United Kingdom (UK) Town Centres Market Analysis by Sectors, Revenue Share, Consumer Attitudes, Key Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Town Centres Market Overview

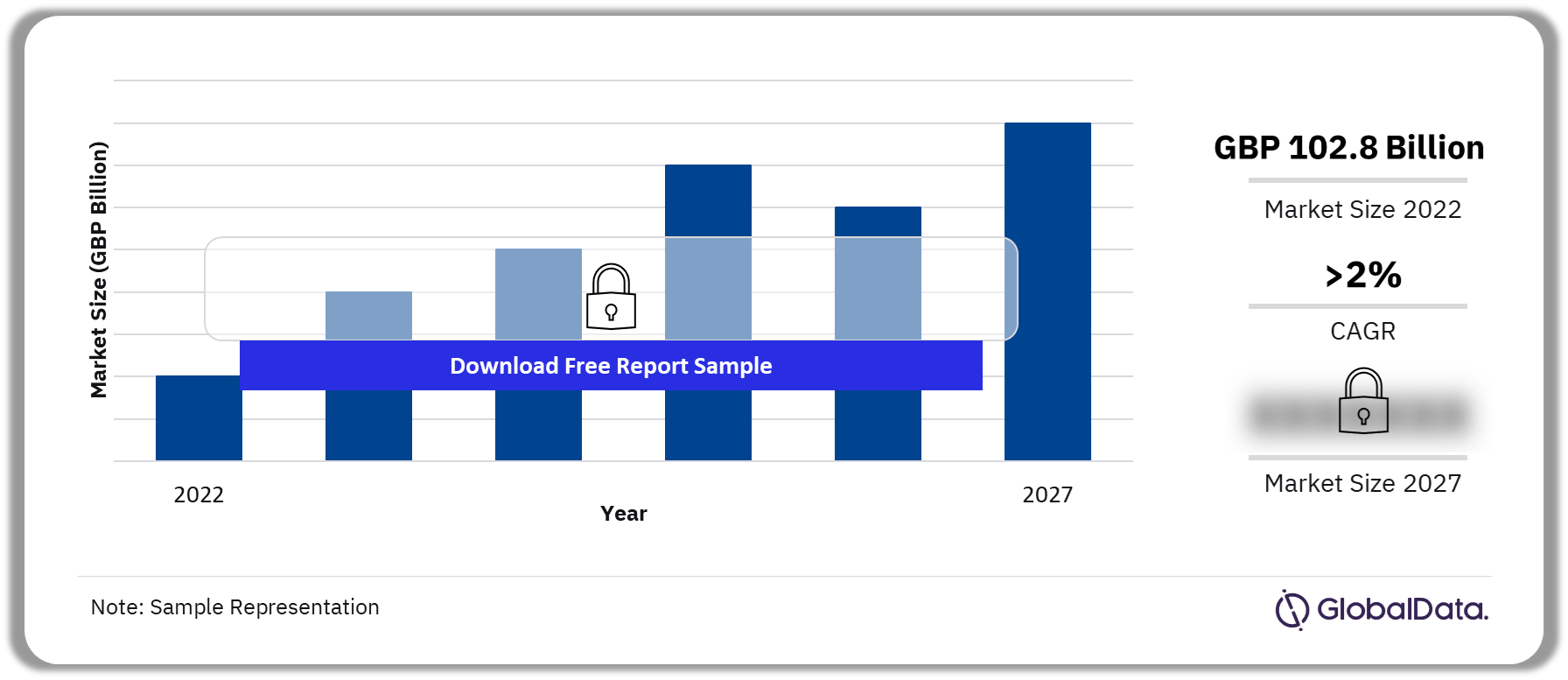

The UK town centres market size was GBP 102.8 billion in 2022. The market is expected to grow at a CAGR of more than 2% during 2022-2027. Retail sales in town centres are expected to grow at a slower rate than total retail sales in the UK over the forecast period, as e-commerce becomes more buoyant up to 2027. However, retailers can appeal to shoppers who want to shop offline by maintaining a wide range of products and keeping prices low enough to compete with their online rivals.

UK Town Centres Market Outlook, 2022-2027 (GBP Billion)

Buy the Full Report for More Insights into the UK Town Centres Market Forecast

The United Kingdom (UK) town centres market research report offers comprehensive insight and analysis of the UK town centres, the key retailers, and consumer attitudes. It provides an in-depth analysis of the market size and forecasts, sector performance and forecasts, retailer usage across different sectors, and consumer data.

| Market Size (2022) | GBP 102.8 billion |

| CAGR (2022-2027) | >2% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Sectors | · Clothing & Footwear

· Health & Beauty · Electricals · Homewares · Food & Grocery · Furniture & Floorcoverings · DIY & Gardening |

| Key Retailers | · Primark

· Currys · Sports Direct · TK Maxx · Boots · Tesco · Pandora · The Works · The Entertainer |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Town Centres Market Trends

- The government and retailers have made efforts to rejuvenate town centres and bring back shoppers through several initiatives that encourage retailers to open stores in prime locations. Rejuvenating town centres to attract consumers helps small businesses with subsidized rent.

- Consumers stated that it was important for them to have an enjoyable shopping experience when visiting town centres. To encourage them back into physical stores, many retailers have adapted retail units to be visually appealing and interactive for consumers. This can range from offering exclusive services such as in-store one-on-one personal training to unique store layouts and designs.

UK Town Centres Market Segmentation by Sectors

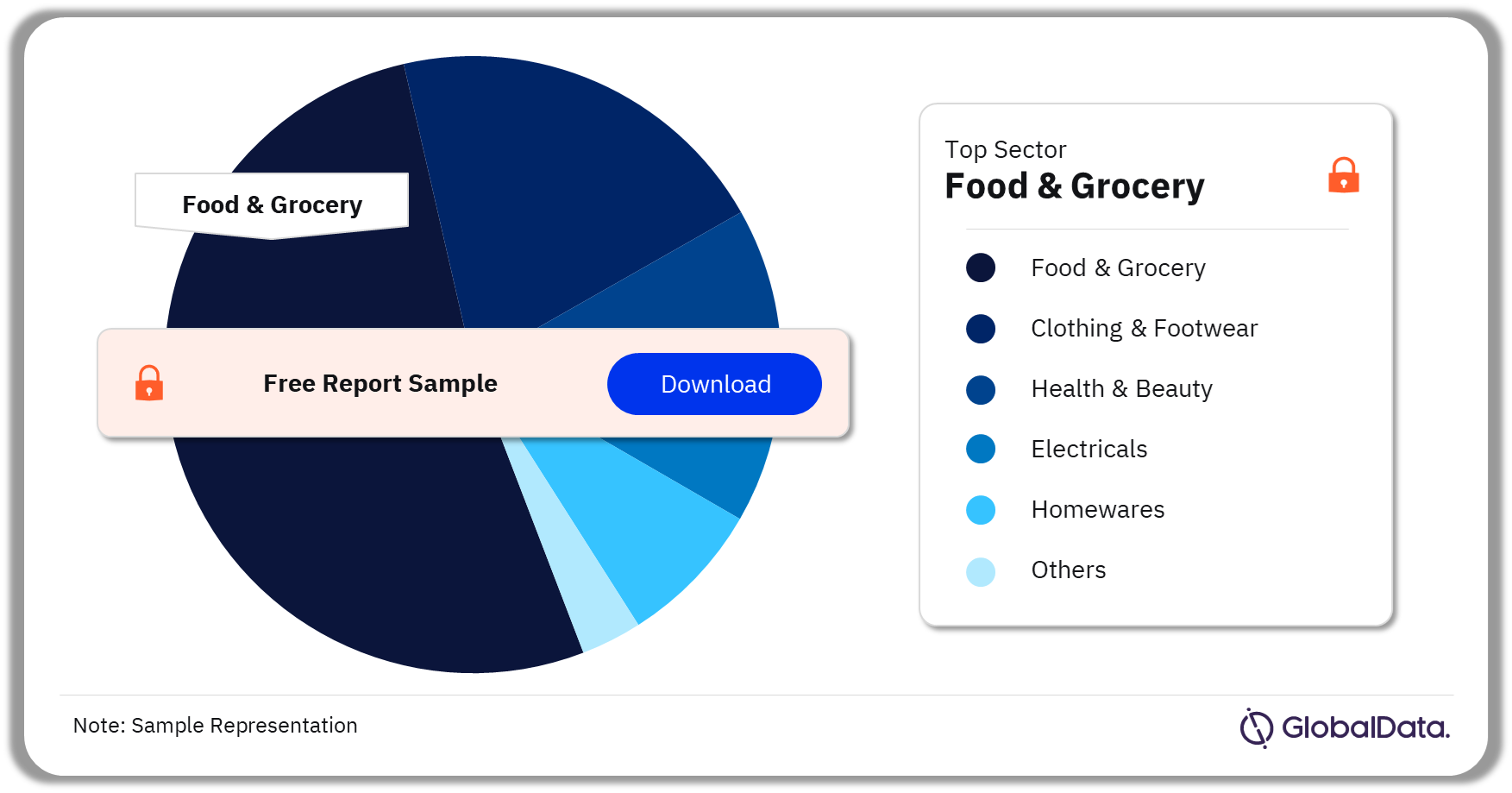

The cost-of-living crisis boosts food & grocery spending in town centres.

The key sectors in the UK town centres market are food & grocery, health & beauty, clothing & footwear, DIY & gardening, homewares, furniture & floorcoverings, and electricals, among others. Food & grocery was the strongest sector in the town centres market in 2022 and experienced the highest growth rate during the forecast period.

UK Town Centres Market Analysis by Sectors, 2022 (%)

Buy the Full Report for More Sector Insights into the UK Town Centres Market

UK Town Centres Market - Competitive Landscape

Some of the leading retailers in the UK town centres are:

- Primark

- Currys

- Sports Direct

- TK Maxx

- Boots

- Tesco

- Pandora

- The Works

- The Entertainer

UK Town Centres Market Analysis by Retailers, 2023

Buy Full Report for More Retailer Insights into the UK Town Centres Market

Segments Covered in the Report

UK Town Centres Sectors Outlook (Value, GBP Billion, 2017-2027)

- Clothing & Footwear

- Health & Beauty

- Electricals

- Homewares

- Food & Grocery

- Furniture & Floorcoverings

- DIY & Gardening

Scope

– As clothing & footwear players focus on right-sizing their store portfolios, town centres will be the hardest hit locations with declining spend being further impacted over the next five years.

– Despite having fewer UK stores in comparison to Marks & Spencer and New Look, Primark was the most visited retailer in town centres for clothing.

– Although food service options are often visited in town centres, other leisure services are less prevalent as town centre visits are likely to be shorter and convenience-driven.

Key Highlights

- Value players located in town centres are expected to have outperformed as consumers switched away to save money during the cost-of-living crisis.

- The cost-of-living crisis has led to a reduction in consumer spending on non-essential products, ensuring a greater proportion of sales in town centres.

- Primark performed well in 2023 ranking as the top retailer used by town centre shoppers for clothing, footwear, and fashion accessories.

Reasons to Buy

- Identify the key retailers used by consumers to purchase products across various sectors.

- Understand the key drivers behind consumers visiting town centres and the services used in these locations.

- Use our in-depth analysis of the challenges faced by the town centres market, and what existing retailers must to do keep consumers visiting this location.

- View our forecasts for town centres up to 2027, including which sectors are expected to prosper in the next five years.

Amazon

Apple

Arcadia

Argos

Boots

Charity Super.mkt

Claire's Accessories

Clarks

Currys

Debenhams

DFS

Dyson

Ernest Jones

F.Hinds

Flying Tiger Copenhagen

Footlocker

GAME

Goldsmiths

Gymshark

H Samuel

H&M

HMV

Holland & Barrett

Home Bargains

Homesense

JD Sports

John Lewis & Partners

Kick Game

Lego

Lululemon

Lush

Mamas & Papas

Marks & Spencer

Natuzzi

New Look

Next

Nike

Pandora

Poundland

Primark

ProCook

Ralph Lauren

River Island

Ryman

Savers

Schuh

Selfridges

Sephora

Smyths Toys

Sports Direct

Superdrug

Swarovski

The Body Shop

The Entertainer

The Fragrance Shop

The Perfume Shop

The Range

The Works

Tiffany and Co

TK Maxx

Trinny London

Warren James

Wilko

Zara

Zara Home

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK town centres market size in 2022?

The UK town centres market size was GBP 102.8 billion in 2022.

-

What is the UK town centres market growth rate?

The town centres market in the UK is expected to grow at a CAGR of more than 2% during 2022-2027.

-

Which was the leading sector in the UK town centres market in 2022?

Food & grocery was the leading sector in the UK town centres market in 2022.

-

Who are the leading retailers in the UK town centres market in 2022?

Some of the leading retailers in the UK town centres market are Primark, Currys, Sports Direct, TK Maxx, Boots, Tesco, Pandora, The Works, and The Entertainer.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.