Sweden Life Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Sweden Life Insurance Market Report Overview

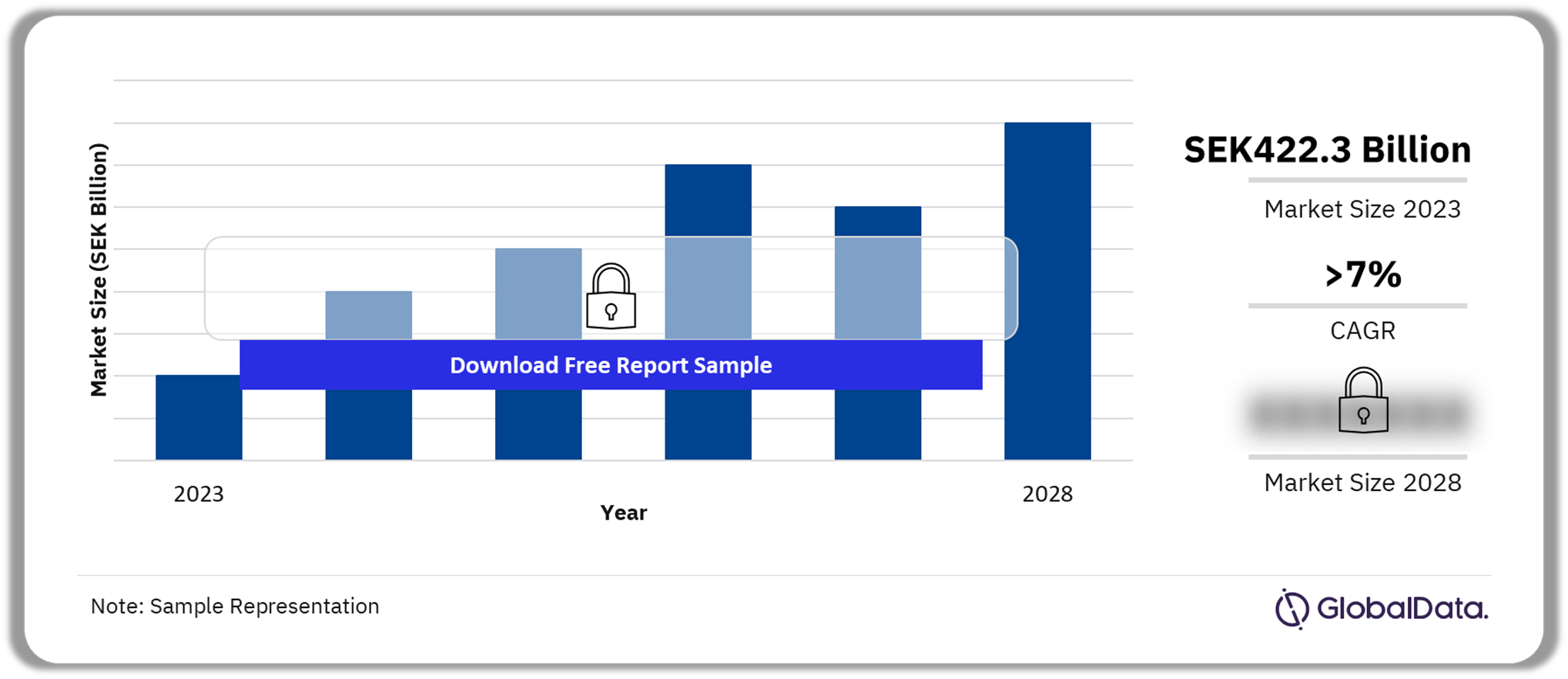

The direct written premium of Sweden life insurance market was SEK422.3 billion ($42.9 billion) in 2023 and is expected to achieve a CAGR of more than 7% during 2024-2028. The Sweden life insurance market research report provides in-depth market analysis, including insights into the lines of business in the country’s life insurance industry. Furthermore, the report provides a detailed outlook by product category as well as values for key performance indicators, including direct written premium, penetration, and premium ceded and cession rates for the review and forecast periods.

Sweden Life Insurance Market Outlook, 2023-2028 (SEK Billion)

Buy the Full Report to Gain More Information about the Sweden Life Insurance Market Forecast

The Sweden life insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the Swedish economy and demographics. It further evaluates the competitive landscape in the country, which entails segment dynamics, competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | SEK422.3 billion ($42.9 billion) |

| CAGR (2024-2028) | >7% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Lines of Business | · Endowment

· Pension · Life PA&H · Other Life |

| Key Distribution Channels | · Direct from Insurers

· Banks · Insurance Brokers · Online Aggregators · Financial Advisors |

| Leading Companies | · Alecta Pensions

· Futur Pension · Avanza Pension · Skandia Omsesidigt · Swedbank |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Sweden Life Insurance Market Trends

Inflation, mental health, ESG, and digital initiatives are the recurring trends in the Swedish life insurance market.

- Inflation has a significant impact on Sweden’s life insurance sector. Higher inflation reduces disposable incomes, which increases the number of policy surrenders.

- In June 2023, the Swedish Government announced that it is considering introducing new regulations that would require insurance companies to disclose their ESG risks and performance. These regulations are designed to promote transparency and accountability in the insurance industry.

Sweden Life Insurance Market Segmentation by Lines of Business

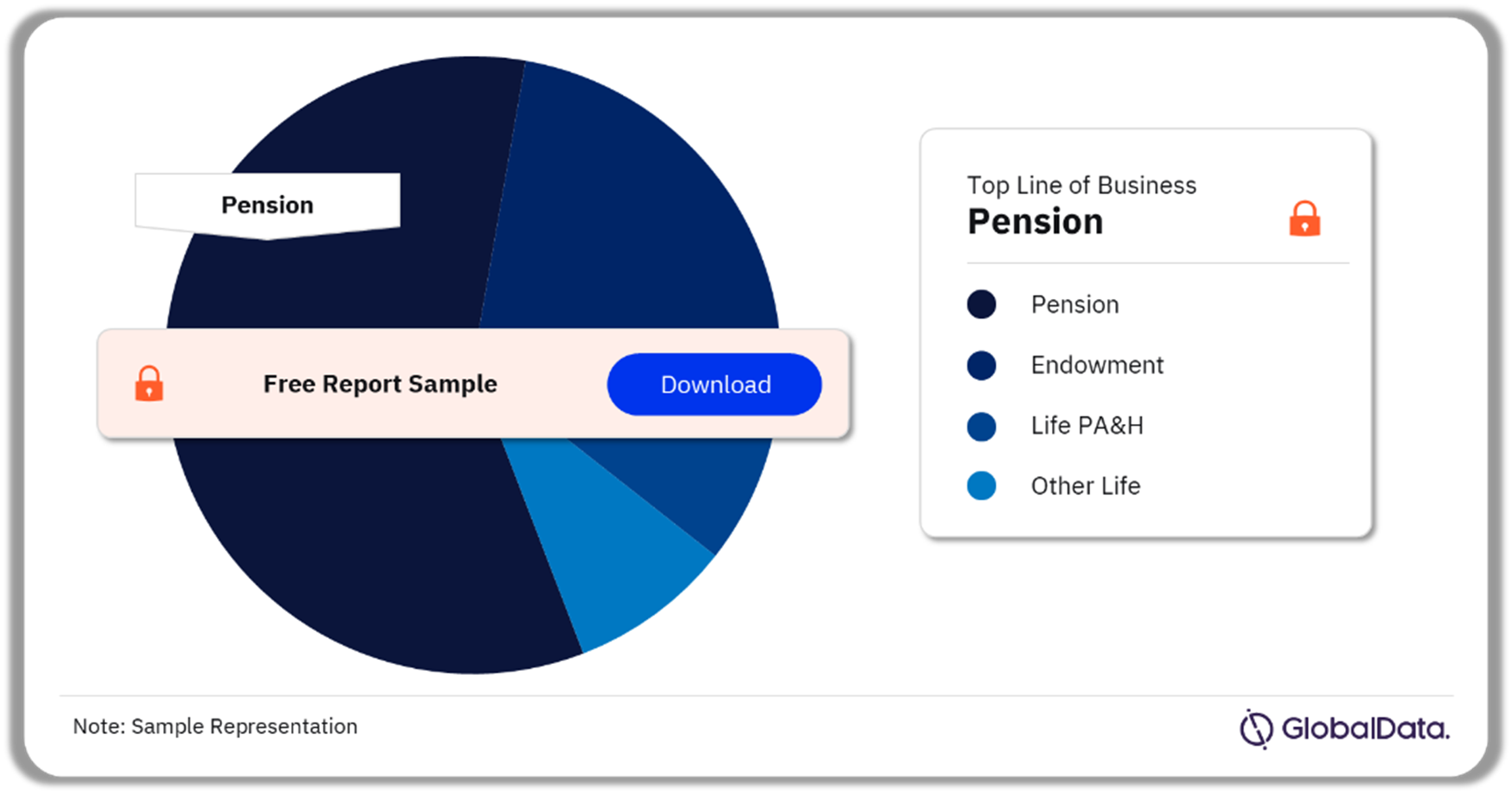

Pension was the leading life insurance line of business in 2023

The key lines of business in the Sweden life insurance industry are endowment, pension, life PA&H, and other life. Pension and endowment life insurance products drive the life insurance sector in Sweden.

Sweden Life Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Sweden Life Insurance Market

Sweden Life Insurance Market Segmentation by Distribution Channels

Direct from insurers was the most preferred channel to purchase life insurance in 2023

A few of the key distribution channels in the Swedish life insurance industry are direct from insurers, banks, insurance brokers, online aggregators, financial advisors, and others. Bancassurance was the second most popular channel for life insurance, followed by insurance brokers.

Sweden Life Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for more Distribution Channel Insights into the Sweden Life Insurance Market

Sweden Life Insurance Market - Competitive Landscape

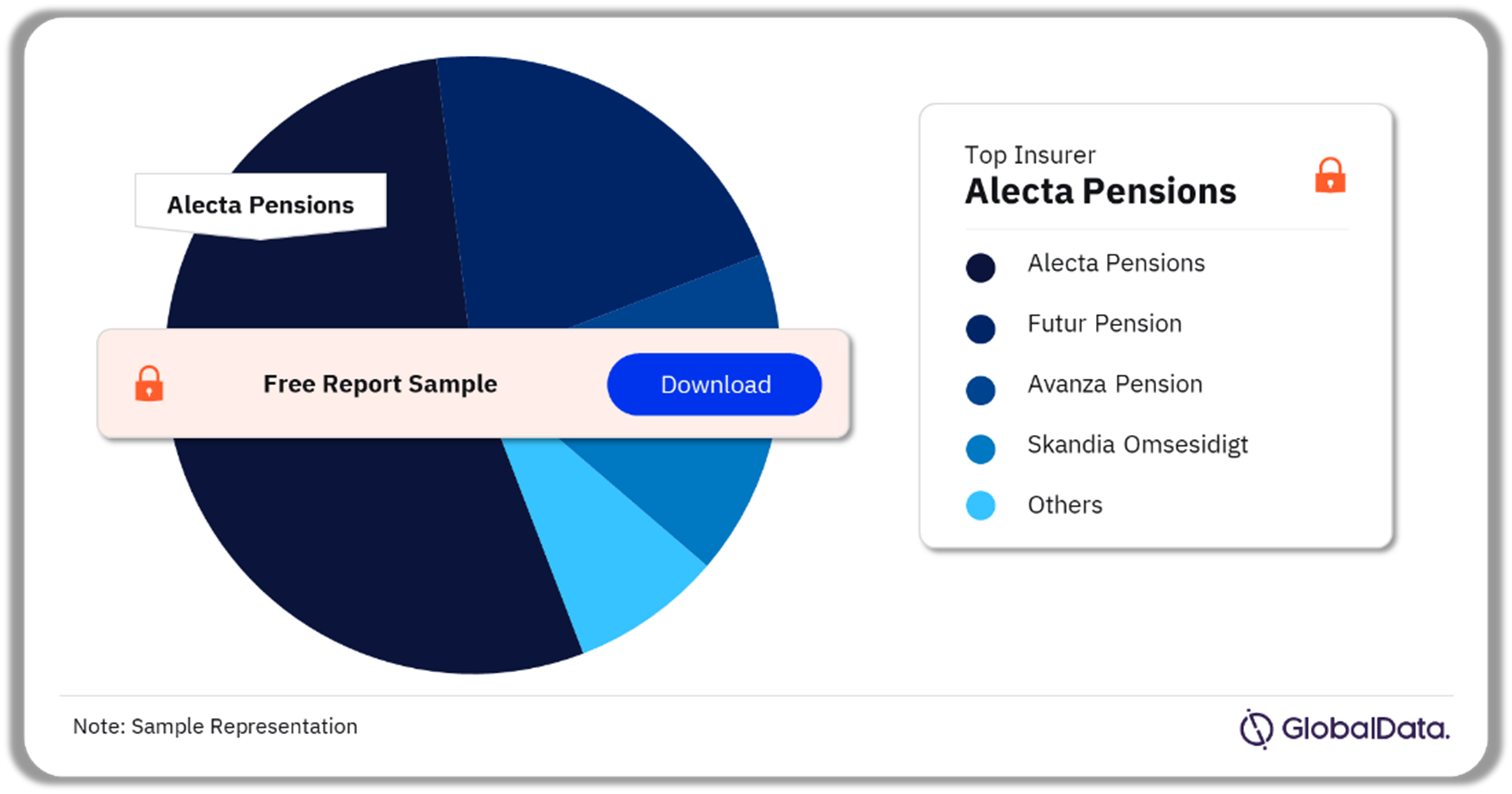

Alecta Pensions was the largest life insurer in 2023

A few of the leading life insurance companies in Sweden are:

- Alecta Pensions

- Futur Pension

- Avanza Pension

- Skandia Omsesidigt

- Swedbank

Sweden Life Insurance Market Analysis by Companies, 2023 (%)

Buy the Full Report to Know More about the Companies in Sweden Life Insurance Market

Sweden Life Insurance Market - Latest Developments

- In April 2023, Finansinspektionen (FI) published a report on the integration of environmental, social, and governance (ESG) factors into the insurance industry. The report found that Swedish insurance companies are making progress in integrating ESG factors into their business practices, but there is still room for improvement.

- In August 2023, insurtech company Bolttech and telecommunications provider Three Sweden announced a new partnership to offer device protection solutions to Three Sweden customers. The partnership will provide customers with access to non-binding device protection insurance and services covering damage, theft, loss, and unauthorized usage.

Segments Covered in the Report

Sweden Life Insurance Lines of Business Outlook (Value, SEK Billion, 2019-2028)

- Endowment

- Pension

- Life PA&H

- Other Life

Sweden Life Insurance Distribution Channel Outlook (Value, SEK Billion, 2019-2028)

- Direct from Insurers

- Banks

- Insurance Brokers

- Online Aggregators

- Financial Advisors

Scope

This report provides:

- A comprehensive analysis of the life insurance segment in Sweden.

- Historical values for the Swedish life insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top life insurance companies in Sweden and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Sweden’s life insurance segment.

- A comprehensive overview of Sweden’s economy, government initiatives, and investment opportunities.

- Sweden’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing and capital requirements.

- Sweden’s life insurance segment’s market structure gives details of lines of business.

- Sweden’s life reinsurance business’s market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Sweden’s life insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Sweden’s life insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Sweden’s life insurance segment.

- Assess the competitive dynamics in the life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Futur Pension

Avanza Pension

Swedbank

Skandia

AMF Pension

Handelsbanken Liv

Nordea Life

Table of Contents

Frequently asked questions

-

What was the Sweden life insurance market direct written premium in 2023?

The direct written premium of the Swedish life insurance market was SEK422.3 billion ($42.9 billion) in 2023.

-

What will the Sweden life insurance market growth rate be during the forecast period?

The life insurance market in Sweden is expected to achieve a CAGR of more than 7% during 2024-2028.

-

Which line of business held the largest share of the Sweden life insurance market in 2023?

Pension was the leading life insurance line of business in 2023.

-

Which distribution channel held the highest share in the Swedish life insurance market in 2023?

Direct from insurers was the leading channel in the Swedish life insurance market in 2023.

-

Which are the key companies operating in the Sweden life insurance market?

A few of the leading life insurance companies in Sweden are Alecta Pensions, Futur Pension, Avanza Pension, Skandia Omsesidigt, and Swedbank.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports