently very small. However, it is expected to grow over the next decade given the age structure of Singapore’s current HNW cohort, which is dominated by older individuals. It, therefore, represents a lucrative market for wealth managers willing to reach out with targeted products.

Singapore Wealth Management Market Investment Preferences

The key investment preferences in the Singapore wealth management market are advisory asset management, automated investment services, discretionary asset management, and execution-only asset management. The importance of a varied approach is demonstrated by the high demand levels across all types of asset management services. Automated investment services/robo-advisors have strong current demand, followed by execution-only mandates.

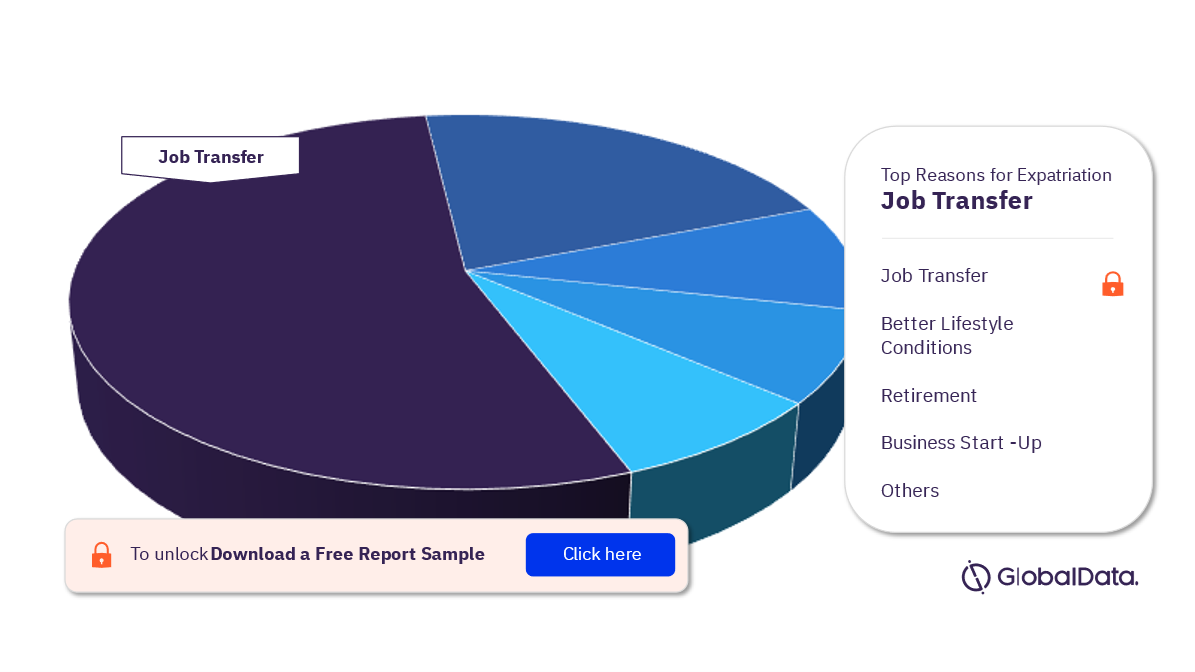

Singapore Wealth Management Market - Reasons for Expatriation for HNW Investors

The drivers of expatriation to Singapore are job transfer, better lifestyle conditions, better opportunities for expats’ children, business start-ups, and retirement among others. The majority of the people shift owing to a job transfer.

Singapore Wealth Management Market, by Reasons For Expatriation

For more expatriation reason insights in the Singapore wealth management market, download a free report sample

Singapore Wealth Management Market - Major Asset Classes of Offshore Investment

The major asset classes of offshore investment for HNW investors in the Singapore wealth management market include equity, cash and near-cash products, bonds, property, alternatives, and commodities. Singaporean HNW investors’ offshore portfolios are heavy on equities and cash and near-cash products, with the two accounting for over half of all assets.

Singapore Wealth Management Market, By Asset Classes of Offshore Investment

For more asset classes of offshore investment insights in Singapore wealth management, download a free report sample

Singapore Wealth Management Market Report Overview

| Key Investment Preferences | Advisory Asset Management, Automated Investment Services, Discretionary Asset Management, and Execution-Only Asset Management. |

| Key Reasons For Expatriation | Job Transfer, Better Lifestyle Conditions, Better Opportunities For Expats’ Children, Business Start-Ups, and Retirement |

| Major Asset Classes Of Offshore Investment | Equity, Cash and Near Cash, Bonds, Property, Alternatives, and Commodities |

Segments Covered in the Report

Singapore Wealth Management Market Asset Classes Outlook (2022)

- Equity

- Cash and Near Cash

- Bonds

- Property

- Alternatives

- Commodities

Key Highlights

- Expats constitute more than 21% of the local HNW population. They represent an attractive target market thanks to their more complex service requirements.

- Robo-advice accounts for over 16% of the Singaporean HNW portfolio. The market for robo-advisory services is growing, with multiple wealth managers entering the space.

- Property, equities, and cash and near-cash investments dominate the Singaporean HNW portfolio.

Reasons to Buy

- Develop and enhance your client targeting strategies using our data on HNW profiles and sources of wealth.

- Enhance your marketing strategies and capture new clients using insights from our data on HNW investors’ asset management style preferences.

- Tailor your investment product portfolio to match current and future demand for different asset classes among HNW individuals.

- Develop your service proposition to match the demand expressed by Singaporean HNW investors and react proactively to forecast changes in demand.

Standard Chartered

Citibank

SaxoWealthCare

Frequently asked questions

-

What are the various investment services in the Singapore wealth management market?

Advisory asset management, automated investment services, discretionary asset management, and execution-only asset management are the various investment services in the Singapore wealth management market.

-

What are the key reasons for expatriation for HNW investors in the Singapore wealth management market?

Job transfer, better lifestyle conditions, better opportunities for expats’ children, business start-ups, and retirement are the key reasons for expatriation for HNW investors in the Singapore wealth management market.

-

What is the key driver for expatriation for HNW investors in the Singapore wealth management market?

The key driver of expatriation to the Singapore management market is job transfer.

-

What are the major asset classes of offshore investment for HNW investors in the Singapore wealth management market?

Equity, cash and near-cash products, bonds, property, alternatives, and commodities are the major asset classes of offshore investment for HNW investors in the Singapore wealth management market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports