West Africa Gold Mining Market by Reserves and Production, Assets and Projects, Fiscal Regime with Taxes, Royalties and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

West Africa Gold Mining Market Report Overview

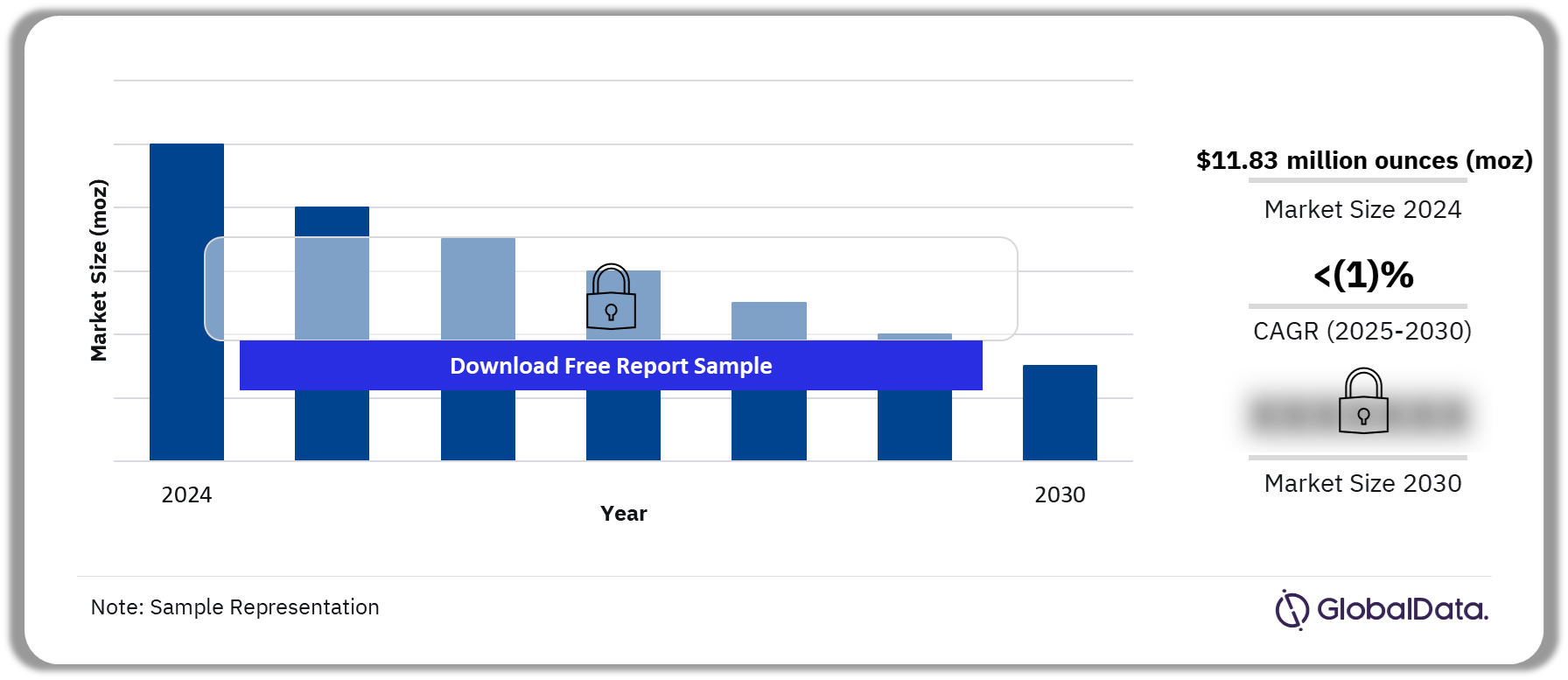

West African gold production is estimated to be 11.83 million ounces (moz) in 2024. The region has emerged as a key gold mining hub with major contributions from Ghana, Burkina Faso, the Republic of Guinea, and Mali. Looking ahead, gold production from these major markets is expected to decline at a CAGR of more than 1% over the forecast period (2025-2030) owing to political instability and unregulated illegal mining.

However, other West African countries, such as Ivory Coast, Niger, Liberia, Senegal, and Sierra Leone are working to develop their gold mining industries by encouraging foreign investment and increasing their supplies through the forecast period.

West Africa Gold Mining Market Outlook, 2024-2030 (Million Ounces)

Buy the Full Report for More Insights into the West Africa Gold Mining Market Forecast

The West Africa gold mining market research report provides a comprehensive coverage of the West Africa gold industry in 2024. The report provides historical and forecast data on gold production, production by company, production by country, reserves by country and world gold prices. Furthermore, the report includes a demand drivers section providing information on factors that are affecting the global gold industry. It further profiles major gold producers, and information on the major active, planned and exploration projects by region. These critical topics will help identify gaps in operations and make high-impact business strategies.

| Market Size (2024) | 11.83 million ounces (moz) |

| CAGR (2025-2030) | <(1)% |

| Forecast Period | 2025-2030 |

| Active Mines | · Loulo-Gounkoto Mine

· Fekola Mine · Ahafo Mine · Tarkwa Mine · Essakane Gold Mine |

| Development Projects | · Namdini Project

· Ahafo North Project · Bankan Gold Project · Syama Phase 2 Expansion Project · Kiaka Project |

| Exploration Projects | · Ferensola Iron Project

· Gaoua Copper Gold Project · ABC Gold Project · Sanutura Project · Bantou Project |

| Leading Companies | · Endeavour Mining Corp

· Newmont Corp · Gold Fields Limited · Barrick Gold · AngloGold Ashanti Ltd · B2 Gold |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

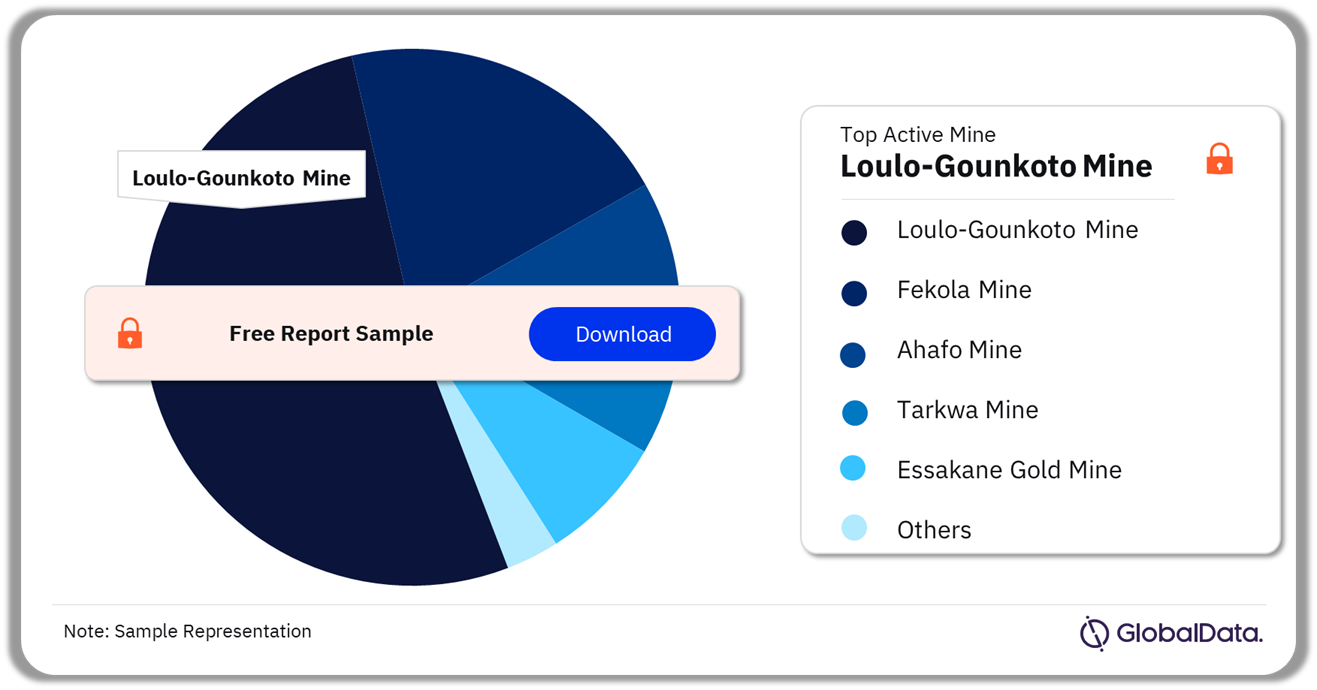

West Africa Gold Mining Market – Active Mines

A few of the active mines in the West African gold mining market are Loulo-Gounkoto Mine, Fekola Mine, Ahafo Mine, Tarkwa Mine, and Essakane Gold Mine among others. In 2024, Loulo-Gounkoto Mine has the highest gold production in West Africa.

West Africa Gold Mining Market Analysis by Active Mines, 2024 (%)

Buy the Full Report for More Active Mine Insights into the West Africa Gold Mining Market

Download a Free Report Sample

West Africa Gold Mining Market - Development Projects

A few of the upcoming gold mining projects in West Africa are the Namdini Project, Ahafo North Project, Bankan Gold Project, Syama Phase 2 Expansion Project, and Kiaka Project among others. On completion, the Namdini Project will have the highest gold production capacity in West Africa.

West Africa Gold Mining Market Analysis by Development Projects, 2024 (%)

Buy the Full Report for More Insights on Development Projects in the West Africa Gold Mining Market

Download a Free Report Sample

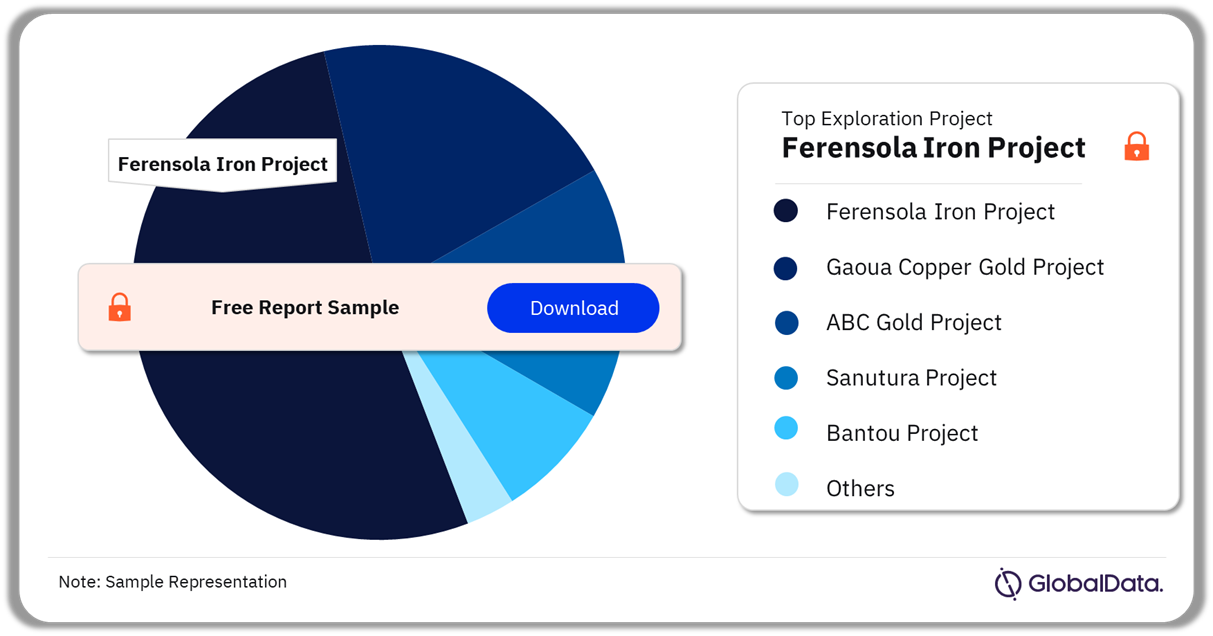

West Africa Gold Mining Market - Exploration Projects

A few of the exploration projects in the West Africa gold mining market are the Ferensola Iron Project, Gaoua Copper Gold Project, ABC Gold Project, Sanutura Project, and Bantou Project among others. As of 2024, the Ferensola Iron Project, owned by Power Metal Resources Plc has the highest capacity.

West Africa Gold Mining Market Analysis by Exploration Projects, 2024 (%)

Buy the Full Report for More Insights on Exploration Projects in the West Africa Gold Mining Market

Download a Free Report Sample

West Africa Gold Mining Market - Competitive Landscape

A few of the leading mining companies in the West Africa gold mining market are:

- Endeavour Mining Corp

- Newmont Corp

- Gold Fields Limited

- Barrick Gold

- AngloGold Ashanti Ltd

- B2 Gold

In 2024, Endeavour Mining Corp accounted for the highest share of the West Africa gold mining market. Headquartered in London, England, Endeavour Mining Plc is one of the largest mining companies in West Africa, with a presence in Burkina Faso, Senegal, Ivory Coast and Mali. The company is investing in on-site solar power to reduce its carbon emissions at its Sabodala-Massawa mine.

West Africa Gold Mining Market Analysis by Companies, 2023 (%)

Buy the Full Report for More Insights on Companies in the West Africa Gold Mining Market

Download a Free Report Sample

Scope

- The report contains an overview of the West Africa (Ghana, Mali, Burkina Faso, Republic of Guinea, Ivory Coast, Niger, Liberia, Senegal and Sierra Leone) gold mining industry including key demand driving factors affecting the West Africa gold mining industry.

- It provides detailed information on reserves, reserves by country, production, competitive landscape, major operating mines, major exploration, and development projects.

Reasons to Buy

- To gain an understanding of the West Africa gold mining industry, relevant driving factors.

- To understand historical and forecast trend on West Africa (Ghana, Mali, Burkina Faso, Republic of Guinea, Ivory Coast, Niger, Liberia, Senegal and Sierra Leone) gold production.

- To identify key players in the West Africa gold mining industry.

- To identify major active, exploration and development projects by region.

- To identify taxes and royalties in Ghana, Burkina Faso and Mali.

Table of Contents

Table

Figures

Frequently asked questions

-

Which are the leading companies in the West Africa gold mining market?

A few of the leading companies associated with the West Africa gold mining market are Endeavour Mining Corp, Newmont Corp, Gold Fields Limited, Barrick Gold, AngloGold Ashanti Ltd, and B2 Gold.

-

Which are the active mines in West Africa gold mining market?

A few of the active mines in the West Africa gold mining market are Loulo-Gounkoto Mine, Fekola Mine, Ahafo Mine, Tarkwa Mine, and Essakane Gold Mine among others.

-

Which are the development projects in West Africa gold mining market?

A few of the development projects in the West Africa gold mining market are Namdini Project, Ahafo North Project, Bankan Gold Project, Syama Phase 2 Expansion Project, and Kiaka Project among others.

-

Which are the exploration projects in West Africa gold mining market?

A few of the exploration projects in the West Africa gold mining market are Ferensola Iron Project, Gaoua Copper Gold Project, ABC Gold Project, Sanutura Project, and Bantou Project among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.