Wealth Management Trends and Themes in 2023

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore trends and insights from the following data in our best-selling ‘Wealth Management Trends and Themes’ report:

- This report considers the key trends and themes that will shape the wealth management sectorin 2023.

- It includes predictions regarding the course of the wealth management market amid high inflation and geopolitical tensions.

- It provides a detailed analysis of the trends including ESG, Recessionary Conditions, Cryptocurrencies, Russia/Ukraine Conflict, Inflation, Robo-Advice, and AI and Personalization.

How is the ‘Wealth Management Trends and Themes’ report different from other reports in the market?

Corporate giants, governments, and individuals across all industry verticals are adapting to new technologies and strategies that will accelerate growth through the rest of the decade. Getting access to our ‘Wealth Management Trends and Themes’ report today will help you to:

- Understand the key trends impacting the wealth management industry in 2023 and how to respond.

- Discover the effect of the succession of negative events in 2022 on the industry and how they will shape 2023 strategies.

- Understand the best approach to client portfolio strategies amid current market conditions.

- Learn about possible use cases for artificial intelligence in wealth management.

We recommend this valuable source of information to anyone involved in:

- Bankers /Fintech Companies/Lending Companies

- Digital payment companies/Insurance Companies/Retail Banks

- Technology Leaders and Startups

- Strategy, Marketing, and Business Development

- Market Intelligence and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A and Investment Consultants

- Management Consultants and Consulting Firms

To Get a Snapshot of the Global Wealth Management Trends and Themes Report, Download a Free Report Sample

Wealth Management Trends Market Report Overview

Wealth management is in for another challenging year, which is set to dampen profits and result in many disappointed clients. Looking at the market trends, there seem to be more challenges and threats than growth opportunities. Geopolitical tensions, inflation, and the Crypto Winter are all headwinds for the industry. Despite these crisis management issues, wealth managers are still looking to build up capabilities in ESG, expand in key growth markets, unlock the benefits of more personalization, and integrate artificial intelligence within more areas of their business.

This report considers the key trends and themes that will shape the wealth industry in 2023, including predictions regarding the course of the global wealth management market amid high inflation and geopolitical tensions.

| Key Trends | ESG, Recessionary Conditions, Cryptocurrencies, Russia/Ukraine Conflict, Inflation, Robo-Advice, and AI and Personalization |

Top Wealth Management Trends

Some of the top wealth management trends in 2023 are ESG, recessionary conditions, cryptocurrencies, Russia/Ukraine Conflict, inflation, robo-advice, and AI and personalization.

ESG

Environmental, social, and governance (ESG) is an enduring concern for wealth managers as they are at the forefront of the West’s financial war in support of Ukraine. Digitalization and consolidation are long-time strategic concerns for wealth managers as well. HNW investors are keen ESG investors, and demand for ESG investment products now outstrips that for philanthropy. Hence, supporting HNW investors in their philanthropic endeavors will remain an important aspect of wealth managers’ repertoire, given that ESG investments and philanthropy support are two distinct propositions.

Russia/Ukraine Conflict

In a bid to cripple Russia’s economy, the West has disconnected key sanctioned Russian banks from the SWIFT global financial system and prevented the Russian central bank from deploying its international reserves. The assets of major Russian banks have been hit with asset freezes and new business restrictions. Russia can no longer conduct transactions through the US and EU systems. Furthermore, G7 nations and the EU have revoked Russia’s most-favored nation status and denied borrowing privileges at leading multilateral financial institutions.

Inflation

Uncertainty remains a key investment theme as wealth managers and investors are scrambling to inflation-proof portfolios. Higher inflation amid slower growth has brought an end to the availability of cheap money and inflated asset prices. Returns are harder to come by as central banks across the world are enacting tighter monetary policies.

To know more about the Inflation trend, download a free report sample

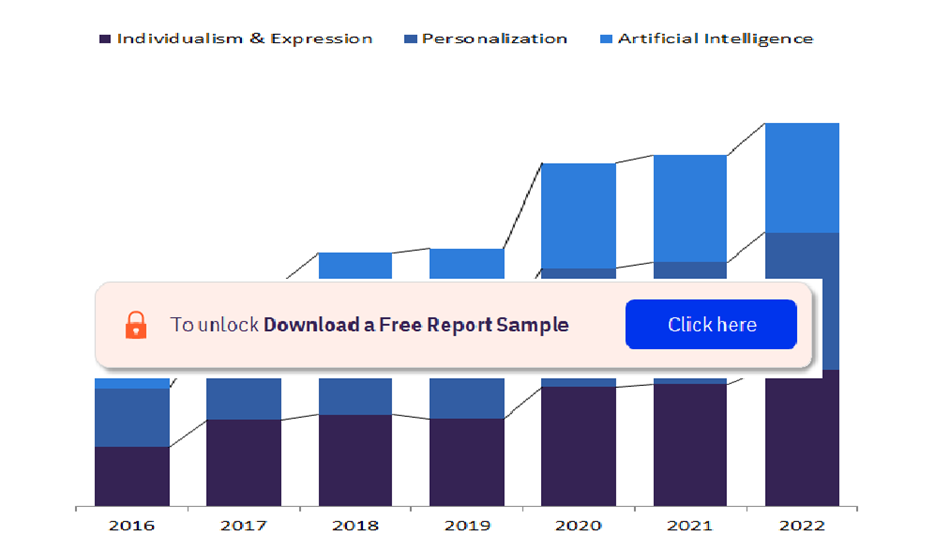

AI and Personalization

In theory, robo-advisors are supposed to churn through large amounts of market data to generate portfolio recommendations that match a wide range of client goals and profiles. However, in practice, this approach is not common. AI-supported investment management aims to generate these hyper-personalized portfolio recommendations and monitoring for even small-scale investors, all at minimal incremental cost. Steps have been made to incorporate this approach into offerings. Direct indexing is one example, increasingly bringing personalized portfolios to investors with lower assets. For instance, launched in July 2022, Fidelity’s Solo FidFolios is one of the first retail-oriented direct-indexing services. It uses AI to support tax management of the portfolio and provide personalized investment strategies that use fractional share trading.

To know more about the AI and Personalization trend, download a free report sample

Wealth Management Trends Report Overview

| Key Trends | ESG, Recessionary Conditions, Cryptocurrencies, Russia/Ukraine Conflict, Inflation, Robo-Advice, and AI and Personalization |

Key Highlights

- ESG remains the top issue for wealth managers.

- Global wealth managers will increasingly jockey for position in China and India.

- ChatGPT will be see extensive use in the advice market.

- Inflation will be the main investor concern around the world.

Table of Contents

Frequently asked questions

-

What are the key wealth management trends in 2023?

The key wealth management trends in 2023 are ESG, Recessionary Conditions, Cryptocurrencies, Russia/Ukraine Conflict, Inflation, Robo-Advice, and AI and Personalization.

-

Which two key areas are long time strategic concerns for wealth managers?

The two key areas which are long-time strategic concerns for wealth managers are digitalization and consolidation.

-

How are the macroeconomic conditions going to impact the wealth management industry in 2023?

Poorly performing financial markets, weighed down by recessionary fears and tighter monetary conditions are a major headwind for 2023.

-

What is the aim of AI-supported investment management?

The aim of AI-supported investment management is to generate hyper-personalized portfolio recommendations and monitoring for even small-scale investors, all at minimal incremental cost.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports