Asia-Pacific (APAC) Foodservice Market Size and Trends by Profit and Cost Sector Channels, Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

APAC Foodservice Market Report Overview

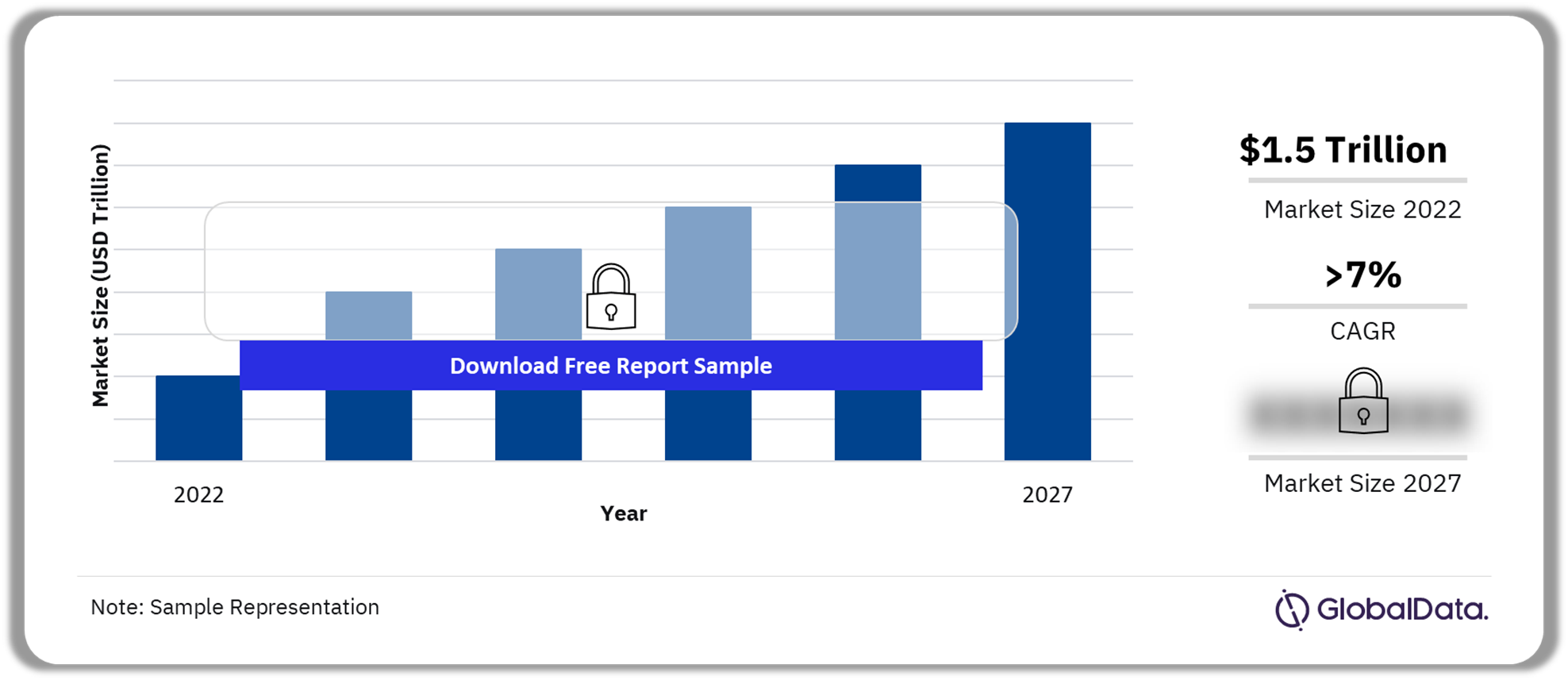

The APAC foodservice profit sector recorded sales of $1.5 trillion in 2022. Rising investments by global chain operators such as McDonald’s, Domino’s, and Starbucks to expand their footprint in Asia-Pacific is expected to drive the sector’s growth at a CAGR of over 7% during 2022-2027. The APAC foodservice profit sector growth will also be attributed to the continuous expansion of regional chain operators to other countries to minimize their risks due to volatile macroeconomic conditions. For instance, Cotti Coffee, a coffee & tea shop that was launched in China in 2022, entered South Korea, Indonesia, and Japan in 2023.

APAC Foodservice Profit Sector Outlook 2022-2027, (USD Trillion)

Buy the Full Report for More Insights on the APAC Foodservice Market Forecast

Download A Free Sample Report

The APAC foodservice market research report provides an in-depth evaluation of the foodservice market in the region, including an analysis of the key issues impacting the market and the opportunities they present for the sector participants. The report includes data and forecast of key channels (QSR; FSR; coffee & tea shop; and pub, club & bar) within the APAC foodservice market and gives an overview of market leaders within the four major channels.

| Market Size (2022) | $1.5 trillion |

| CAGR (2022-2027) | >7% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Profit Sector Channels | · Full-service Restaurant (FSR)

· Quick-service Restaurant (QSR) · Workplace · Accommodation · Pub, Club & Bar |

| Key Outlet Type | · Dine-in

· Takeout |

| Key Owner Type | · Independent Operators

· Chain Operators |

| Key Cost Sector Channels | · Education

· Healthcare · Military & Civil Defense · Welfare & Services · Complimentary Services |

| Key Companies | · Yum! Brands

· Zensho · Skylark Group · Akindo Sushiroi · Reins International · Fujian Wallace Food · Restaurant Brands International |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

APAC Foodservice Market Trends

- Convenience is the key: A large proportion of frequent visitors to foodservice channels in Asia-Pacific consider convenience and ease of consumption essentials or nice-to-have factors across different channels. Moreover, the COVID-19 pandemic saw the rise of operators with a focus mainly on takeouts and deliveries. For instance, Luckin Coffee built its business with an emphasis on lean store formats that depend more on takeouts and deliveries.

- Digitalization is a focus area: Operators have been investing in digital capabilities to enhance their in-store dining experience. From offering app-exclusive promotional deals to enabling consumers to order their food and drinks on the mobile app, customer engagement through online channels has become the norm.

Buy the Full Report for more Insights into the APAC Foodservice Market Trends

Download A Free Sample Report

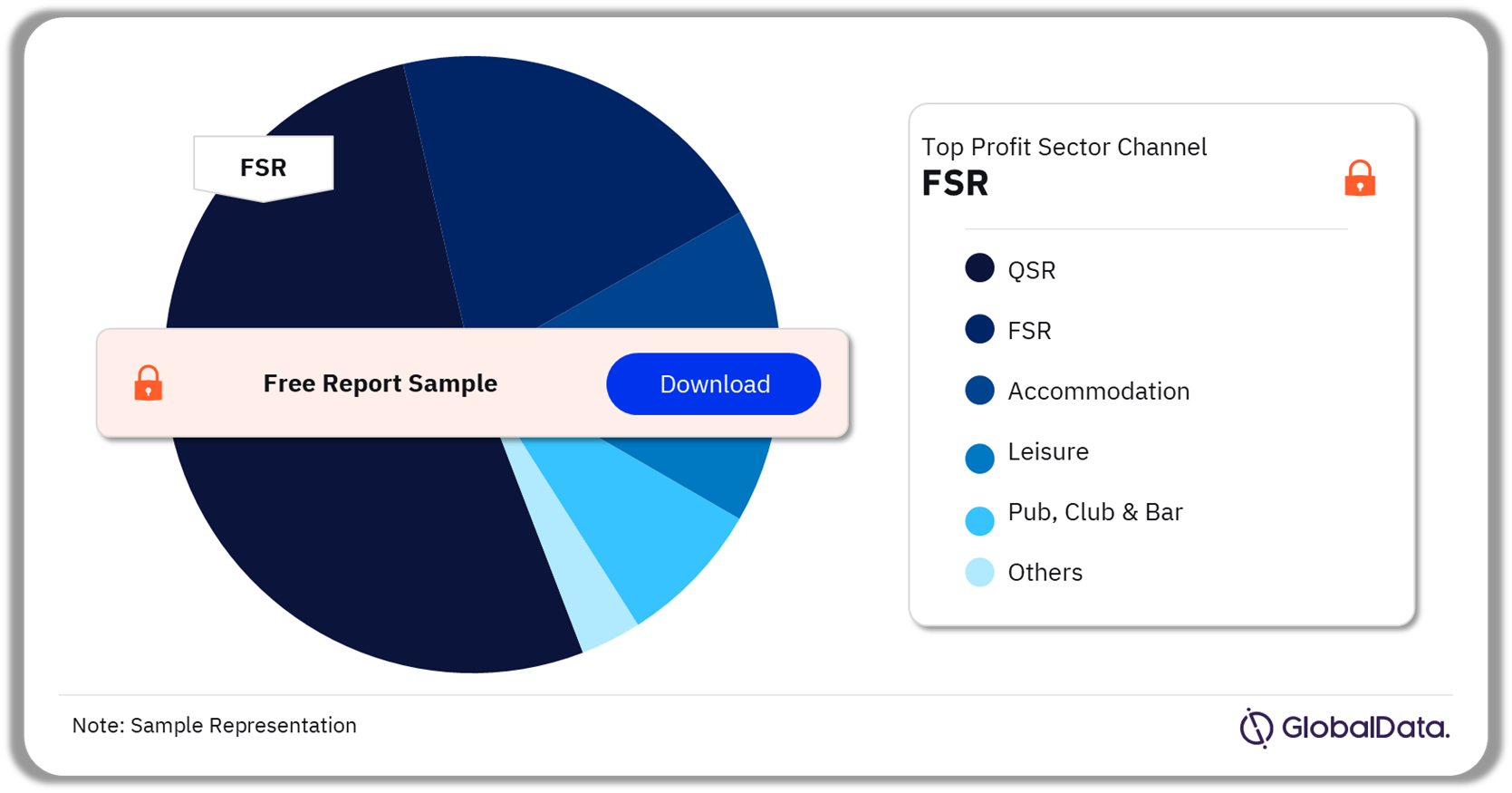

APAC Foodservice Market Segmentation by Profit Sector Channels

The FSR was the largest profit sector channel in 2022 by value sales

The key profit sector channels in the APAC foodservice market are FSR; QSR; accommodation; leisure; pub, club & bar; and retail. In 2022, the FSR was the leading profit sector channel, with a value share of over 52%, followed by QSR. Tourism expansion, an improvement in consumers’ purchasing power, and the growing desire among consumers to indulge will drive the sector’s growth during the forecast period.

APAC Foodservice Market Analysis by Profit Sector Channels, 2022 (%)

Buy the Full Report for More Channel Insights into the APAC Foodservice Market

Download A Free Sample Report

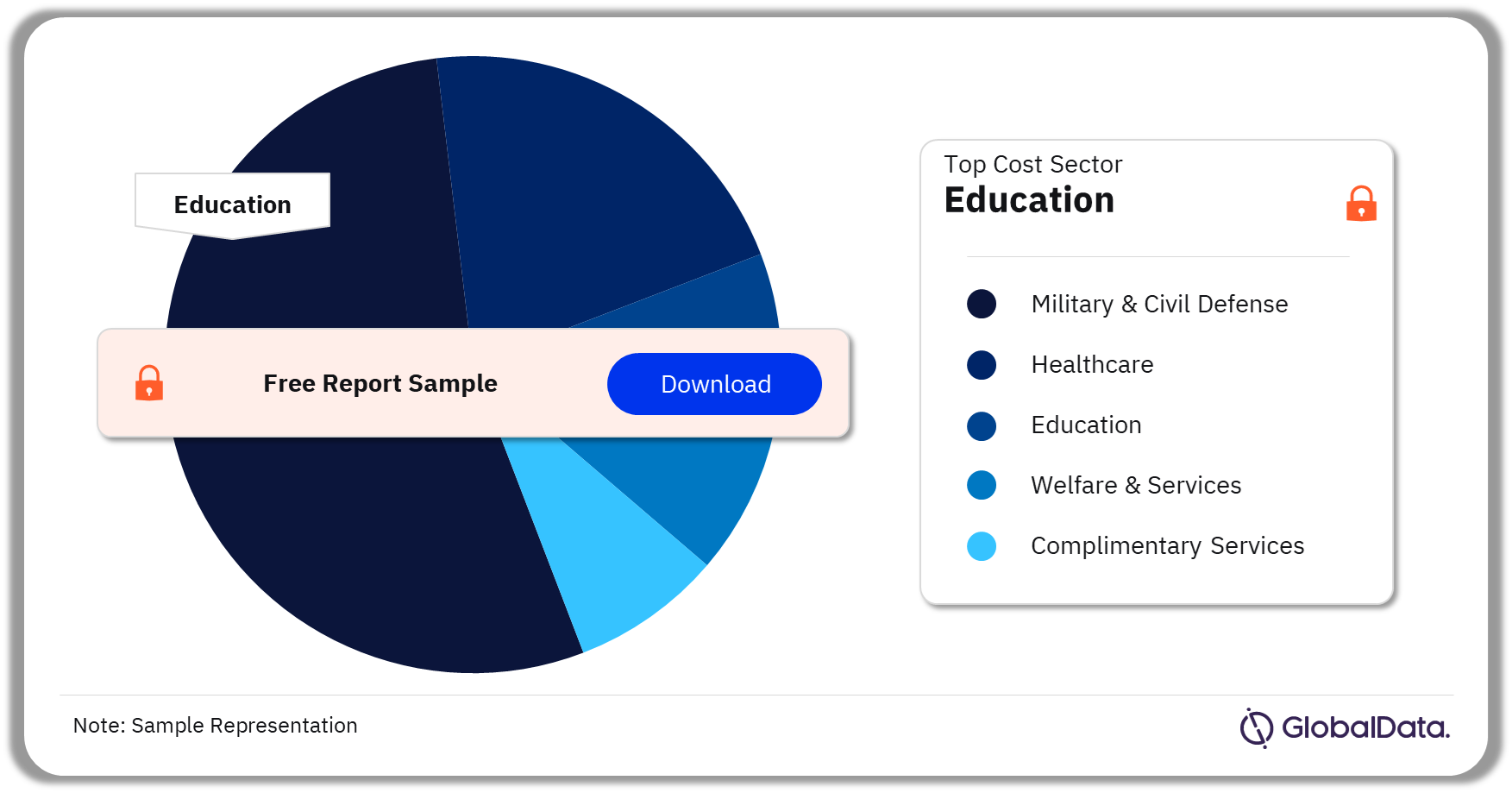

APAC Foodservice Market Segmentation by Cost Sector Channels

Education was the largest cost sector channel in 2022

The key cost sector channels in the APAC foodservice market are military & civil defense, healthcare, education, welfare & services, and complimentary services. In 2022, education was the largest cost sector, followed by healthcare, and military & civil defense.

APAC Foodservice Market Analysis by Cost Sector Channels, 2022 (%)

Buy the Full Report for More Information on the Cost Sectors in the APAC Foodservice Market

Download A Free Sample Report

APAC Foodservice Market – Competitive Landscape

Yum! Brands was the largest FSR operator in the region in 2022

The key foodservice companies in APAC are:

- Yum! Brands

- Zensho

- Skylark Group

- Akindo Sushiroi

- Reins International

- Fujian Wallace Food

Yum! Brands of Restaurant Brands International operates in Asia-Pacific in the FSR channel through its Pizza Hut brand. Pizza Hut has a presence in many major markets of the region, with China being the leading one. Malaysia, India, Indonesia, and Australia are the other leading markets. The chain has been investing in technology to enhance customer experience and attract more customers. For instance, it introduced AI-enabled, mood-detector screens that analyze consumers’ facial expressions as they stand in front of the screen and recommend certain pizzas according to their moods. This initiative was launched in a few select restaurants across India.

APAC Foodservice Market Analysis by Competitors

Buy the Full Report for Additional Information on APAC Foodservice Market Players

Download A Free Sample Report

APAC Foodservice Market – Latest Developments

- In February 2023, McDonald’s launched its nationwide delivery service through its MyMacca’s application in Australia.

- In August 2022, to counter rising prices in China, KFC launched a chicken bucket containing chicken feet, neck, wing tips, and other non-regular parts, which are cheaper and traditionally favored by Chinese people.

Segments Covered in the Report

APAC Foodservice Market Outlook by Profit Sector Channel (Value SGD Billion, 2017-2027)

- Full-service Restaurants (FSR)

- Quick-service Restaurants (QSR)

- Pub, Club & Bar

- Retail

- Accommodation

APAC Foodservice Market Outlook by Cost Sector Channels (Value, SGD Billion, 2017-2027)

- Military & Civil Defense

- Healthcare

- Education

- Welfare & Services

- Complimentary Services

Scope

The QSR channel was relatively more resilient during 2017–22 than all other profit sector channels. While other channels declined in value terms, QSR achieved a value CAGR of 0.4% in this period. In 2022, takeouts made up 61.2% of the QSR channel’s value. Their share more than doubled during 2017–22, rising from 29.1% in 2017 to 61.2% in 2022. Takeouts generated a CAGR of 16.5% in this period.

Full-service restaurant (FSR) was the largest channel in Asia-Pacific in 2022. In the region, the channel accounted for 52.3% of the profit sector’s value in 2022. China was the largest market in the region, with a channel value share of 70.7%.

The coffee & tea shop’s channel’s value declined at a negative CAGR of 1% during 2017–22. China was the largest market in 2022, with a value share of 32.1%. The number of outlets generated a CAGR of 6.1% over 2017–22.

The pub, club & bar channel’s value declined at a negative CAGR of 5.5% during 2017–22. India was the largest market in 2022, with a value share of 38.1%. The number of transactions decreased at a negative CAGR of 2.5% in the 2017–22 period, while the number of outlets fell at a negative CAGR of 1.5%.

Reasons to Buy

- Identify emerging/declining markets and understand specific forecasts of the foodservice market over the next five years to make informed business decisions.

- Understand the target audience and changing consumer behavior through a detailed analysis of the consumer segmentation, which elaborates on the desires of known consumers among all major foodservice channels (QSR; FSR; coffee & tea shop; and pub, club & bar).

Yum! Brands

Fujian Wallace Food

Restaurant Brand International

Domino’s Pizza

Zensho Holdings

Skylark Holdings

Akindo Sushiro

Starbucks

Shenzhen Meixixi Catering Management

Zhengzhou Liang’an Enterprise

Shenzhen Pindao Food & Beverage Management

Luckin Coffee

Country Style Cooking Restaurant Chain

Inner Mongolia Xiao Wei Yang Chained Food Service

Table of Contents

Frequently asked questions

-

What was the APAC profit sector market size in 2022?

The APAC profit sector market size was $1.5 trillion in 2022.

-

What will the APAC profit sector growth rate be during the forecast period?

The profit sector in APAC will grow at a CAGR of over 7% during 2022-2027.

-

Which was the leading profit sector channel in the APAC foodservice market in 2022?

FSR was the leading profit sector channel in the APAC foodservice market in 2022.

-

What cost sector channel had the highest share in the APAC foodservice market in 2022?

The education sector had the highest share in the APAC foodservice market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports