Angola Insurance Industry – Key Trends and Opportunities to 2025

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

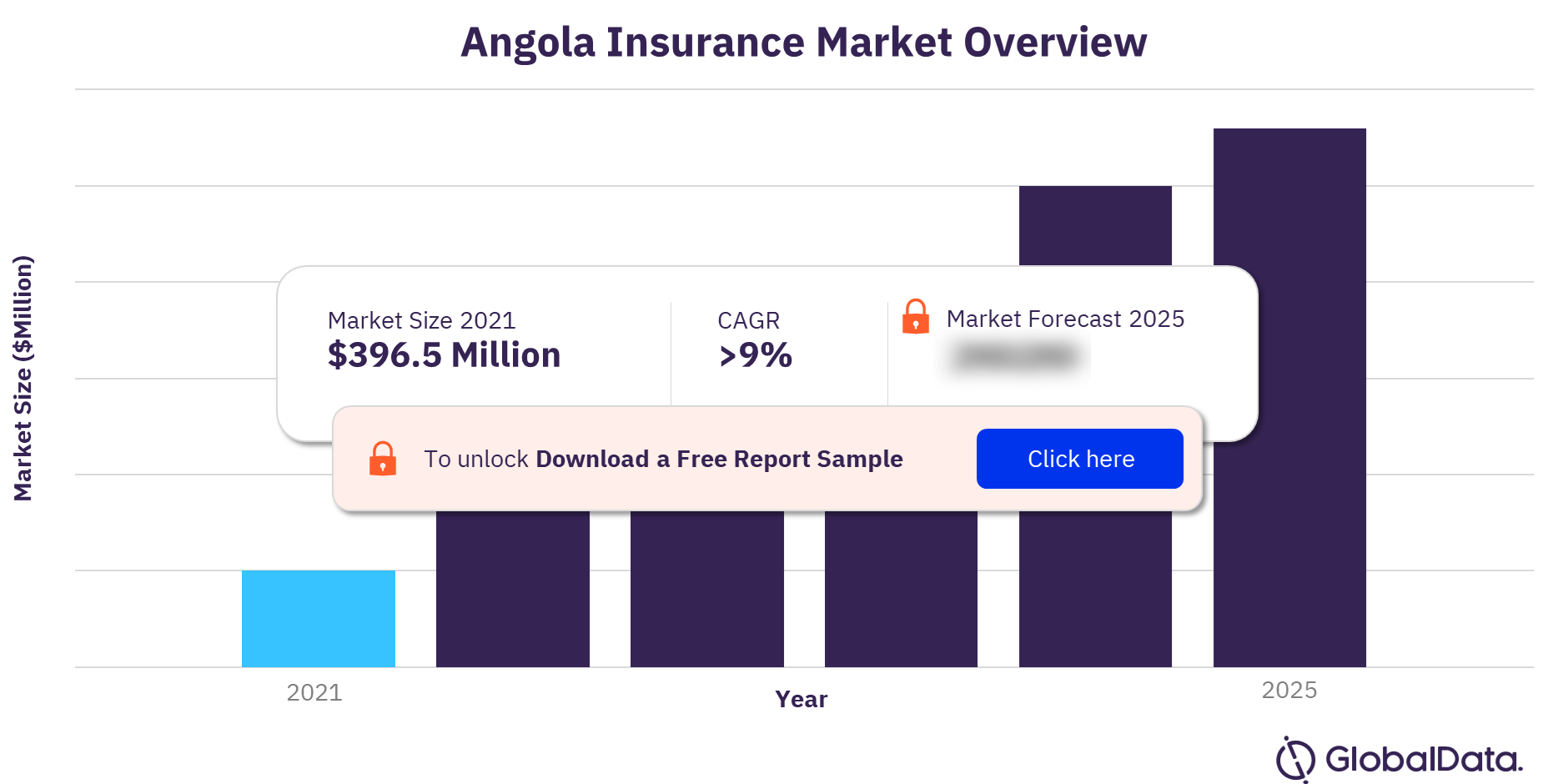

The Angola insurance market size was valued at $396.5 million in 2021. The market is expected to grow at a CAGR of more than 9% during the period 2020 and 2025. The COVID-19 pandemic significantly impacted various segments of the insurance market in Angola, including motor insurance, MAT insurance, and non-life PA&H insurance.

The Angola insurance market research report provides a detailed outlook by product category for the Angola insurance industry. It provides values for key performance indicators such as gross written premium, retail and commercial split, premium retained and ceded, profitability ratios, and premium by line of business, during the review period and forecast period. The report also gives a comprehensive overview of the Angolan economy and demographics, and the COVID-19 impact on the industry. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

Angola Insurance Market Overview

To gain more information on Angola insurance market forecast, download a free report sample

What are the key Angola insurance market trends?

The COVID-19 outbreak has led to a huge demand for the telemedicine market in the country. The segment is expected to grow exponentially on the back of a rise in the advent of digitalization. In February 2019, the Ministry of Health announced to provide telemedicine services in northeastern Angola. The Ministry aims to provide improved medical assistance to citizens in areas without specialized doctors.

An increasing number of insurers are adopting digitalization processes for customized and individual risk-based underwriting outcomes. Adopting digital technologies in their operations enables insurers to assist in risk assessment and reduce their operational costs of insurers. Furthermore, with the need for new products and customer service strategies, insurtech companies are helping insurers to digitize the entire insurance process.

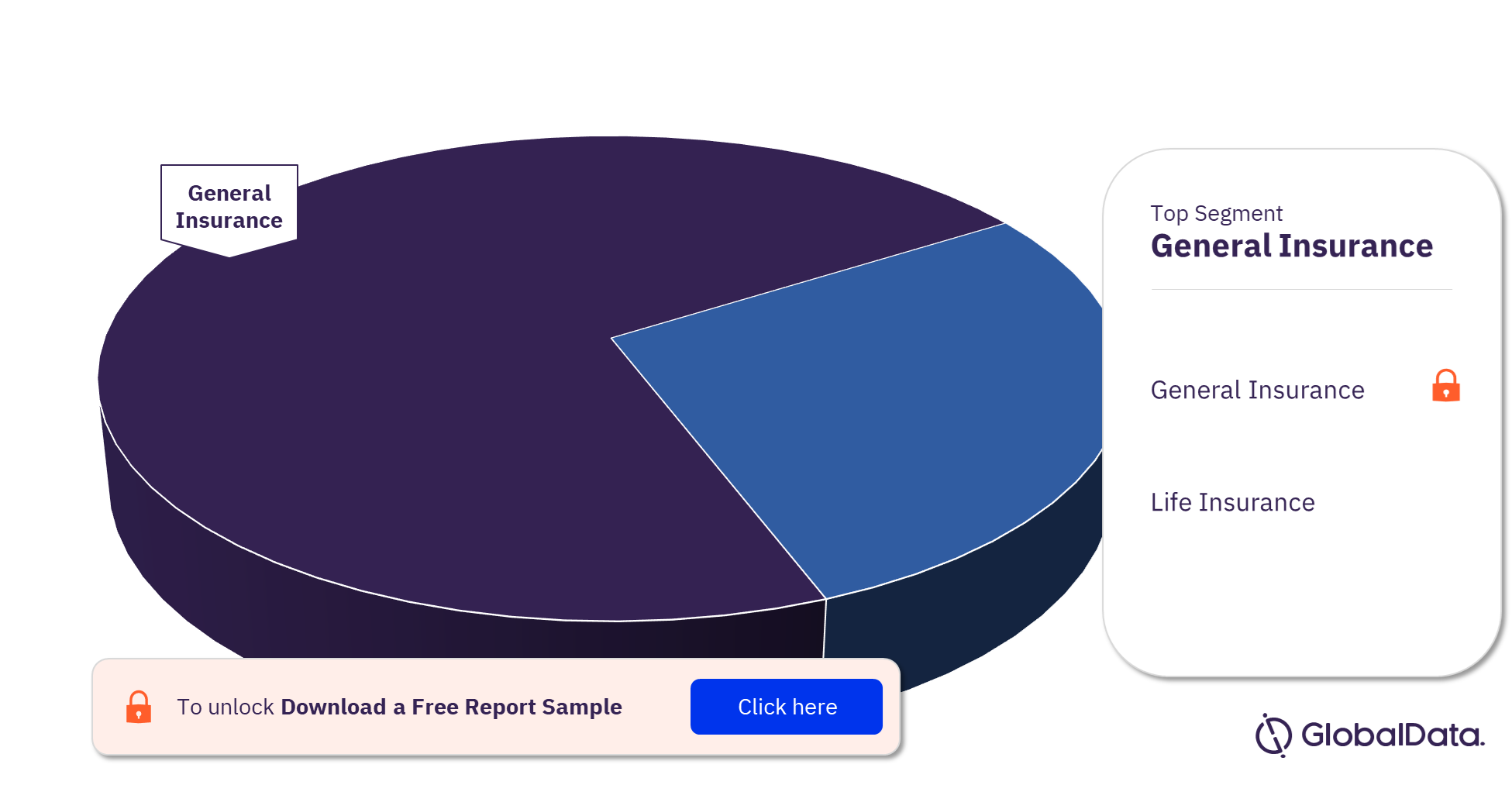

What are the key segments in the Angola insurance market?

The key segments in the Angola insurance market are life insurance and general insurance.

Life insurance market in Angola

The growth of Angola’s life insurance market declined in 2020 owing to the COVID-19 pandemic, which caused lower economic activities and decreased the employment rate and household income in the country. Penetration of life insurance was very low compared to the emerging and developed markets’ penetration rates.

General insurance market in Angola

The Angola insurance industry was dominated by the general insurance segment in 2020. Non-life PA&H was the largest insurance class in 2020 followed by property insurance and motor insurance.

Angola Insurance Market Analysis by Segments

For more segment insights, download a free report sample

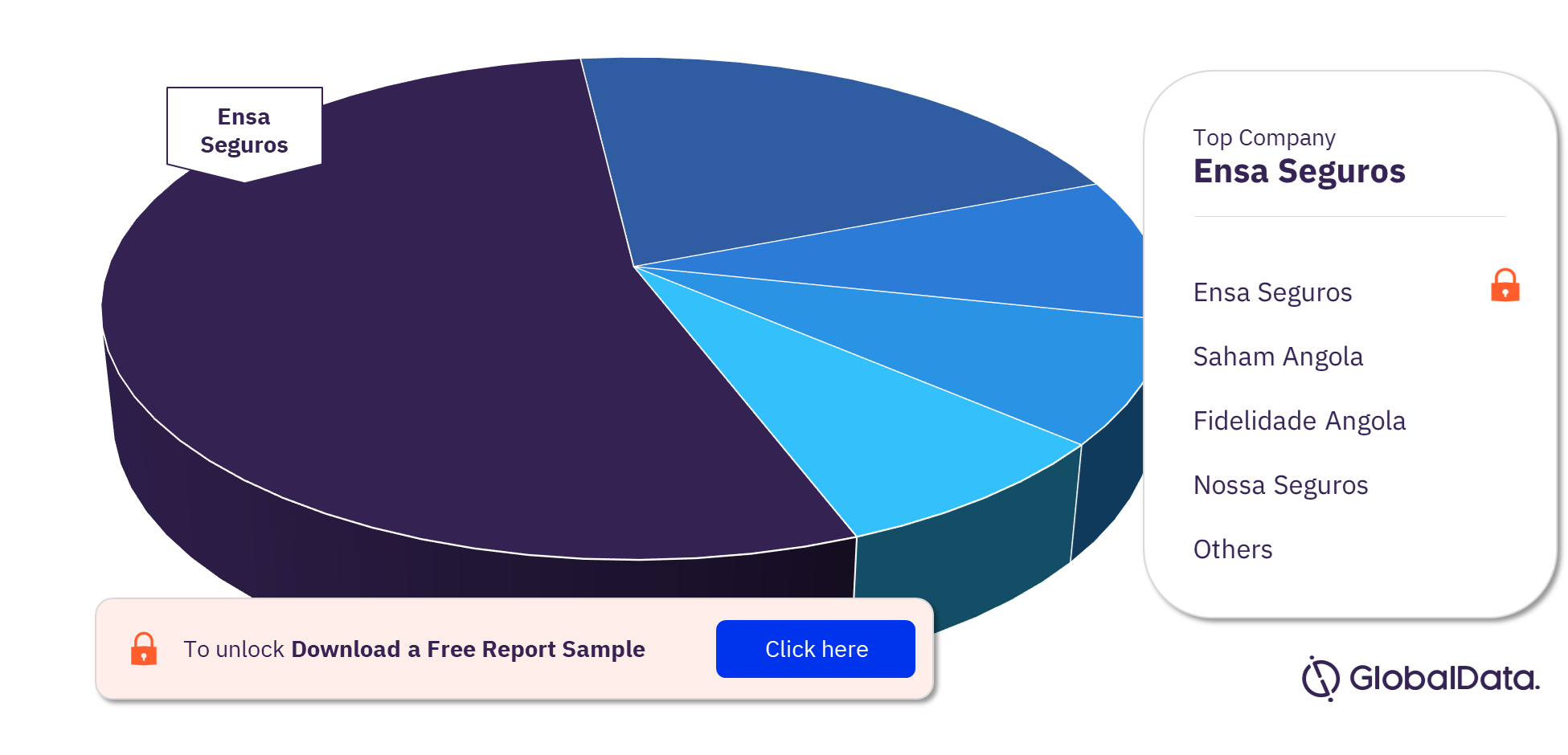

Which are the leading companies in the Angola insurance market?

The leading companies in the Angola insurance industry are Ensa Seguros, Saham Angola, Fidelidade Angola, Nossa Seguros, BIC Seguros, Global Seguros, Aliança Seguros, Prudencial Seguros, Fortaleza Seguros, and Mundial Seguros SA. Confiança Seguros and Bonws Seguros were the fastest growing insurers during the review period.

Angola Insurance Market Analysis by Companies

To know more about the leading companies, download a free report sample

Market Report Scope

| Market size (2021) | $396.5 million |

| CAGR (2020 – 2025) | >9% |

| Key segments | Life Insurance and General Insurance |

| Leading companies | Ensa Seguros, Saham Angola, Fidelidade Angola, Nossa Seguros, BIC Seguros, Global Seguros, Aliança Seguros, Prudencial Seguros, Fortaleza Seguros, and Mundial Seguros SA |

Scope

This report provides a comprehensive analysis of the Angola insurance industry –

- It provides historical values for the Angola insurance industry for the report’s review period, and projected figures for the forecast period.

- It offers a detailed analysis of the key categories in the Angola insurance industry, and market forecasts to 2025.

- It profiles the top life insurance companies in Angola and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Angola insurance industry, and each sub-segment and category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Angola insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

- Gain insights into key regulations governing the Angola insurance industry, and their impact on companies and the industry’s future.

Saham Angola

Fidelidade Angola

Nossa Seguros

BIC Seguros

Global Seguros

Aliança Seguros

Prudencial Seguros

Fortaleza Seguros

Mundial Seguros, SA

Table of Contents

Frequently asked questions

-

What was the Angola insurance market size in 2021?

The insurance market size in Angola was valued at $396.5 million in 2021.

-

What is the Angola insurance market growth rate?

The insurance market in Angola is expected to grow at a CAGR of more than 9% during the period 2020 and 2025.

-

What are the key segments in the Angola insurance market?

The key segments in the Angola insurance market are life insurance and general insurance.

-

Which are the leading companies in the Angola insurance industry?

The leading companies in the Angola insurance industry are Ensa Seguros, Saham Angola, Fidelidade Angola, Nossa Seguros, BIC Seguros, Global Seguros, Aliança Seguros, Prudencial Seguros, Fortaleza Seguros, and Mundial Seguros SA.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports