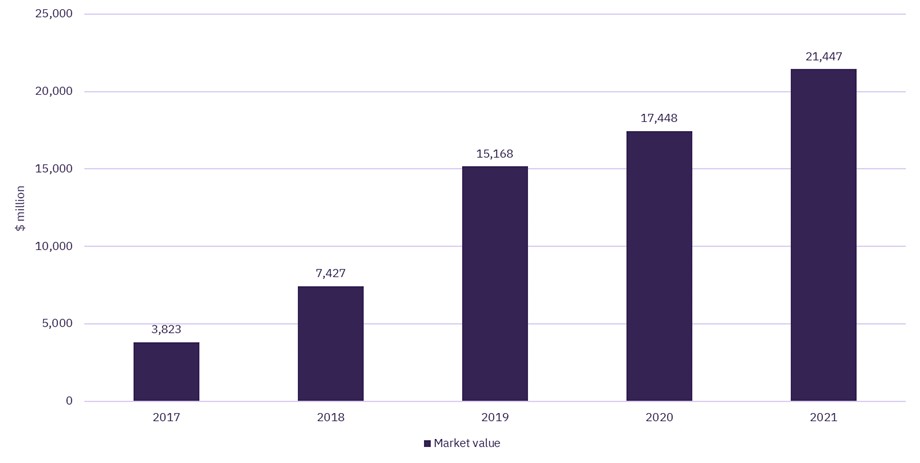

Market Value of Green Bond in Netherlands (2017-2021, $ Million)

-

The Market Value of Green Bond in Netherlands reached $21,447 million in 2021

-

This represents an increase of 22.9% as compared to $17,448 million in 2020

-

The indicator recorded a historical growth (CAGR) of 53.9% between 2017 and 2021

Market Value of Green Bond in Netherlands (2017-2021, $ Million)

Climate change is one of the biggest challenges globally. The world is already facing the effects of climate change in the form of extreme storms, frequent wildfires, regular drought, and other calamities. The public and the private sectors aim at tackling climate change issues by reducing pollution, keeping their carbon emissions in check, making optimum use of natural resources, and adopting sustainability practices. However, the implementation of these solutions requires considerable finance. One of the trending financial instruments available for companies working towards a sustainable future is ‘green bond’.

Green bonds are similar to regular bonds but with a major distinguishing factor – they are used exclusively to raise money to promote environmental projects related to renewable energy resources such as solar, wind, hydro, and nuclear, or practices that promote sustainable agriculture and forestry, sustainable water management, clean transportation such as electric vehicles (EVs), and green buildings. Green bonds are available in various types, including Use of Proceeds Bond (to finance green projects), Use of Proceeds Revenue Bond (to refinance green projects), Project Bond (to finance specific green projects), and Securitization Bond (to refinance portfolios of green projects).

The European Investment Bank (EIB) issued the first green bond in 2007. Strong demand from investors and sustainable initiatives taken by governments worldwide are propelling growth in this market. Green bonds come with tax incentives and favorable rules and regulations, and this is expected to boost the green bond market in the coming years.

The global green bond market has been growing exponentially. The major countries fueling this growth are the US, Germany, France, China, and the Netherlands. The green bond market value in Netherlands reached $21,447 million in 2021, recording a compound annual growth rate (CAGR) of 53.9% during 2017–21, and a 22.9% increase in market value in comparison to that in 2020.

Related Data & Insights

Related Companies

United States of America

China

United States of America

United States of America

United Kingdom

France

China

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward