Third-Party Logistics (3PL) Market Size, Share, Trends, and Analysis by End-Use, Mode of Transportation and Region Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Third-Party Logistics’ report can help you:

- Identify gaps within the value chain and utilize this insight to make strategic decisions regarding their current market strategies.

- Identify the key regions witnessing the highest number of market dynamic activities such as mergers & acquisitions and venture financing.

- Identify your competitors’ capabilities to stay ahead in the market.

- Identify and analyze key segments (End-Use Type, and Transport Type), growth drivers, challenges, industry trends, and markets to expand your geographical footprint, service portfolio, or successful investment.

- Anticipate expected changes in demand and adjust your business development strategies.

How is our ‘Third-Party Logistics’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 15 countries, including historical and forecast analysis for the period 2018-2027 for market assessment.

- Detailed segmentation by end-use type – Manufacturing, Retail & E-commerce, Healthcare, Consumer Goods, and Others

- Detailed segmentation by transport type – Roadways, Railways, Waterways, and Airways

- The report offers technological and regulatory trends, along with key market drivers and challenges impacting the 3PL market, which is expected to help stakeholders align their service portfolio in line with the latest innovations and developments.

- The value chain analysis included in the report, which comprehensively explains the various stages, enables the stakeholders to identify the key stages in the process and the usage of emerging technologies that enhance productivity and cost-effectiveness.

- Detailed profiling of leading companies in the market for a deeper understanding of the competition.

We recommend this valuable source of information to:

- 3PL Companies

- Supply Chain Management Companies

- Freight Forwarding Companies

- E-commerce Companies

- Startups

- Head of Market Intelligence

- Management Consultants

- Equity Partners

- Venture Capital firms

Third-Party Logistics Market Report Overview

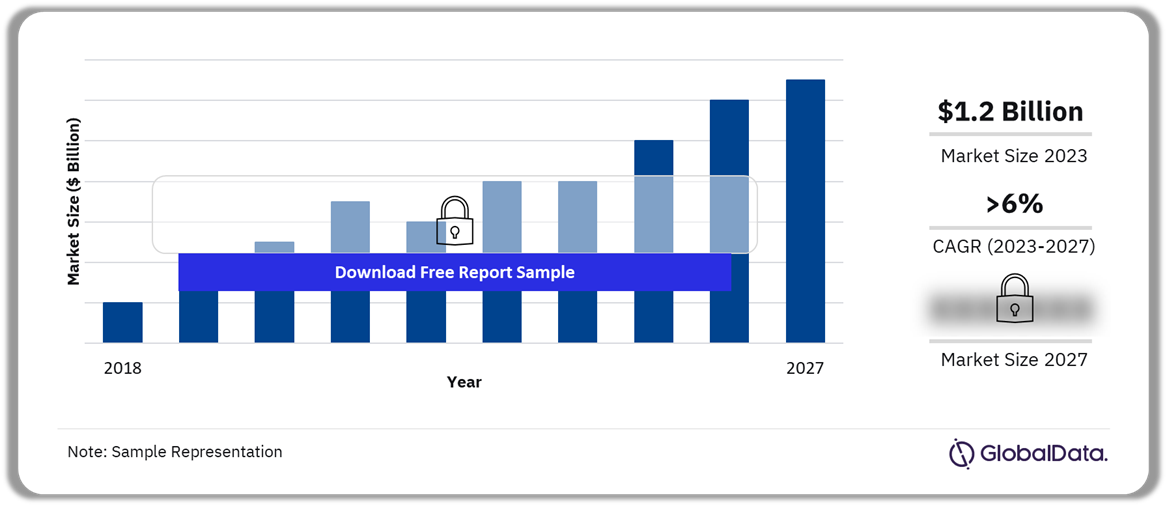

The third-party logistics (3PL) market was valued at $1.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 6% over the forecast period. Businesses are increasingly outsourcing their logistics operations to third-party logistics companies to concentrate their primary expertise and resources on core organizational activities. These 3PL companies assist businesses in optimizing their logistics operations through their expertise and resources, leading to improved supply chain management and customer order delivery. As a result, businesses can expand their geographical reach and customer base, gaining a competitive edge in the market.

Third-Party Logistics Market Outlook, 2018-2027 ($ Billion)

Buy the Full Report for Insights into the 3PL Market Forecast,

In recent years, the global third-party logistics (3PL) market has experienced considerable growth. This growth can be attributed to the robust expansion of the e-commerce market and the evolving demand and expectations of consumers regarding product quality and delivery, which is fueling the need for 3PL services.

The increasing trend of globalization has resulted in a significant surge in international trade. This has encouraged businesses to subcontract their logistics operations to third-party logistics companies that are adept at efficiently managing cross-border supply chain activities. This transition is opening up new avenues for growth in the 3PL market.

The growing recognition of environmental concerns has prompted businesses to prioritize sustainability in their supply chain operations. 3PL providers offer environmentally friendly logistics solutions, including green transportation and warehouse practices, which assist businesses in lowering their carbon footprint and achieving their sustainability objectives.

The implementation of omnichannel retail strategies by major companies like Walmart and Target is introducing greater complexities in supply chain management. As a result, vendors are facing significant challenges in efficiently managing warehousing, order fulfillment, and last-mile deliveries. Third-party logistics companies are leveraging these challenges by offering effective supply chain solutions to their clients, thereby creating new opportunities for growth in the market.

Key industries such as healthcare, defense, oil & gas, and chemicals are experiencing growth, leading to an increased need for specialized logistics services. These services encompass cold chain logistics, hazardous material handling, special equipment transportation, climate-controlled transportation, and the handling of heavy and sensitive materials. Third-party logistics (3PL) providers possess the requisite expertise and resources to manage these specialized logistics operations and provide value-added services, thereby driving market growth.

The 3PL companies are progressively embracing emerging technologies such as data analytics, automation, artificial intelligence, the Internet of Things, and robotics. These technologies have empowered 3PL firms with advanced transportation management systems and warehouse management systems, enhancing visibility, quality control, and efficiency in logistics operations.

| Market Size (2023) | $1.2 billion |

| CAGR (2024 – 2027) | >6% |

| Quantitative units | Revenue in $ Million/Billion and CAGR from 2024 to 2027 |

| Forecast Period | 2024 – 2027 |

| Historic Period | 2018 – 2022 |

| Report Scope & Coverage | Revenue Forecast, Industry Value Chain, Market Trends, Competitive Landscape, and Growth Trends |

| End-Use Type | Manufacturing, Retail & E-commerce, Healthcare, Consumer Goods, and Others |

| Transport Type | Roadways, Railways, Waterways, and Airways |

| Key Companies | Kuehne + Nagel, DHL, Geodis, FedEx, Ceva Logistics, Nippon Express, Kerry Logistics, Yusen Logistics, DSV AS, and Allcargo Logistics |

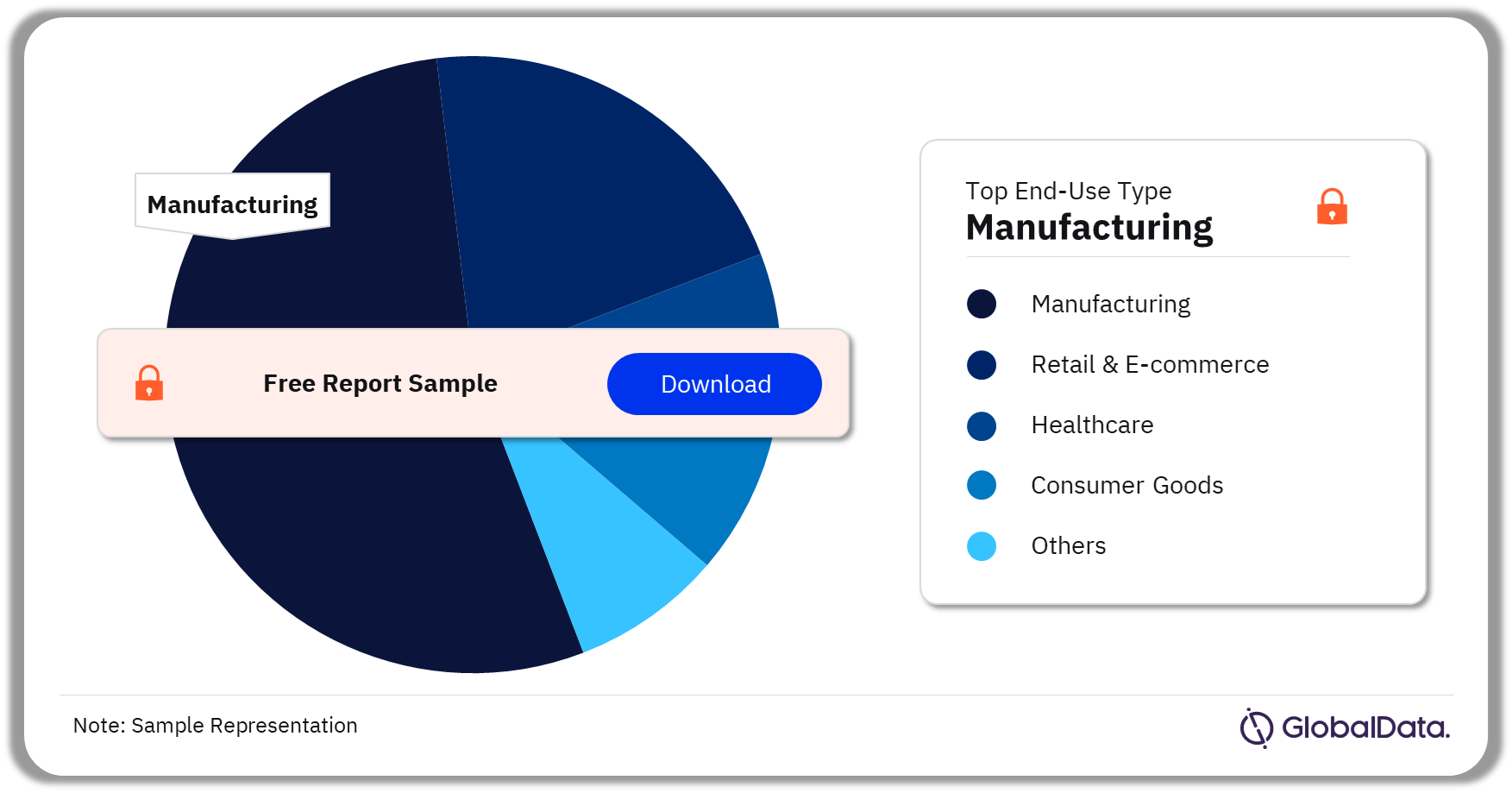

Third-Party Logistics Market Segmentation by End-Use Type

Based on the end-use type, the 3PL market is segmented into manufacturing, retail & e-commerce, healthcare, consumer goods, and other sectors. The manufacturing industry leads the global market due to its highly complex supply chain.

Logistics operations in the manufacturing sector are complex, involving the coordination of multiple shipments of materials and equipment from various suppliers, as well as order fulfillment, inventory management, transportation, and customer delivery. As a result, manufacturing vendors are increasingly turning to 3PL companies to outsource their logistics tasks, aiming to achieve cost-effectiveness and expand their geographic reach.

Third-Party Logistics Market Analysis by End-Use Type, 2023 (%)

Buy the Full Report for Insights into the End-Use Types in the 3PL Market,

The retail and e-commerce industry segment is projected to experience the most rapid growth during the forecast period, largely due to the increasing popularity of online shopping globally. With many established retailers adopting omnichannel strategies, they are entrusting their 3PL partners to manage their intricate logistics operations. As a result, retail and e-commerce companies can enhance their productivity, and cost-efficiency, and expand their geographic reach and customer base.

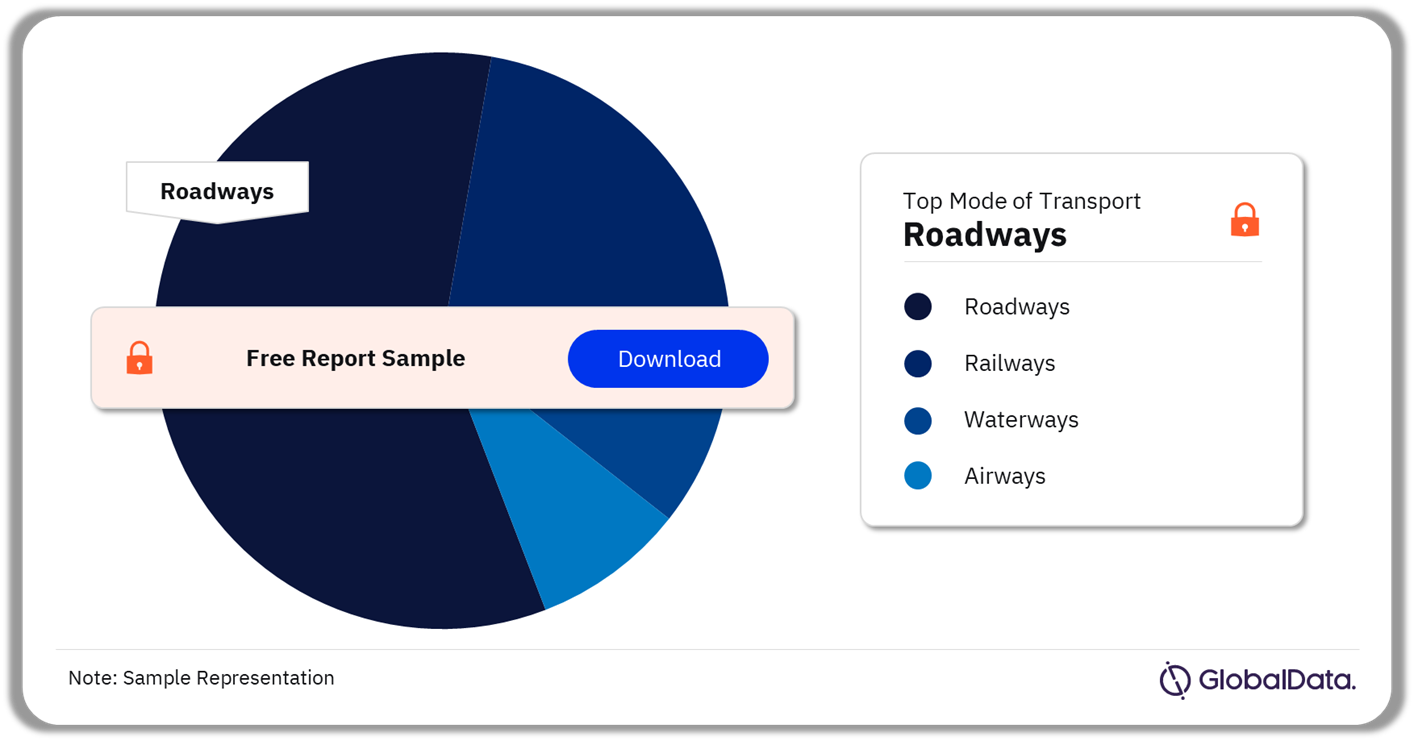

Third-Party Logistics Market Segmentation by Transport Type

The third-party logistics sector operates through different modes of transport, such as roadways, railways, waterways, and airways. Among these, roadways constitute the largest segment in terms of market size due to their extensive accessibility and ability to reach remote areas.

The 3PL companies maintain a diverse fleet of trucks tailored to transport shipments with specific requirements, enabling them to manage specialized logistics needs. Additionally, Road transportation facilitates door-to-door delivery, which is essential for many businesses seeking to optimize their supply chain operations and minimize transit times.

Third-Party Logistics Market Analysis by Mode of Transport, 2023 (%)

Buy the Full Report for Insights into the Transport Modes in the 3PL Market,

Air transportation is anticipated to experience the most rapid growth during the forecast period. This is attributed to the increasing demand for same-day and last-mile delivery services in the e-commerce sector. Airways provide faster delivery of goods compared to roadways and waterways, thereby offering more reliability to businesses and aligning with customers’ expectations for fast delivery. Further, Air transportation enables businesses to practice just-in-time inventory management, helping them reduce inventory carrying costs and enhance efficiency.

Third-Party Logistics Market Segmentation by Region

In 2023, the Asia-Pacific region led the global 3PL market and is projected to maintain its position as the largest market throughout the forecast period. The region is undergoing rapid economic development, particularly in major economies such as China, India, Indonesia, and Vietnam, where all key industries are thriving. This growth is driving an increased demand for 3PL services. Additionally, governments in the region are making significant investments in the development of logistics infrastructure, including roads, railways, airports, and seaports, further fueling the growth of the regional market.

The logistics industry in the Asia Pacific region is transforming due to the increasing adoption of technological advancements like automation, data analytics, and the Internet of Things (IoT). These innovations are enhancing the efficiency, visibility, and transparency of supply chain operations, thus stimulating the growth of the 3PL market.

3PL Market Analysis by Region, 2023 (%)

Buy the Full Report for More Regional Insights into the 3PL Market,

The Asia Pacific region is projected to experience the most rapid revenue growth in the third-party logistics market during the forecast period. China leads the regional market, contributing the largest share of revenue in 2023. As the world’s manufacturing hub, China supplies goods to a majority of countries, making it the most attractive market in the region.

India is poised to surpass other countries in the regional 3PL market, with the fastest growth projected over the forecast period. This growth is mainly driven by supply chain modernization, the rapid expansion of the e-commerce market, and the swift development of logistics infrastructure in the country. Additionally, government initiatives like the “Make in India” campaign and the implementation of the goods and services tax (GST) are expected to stimulate domestic manufacturing, trade, and logistics, further bolstering growth in the market.

Leading Companies in the Third-Party Logistics Market

- Kuehne + Nagel Inc.

- DHL International

- Geodis

- FedEx Corporation

- Ceva Logistics

- Nippon Express

- Kerry Logistics

- Yusen Logistics

- DSV AS

- Allcargo Logistics

Other 3PL Market Companies Mentioned

C.H. Robinson, XPO Logistics, DB Schenker, United Parcel Service of America Inc., AmeriCold Logistics, Maersk, UPS, JB Hunt, Agility, and Panalpina

Scope

GlobalData Plc has segmented the 3PL market report by end-use type, transport type, and region:

Third-Party Logistics End-Use Type Outlook (Revenue, $ Million, 2018-2027)

- Manufacturing

- Retail & E-commerce

- Healthcare

- Consumer Goods

- Others

Third-Party Logistics Transport Type Outlook (Revenue, $ Million, 2018-2027)

- Roadways

- Railways

- Waterways

- Airways

Third-Party Logistics Regional Outlook (Revenue, $ Million, 2018-2027)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- South & Central America

- Brazil

- Argentina

- Colombia

- Rest of South & Central America

- Middle East & Africa

- Turkey

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global third-party logistics market by end-use type and mode of transportation type and their key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the third-party logistics market.

The report highlights the third-party logistics end-use type segment (manufacturing, retail & ecommerce, healthcare, consumer goods, and others), mode of transportation type segment (roadways, railways, waterways, and airways), and region.

With more than 50 figures and tables, the report is designed for an executive-level audience, with enhanced presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in the third-party logistics market.

The broad perspective of the report coupled with comprehensive, actionable detail will help 3PL companies, supply chain solution providers, freight forwarders, and other market players to succeed in growing the Third-Party Logistics market globally.

Key Players

Kuehne + Nagel Inc.DHL International

Geodis

FedEx Corporation

Ceva Logistics

Nippon Express

Kerry Logistics

Yusen Logistics

DSV AS

Allcargo Logistics

Table of Contents

Table

Figures

Frequently asked questions

-

What was the third-party logistics market size in 2023?

The third-party logistics market size was valued at $1.2 billion in 2023.

-

What is the third-party logistics market growth rate during the forecast period?

The third-party logistics market is expected to grow at a CAGR of more than 6% during the forecast period.

-

What are the key third-party logistics market drivers?

Rapid e-commerce growth, globalization, adoption of advanced technologies, and rising complexities of supply chains are the key growth drivers of the 3PL market.

-

Which end-use type accounted for the highest share of the key third-party logistics market in 2023?

Manufacturing accounted for the highest share of the key third-party logistics market in 2023.

-

Which transportation type accounted for the highest share of the key third-party logistics market in 2023?

Roadways was the most preferred transportation type for the key third-party logistics market in 2023.

-

Which are the leading third-party logistics companies globally?

The leading third-party logistics companies are Kuehne + Nagel, DHL, Geodis, FedEx, Ceva Logistics, Nippon Express, Kerry Logistics, Yusen Logistics, DSV AS, and Allcargo Logistics.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.