South Africa Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

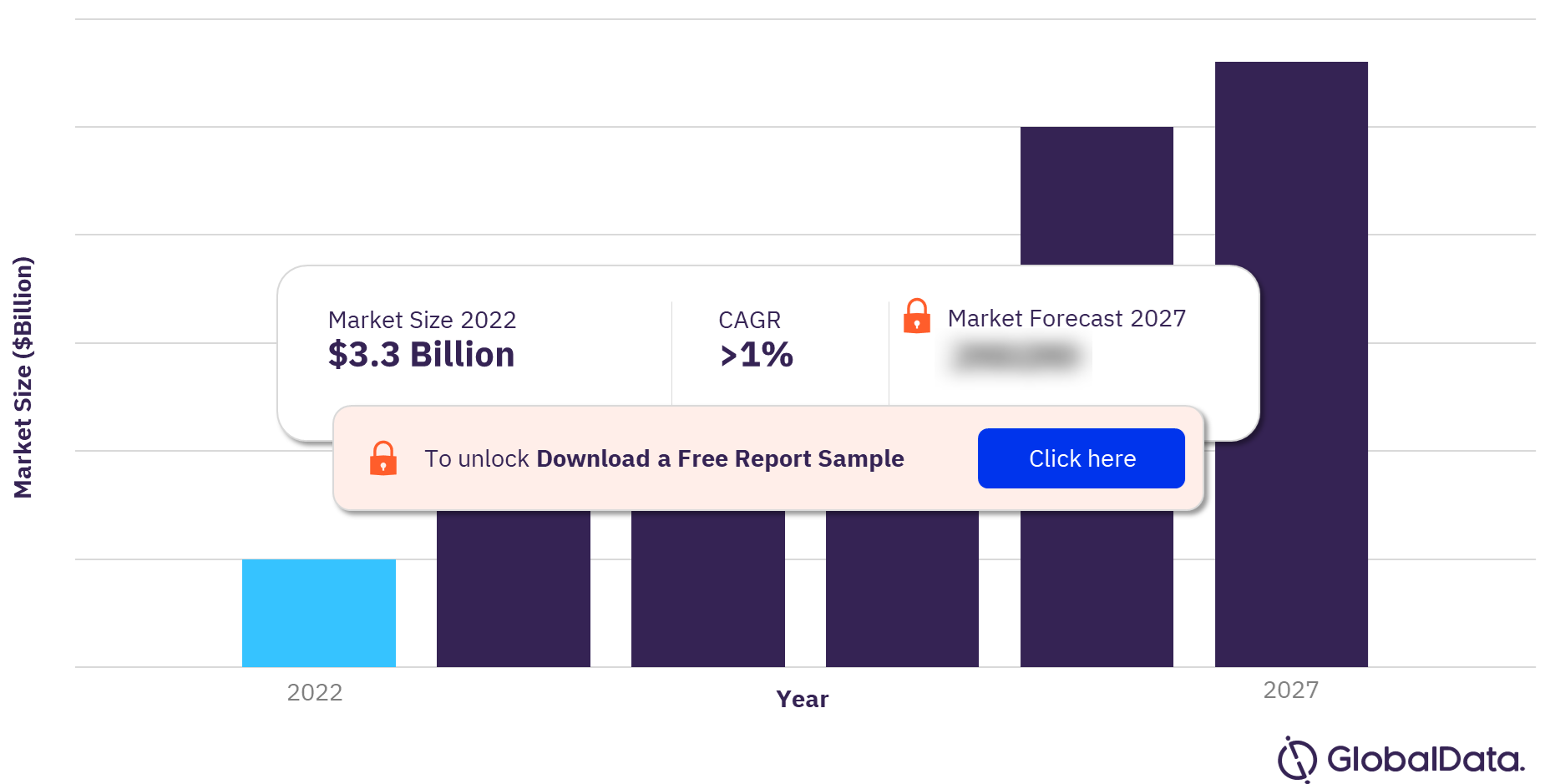

South Africa’s defense budget declined from 2018 to reach $3.3 billion in 2022. However, it is expected to achieve a CAGR of more than 1% during 2023-2027. The South Africa defense market research report provides the market size forecast and the projected growth rate for the next five years. The report covers industry analysis including the key market drivers, emerging technology trends, and major challenges faced by market participants. It also offers insights regarding key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

South Africa Defense Market Overview

To gain more information on the South Africa defense market forecast, download a free report sample

South Africa Defense Market Drivers

South Africa needs to raise its spending levels to maintain regional security, including operations in the Democratic Republic of the Congo (DRC) and Mozambique. Despite ongoing reforms, more than half of the defense spending is predicted to be allocated to personnel spending over the forecast period. Moreover, South Africa is attempting to boost domestic defense industrial capabilities and spending in the forecast period will be targeted to ensure this.

South Africa Military Doctrines and Defense Strategies

South Africa relies on its special forces for defense operations across domains, particularly for strategic reconnaissance, special tasks, and anti-terror operations. Medium-combat forces are utilized for projectable combat capabilities with higher levels of firepower and maneuvers. Additionally, heavy combat forces are self-supporting armor, artillery, and mechanized infantry brigades, which are utilized to boost the capabilities of other forces and adapt to strategic environments.

The South African 2015 defense review is the current document that governs military strategy in the country. Its domestic priorities include maintaining territorial integrity and order, as well as supporting governance and the economy. Its regional priorities include supporting other countries in Southern Africa, supporting trade, and attracting FDI.

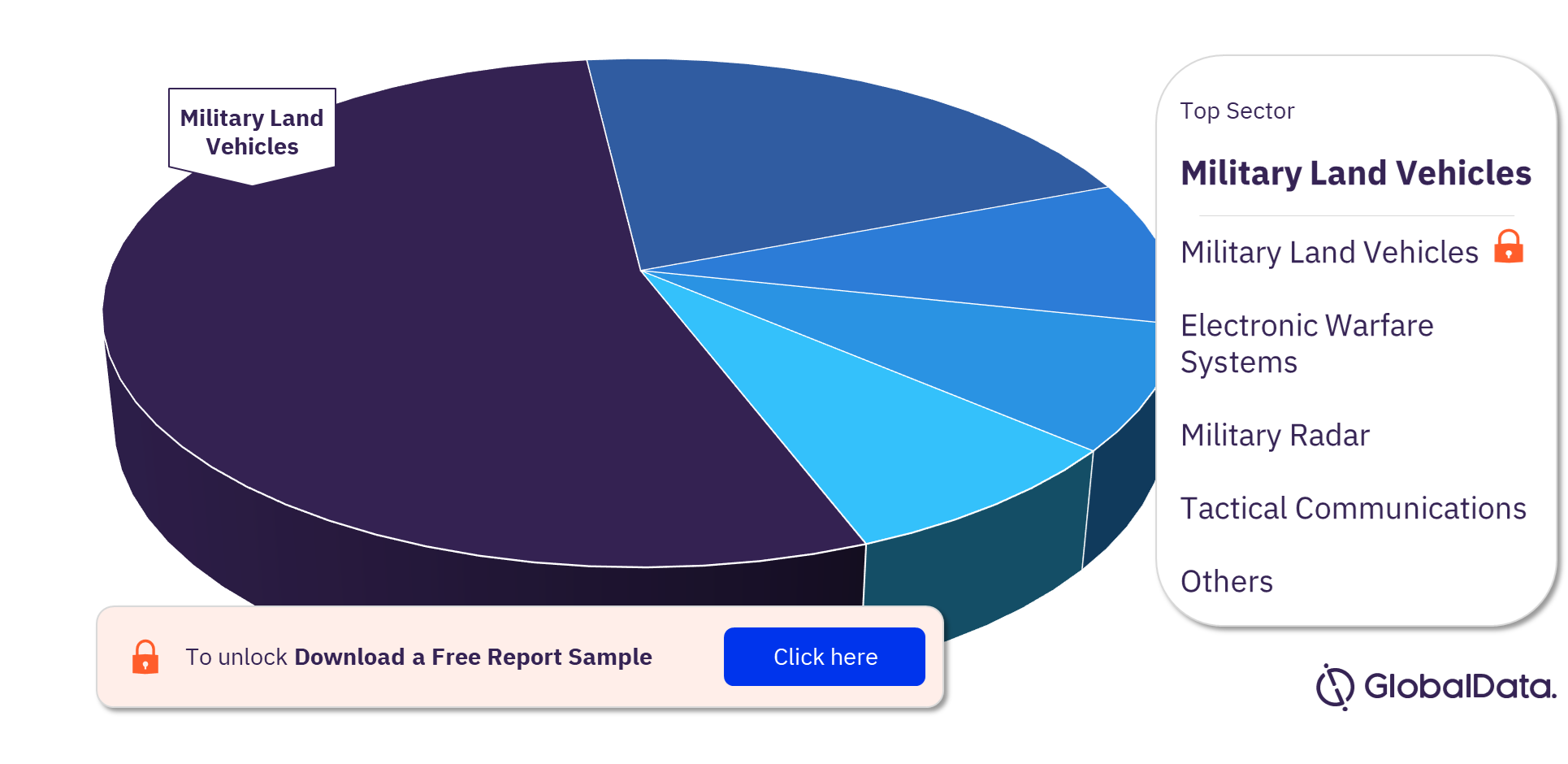

South Africa Defense Market Segmentation by Sectors

The top three sectors in the South Africa defense market are military land vehicles, electronic warfare systems, and military radar. Others include tactical communications, military fixed-wing, military ammunition, military simulation and training, naval vessels & surface combatants, military UAV, EOIR systems, underwater warfare systems, missiles and missile defense systems, INS GNSS, and body armor and personal protection. Military land vehicles is the largest sector in South Africa’s defense market, followed by electronic warfare and military radar.

South Africa Defense Market Analysis by Sectors

For more sector insights into the South Africa defense market, download a free report sample

South Africa Defense Market Competitive Landscape

The leading defense companies in the South Africa defense market are Denel SOC Ltd, Reutech Pty Ltd, Ideco Group Limited, Square One Solutions Group Limited, ETION Ltd, Defensor Security (Pty) Ltd, Denel Aviation, Denel Land Systems, Hensoldt Optronics (Pty) Ltd, and Paramount Group.

South Africa Defense Market Report Overview

| Market Size (2022) | $3.3 billion |

| CAGR (2023-2027) | >1% |

| Key Sectors | Military Land Vehicles, Electronic Warfare Systems, Military Radar, Tactical Communications, Military Fixed-Wing, Military Ammunition, Military Simulation and Training, Naval Vessels & Surface Combatants, Military UAV, EOIR Systems, Underwater Warfare Systems, Missiles and Missile Defense Systems, INS GNSS, and Body Armor and Personal Protection |

| Leading Companies | Denel SOC Ltd, Reutech Pty Ltd, Ideco Group Limited, Square One Solutions Group Limited, ETION Ltd, Defensor Security (Pty) Ltd, Denel Aviation, Denel Land Systems, Hensoldt Optronics (Pty) Ltd, and Paramount Group |

Scope

This report provides:

- Detailed analysis of the South Africa’s FY2022 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Explanation of the procurement policy and process. This is coupled with an analysis of South Africa’s military doctrine and strategy to provide a comprehensive overview of South Africa’s military regulation.

- Examination of political alliances and perceived security threats to South Africa. They help to explain trends in spending and modernization.

- Analysis of prevalent trends in the country’s imports and exports over the last five years.

- Analysis of the competitive landscape of the South African defense industry.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the South Africa defense market over the next five years.

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the South African market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the South African defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the South African government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Aerosud

Denel Dynamics

Saab

BAE Systems

Pilatus Aircraft

Dassault Aviation

Boeing

Cessena Aircraft Company

Lockheed Martin

Cessena Aircraft Company

Textron

Table of Contents

Table

Figures

Frequently asked questions

-

What is the South Africa defense market size in 2022?

The defense market size in South Africa is valued at $3.3 billion in 2022.

-

What is the South Africa defense market growth rate?

The defense market in South Africa is expected to achieve a CAGR of more than 1% during 2023-2027.

-

What are the key sectors in the South Africa defense market?

The key sectors in the South Africa defense market are military land vehicles, electronic warfare systems, military radar, tactical communications, military fixed-wing, military ammunition, military simulation and training, naval vessels & surface combatants, military UAV, EOIR systems, underwater warfare systems, missiles and missile defense systems, INS GNSS, and body armor and personal protection.

-

Which are the leading companies in the South Africa defense market?

The leading defense companies in the South Africa defense market are Denel SOC Ltd, Reutech Pty Ltd, Ideco Group Limited, Square One Solutions Group Limited, ETION Ltd, Defensor Security (Pty) Ltd, Denel Aviation, Denel Land Systems, Hensoldt Optronics (Pty) Ltd, and Paramount Group.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports