United Kingdom (UK) Supermalls Market Size, Trends, Categories, Consumer Attitudes and Key Players to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Supermalls Market Report Overview

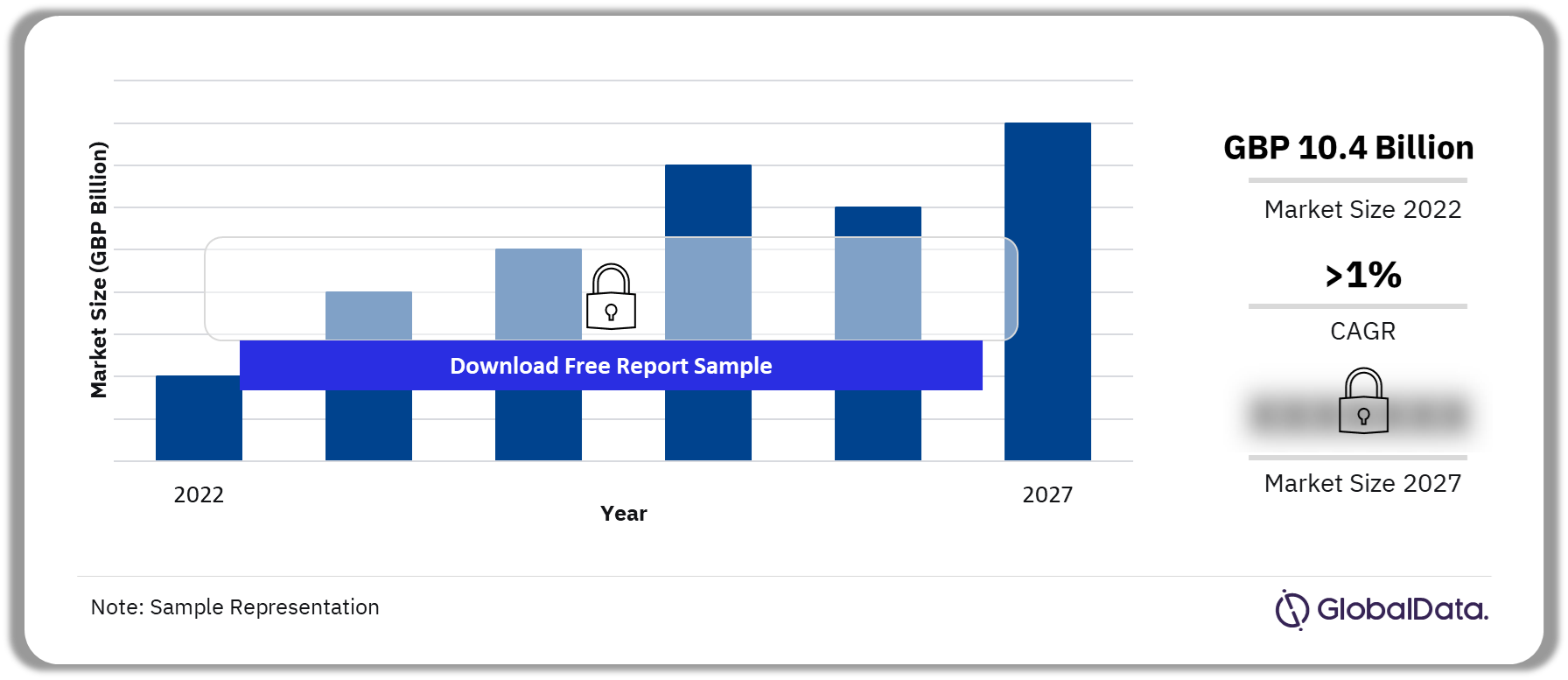

The UK supermalls market size was GBP 10.4 billion in 2022. The market is expected to grow at a CAGR of more than 1% during 2022-2027. The supermall market is anticipated to grow at an accelerating rate over the forecast period, driven by increased investment by local authorities, supermalls, and retailers. Supermalls must continue to invest in marketing and expanding retail and leisure services to maintain demand, as this will be key in bolstering footfall and ensuring that supermalls themselves remain an attractive location for retailers to invest in.

UK Supermalls Market Outlook, 2022-2027 (GBP Billion)

Buy Full Report for More Insights into the UK Supermalls Market Forecast

The United Kingdom (UK) Supermalls market research report offers comprehensive insight and analysis of the UK Supermalls, the key retailers, and consumer attitudes. It provides an in-depth analysis of the market size and forecasts, sector performance and forecasts, retailer usage across different sectors, and consumer data.

| Market Size (2022) | GBP 10.4 billion |

| CAGR (2022-2027) | >1% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Sectors | · Clothing & Footwear

· Health & Beauty · Electricals · Homewares · Food & Grocery · Furniture & Floorcoverings · DIY & Gardening |

| Key Retailers | · Primark

· Currys · JD Sports · H&M · Boots · John Lewis & Partners · Pandora · WH Smith · Smyths Toys |

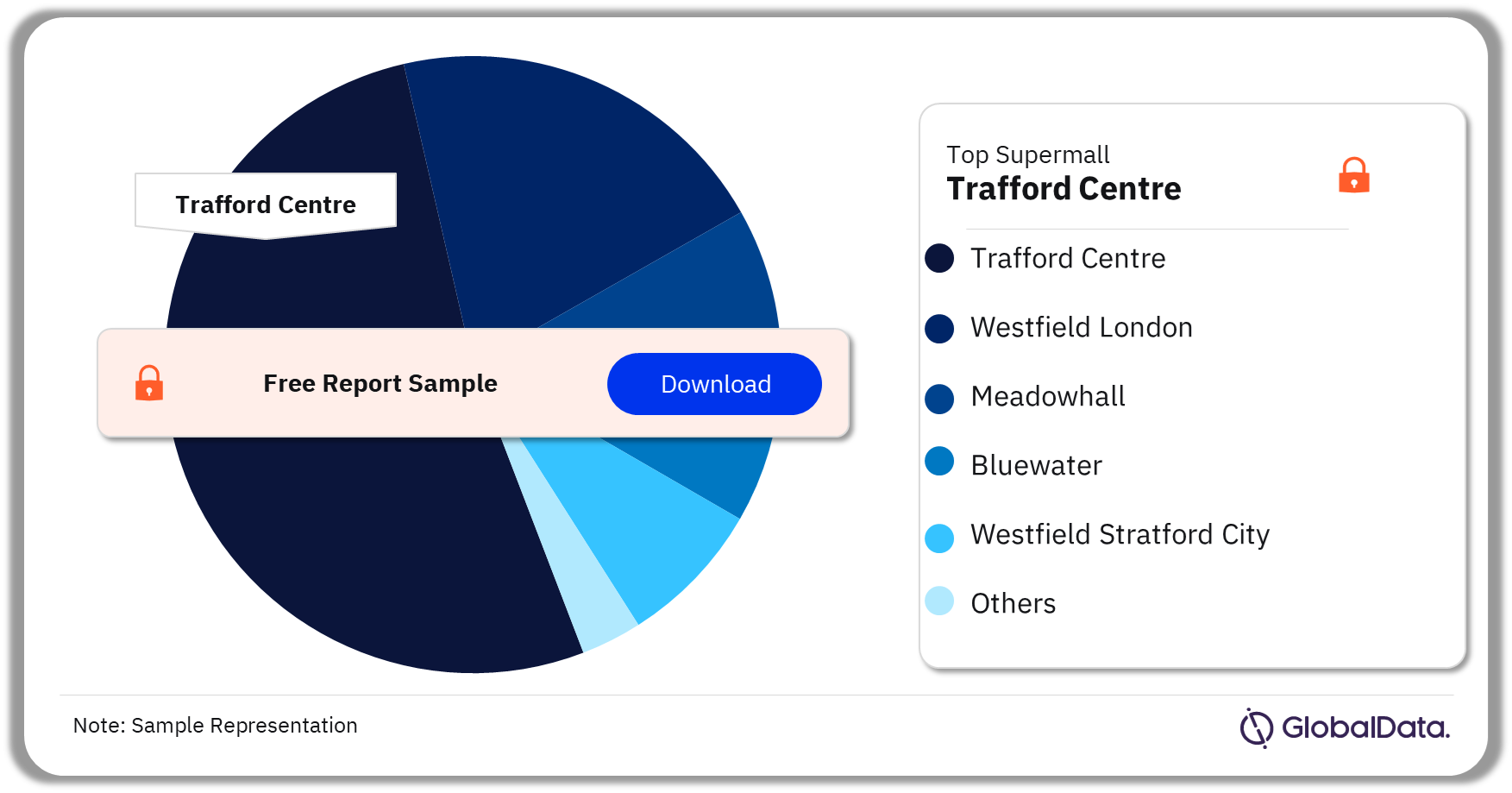

| Leading Supermalls | · Trafford Centre

· Westfield London · Meadowhall · Bluewater · Westfield Stratford City · Lakeside · Manchester Amdale · Metrocentre · Merry Hill · Eldon Square |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Supermalls Market Trends

Supermalls are regarded as prime locations for many retailers as they enable retailers to showcase the best of their proposition, as well as supplement retail with leisure facilities. Hence companies are enticed to invest in these locations given the expectation of high footfall. Supermalls would further benefit from working with new retailers, whose presence is predominantly on high streets, to open flagship stores in these locations.

Due to the COVID-19 pandemic and its aftermath, coupled with the ongoing cost-of-living crisis, consumers are limiting their spending on non-essential products. This has led to retailers closing stores in supermalls. Moreover, increased rents and energy prices have led to retailers being forced to back out of contracts earlier than expected, leaving less time to find successors and leaving vacant units in supermalls.

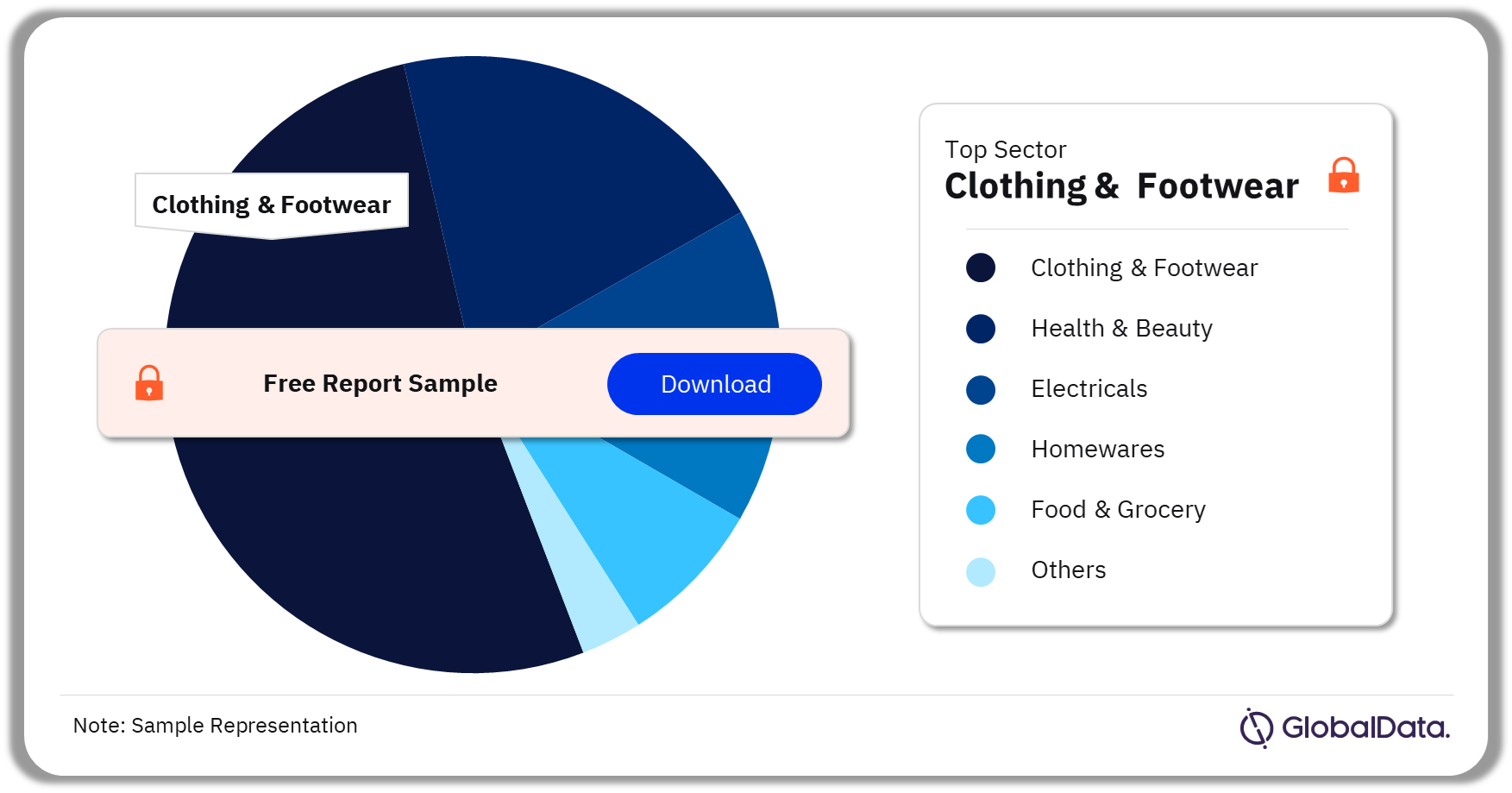

UK Supermalls Market Segmentation by Sectors

The key sectors in the UK supermall market are clothing & footwear, health & beauty, electricals, homewares, food & grocery, furniture & floorcoverings, DIY & gardening, among others. Clothing & footwear continues to be the strongest sector in the supermalls market and experienced the highest growth rate in 2022. The retailers in this sector have been performing well in supermalls, with expansions into bigger units coming as the next logical step.

UK Supermalls Market Analysis by Sectors, 2022 (%)

Buy Full Report for More Sector Insights into the UK Supermalls Market

UK Supermalls Market - Competitive Landscape

Some of the leading retailers in the UK supermalls market are Primark, Currys, JD Sports, H&M, Boots, John Lewis & Partners, Pandora, WH Smith, and Smyths Toys.

UK Supermalls Market Analysis by Retailers, 2023

Buy the Full Report for More Retailer Insights into the UK Supermalls Market

Some of the leading supermalls in the UK are Trafford Centre, Westfield London, Meadowhall, Bluewater, Westfield Stratford City, Lakeside, Manchester Amdale, Metrocentre, Merry Hill, and Eldon Square. Consumers prefer Trafford Centre supermall the most.

UK Supermalls Market Analysis, 2023 (%)

Buy Full Report for More Supermall Insights into the UK Supermalls Market

Segments Covered in the Report

UK Supermalls Market Sectors Outlook (Value, GBP Billion, 2017-2027)

- Clothing & Footwear

- Health & Beauty

- Electricals

- Homewares

- Food & Grocery

- Furniture & Floorcoverings

- DIY & Gardening

Scope

- Retailer investment will ensure clothing & footwear remains the prevalent sector as players such as Primark and H&M update and open key stores.

- Primark is the most visited retailer for clothing & footwear as its large, destination stores appeal to a broad audience.

- The variety of retailers, leisure and food services drives the appeal of supermalls as 45.3% of visitors prefer supermalls over other locations because of the wide choice of retailers.

Key Highlights

Clothing & footwear continues to be a dominant sector in the UK supermalls market, with sales up over 10% between 2022 and 2027. As many supermall locations are heavily saturated with clothing & footwear retailers, this sector is key in driving growth in the market with these retailers achieving robust growth in 2022 and into 2023.

Electricals has the lowest projected growth in the forecast period, up 1% between 2022 and 2027. This is due in part to the offline electricals market being forecast to remain relatively flat in the coming years, with growth in the overall market being driven by the online channel.

Though consumers have been visiting supermalls less often in 2023, down on 2022, the time spent in supermalls has increased on the previous year.

Reasons to Buy

- Identify the key retailers used by consumers to purchase products across various sectors.

- Understand the key drivers behind consumers visiting supermalls, and the services used in this location.

- Use our in-depth analysis of the challenges faced by the supermalls market, and what existing retailers must to do keep consumers visiting this location.

- View our forecasts for supermalls up to 2027, including which sectors are expected to prosper in the next five years.

Amazon

Apple

Arcadia

Argos

Boots

Charity Super.mkt

Claire's Accessories

Clarks

Currys

Debenhams

Design 44

DFS

Dyson

Ernest Jones

F.Hinds

Flying Tiger Copenhagen

Footlocker

GAME

Goldsmiths

Gymshark

H Samuel

H&M

HMV

Holland & Barrett

Home Bargains

Homesense

JD Sports

John Lewis & Partners

Kick Game

Lego

Lululemon

Lush

Mamas & Papas

Marks & Spencer

Natuzzi

New Look

Next

Nike

Pandora

Poundland

Primark

ProCook

Ralph Lauren

River Island

Ryman

Savers

Schuh

Selfridges

Sephora

Smyths Toys

Sports Direct

Superdrug

Swarovski

The Body Shop

The Entertainer

The Fragrance Shop

The Perfume Shop

The Range

The Works

Tiffany and Co

TK Maxx

Trinny London

Warren James

Wilko

Zara

Zara Home

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK supermalls market size in 2022?

The UK supermalls market size was GBP 10.4 billion in 2022.

-

What is the UK supermalls market growth rate?

The supermalls market in the UK is expected to grow at a CAGR of more than 1% during 2022-2027.

-

Which was the leading sector in the UK supermalls market in 2022?

Clothing & footwear was the leading sector in the UK supermalls market in 2022.

-

Who are the leading retailers in the UK supermalls market in 2022?

Some of the leading retailers in the UK supermalls market are Primark, Currys, JD Sports, H&M, Boots, John Lewis & Partners, Pandora, WH Smith, and Smyths Toys.

-

Which are the leading supermalls in the UK?

Some of the leading supermalls in the UK are Trafford Centre, Westfield London, Meadowhall, Bluewater, Westfield Stratford City, Lakeside, Manchester Amdale, Metrocentre, Merry Hill, and Eldon Square.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.