Vietnam Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Vietnam Defense Market Report Overview

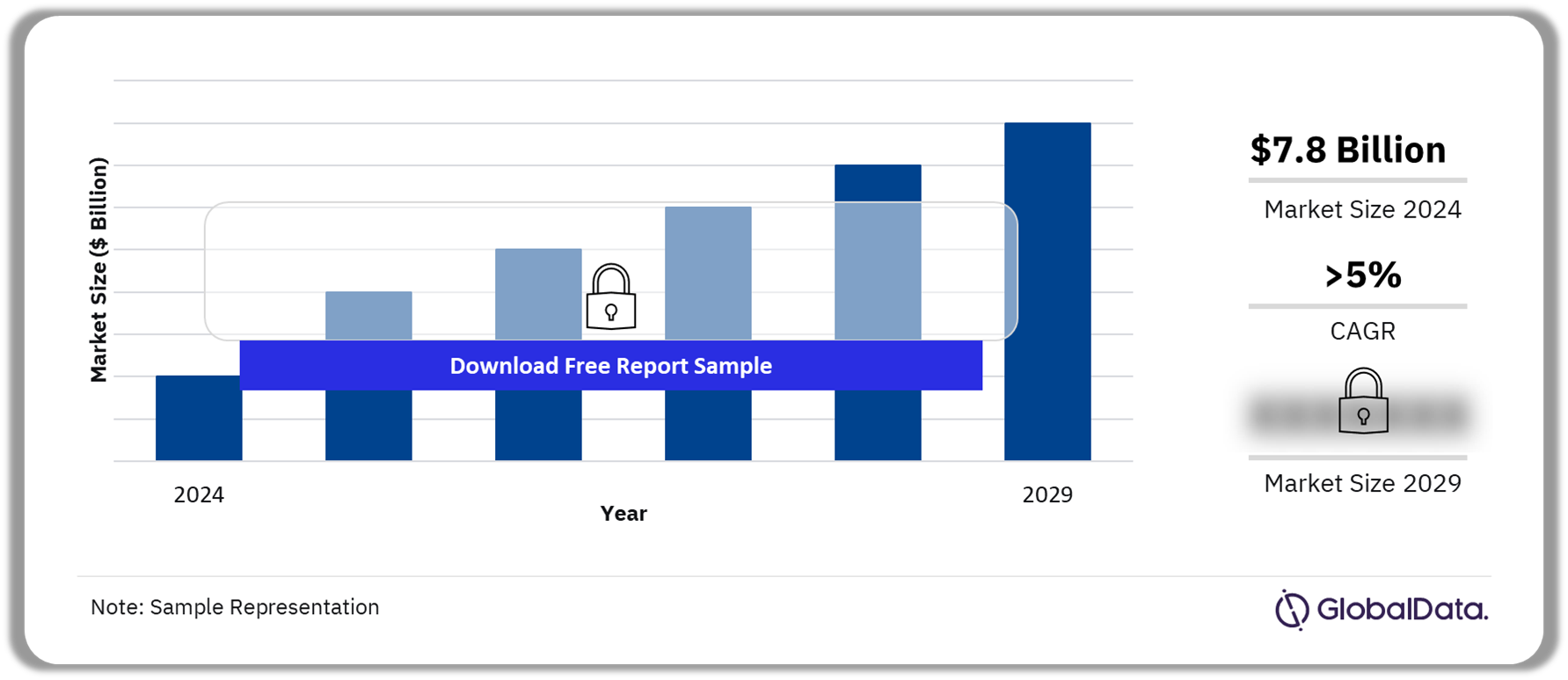

The Vietnam defense budget is worth $7.8 billion in 2024 and is forecast to register a robust CAGR of more than 5% during 2025-2029. Territorial claims in the South China Sea and the increasing strength and assertiveness of the Chinese armed forces have spurred the Vietnamese government to enhance its military capabilities, driving Vietnam’s defense expenditure. Additionally, Vietnam is planning to replace its obsolete equipment to combat the modern threat scenario. The country is expected to procure fighter and multirole aircraft, armored vehicles, naval vessels, patrol ships, maritime patrol aircraft, and surveillance equipment over the forecast period.

Vietnam Defense Market Outlook, 2024-2029 ($ Billion)

Buy the Full Report for More Insights into the Vietnam Defense Market Forecast

The Vietnam defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The Vietnam defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $7.8 billion |

| CAGR (2025-2029) | >5% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Disputes in the South China Sea

· Military modernization |

| Key Sectors | · Artillery Systems

· Missiles & Missile Defense Systems · Military Fixed Wing Aircraft · Military Unmanned Aerial Vehicles · Submarines · Tactical Communication Systems · Naval Vessels and Surface Combatants |

| Leading Companies | · Viettel Military Industry and Telecoms Group

· FPT Corp · General Aviation Import-Export Company · 189 One Member Limited Liability Co · Border Guard – Socialist Republic of VietNam · Israel Aerospace Industries Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Vietnam Defense Market Drivers

Modernization of depleting equipment and disputes in the South China Sea are key factors driving defense expenditure.

Disputes in the South China Sea: China’s sovereignty claims over territory in the South China Sea, as well as the estimated 190 trillion cubic feet of natural gas and 11 billion barrels of untapped oil, have fueled rivalries between China and other countries in the vicinity of the South China Sea, such as the Philippines, Malaysia, Indonesia, Brunei, and Vietnam, by compelling them to stake a claim. These territorial disputes in the South China Sea have driven military expenditure by members of the Association of Southeast Asian Nations (ASEAN).

Buy the Full Report for Additional Information on the Vietnam Defense Market Drivers

Vietnam Military Doctrines and Defense Strategies

North Korea and China continue to be a focal point of Vietnam’s military doctrine. In November 2019, Vietnam published its white paper on national defense. It explains the overall guidelines and principles of the military strategy to protect Vietnam during the next 10 years. One of the key doctrines reasserted in the white paper were, no foreign bases and utilization of territory for military activities, no military alliances, and no siding with one nation against another nor threatening to use force in any international relations. Vietnam announced in this white paper that it promotes cooperation with countries to improve its capabilities to protect the country and address common security challenges.

Furthermore, Vietnam has established defense ties with various countries and international organizations. For instance, Vietnam has traditionally enjoyed close defense ties with Russia and most of its defense equipment is of Russian origin. Likewise, Vietnam is also working toward bolstering its relationship with Japan. The two countries have agreed to promote an exchange program involving their defense industries. Japan also agreed to expand naval collaboration with Vietnam, and in March 2020, it agreed to implement a cooperation project regarding shipbuilding.

Buy the Full Report for More Insights on the Military Doctrines and Defense Strategies in the Vietnam Defense Market

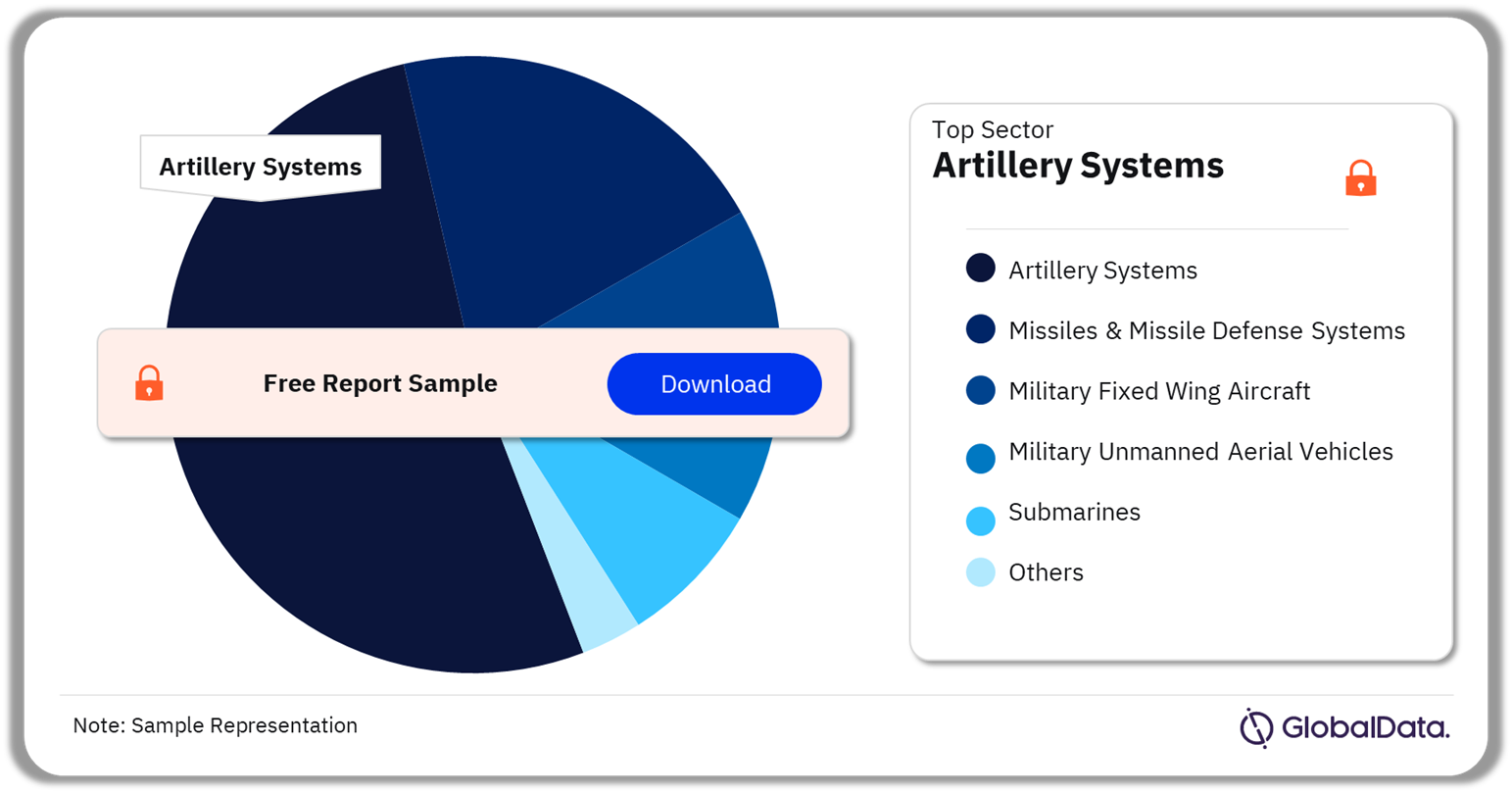

Vietnam Defense Market Segmentation by Sectors

The key sectors in the Vietnam defense market are artillery systems, missiles & missile defense systems, military fixed wing aircraft, military unmanned aerial vehicles, submarines, tactical communication systems, naval vessels, and surface combatants among others. The artillery systems sector was the largest sector within the Vietnamese defense market in 2024. The artillery systems market is sustained by acquisition programs, especially within the multiple rocket launch systems and towed artillery systems.

Vietnam Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the Vietnam Defense Market

Buy the Full Report for More Sector Insights into the Vietnam Defense Market

Vietnam Defense Market - Competitive Landscape

A few of the leading defense companies operating in Vietnam are:

- Viettel Military Industry and Telecoms Group

- FPT Corp

- General Aviation Import-Export Company

- 189 One Member Limited Liability Co

- Border Guard – Socialist Republic of VietNam

- Israel Aerospace Industries Ltd

Israel Aerospace Industries (IAI) provides aerospace and defense technology for military and commercial markets. The company designs, develops, manufactures, and supplies business jets, fighter aircraft, helicopters, radar systems, hydraulic systems, and components. It manufactures communications satellites, light-weight imaging satellites, observation satellites, and satellite launchers. It also offers unmanned air systems, anti-ballistic defense systems, naval weapons systems, C4I systems, and maritime radars. The company operates in the US, Brazil, Russia, Vietnam, India, Chile, Australia, Germany, Colombia, South Korea, and Thailand. IAI is headquartered in Lod, Tel Aviv, Israel.

Vietnam Defense Market Analysis by Companies

Buy the Full Report for More Company Insights into the Vietnam Defense Market

Buy the Full Report for More Company Insights into the Vietnam Defense Market

Segments Covered in the Report

Vietnam Defense Market Sectors Outlook (Value, $ Million, 2020-2029)

- Artillery Systems

- Missiles & Missile Defense Systems

- Military Fixed Wing Aircraft

- Military Unmanned Aerial Vehicles

- Submarines

- Tactical Communication Systems

- Naval Vessels and Surface Combatants

Scope

The report provides:

- Detailed analysis of the Vietnam 2024 defense budget broken down into market size and market share.

- Overview of key current and future acquisitions.

- Explanation of the procurement policy and process.

- Analysis of Vietnam’s military doctrine and strategy to provide a comprehensive overview of Vietnam’s military procurement regulation.

- Outline of political alliances and perceived security threats to Vietnam and trends in spending and modernization.

- Analysis of the competitive landscape and strategic insights of Vietnam’s defense industry.

Key Highlights

• Drivers of Defense expenditure include Military modernization,

South China Sea dispute

• Major ongoing procurement program include procurement of Barak-8, Indigenous midget submarine, L-39

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Vietnam defense market over the next five years.

- Understand the underlying factors driving demand for different defense and internal security segments in the Vietnam market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Vietnam defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Vietnam government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Sukhoi Co

Israel Aerospace Industries (IAI)

Table of Contents

Frequently asked questions

-

What was the Vietnam defense market size in 2024?

The defense market size in Vietnam is estimated to be $7.8 billion in 2024.

-

What will the Vietnam defense market growth rate be during the forecast period?

The defense market in Vietnam is expected to achieve a CAGR of more than 5% during 2025-2029.

-

Which sector accounted for the highest market attractiveness in the Vietnam defense market in 2024?

The artillery systems sector accounted for the highest market attractiveness in the Vietnam defense market in 2024.

-

Which are the key companies operating in the Vietnam defense market?

A few of the leading defense companies operating in Vietnam are Viettel Military Industry and Telecoms Group, FPT Corp, General Aviation Import-Export Company, 189 One Member Limited Liability Co, Border Guard – Socialist Republic of VietNam, and Israel Aerospace Industries Ltd, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports