United Kingdom (UK) Private Motor Insurance Market Size, Trends, Competitor Dynamics and Opportunities

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Private Motor Insurance Market Report Overview

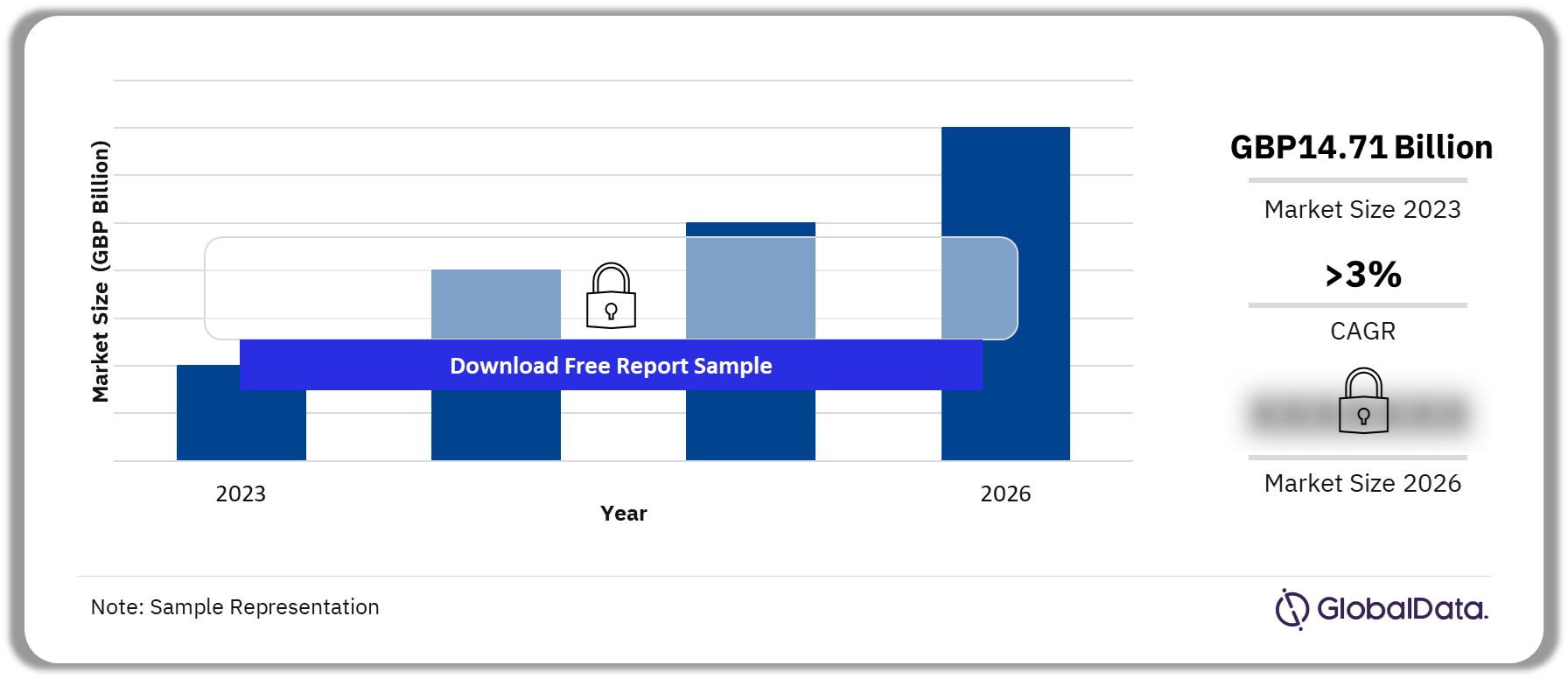

The gross written premium of the United Kingdom (UK) private motor insurance market size is estimated to be GBP14.71 billion in 2023. Going forward, the cost-of-living crisis and rising claims will continue to impact the motor insurance market. The average premiums are forecast to have reached all-time highs in 2023, driven by the rising cost of claims. The UK private motor insurance market is expected to achieve a CAGR of more than 3% during 2023-2026.

UK Private Motor Insurance Market Outlook 2023-2026 (GBP Billion)

Buy Full Report to Gain More Information About the UK Private Motor Insurance Market Forecast, Download a Free Report Sample

The UK private motor insurance market research report explores the claims landscape in 2023, as well as the motor market and upcoming regulatory changes within the insurance industry. Incumbent competitors are analyzed and compared, along with newcomers and insurtechs operating in this space. Future impactors on the market including inflation as well as emerging technologies such as artificial intelligence and autonomous vehicles are also examined.

| Market Size (2023) | GBP14.71 Billion |

| CAGR | >3% |

| Forecast Period | 2023-2026 |

| Passenger Types | • Car Occupants

• Pedestrians • Motorcycle Users • Pedal Cyclists • Others |

| Leading Motor Insurers | • Admiral

• Direct Line • Allianz • Aviva • Advantage Insurance • Covéa |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Private Motor Insurance Market Dynamics

As the transition to electric EVs gains momentum due to government mandates and consumers’ growing preference for cleaner transportation options, insurers must proactively adapt their offerings to cater to this evolving market. Insuring EVs presents unique challenges compared to traditional internal combustion engine (ICE) vehicles, such as handling complex battery technology, assessing repair costs, and addressing specialized maintenance requirements. To succeed in this shifting landscape, insurers should invest in hiring experts well-versed in EV insurance intricacies.

Insurers should also utilize artificial intelligence (AI) technology as they stand to benefit significantly. AI-driven predictive analytics can revolutionize risk assessment by analyzing vast datasets to identify high-risk policyholders and situations. This enables insurers to take proactive measures, such as offering personalized safety recommendations or adjusting pricing based on driving behavior.

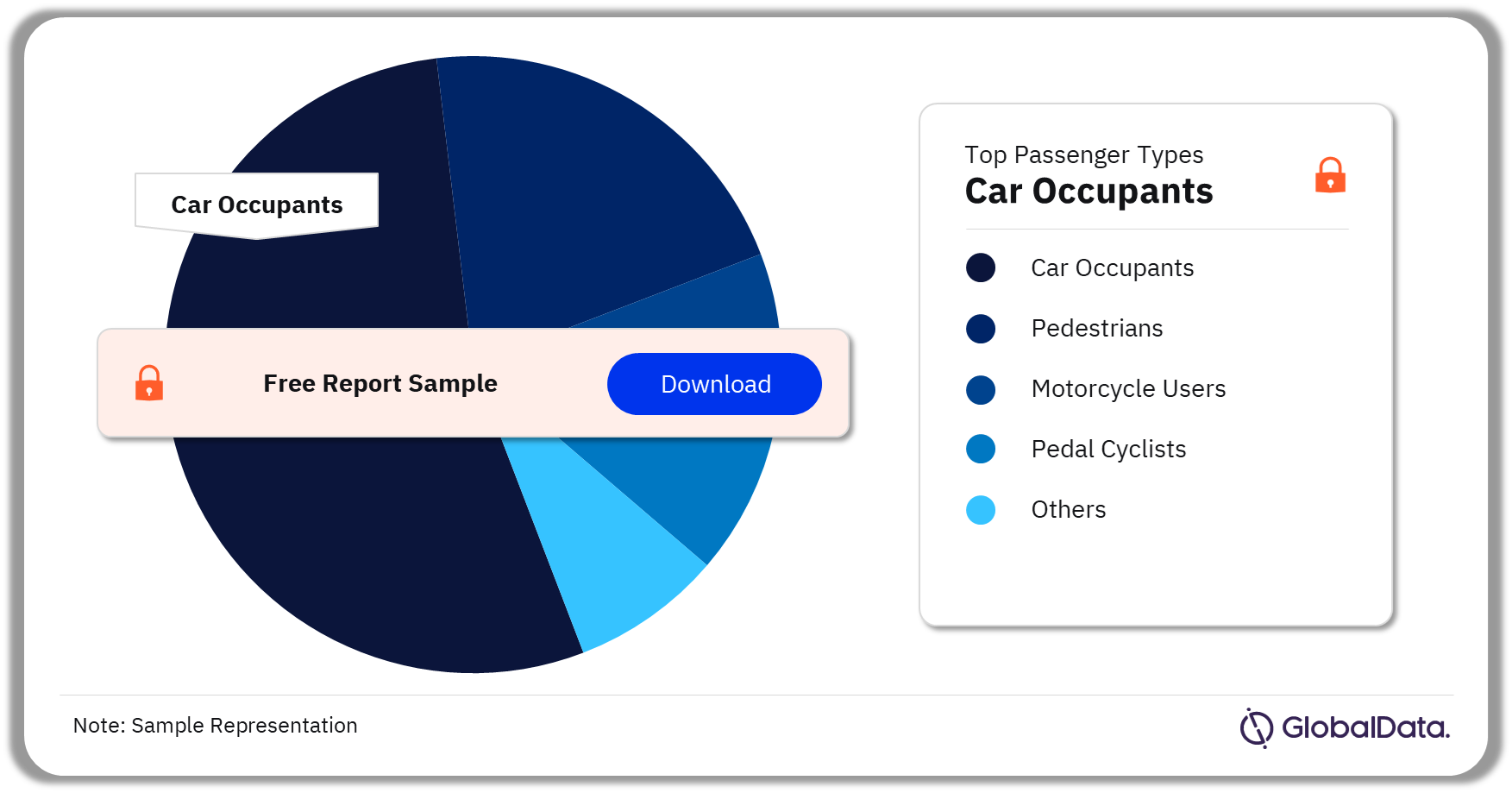

UK Private Motor Insurance Market Segmentation by Passenger Types

The key passenger types in the UK private motor insurance market include car occupants, pedestrians, motorcycle users, and pedal cyclists. Car occupants made up the highest proportion of casualties in 2022.

UK Private Motor Insurance Market Analysis by Passenger Types 2022 (%)

Buy Full Report to Gain More Information About the Passenger Types in the UK Private Motor Insurance Market

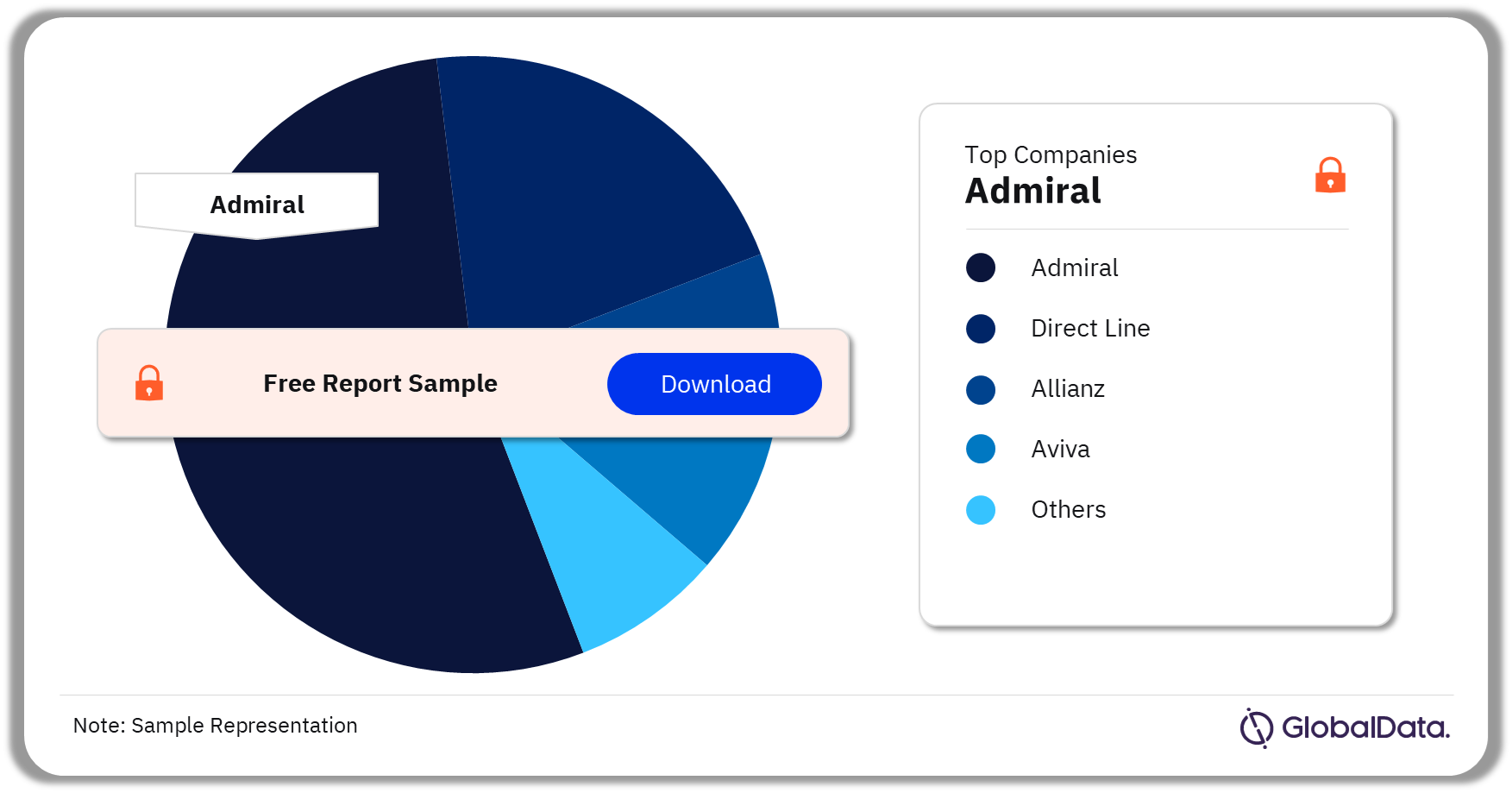

UK Private Motor Insurance Market - Competitive Landscape

Some of the leading private motor insurers in the UK are:

- Admiral

- Direct Line

- Allianz

- Aviva

- Advantage Insurance

- Covéa

Admiral led the private motor insurance industry in 2022. Its market share grew by more than 1 pp. Direct Line remained in second place.

UK Private Motor Insurance Market Analysis by Motor Insurers 2023 (%)

Buy Full Report to Gain More Information About the UK Private Motor Insurance Market

Segments Covered in the Report

UK Private Motor Insurance Passenger Types Outlook (Value, GBP Billion, 2023-2026)

- Car Occupants

- Pedestrians

- Motorcycle Users

- Pedal Cyclists

Scope

• The UK private motor insurance market is expected to grow by 19.1% in 2023e, following a 1.7% increase in 2022.

• Average premiums remained unchanged from 2021 to 2022, standing at GBP434.

• Total policies written increased by 0.4% from 2021 to 2022.

• The total number of claims notified increased by 17.1% from 2021 to 2022, while gross claims paid increased by 13.3%.

Reasons to Buy

- Determine the underlying factors affecting the private motor insurance market.

- Understand the impact of new regulations on the industry.

- Observe the actions and reactions of incumbent market leaders and insurtech newcomers.

- Understand the effects of the cost-of-living crisis.

- Anticipate new challenges and changes in the market going forward.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK private motor insurance gross written premium in 2023?

The gross written premium of the United Kingdom (UK) private motor insurance market size was valued at GBP14.71 billion in 2023.

-

What was the UK private motor insurance market growth rate?

The UK private motor insurance market is expected to achieve a CAGR of more than 3% during 2023-2026.

-

Which passenger type made up the highest proportion of casualties in 2022?

Car occupants passenger type made up the highest proportion of casualties in 2022.

-

Who are the leading motor insurers in the UK private motor insurance market?

Some of the leading motor insurers in the UK private motor insurance market are Direct Line, Admiral, Allianz, Aviva, Advantage Insurance, and Covéa.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Motor reports