Asia Pacific (APAC) Enterprise IT Outlook Bundle

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Asia Pacific Enterprise IT Outlook Bundle

The enterprise IT market is currently undergoing a surge in innovation and has the capability to transform the face of Asia-Pacific’s business landscape faster than ever. Moreover, in the COVID-19 era, many firms are aggressively digitizing in response to rapid economic shifts.

As a part of this bundle, you will gain access to in-depth insights available in the following reports:

- China Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

- India Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

- South Korea Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

- Hong Kong Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

- China Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

- Australia Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

- India Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

- Japan Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

Report 1: China Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

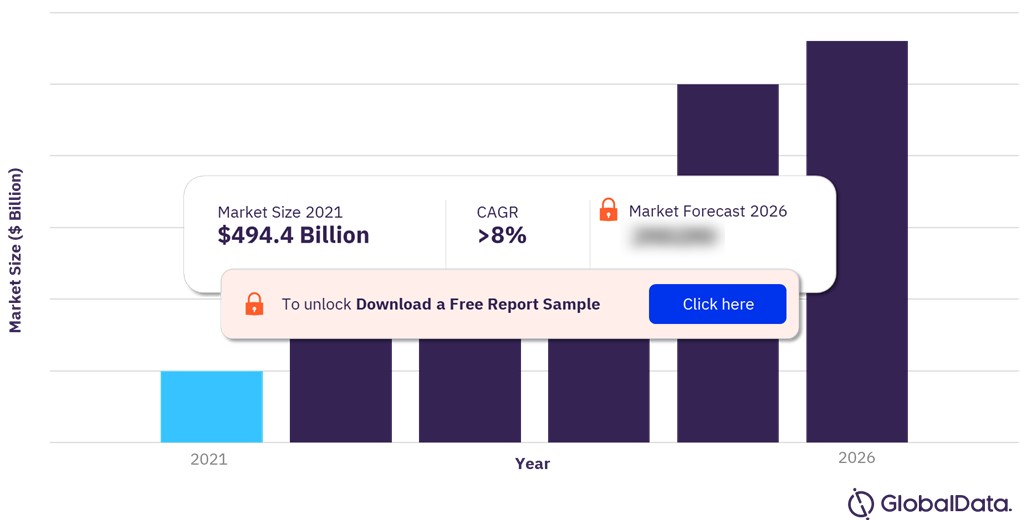

The China enterprise ICT market was valued at $494.4 billion in 2021 and is expected to achieve a CAGR of more than 8% during 2021-2026. China is one of the most important markets for ICT products and services in Asia-Pacific owing to its strong digital economy. The Chinese government’s push towards creating a diverse digital economy as well as Vision 2035 is significantly driving the demand for various ICT products and services in the country. Moreover, the integration of digital services components such as AI, IoT, etc., will play a significant role in the country’s ICT revenue opportunity growth.

China Total ICT Revenue Opportunity ($billions) 2021-2026

To gain more information on China enterprise ICT revenue opportunity, download a free sample

Report 2: India Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

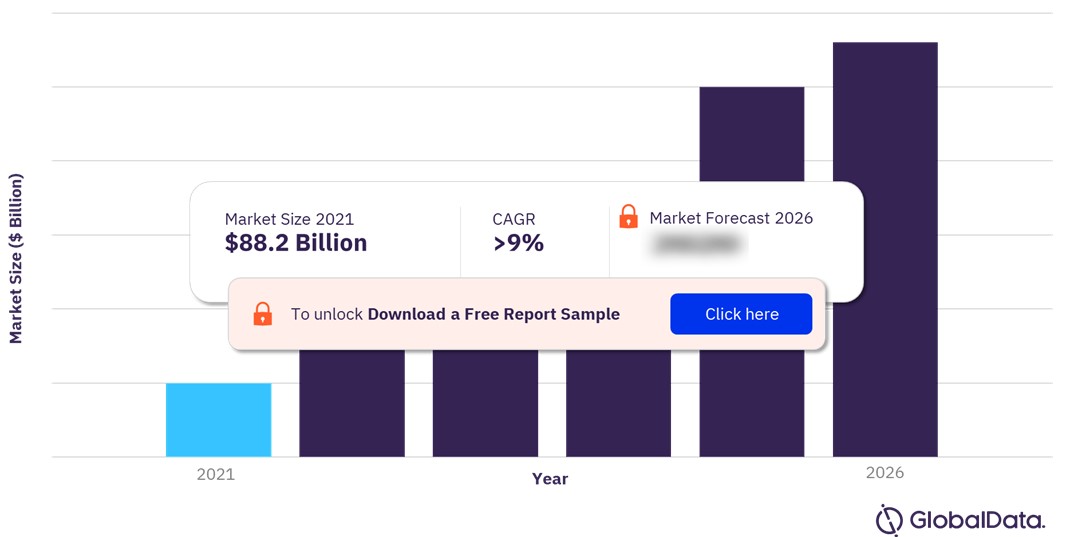

The India enterprise ICT market was valued at $88.2 billion in 2021 and is expected to achieve a CAGR of more than 9% during 2021-2026. The ongoing efforts undertaken by the Indian government to accelerate technology adoption and drive the country’s digital inclusiveness are expected to enhance ICT market growth in the country. The adoption of digital services by businesses and government agencies will also drive enterprise ICT spending in India. Moreover, digital transformation investments by enterprises cutting across verticals, especially spending on AI, IoT, cloud, and cybersecurity implementations will provide many opportunities to the ICT vendors and service providers.

India Total ICT Revenue Opportunity ($billions), 2021-2026

To gain more information on India enterprise ICT revenue opportunity, download a free sample

Report 3: South Korea Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

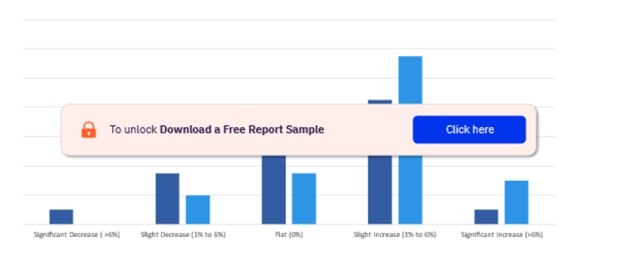

Most enterprises in South Korea have seen slight increases in their enterprises’ ICT budgets in 2022. This can be attributed to an increased focus on digital transformation among the country’s leading enterprises as well as SMEs. As many businesses are currently running in remote and hybrid mode, cloud computing will remain a key trend in enterprises’ day-to-day functioning. Moreover, businesses in South Korea are looking to harness information and communication technologies to remain competitive in the domestic and global markets.

Annual Change in Enterprise ICT Budget Allocation in South Korea (2021-2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in South Korea, download a free sample

Report 4: Hong Kong Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

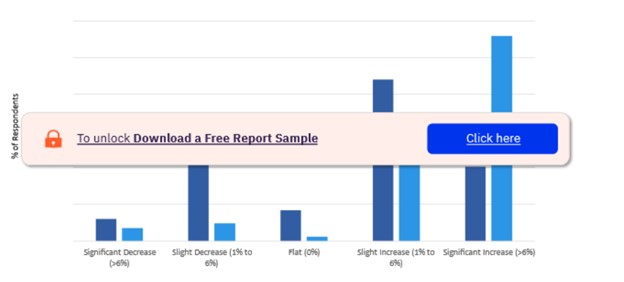

A majority of enterprises in Hong Kong have seen a slight increase in their enterprise ICT budget in 2022. One of the key reasons for this can be the ongoing government efforts to establish the country as one of the leaders in digital space. The government aims to achieve this through initiatives such as ‘Smart City Blueprint for Hong Kong,’ which includes financial, technological, and structural support for enterprises to adopt digital technologies. Moreover, cloud computing is providing many benefits to enterprises in setting up their virtual office and in deploying their key applications.

Annual Change in Enterprise ICT Budget Allocation in Hong Kong (2021 to 2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in Hong Kong, download a free sample

Report 5: China Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

Most enterprises have seen moderate increases in their ICT budgets for their internal ICT departments and business functions for 2022 over 2021. The increase in enterprise ICT budget in the country can be attributed to government initiatives such as “Made in China 2025,” “China Standards 2035,” as well as digital economy initiatives outlined in the country’s “14th Five-Year Plan.” Moreover, cloud computing is offering many benefits to enterprises. Currently, ICT players like Baidu, Alibaba, and Tencent are not only gaining prominence in China but also expanding their capacity to serve enterprises either independently or in partnership with international cloud players.

Annual Change in Enterprise ICT Budget Allocation in China (2021-2022 vs. 2020-2021)

To know more about changes in enterprise ICT budget allocation in China, download a free sample

Report 6: Australia Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

A majority share of enterprises in Australia has seen an increase in their ICT budgets in 2022. The continued adoption of remote/hybrid working models is contributing to this increased ICT spending preference among enterprises especially in enabling technologies like mobility, security, communication, and collaboration solutions. Likewise, cloud adoption in Australia has witnessed a significant acceleration in the last few years. Most recently, the US-based cloud security and compliance provider Qualys announced the establishment of a new multi-tenant cloud platform in Australia and highlighted the growing customer base for cloud services in the country.

Annual Change in Enterprise ICT Budget Allocation in Australia

To know more about changes in enterprise ICT budget allocation in Australia, download a free sample

Report 7: India Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

Most enterprises saw an increase in ICT budgets for internal ICT departments and business functions this year. The increase in enterprise ICT budget in the country can be attributed to the growing focus on digital transformation activities like cloud migration, automation, and upgrading of legacy IT infrastructure alongside favorable government policies that envision Digital India. Furthermore, firms across geographies and verticals are utilizing cloud computing to deploy their key applications and data to benefit from the scalability as well as the cost advantage offered by the cloud.

Annual Change in Enterprise ICT Budget Allocation in India

To know more about changes in enterprise ICT budget allocation in India, download a free sample

Report 8: Japan Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

Most enterprises have seen an increase in ICT budgets for internal ICT departments and business functions in 2022. The increase in enterprise ICT budget in Japan can be attributed to the pent-up demand for ICT systems and applications following a conservative spending approach adopted by them amidst the COVID-19 crisis. The expected recovery in the economic scenario for the country can also be one of the reasons behind the demand. Moreover, many enterprises in Japan are being exposed to cloud infrastructure and are continuing with their cloud implementations.

Annual Change in Enterprise ICT Budget Allocation in Japan

To know more about changes in enterprise ICT budget allocation in Japan, download a free sample

Table of Contents

Frequently asked questions

-

Report 1: China Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

-

What was the China enterprise ICT market size in 2021?

The enterprise ICT market in the China was valued at $494.4 billion in 2021.

-

Report 2: India Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

-

What was the India enterprise ICT market size in 2021?

The ICT market in India was valued at $88.2 billion in 2021.

-

Report 3: South Korea Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

-

What is the reason behind the increase in South Korea enterprises' ICT budgets?

The reason behind the increase in South Korea enterprises’ ICT budgets can be attributed to an increased focus on digital transformation among the country’s leading enterprises as well as SMEs.

-

Report 4: Hong Kong Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

-

What is the reason behind the increase in the enterprise ICT budget in Hong Kong?

One of the key reasons behind the increase in Hong Kong’s enterprise budget can be the ongoing government efforts to establish the country as one of the leaders in digital space.

-

Report 5: China Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

-

What is the reason behind the increase in the enterprise ICT budget in China?

The increase in enterprise ICT budget in China can be attributed to government initiatives such as “Made in China 2025,” “China Standards 2035,” as well as digital economy initiatives outlined in the country’s “14th Five-Year Plan.”.

-

Report 6: Australia Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services and Network and Communications

-

What is the reason behind the increased ICT spending preference in Australia?

The continued adoption of remote/hybrid working models is contributing to the increased ICT spending preference among enterprises in Australia.

-

Report 7: India Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

-

What is the reason behind the increase in the enterprise ICT budget in India?

The increase in enterprise ICT budget in India can be attributed to the growing focus on digital transformation activities like cloud migration, automation, and upgrading of legacy IT infrastructure alongside favorable government policies that envision Digital India.

-

Report 8: Japan Enterprise ICT Investment Trends and Future Outlook by Segments Hardware, Software, IT Services, and Network and Communications

-

What is the reason behind the increase in the enterprise ICT budget in Japan?

The increase in enterprise ICT budget in Japan can be attributed to the pent-up demand for ICT systems and applications following a conservative spending approach adopted by them amidst the COVID-19 crisis.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.