United Kingdom (UK) Toys and Games Market Analysis by Categories, Revenue Share, Consumer Attitudes, Key Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Toys and Games Market Report Overview

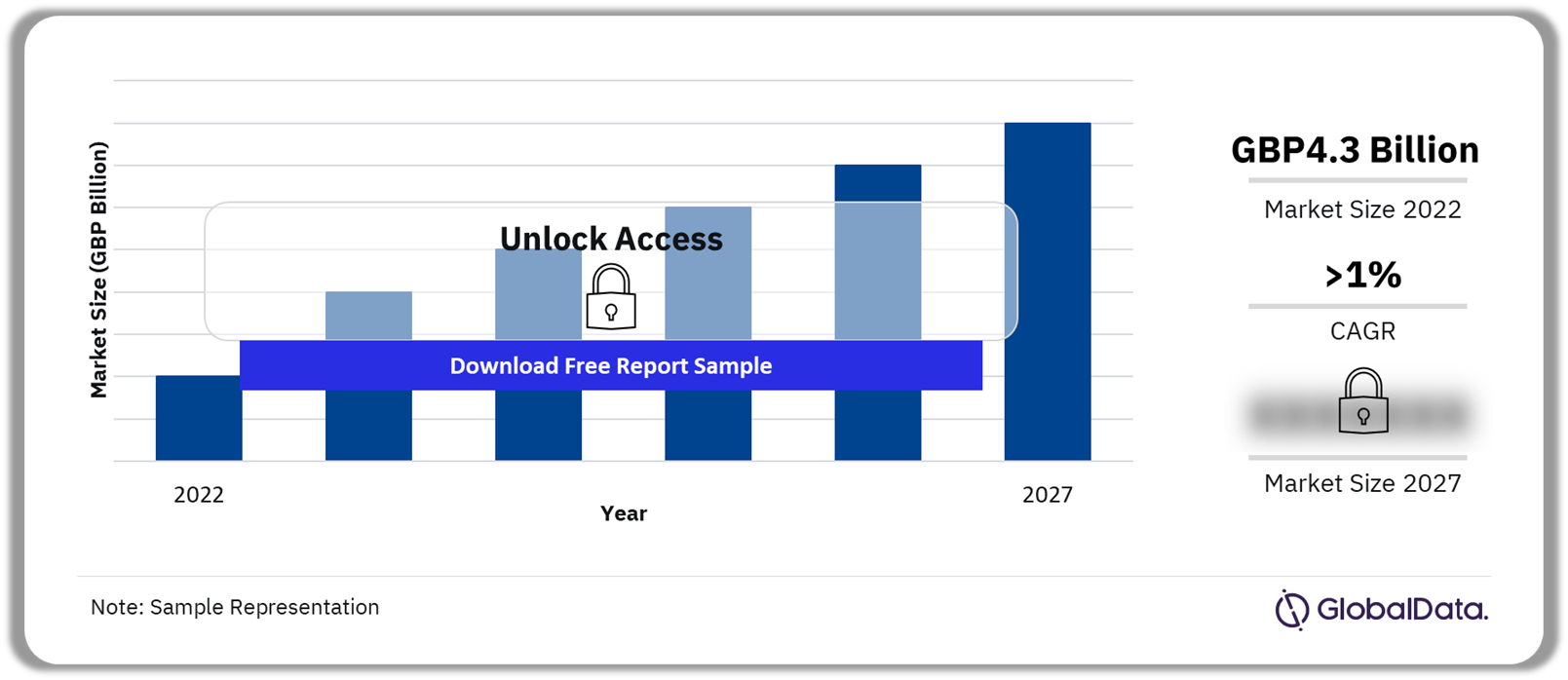

The UK toys and games market was valued at GBP4.3 billion in 2022 and is forecast to grow at a compound annual growth rate (CAGR) of more than 1% between 2022-2027. The year 2020 was a historic year for the UK toys and games market as many invested in the sector to help pass the time during lockdowns. However, the market has been bleak since predominantly due to the cost-of-living crisis deterring less essential spending, particularly among adults that purchase toys & games for themselves.

UK Toys and Games Market Outlook 2022-2027 ($ Billion)

For more insights into the UK toys & games market forecast, download a free report sample

The UK toys & games report offers a comprehensive insight into the toys & games market in the UK, analyzing the sector, the major players, the main trends, and consumer attitudes, as well as providing market forecasts out to 2027.

| Market Size (2022) | GBP4.3 billion |

| CAGR (2022-2027) | >1% |

| Key Categories | · Outdoor Toys

· Soft Toys · Construction Toys · Action Figure Toys · Electronic Toys · Board Games & Jigsaw Puzzles · Art Toys |

| Key Distribution Channels | · Other Online Retal

· Online Pureplays · Toys & Games Specialists · Value, Discount and Variety Stores and General Merchandise Retail · Hypermarkets, Supermarkets, and Hard Discounters · Others |

| Leading Players | · Amazon

· Smyths · Argos · Tesco · ASDA · The Entertainer · Others |

| Growth Drivers | · Adults offering untapped potential

· Resurgence of traditional toys |

| Market Opportunities | · Limited runs of product ranges to create hype

· Vibrant displays and tangible experiences |

| Challenges | · Rising inflation rates

· Growing internet accessibility reduceing interest in physical toys |

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Toys and Games Market Trends

Millennial and Gen Z consumers are investing more in toys & games than ever before. Brands such as Hasbro and Mattel have reintroduced Furby and new Barbie movie collectables, appealing to shoppers that have a sense of nostalgia for these products. Additionally, cinematic and streaming releases will continue to play a vital role in the toys & games market. Box office hits from film franchises such as Star Wars and the Marvel Cinematic Universe remain drivers, boosting sales of licensed toy ranges among both adults and children alike.

‘Kidults’, adults interested in forms of entertainment such as computer games and television programmes intended for children, are a growing market for retailers in the toys & games sector. Collectable toys that form part of a wider world are some of the most popular among the older demographic. For this purpose, retailers must appeal to consumers over the age of 16 through social media and content creation.

Engaging and interactive instore experiences appealing to all generations are essential for offline sales and community building. For instance, through vibrant displays and tangible experiences, LEGO attracts customers into stores through Pick & Build walls, display cabinets highlighting prebuilt sets and large models. These features encourage footfall by introducing new and long-standing customers into stores, creating an area for play, building, and sharing experiences across age ranges.

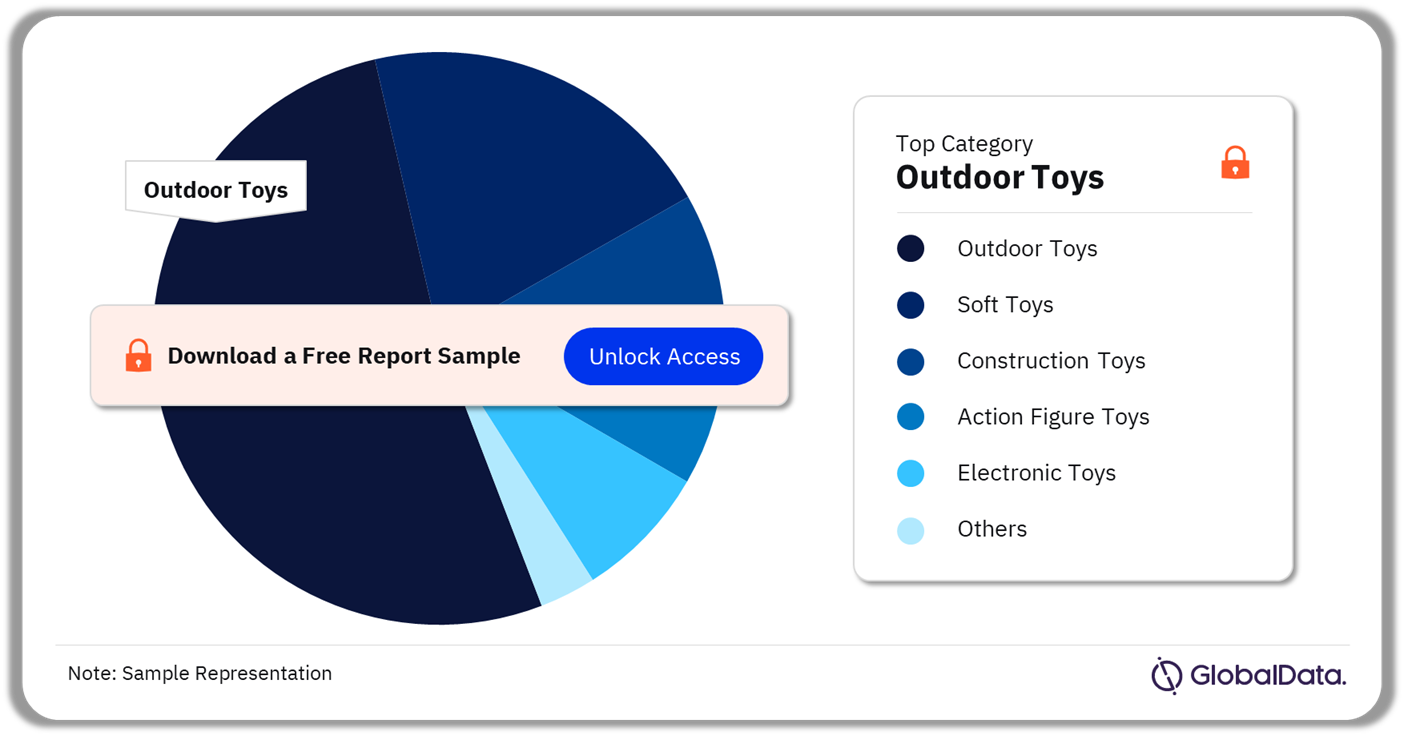

UK Toys and Games Market Segmentation by Category

The UK toys & games market is categorized into outdoor toys, soft toys, construction toys, action figure toys, electronic toys, board games & jigsaws, art toys, and dolls house & rail sets among others. The outdoor toys lead the toys & games market in size and growth in the UK in 2022. The market is expected to grow during the forecast period as these items continue to appeal to parents looking to keep their children occupied over the summer months.

Furthermore, the action figures category is expected to show a significant growth between 2022 and 2027, higher than any other toys & games category. The continued pace of growth could well see action figures overtaking construction toys as the third most valuable category in the next decade.

UK Toys and Games Market Analysis, by Category 2022(%)

For more information on the UK toys & games market segments, download a free report sample

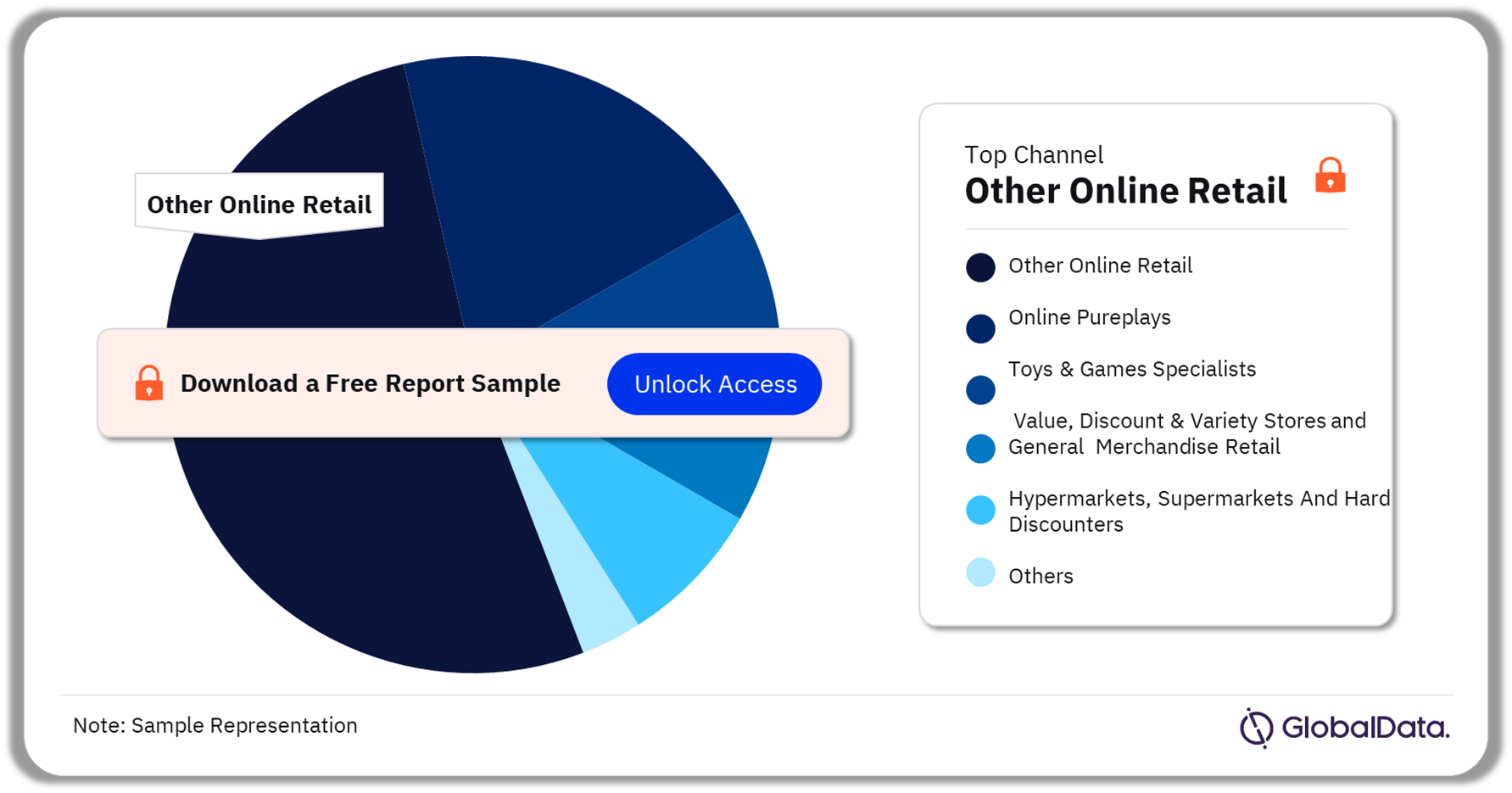

UK Toys and Games Market Segmentation by Channel

The key distribution channels in the UK toys & games market are other online retail, online pureplays, toys & games specialists, value, discount and variety stores & general merchandise retail, hypermarkets, supermarkets & hard discounters, and others. The online retail market overtook offline in 2022. However, this is expected to slow between 2022 and 2027 as the market is challenged by a post-pandemic slump in sales and added inflationary costs of online operations.

UK Toys and Games Market Analysis, by Channel 2022(%)

For more channel insights into the UK toys & games market, download a free report sample

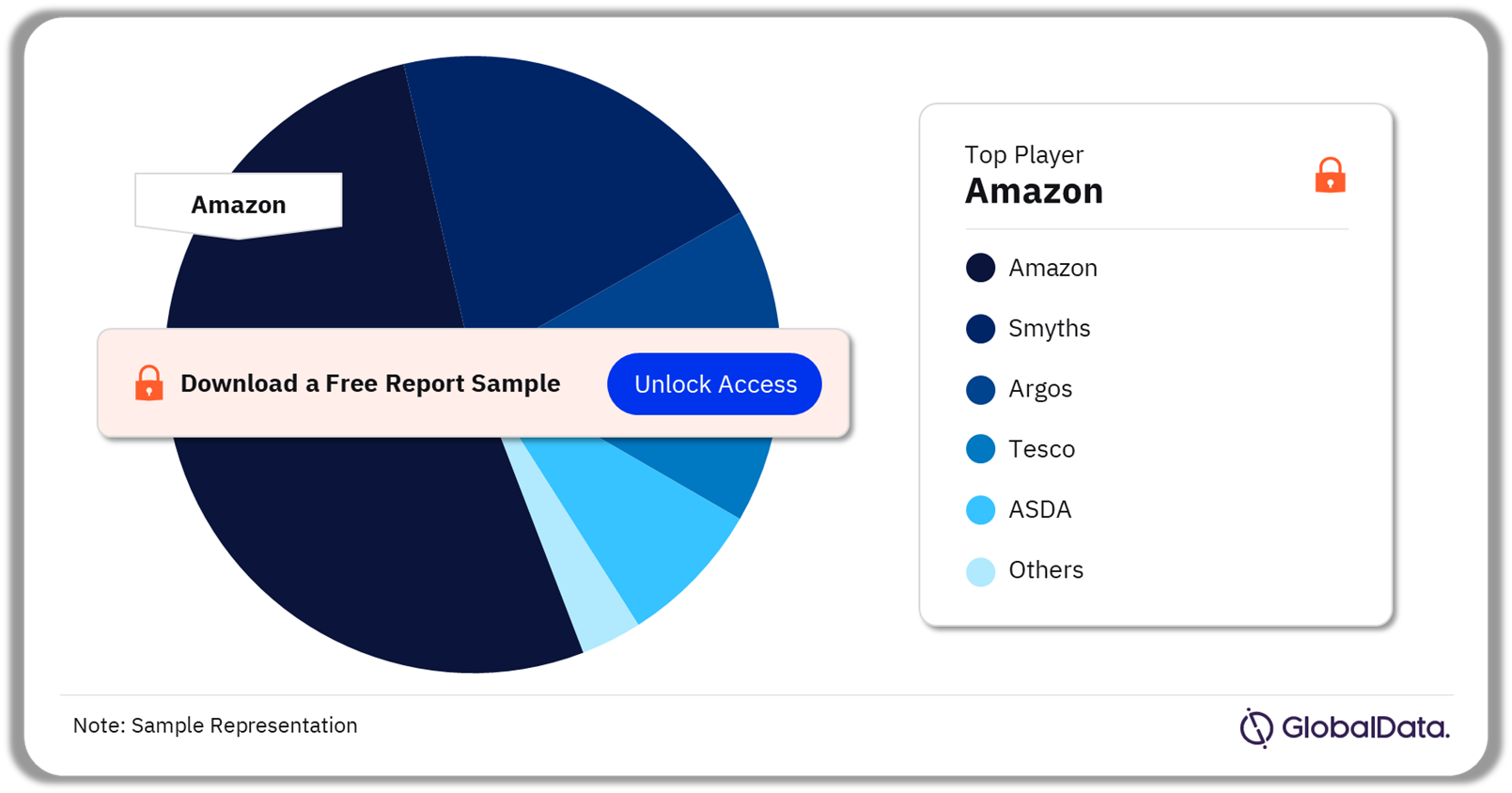

UK Toys and Games Market - Competitive Landscape

The leading players in the UK toys & games market are Amazon, Smyths, Argos, Tesco, ASDA, and The Entertainer among others. Amazon retained the largest share of the UK toys & games market in 2022, despite a marginal declcine in sales between 2021 and 2022 as shoppers returned to physical stores post the ending of COVID-19 restrictions.

UK Toys and Games Market Analysis, by Retailers 2022(%)

To know more about the leading players, download a free report sample

UK Toys & Games Market Segmentation

- UK Toys & Games Market Outlook by Category

- Outdoor Toys

- Soft Toys

- Construction Toys

- Action Figure Toys

- Electronic Toys

- Board Games & Jigsaw Puzzles

- Art Toys

- UK Toys & Games Market Outlook by Distribution Channels

- Other Online Retail

- Online Pureplays

- Toys & Games Specialists

- Value, Discount and Variety Stores and General Merchandise Retail

- Hypermarkets, Supermarkets, and Hard Discounters

- Others

Key Highlights

- Toys & games market to decline in 2023 as consumers cut back discretionary spend.

- Amazon remains the market leader in 2023, despite a decline in market share as online sales fall.

- Soft toys was the most popular category for toys & games purchases in 2023.

Reasons to Buy

- Using our five-year forecasts to 2027, learn which subcategories in the toys & games market will be the fastest performing to enable focus and investment in these winning product areas.

- Understand how drivers of toys & games purchases, such as range, price and quality, vary in importance among different demographics in order to maximize sales potential.

- Use our in-depth analysis of the challenges faced by key retailers in the sector in order to understand how to steal shoppers and market share.

Aldi

Argos

ASDA

B&M

Disney

Games Workshop

Hamleys

Hasbro

Home Bargains

John Lewis & Partners

LEGO

Lidl

Marvel

Mattel

Morrisons

Poundland

Primark

Sainsbury's

Smyths

Squismallows

Tesco

The Entertainer

The Range

The Very Group

The Works

TikTok

TK Maxx

WH Smith

Wilko

YouTube

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK toys & games market size in 2022?

The UK toys & games market size in 2022 was GBP4.3 billion.

-

What will be the UK toys & games market growth during 2022-2027?

The UK toys & games market will witness a CAGR of more than 1% during 2022-2027.

-

Which category dominated the UK toys & games market share in 2022?

The outdoor toys category accounted for the highest share of the UK toys & games market in 2022.

-

Which distribution channel generated the highest UK toys & games market revenue in 2022?

The other online retail was the largest distribution channel segment in the UK toys & games market in 2022.

-

Who are the leading players in the UK toys & games market?

Amazon, Smyths, Argos, Tesco, ASDA, and The Entertainer among others are the leading players in the UK toys & games market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.