United Kingdom (UK) Home Insurance (Mid-Net-Worth and High-Net-Worth) Market Size, Trends, Competitor Dynamics and Opportunities

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK HNW Home Insurance Market Overview

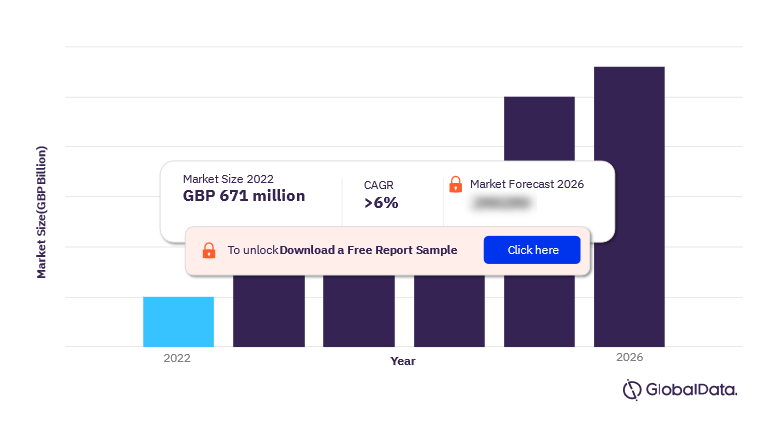

The UK HNW home insurance market was worth GBP671 million in 2022. The growth can be attributed to the rising number of HNW individuals and surging double-digit premium rates. The HNW home insurance GWP is expected to grow at a CAGR of more than 6% during 2022-2026. HNW and MNW home insurance requirements differ from those of mass-market customers, due to the high value and specialist nature of property and possessions, which may include multiple homes, antiques, and fine art.

In addition, the mid-net-worth (MNW) home insurance market in the UK was valued at GBP350 million in 2022. The UK MNW home insurance market will grow at a CAGR of over 3% during 2022-2026. The core target market for specialist MNW home insurers is those MNW individuals with high-value individual items or collections, who require coverage that cannot be met by these high-end standard market offerings. Specialist MNW customers also include many former HNW individuals who may be downsizing and passing on wealth and possessions to the next generation.

The UK HNW and MNW home insurance market report provides an in-depth study into specialist home insurance products for wealthy individuals. It begins by defining the mid-net-worth (MNW) and high-net-worth (HNW) segments, followed by analysis of the historical growth in the number of these individuals and an estimate of market size. It outlines what a typical MNW and HNW home insurance product includes and how they are distributed.

UK HNW Home Insurance Market Overview, 2022-2026 (GBP Million)

For more insights on the UK HNW and MNW home insurance market forecast, download a free sample report

UK HNW and MNW Home Insurance Market Dynamics

There are more than 400,000 HNW individuals in the UK. Although the number of HNW individuals has been impacted by stock market performance and pandemic-related turbulence, the number of HNW individuals has increased by an average of approximately 3% annually between 2018 and 2022. Simultaneously, the number of MNW individuals in the UK has been more consistent in its annual growth, but the rise was minimal in 2022. There are now 15.7 million MNW individuals in the UK, although, many of these would not be suitable for specialized insurance policies and would therefore fall outside the remit of this market.

However, underinsurance, in terms of consumers holding the wrong type of policy for their specialist insurance needs, has long been a significant problem in the HNW and MNW home insurance market. Inflation and the dramatic price rises seen in many high-value items in recent years also mean that insurers and brokers need to tackle the issue of HNW and MNW customers no longer having sufficient cover limits under their existing specialist policies.

For more UK HNW and MNW home insurance market dynamics, download a free sample report

UK HNW and MNW Home Insurance Market Emerging Segments

The key emerging HNW individual or customer segments are next generation inheritors and mass affluent and emerging HNW individuals. It is equally important for the insurance industry to understand and cater for these new customer segments. Not only are there growth opportunities in capturing emerging high-wealth newcomers and those outside the traditional HNW home insurance customer demographic, but the young and emerging MNW individuals and HNW individuals of today will be the established HNW insurance customers of tomorrow. Insurers and brokers therefore need to ensure they are prepared for this changing customer base.

For additional inputs on UK HNW and MNW home insurance customer segments, download a free sample report

UK HNW and MNW Home Insurance Market – Competitive Landscape

The main players in the HNW home insurance market had been relatively stable, with little change in the positions of Hiscox and Chubb as the two largest providers. Other key insurers in the market are Aviva, Zurich, Covea, Ecclesiastical, Brit, and Home & Legacy’s new MGA status.

Hiscox: Hiscox is one of the most well-established specialist HNW insurance providers in the UK, with a long history of focus on this line of business and a reputation for insuring and owning fine art. In the UK, Hiscox offers HNW insurance through its traditional retail broker channel and has a direct online and telephone-based offering, catering more to MNW individuals and those HNW individuals comfortable with direct distribution.

Aviva: The company aims to be the new UK HNW market leader. The firm has been on the acquisition trail, buying AXA XL’s Private Client team and business in March 2021, and announcing an agreement to acquire specialist MGA Azur Underwriting in August 2022. The company plans to combine the acquired businesses with its existing Private Client business and its MNW proposition.

For more insights on the UK HNW and MNW home insurance market players, download a free sample report

UK HNW and MNW Home Insurance Market Overview

| Market Size (2022) | GBP671 million (HNW) and GBP350 million (MNW) |

| CAGR % (2022-2026) | >6% (HNW) and >3% (MNW) |

| Forecast Period | 2022-2026 |

| Key Players | Hiscox, Chubb, Aviva, Zurich, Covea, Ecclesiastical, Brit, and Home & Legacy’s new MGA status |

Scope

- GlobalData estimates that the HNW home insurance market was worth GBP671 million in 2022, with strong growth driven by the rising number of HNW individuals and double-digit premium rate increases.

- There are more than 400,000 HNW individuals (with liquid assets in excess of $1 million) in the UK. Overall, the number of HNW individuals increased by an average of 3.9% a year between 2018 and 2022.

- Long-established HNW market leaders Hiscox and Chubb are facing competition from a range of insurers with ambitious growth aims. Aviva is expecting to become market leader with its recent acquisition of Azur.

- Personalized service remains vital, but seamless digital and physical interactions in other areas of HNW individuals’ lives will raise their expectations for their insurance providers to offer the same.

Reasons to Buy

- Understand the current and forecast size and growth of the UK HNW home insurance market.

- Gain insight into emerging HNW market segments and the impact of changing HNW expectations on their insurance relationships.

- Understand the major players and shifting competitor dynamics in the UK HNW home insurance sector.

- Learn what forces will affect the future shape of the UK HNW home insurance market.

Chubb

Aviva

Azur

Ondo

Ecclesiastical

Zurich

Covéa

Brit

Home & Legacy

AXA

Allianz

HDI Global

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK HNW and MNW home insurance market size in 2022?

The UK HNW and MNW home insurance market size was GBP671 million and GBP350 million respectively in 2022.

-

What will be the CAGR at which the UK HNW and MNW home insurance market grow during 2022-2026?

The UK HNW home insurance market will grow at a CAGR of over 6% and MNW market will grow at a CAGR of more than 3% during 2022-2026.

-

Which are the key emerging customer segments in the UK HNW and MNW home insurance market?

The key emerging customer segments in the UK HNW and MNW home insurance market are next-generation inheritors and mass affluent and emerging HNW individuals.

-

Who are the top players of the UK HNW and MNW home insurance market?

The top players of the UK HNW and MNW home insurance market are Hiscox, Chubb, Aviva, Zurich, Covea, Ecclesiastical, Brit, and Home & Legacy’s new MGA status

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Property reports