United States (US) Coal Mining Market by Reserves, Production, Assets, Projects, Fiscal Regime with Taxes, Royalties and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Empower your strategies with our US Coal Mining to 2026 report and make more profitable business decisions.

United States (US) Coal Mining Market Report Overview

In 2023, the coal mine production output in the US was 504.3 million tonnes (Mt). There has been a dip in the coal mine production growth compared to that in 2022 due to the declining demand from the electricity sector. The factors responsible for the demand decline are the ongoing retirements of coal-fired power plants, growing natural gas-fired generation, and low natural gas prices. In terms of reserves, Montana had the largest volume of estimated recoverable coal reserves, as of January 2022.

The US coal mining market research report provides comprehensive coverage of the US coal industry. It provides historical and forecast data on coal production, production by company, reserves by country, and world coal prices. The report also includes a demand drivers section providing information on factors that are affecting the US coal industry. It further profiles major coal producers, and information on the major active, planned, and exploration projects by region.

| Market Size (Coal Production in 2023) | 504.3Mt |

| Active Mines | · North Antelope Rochelle Mine

· Black Thunder Mine · Antelope Mine · Freedom Mine · Eagle Butte Mine |

| Development Projects | · Cypress Mine

· Heavener Mine · Russell County Project · Youngs Creek Mine · A Seam Project |

| Exploration Projects | · Buick Coal Project

· Jonesville Coal Project · Seymour Property · Alumbaugh Property · Miller-Walker Property |

| Leading Companies | · Peabody Energy Corp

· Arch Resources Inc · Alliance Resource Partners LP · Nacco Industries · CONSOL Energy Inc |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

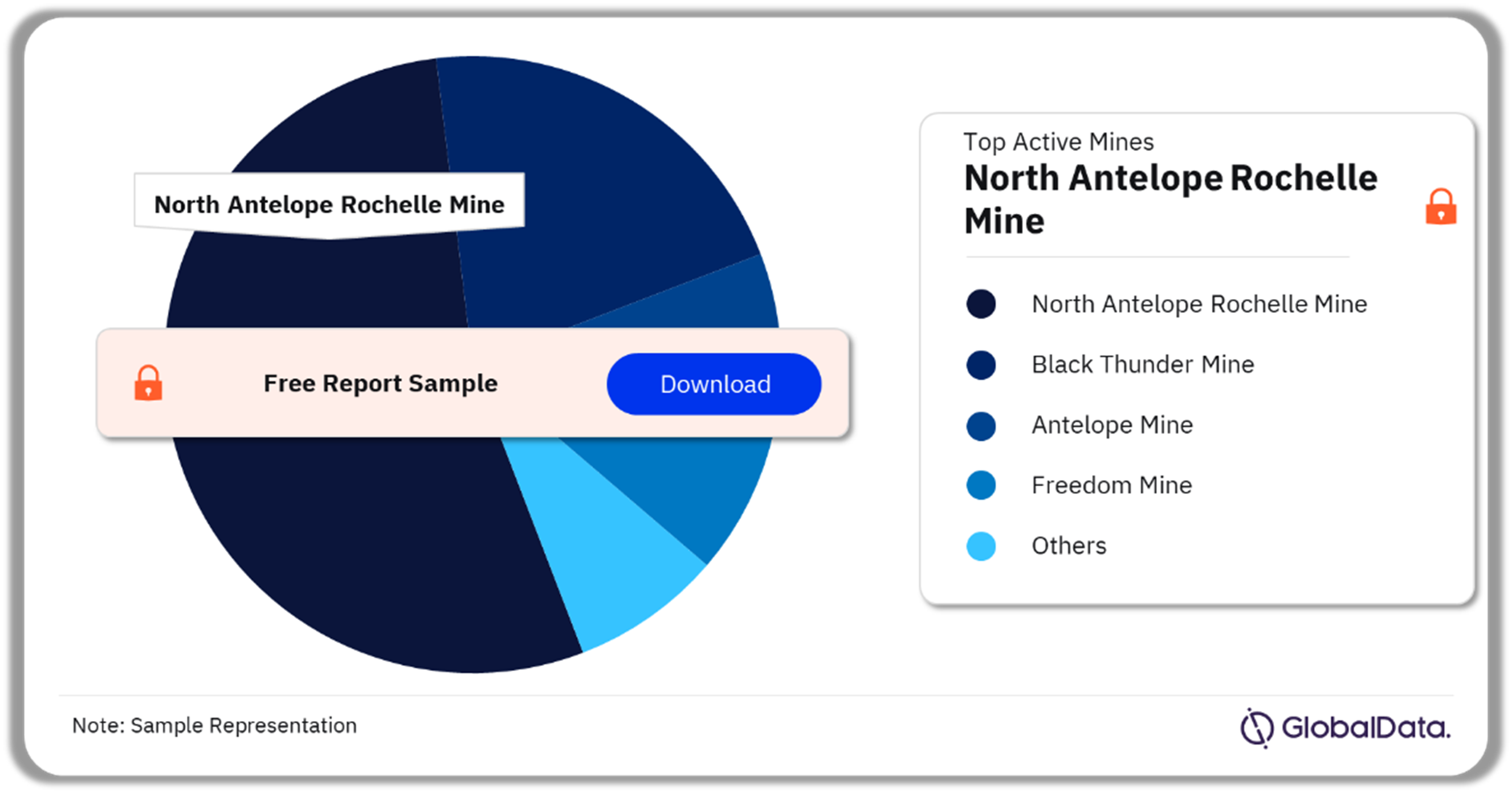

US Coal Mining Market - Active Mines

The key active coal mines in the US are North Antelope Rochelle Mine, Black Thunder Mine, Antelope Mine, Freedom Mine, and Eagle Butte Mine among others. In 2023, North Antelope Rochelle Mine was the leading active coal mine with the highest saleable coal production, followed by Black Thunder Mine, and Antelope Mine.

US Coal Mining Market Analysis by Active Mines, 2023 (%)

Buy the Full Report for More Active Mine Insights into the US Coal Mining Market

Download a Free Report Sample

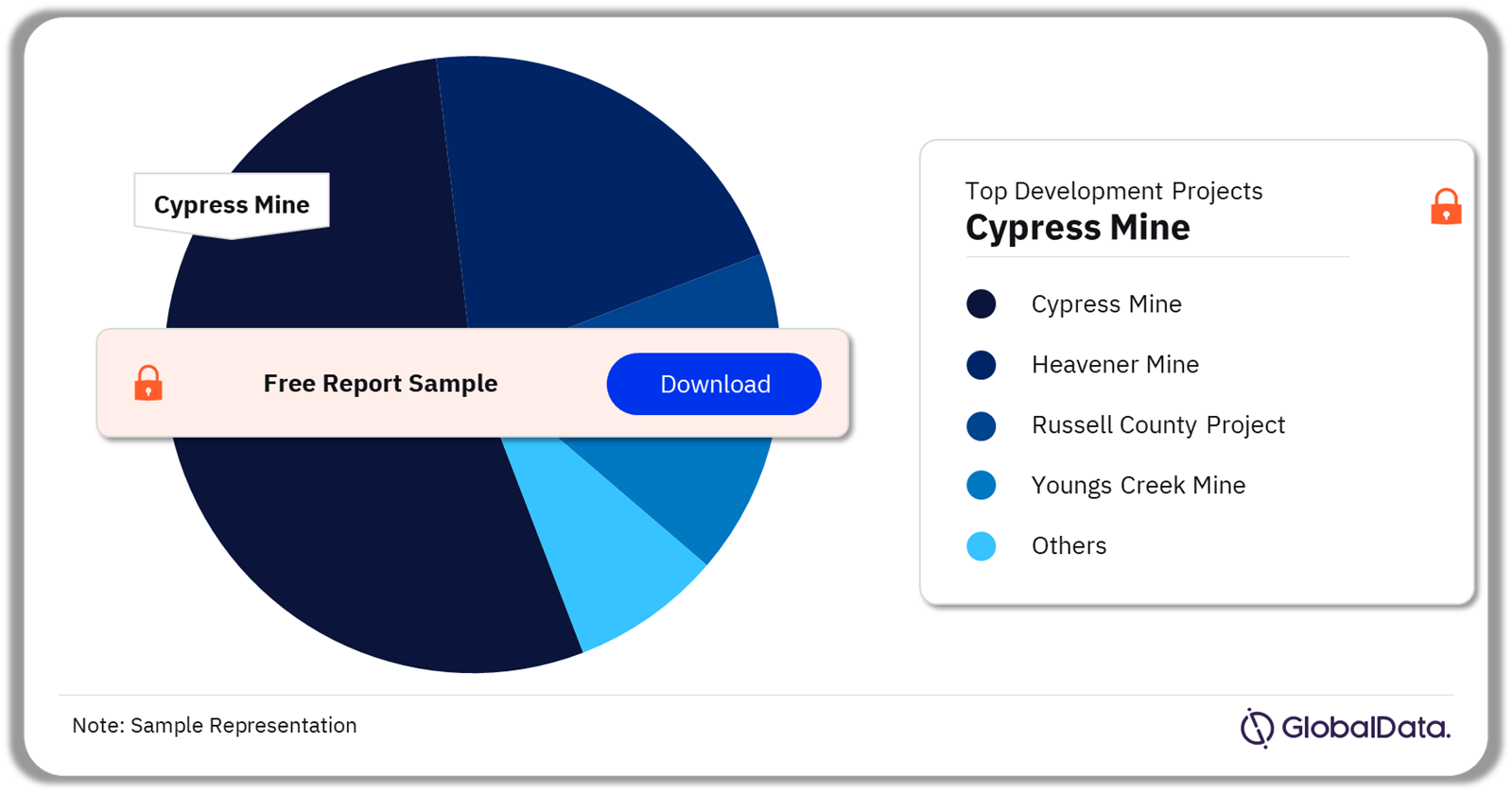

US Coal Mining Market - Development Projects

The key development projects in the US coal mining market are Cypress Mine, Heavener Mine, Russell County Project, Youngs Creek Mine, and A Seam Project among others. In 2023, Cypress Mine was the leading development project of the US coal mining market, followed by Heavener Mine and Russell County Project.

US Coal Mining Market Analysis by Development Projects, 2023 (%)

Buy the Full Report for More Insights on Development Projects in the US Coal Mining Market

Download a Free Report Sample

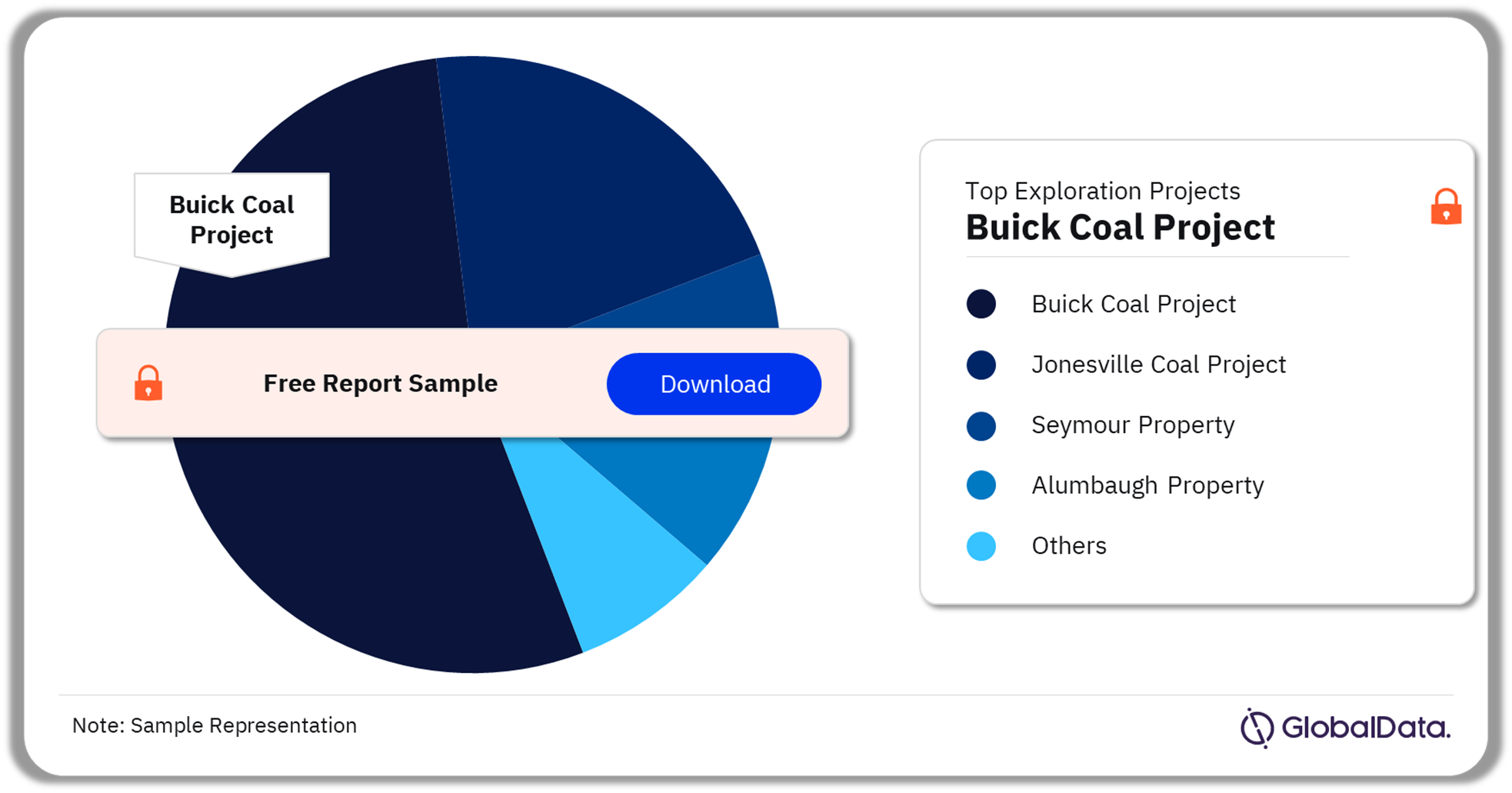

US Coal Mining Market - Exploration Projects

The key exploration projects in the US coal mining market are Buick Coal Project, Jonesville Coal Project, Seymour Property, Alumbaugh Property, and Miller-Walker Property. In 2023, Buick Coal Project was the leading exploration project of the US coal mining market.

US Coal Mining Market Analysis by Exploration Projects, 2023 (%)

Buy the Full Report for More Insights on Exploration Projects in the US Coal Mining Market

Download a Free Report Sample

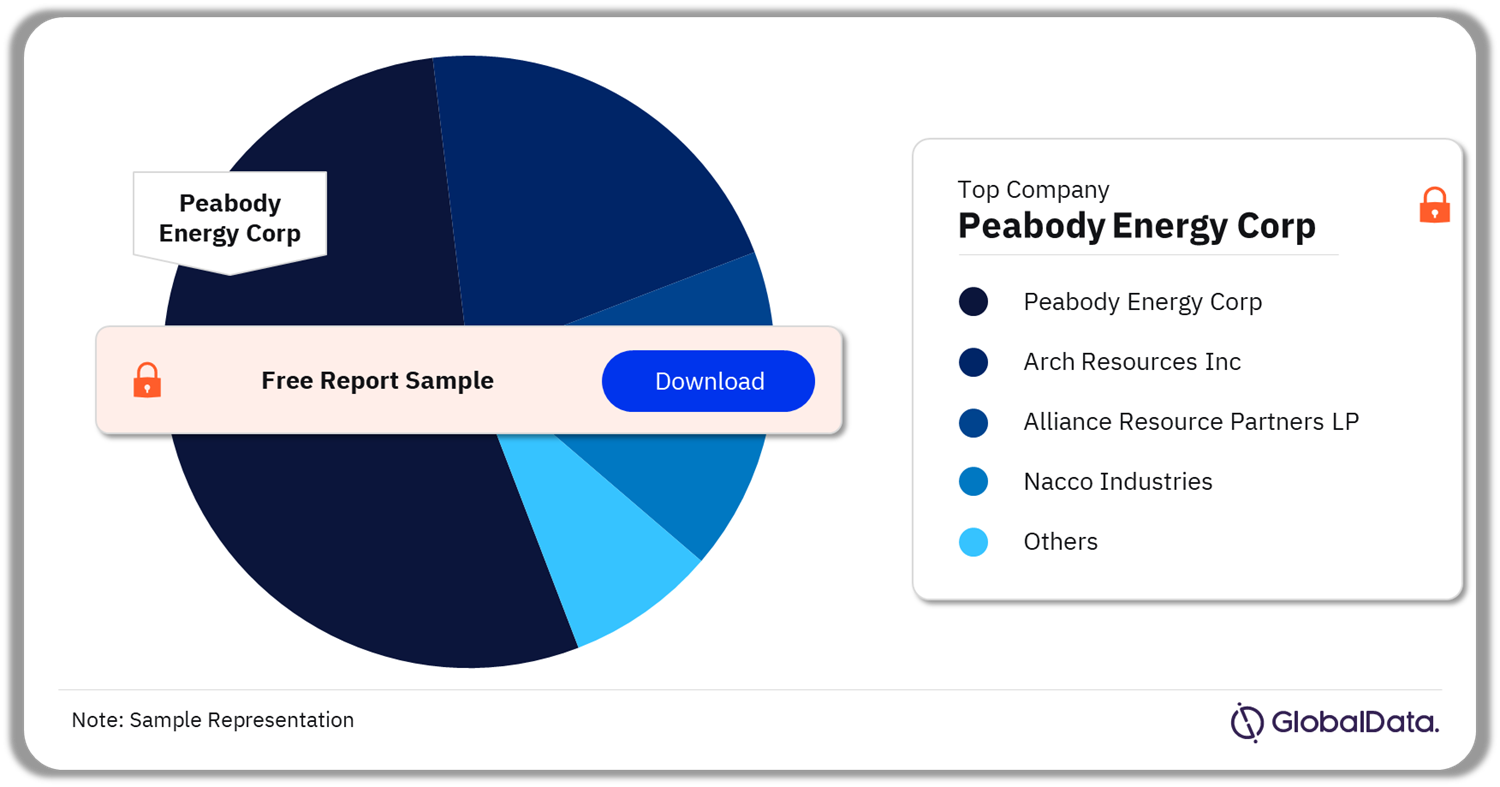

US Coal Mining Market - Competitive Landscape

The leading companies in the US coal mining market are:

- Peabody Energy Corp

- Arch Resources Inc

- Alliance Resource Partners LP

- Nacco Industries

- CONSOL Energy Inc

Peabody Energy Corp (Peabody) is a coal mining company based in the US. Peabody’s portfolio of products includes bituminous coal, sub-bituminous coal, metallurgical coal, and thermal coal. In March 2022, Peabody launched R3 Renewables LLC company, in partnership with Riverstone Credit Partners and Summit Partners Credit Advisors for the development of 3.3GW of utility-scale solar PV and 1.6GW of battery storage on reclaimed mining properties.

Leading US Coal Mining Market Analysis by Companies, 2022 (%)

Buy the Full Report for More Insights on Companies in the US Coal Mining Market

Scope

- Overview of the US coal mining industry

- Key demand driving factors

- Historical and forecast data on coal production, production by company and reserves by country

- World coal prices

- Profiles of major coal producers

- Competitive landscape

- Major operating, explorational and developmental mines

Reasons to Buy

- In-depth Insights: Gain comprehensive industry insights into the US coal mining market and understand the key market drivers influencing production trends, reserves and market dynamics.

- Strategic market analysis: Access historical and forecast trends on US coal production to anticipate market shifts and make forward-looking decisions.

- Forge valuable partnerships: Identify the leading companies in the US coal mining market, including information on their sectors of operation, headquarters location, production capacity and owned coal mines.

- Uncover major projects: Dive into a detailed overview of major active, explorational, and developmental projects.

Arch Resources Inc

Alliance Resource Partners LP

Nacco Industries

CONSOL Energy Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total coal production in the US in 2023?

In 2023, the coal mine production output in the US was 504.3Mt.

-

Which are the leading development projects in the US coal mining market?

The key development projects in the US coal mining market are Cypress Mine, Heavener Mine, Russell County Project, Youngs Creek Mine, and A Seam Project among others.

-

Which are the leading exploration projects in the US coal mining market?

The key exploration projects in the US coal mining market are Buick Coal Project, Jonesville Coal Project, Seymour Property, Alumbaugh Property, and Miller-Walker Property.

-

Which are the leading companies in the US coal mining market?

The leading companies associated with the US coal mining market are Peabody Energy Corp, Arch Resources Inc, Alliance Resource Partners LP, Nacco Industries, and CONSOL Energy Inc.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.