Space Economy – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Space Economy Theme Analysis Report Overview

Space is no longer the sole domain of governments and incumbent aerospace and defense companies. Technological advances in manufacturing, propulsion, and the launch of rockets have made it much easier and less expensive to venture into space. Those businesses that pursued emerging opportunities have gained a first-mover advantage. For instance, SpaceX was the first private company to launch a spacecraft into orbit and return it safely to Earth-.

The Space Economy thematic report provides an overview of the space economy theme. It identifies the key trends impacting the growth of the sector over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends. It includes a comprehensive industry analysis, outlining the key growth areas and potential use cases.

| Total Pages | 68 |

| Market Size (2022) | $450 Billion |

| CAGR (2022-2030) | 6% – 10% |

| Key Value Chain Components | · Physical Layer

· Connectivity Layer · Data Layer · App Layer · Services Layer. |

| Leading Listed Players | · Astra Space

· Boeing · L3Harris |

| Leading Private Players | · Agnikul Cosmos

· Arianespace · Blue Origin |

| Leading State-Owned Companies | · Antrix

· China Aerospace Science & Industry Corporation (CASIC) · China Aerospace Science and Technology Corporation (CASC) |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Space Economy Market Trends

The main trends shaping the space theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, and regulatory trends.

Technology Trends: Some of the key technology trends gaining traction in the space economy market include the growing popularity of small satellites, the development of new types of propulsion beyond chemical rockets, investment in the removal of space junk, ongoing R&D in microgravity manufacturing, and increasing space cybersecurity risks among others.

Macroeconomic Trends: The dominance of big players such as SpaceX, renewed interest in developing space weaponry owing to geopolitical tensions, and deterioration of Russia’s space sector among others are the key macroeconomic trends impacting space the economy market.

Regulatory Trends: Lack of global space regulations, minimal impact of regulation on private companies, and lack of uniform regulation for collisions and space debris among others are the prominent regulatory trends influencing the space economy theme.

Buy the Full Report for More Insights on Space Economy Trends

Space Economy - Industry Analysis

The space economy industry was worth $450 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) somewhere between 6% and 10% from 2022 to 2030. This growth can be attributed to an increase in the adoption of satellites, applications, and services around data communications, navigation, and Earth observation. Other growth drivers include falling manufacturing and launch costs, the entrance of non-Western companies in the space economy market, increased space militarization, and new uses for data points from space.

However, different scenarios indicate different growth rates for the space economy market over the coming decade. This is because of the issues that may restrict growth. The issues include a continuation of the currently challenging global economic environment, Russia’s permanent exit from the space economy, and whether Chinese companies can live up to China’s space ambitions.

The space economy industry analysis also comprises –

- Timeline

- M&A trends

- Venture financing trends

- Patent trends

- Company filing trends

- Hiring trends

Buy the Full Report for More Insights on Industry Analysis in the Space Economy

Space Economy Value Chain Insights

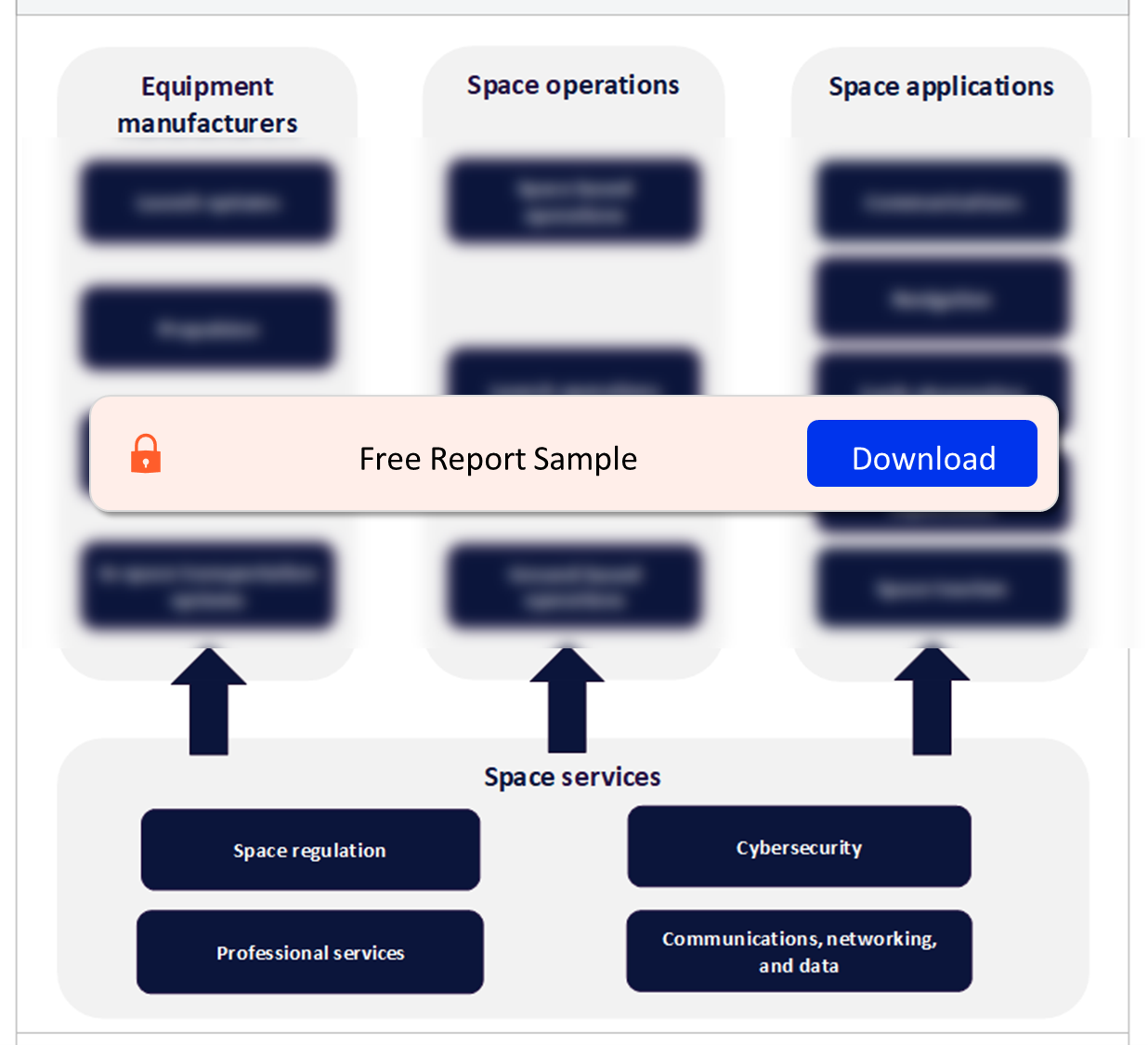

The space economy value chain is growing in complexity as it moves from an R&D-focused industry into the large-scale production and exploration of space. The value chain is divided into four core layers: equipment manufacturers, space operations, space applications, and space services.

Space services: The growing commercial space economy drives the development and delivery of regulatory, professional, and technical services. These services are provided to companies working in the space economy. They include space regulation, legal services, insurance, consulting services, networking, connectivity and communications, and cybersecurity. Each of these services demands a specialist capability be applied to an area of the commercial space world that is still a work in progress as an industry.

The Space Economy Value Chain Analysis

Buy the Full Report for More Insights on the Value Chain in Space Economy

Space Economy Industry – Competitive Landscape

Some of the public companies making their mark within the space economy theme.

- Astra Space

- Boeing

- L3Harris

- Lockheed Martin

- Northrop Grumman

Some of the private companies making their mark within the space economy theme.

- Agnikul Cosmos

- Arianespace

- Blue Origin

- ICON

- SpaceX

Some of the state-owned companies making their mark within the space economy theme.

- Antrix

- China Aerospace Science & Industry Corporation (CASIC)

- China Aerospace Science and Technology Corporation (CASC)

Buy Full Report for More Insights on leading players in the Space Economy

Scope

The space economy can be broadly defined as the full range of activities that create value and benefits for humans while exploring, researching, understanding, managing, and using space. Space is an extensive industry, and a vast number of companies are helping drive this new economy. From equipment manufacturers to space operations, applications, and services, these comprise many of the world’s most technologically advanced and innovative organizations.

Key Highlights

Space is no longer the sole domain of governments and incumbent aerospace and defense companies. Technological advances in manufacturing, propulsion, and the launch of rockets have made it much easier and less expensive to venture into space. Those businesses that pursued emerging opportunities have gained a first-mover advantage. SpaceX was the first private company to launch a spacecraft into orbit and return it safely to Earth. Today, SpaceX is charging clients $67 million per launch of the Falcon 9, its partially reusable medium-lift launch vehicle.

Investor interest, evident gaps in the market, and advancements in space technologies have led to a surge in start-ups entering the space economy in the last five years. Governments, too, see space as an opportunity and are investing in it. In August 2023, India’s Chandrayaan-3 was the world’s first spacecraft to land on the south pole of the Moon. In India, the successful landing led to a collective national celebration. Such events are rare. The unforgiving environment of space exploration is matched by the harsh financial reality of developing space technologies, which has made acquisitions of complementary companies, strategic suppliers, and partners more likely. The sector has become incredibly competitive, with various start-ups developing similar concepts for cost-effective rockets and satellites to rival the aerospace giants. In 2022, Eutelsat and OneWeb merged, while Viasat acquired Inmarsat in 2023. Market consolidation will continue.

Reasons to Buy

Understand the impact of the space economy theme. Access the latest data on the space economy theme across all sectors. Identify the leading technological advancements increasing investment into the space economy theme. Understand what leading players are doing in the space economy theme.

Aalyria

Accenture

Aerospace Corporation

Airbus

Alden Legal

Allianz

Altius Space Machines

Amazon

Aon

ArianeGroup

Arturo.AI

Astra

Astranis

Astroforge

Astroscale

ATLAS

Atomos

Atrium

Avio

Axa

Axiom Space

Axipeter

BAE Systems

Bain

BCG

BlackSky

Blue Orbit

Blue Origin

Boeing

Booz Allen

Burges Salmon

CACI

Canopius

CAPE Analytics

CAS Space

CASC

CGI

ClearSpace

ClimateX

Clyde & Co

CNSA

Copernicus

Crescent

CSA

CyberOps

DARPA

Deloitte

Descartes Labs

DLA Piper

EchoStar (Hughes)

Energia

EOS Data Analytics

ESA

Euroconsult

European Center for Space Law

Eutelsat

Exolaunch

Exotrail

ExpanseInsure

EY

FAA

Fairmont

FCC

FieldFisher

Firefly Aerospace

GAIT Global

Galactic Energy

GalaxySpace

Gallagher

Garmin

General Dynamics

Geospatial Insight

Global Space Consulting

GOMspace

Hexagon

HFW

Hogan Lovells

Honeywell

Impulse Space

Inmarsat

Intelsat

Invictus

Iridium Communications

iSpace

ISRO

JAXA

Jones Walker

KARI

Kongsberg (KSAT)

KPMG

L3Harris Technologies

LandSpace

Leaf Space

Leonardo

Lockheed Martin

Maana Electric

Marsh

Maxar Technologies

McKinsey

MDA

Microsoft

Millbank

Moog

Munich Re

Nanoracks

NASA

NearSpace Launch

Northrop Grumman

OBH

Obruta

OneWeb

Orbex

Orbital Insights

PA Consulting

Parker Hannifin

Planet Labs

Preligens

Priamos

Reaction Engines

Redwire

Relativity Space

Rezatec

RHEA Group

Rivada Space

Rocket Lab

Roscosmos

RTX

Safran

Satellogic

SES

Sierra Nevada (Sierra Space)

Skyrora

Skywatch

Space Pioneer

Spaceflight

SpaceKnow

SpaceLink

SpaceTec Partners

SpaceX

Spire Global

ST Engineering

Swift Geospatial

Taranis

Telesat Communications

Telespazio

TerraMonitor

Tethers Unlimited

Thales Alenia Space

Thales Group

The Exploration Company

ThrustMe

TransAstra

Trimble

United Launch Alliance

US Air Force

Viasat

Virgin Galactic

XingWang

Table of Contents

Frequently asked questions

-

What was the size of the space economy industry in 2022?

The space economy industry was worth $450 billion in 2022.

-

What is the space economy industry's growth rate?

The space economy industry is expected to expand at a compound annual growth rate (CAGR) of between 6% and 10% between 2022 and 2030.

-

What are the key space economy industry trends?

The key space economy industry trends are technology, regulatory, and macroeconomic trends.

-

Who are the leading public players associated with the space economy theme?

Some of the leading public players associated with this space economy theme include Astra Space, Boeing, L3Harris, Lockheed Martin, and Northrop Grumman among others.

-

Who are the leading private players associated with the space economy theme?

Some of the leading private players associated with this space economy theme include Agnikul Cosmos, Arianespace, Blue Origin, ICON, and SpaceX.

-

Who are the leading state-owned players associated with the space economy theme?

Some of the leading state-owned players associated with this space economy theme include Antrix, China Aerospace Science & Industry Corporation (CASIC), and China Aerospace Science and Technology Corporation (CASC).

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Space Systems reports