Impact of Russia-Ukraine Conflict on Airlines Industry

-

The US, the European Union (EU), Canada, and other countries banned Russian flights from their airspace following the Russian invasion of Ukraine

-

In response to the sanctions, on March 7, 2022, the Russian aviation authority announced the closure of its airspace to 36 countries, including the 27 member countries of the EU

-

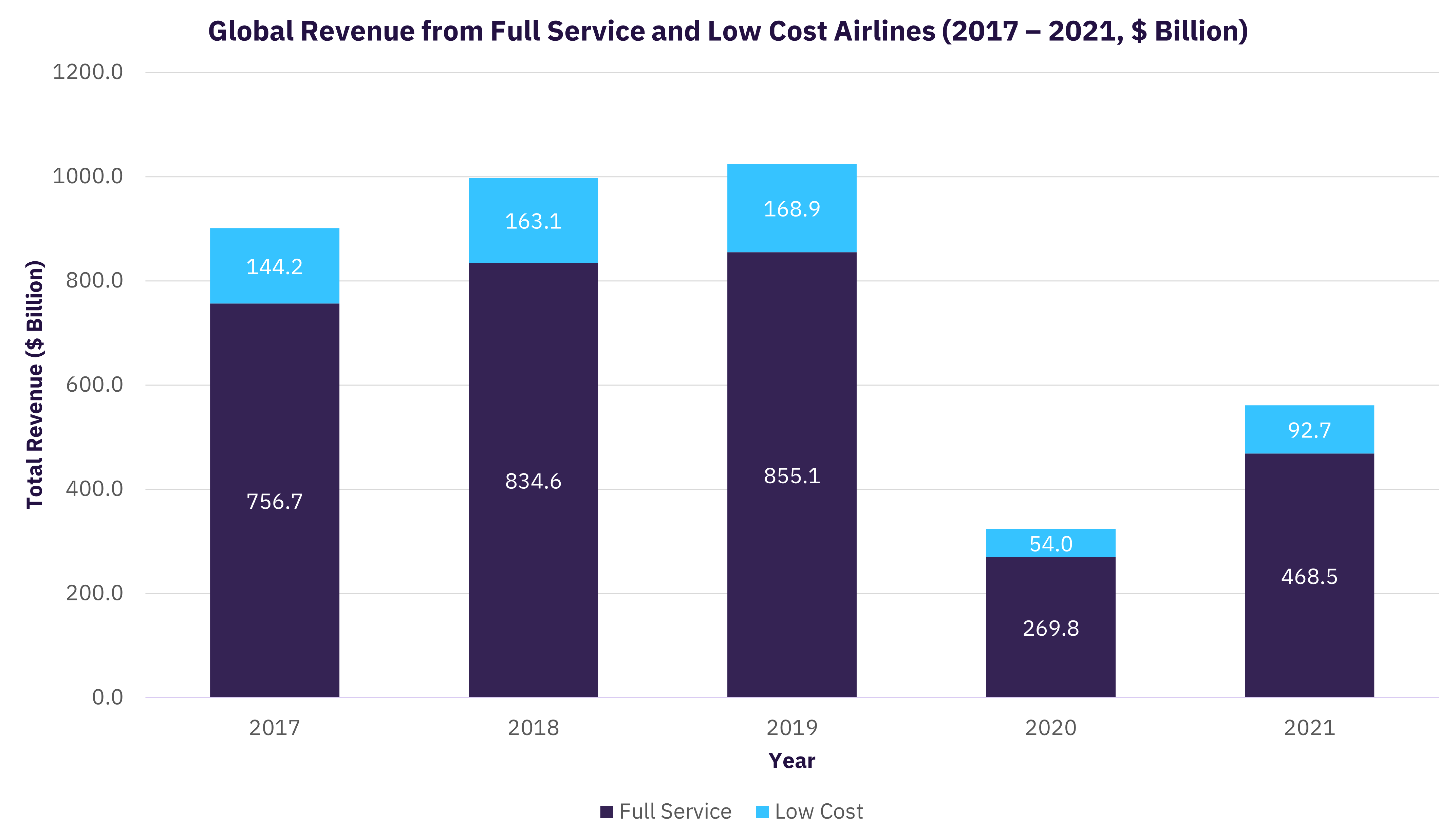

According to GlobalData, the global revenue from full service and low-cost airlines combined witnessed a recovery following the relaxation of COVID-19 travel bans, with revenue growth of 73%

Impact of Russia-Ukraine Conflict on Airlines Industry

On February 27, 2022, following Russia’s invasion of Ukraine, the EU imposed a blanket ban on flights and closed its airspace to all Russian flights across its 27 member countries. Later, Canada joined the EU in closing its airspace to Russian carriers. In a reciprocal action, Russia closed its airspace to all European aircraft. On March 1, 2022, the US announced the closure of its airspace to Russian planes. So far, 40 countries made similar moves in recent days. These responses to the conflict have spurred travel interventions across the globe.

Impact on Airline Industry

In 2021, most airlines started to recover from the pandemic, but dark clouds of the Russia-Ukraine conflict cast a shadow over the recovery of the airline industry. According to GlobalData, the total revenue from passenger airlines in the US was $304 billion in 2019, which decreased by over 50% to $103 billion following the outbreak of the COVID-19 pandemic in 2020. In 2021, the market recovered, recording $171 billion in revenue. Russia’s total revenue from passenger airlines was $22 billion in 2021, an increase of 29% in comparison to that in 2020. Similarly, other countries such as the UK, Germany, and Ukraine also saw significant revenue growth. The Russia-Ukraine conflict comes when the markets started to reopen after the COVID-19 pandemic and the airlines witnessed buoyant demand.

Rerouting or Cancellation of Flights: The result of closed airspace is rerouting. It means flights will have to take a different route to their destinations, with longer distances and fewer diversion airports. Diversion airports are technical stops for flights for refueling; fewer points will increase the flight time and cost. For example, direct flights from the US to India require Russian airspace, and in case of rerouting, flights will have to take a technical stop in Turkey or the UAE, which means longer distances and higher costs. Apart from higher airfares, traveling to Ukraine and its neighboring countries is not entirely safe due to the ongoing conflict and the flood of refugees crossing the borders.

Higher Fuel Costs: The sanctions on Russia have fuelled supply concerns and already affected oil prices. For an airline, fuel is one of the high operating costs. Rising fuel costs will dent the profitability of airlines, which are still recovering after the fall in demand owing to the pandemic. Closed airspace means longer flight time, more fuel consumption, more pilot hours, higher cost, and consequently higher fares. Higher fares could also affect demand recovery.

Titanium Supply: Titanium is a critical metal used in the manufacture of aircraft. Ukraine and Russia are among the major producers of titanium, and the ongoing conflict could disrupt supply in the near term. The Russian company, VSMPO-Avista, is the major supplier of titanium for Boeing and Airbus. In a recent statement, Airbus announced, “Geopolitical risks are integrated into our titanium sourcing policies. We are therefore protected in the short/medium term.”

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer