Artificial Intelligence (AI) Market Size, Share, Trends, Analysis and Forecast by Product/Service (Specialized AI Applications, AI Hardware, AI Platforms, AI Consulting and Support Services), Enterprise Size Band, Vertical and Region, by 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Artificial Intelligence (AI) Market’ report can help you:

- Make informed decisions about investments, partnerships, and product development.

- Stay ahead of the competition by identifying their positioning in the market.

- Expand product portfolios or invest successfully by identifying high-potential product/service types, growth trends, segments, and markets.

- Adjust business development strategies by anticipating expected changes in demand.

- Identify growth opportunities in potential regions and countries

How is our ‘Artificial Intelligence (AI) Market’ report different from other reports in the market?

- This report features a comprehensive market sizing analysis at segment level for more than 20 countries including historic and forecast market assessment for the period 2021-2026 providing valuable insights and supporting market entry and other strategic decisions. Our analysis is supported by robust research methodology and subject matter experts

- Detailed segmentation by product/service type, verticals, and enterprise size bands allows businesses to tailor their marketing strategies to the market.

- Value chain analysis that can help businesses understand the market by identifying the different stages involved in the creation, production, and distribution of AI products and services. By analyzing the value chain, businesses can identify areas where they can improve their efficiency and effectiveness, reduce costs, optimise supply chain and enhance their competitive advantage.

- Vendor growth innovation matrix and competitive profiling and benchmarking of key players provide a deeper understanding of industry competition.

- Valuable tool for AI companies to track and understand the latest developments and future scope in the market to re-evaluate their marketing strategies and maximize profitability

We recommend this valuable source of information to anyone involved in:

- AI Hardware Companies

- AI Services Companies

- AI Application Development Companies

- Machine Learning Companies

- Conversational Platform Companies

- AI Chip Manufacturing Companies

- Smart Robot Manufacturing Companies

- Investment and Venture Capitalists

- Start-ups and Seed Companies

Artificial Intelligence Market Overview

The global artificial intelligence market size will be valued at $97 billion by 2023 and is expected to grow at a CAGR of over 19% over the forecast period. Growing popularity of the metaverse and its integration with artificial intelligence is expected to bode well for market growth over the forecast period. Furthermore, increasing adoption of explainable AI (XAI) , natural language processing (NLP), chatbots in BFSI, retail, and e-commerce, advancements in quantum computing is anticipated to bode well for market growth over the next few years.

For enterprises, accumulating more data means gaining more insights. The value of ‘data’, comprising sensitive information like business plans, intellectual property, correspondence, customer records, etc. has grown over the years, considering the critical insights that it can provide to business owners. AI in this regard help firms generate key insights from data that would otherwise be impossible to uncover. Having such insights helps enterprises to make data-driven decisions, realize data-led innovation, develop new products and services serving customer needs, build business strategies, enhance customers engagement, and automate internal processes. Organizations that deploy AI can achieve step-function improvements in business processes throughout their value chain, resulting in increased business resilience, greater efficiency, improved profitability, and reduced environmental impact. Organizations can also leverage AI as a core enabler of digitalization.

Today, organizations across virtually every industry are deploying enterprise AI applications to address a broad range of use cases across the value chain, from predictive maintenance for a vast array of industrial assets – including aircraft, manufacturing equipment, power generation, and transmission assets, and oil and gas production equipment (compressors, pumps, valves, etc.) – to inventory optimization, fraud detection, anti-money laundering, securities lending optimization, customer retention, and more.

Artificial Intelligence Market Outlook, 2021-2026 ($ Billion)

To Gain More Information on the Artificial Intelligence Market Forecast, Download a Free Report Sample

Technology companies are increasingly implementing artificial intelligence in a wide variety of applications including autonomous cars, security systems, virtual assistants, disease detection, gaming, and others. Major companies such as International Business Machines Corp (IBM), Microsoft Corporation, Alphabet Inc, Intel Corp, Apple Inc are investing heavily in the research, development, and implementation of AI technology across industries. As of October 2022, Alphabet Inc. was in talks with Cohere Inc., a developer of natural language processing software to invest $200 million.

The adoption of AI around the globe is anticipated to be significantly impacted by developments in machine learning (ML). Businesses have incorporated ML into platforms or predictive data models that analyse behavioural data. Applications range from identifying bank fraud to determining a person’s credit worthiness, stopping cyberattacks, and displaying tailored advertisements to customers. The ability to personalise marketing efforts depending on linguistic settings, such as social media posts, emails, customer service contacts, and product evaluations, is made possible by natural language processing (NLP), a key application of machine learning (ML). Machines may learn new words and recognise word patterns in spoken language by using NLP algorithms, which can help them become more accurate over time. They can infer a customer’s preferences and purchasing intent by doing this.

The disruption caused by COVID-19 is accelerating the adoption of AI across all industries. For example, according to GlobalData’s 2021 Global Emerging Tech Trends survey, more than 75% of businesses believe AI has played a role in weathering the COVID-19 pandemic. Conversational platforms have become one of the more profitable areas over the past two years due to increased demand for support services. The pandemic has also accelerated AI research in the field of federated learning, enabling collaboration on models without disclosing confidential information.

| Market Size 2023 | $97 billion |

| Market Size 2026 | $163.6 billion |

| CAGR | 19% from 2022 to 2026 |

| Forecast Period | 2022-2026 |

| Historic Data | 2021 |

| Product/Service Segment | Specialized AI applications, AI hardware, AI platforms, and AI consulting and support services |

| Vertical Segments | BFSI, Communication, Construction, Consumer Goods, Education, Energy, Government, Healthcare, Information Technology, Manufacturing, Media, Medical Devices, Mining, Pharmaceuticals, Retail, Transport and Logistics, Travel and Leisure, Utilities, Food Service, and Others. |

| Enterprise Size Band | Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), Very Large (5000+) |

| Leading Companies | IBM Corporation, Microsoft Corporation, Alphabet Inc., Intel Corporation, Apple Inc, Advanced Micro Devices Inc (AMD), Alibaba, SenseTime Group Ltd. (SenseTime), Alteryx Inc, and SparkCognition Inc. |

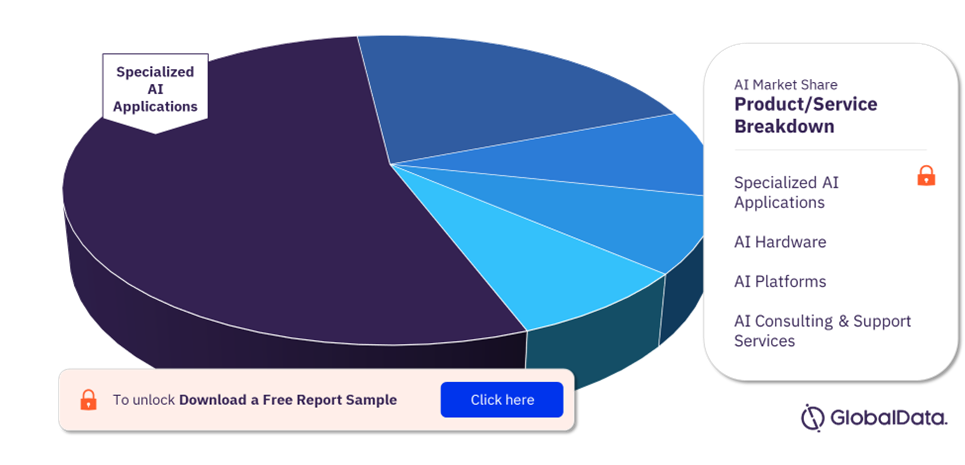

Artificial Intelligence Market Analysis by Product/Service

Based on Product/Service, the AI market has been categorized into Specialized AI applications, AI Consulting Services, AI Hardware, and AI platforms. Of the four AI product/service segments, the Specialized AI applications segment will have the largest share of revenue opportunity through 2021-2026. The Specialized AI applications segment will remain the largest revenue contributing segment through 2026.

Widespread integration and use of AI in specialized software applications and platforms such as image recognition, speech recognition, computer vision applications, natural language processing, sentiment analysis, risk management, content workflow management, and context awareness will especially drive revenue prospects for the specialized AI applications segment.

Artificial Intelligence Market Share by Product/Service, 2023 (%)

For More Product/Service Insights on AI Market, Download a Free Report Sample

Furthermore, the Specialized AI application segment is expected to account for above 35% of the overall AI market size by 2023. The market growth can be attributed to the COVID-19 disruption that accelerated the adoption of AI-driven horizontal business process applications such as enterprise risk management, collaborations to increase the productivity and efficiency of enterprises across the verticals, and content workflow management.

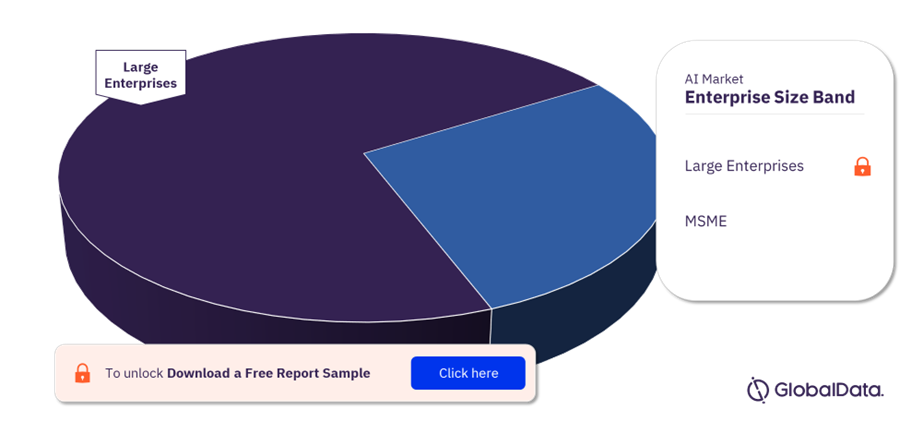

Artificial Intelligence Market Analysis by Enterprise Size Band

The large enterprise group includes companies with a workforce strength of more than 1000 employees. Over the course of the projection period, the category is expected to retain its dominance and take more than 50% of the market. Over the course of the forecast period, the market is expected to be driven by rapid digital business operations transformation and high financial capability to move from old to sophisticated application systems to streamline business function. The market expansion over the forecast period is also anticipated to benefit from increasing investment in AI-driven data science, big data, and machine learning approaches to provide data-led strategic decisions for its clients.

Artificial Intelligence Market Share by Enterprise Size Band, 2023 (%)

Fetch Sample PDF for Analysis by Enterprise Size Band, Download a Free Report Sample

The MSMEs segment is expected to be the fastest growing segment over the forecast period exceeding over 14% CAGR over the forecast period. However, considering the current scenario, low seed funding from investors to startups owing to a high degree of uncertainty over the global recession is expected to be one of the bottlenecks for market growth over the forecast period. Furthermore, the MSMEs segment continues to witness double-digit growth over the forecast period. This is because MSMEs prefer outsourcing AI services to consulting firms owing to limited IT budgets, vulnerable infrastructure, and lack of skilled resources.

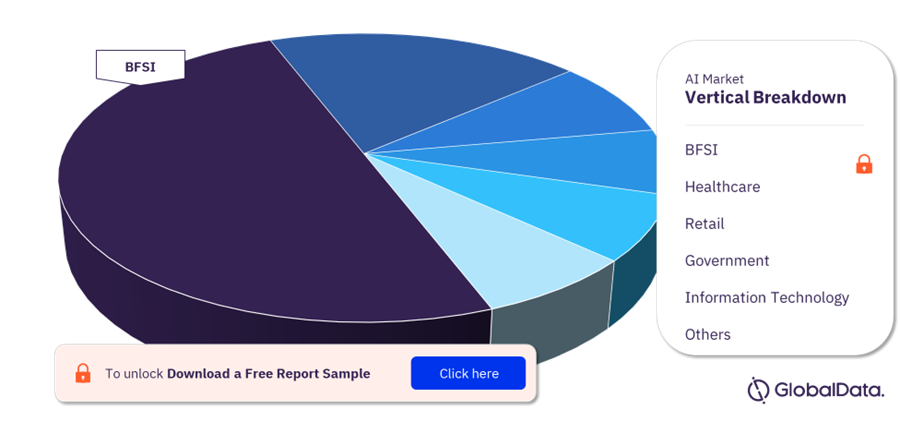

Artificial Intelligence Market Analysis by Vertical

Based on vertical, the AI market size has been categorized into BFSI, communication, construction, consumer goods, education, energy, government, healthcare, information technology, manufacturing, media, medical devices, mining, pharmaceuticals, retail, transport and logistics, and others. Among these, BFSI, healthcare, retail, government, and information technology are the top 5 verticals and contributing major share.

The BFSI segment will capture a major share by 2023. One of the reasons promoting market expansion over the projection period is the widespread implementation of natural language processing (NLP), machine learning (ML), predictive analytics, and chatbots in retail banking, financial markets, and the insurance industry. Additionally, the spike in demand for AI-enabled biometrics like fingerprint and facial recognition in payment transactions is anticipated to speed up market expansion throughout the course of the projected period.

Artificial Intelligence Market Share by Vertical, 2023 (%)

Artificial Intelligence Market Report with Detailed Segment Analysis is Available with GlobalData Now!, Download a Free Report Sample

One of the profitable industries for AI is the healthcare industry. Wearable technology, robotic surgery, automated diagnostics, virtual health assistants, improved compliance monitoring, and improved document review processes are some of the application areas. Healthcare organizations have adopted artificial intelligence technology as a result of the COVID-19 disruptions, which have further encouraged them to address problems from the first COVID wave. Early infection identification and diagnosis, contact tracking, the creation of medications and vaccines, and training of medical personnel are a few applications where artificial intelligence has aided in the fight against COVID-19 instances.

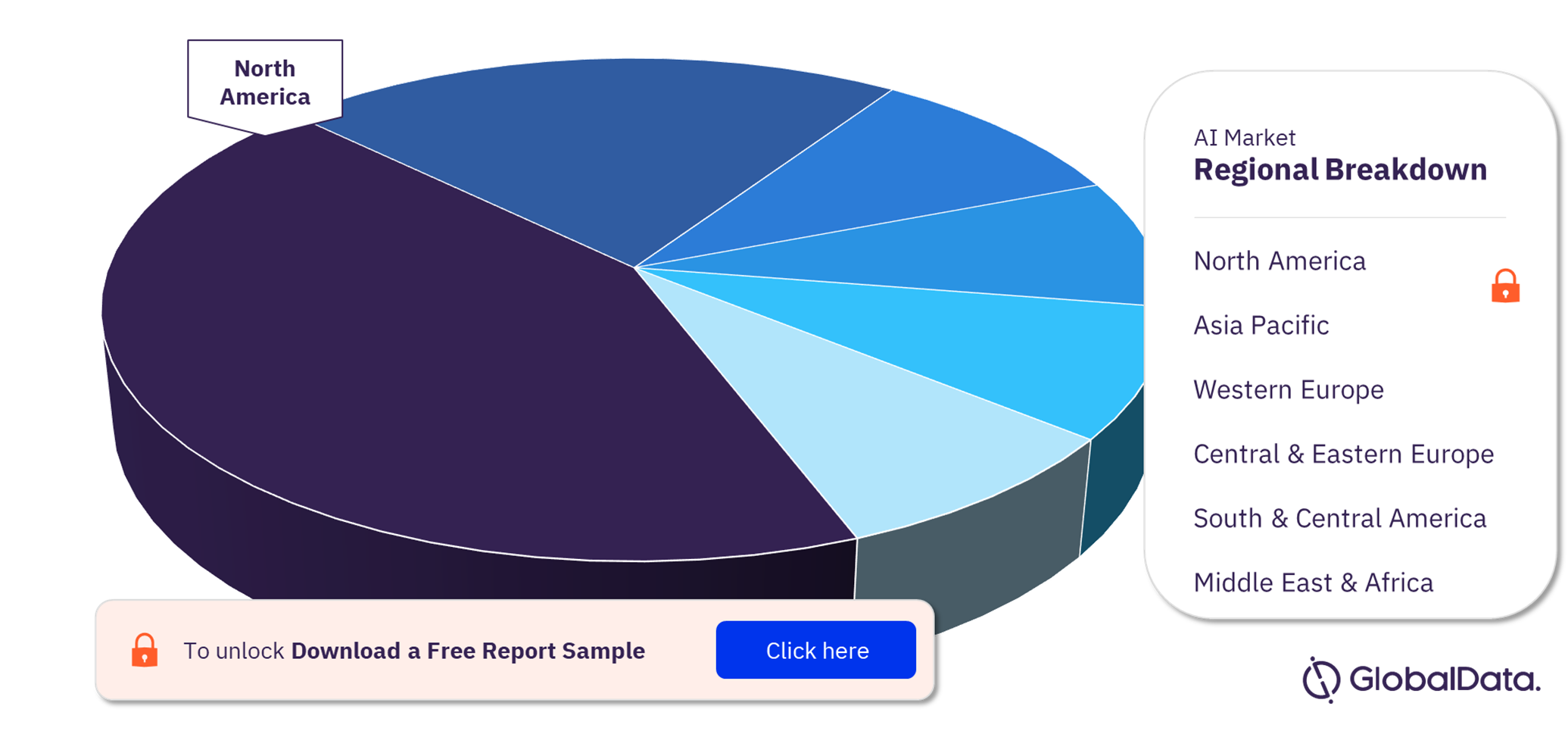

Artificial Intelligence Market Analysis by Region

North America accounted for the largest share of the total artificial intelligence market opportunity in 2023, the region will remain the leading revenue contributor over the forecast period. North America has one of the highest numbers of AI/ML-related startups as well as several established technology companies looking to embed and utilize AI in their existing offerings. Its growth will slightly be tapered as the AI landscape in the region and particularly in the US starts heading towards maturity from the early growth stage.

The US contributes the largest share of the AI revenue estimated for North America in 2023. This is mainly because the country hosts some of the largest tech companies like Apple, Google, IBM, and Microsoft, which have played a major role in the development and adoption of AI technology. The country hosts many tech startups with a strong focus on developing AI products and services. Government initiatives to drive the development and adoption of AI and the steady flow of investments from both government and private establishments in the research and development of AI technology for use in various applications also make the US a major market for AI products and services.

Well-established industry sectors in the US, especially banking, financial services, and insurance (BFSI), automotive, and healthcare industries have been adding significant demand for AI technology in the country. Most of the leading BFSI, automotive, and pharmaceutical companies in the country have already been leveraging the power of AI in a range of applications, including process automation, customer experience management, etc.

Artificial Intelligence Market Share by Vertical, 2023 (%)

Asia Pacific will continue to remain the second largest and the most attractive regional market for artificial intelligence through the forecast. The growth in the Asia Pacific region will largely be driven by a mix of institutional support to AI/ML commercialization by governments of countries like China, South Korea, and India, as well as by rapid growth in the utilization of AI/ML by technology-focused companies in the region across sectors such as e-commerce, manufacturing, and financial services.

Artificial Intelligence Market – Competitive Landscape

The AI market landscape is highly fragmented and includes numerous well-known companies from around the world, including IBM Corporation, NVIDIA, Alphabet Inc., Microsoft Corporation, and Amazon Web Services. These vendors are heavily investing in a variety of AI methodologies, with conversational platforms technology being the most promising. Over the past two years, the market has seen a surge in agreements, partnerships, and mergers and acquisitions (M&A) from both supplier and demand side market participants For instance, in March 2022, Microsoft acquired Nuance Communications, Inc, a technology company that offers conversational artificial intelligence (AI) and ambient clinical intelligence solutions. Considering these factors, the market competition is expected to be much more intense over the next few years.

Leading Players in the Artificial Intelligence Market

- IBM Corporation

- Microsoft Corporation

- Alphabet Inc.

- Intel Corporation,

- Apple Inc,

- Advanced Micro Devices Inc (AMD)

- Alibaba

- SenseTime Group Ltd. (SenseTime)

- Alteryx Inc

- SparkCognition Inc.

Other Artificial Intelligence Market Vendors Mentioned

Nvidia, AWS, Samsung, SONY Corporation, Huawei Technology Co. Ltd, Tencent, Graphcore, ABB, Wolfram, Oracle, SAS, SAP SE, Baidu, Salesforce, and BigML.

To Know More About Leading Artificial Intelligence Companies, Download a Free Report Sample

Artificial Intelligence Market Scope

GlobalData Plc has segmented the artificial intelligence market report by product/services, vertical, enterprise size band, and region:

Artificial Intelligence Market – Revenue Opportunity Forecast, by Product/Service Segments 2021-2026 (US$ million)

- Specialized AI applications

- AI hardware

- AI platforms

- AI consulting & support services

Artificial Intelligence Market – Revenue Opportunity Forecast by Vertical Industry Segments, 2021-2026 (US$ million)

- BFSI

- Healthcare

- Retail

- Government

- Information Technology

- Communication

- Consumer Goods

- Transport and Logistics

- Manufacturing

- Energy

- Utilities

- Construction

- Education

- Media

- Pharmaceuticals

- Others

Artificial Intelligence Market – Revenue Opportunity Forecast by Enterprise Size Band, 2021-2026

- Large Enterprise

- MSME

Artificial Intelligence Market – Revenue Opportunity Forecast by Regions, 2021-2026 (US$ million)

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- North America

- US

- Canada

- Mexico

- South & Central America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- Rest of South & Central America

- Western Europe

- Germany

- United Kingdom

- France

- Italy

- Netherlands

- Others

- Central & Eastern Europe

- Russia

- Turkey

- Rest of Central & Eastern Europe

- Middle East & Africa

- United Arab Emirates

- South Africa

- Saudi Arabia

- Kuwait

- Qatar

- Rest of MEA

Scope

The market intelligence report provides an in-depth analysis of the following –

- AI market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the Specialized AI applications, AI platforms, AI hardware, and AI consulting and support services.

- AI market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the key vertical industry segments.

- AI market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the enterprise size band perspective.

- The competitive landscape: an examination of the positioning of leading players in the AI market.

- Company snapshots: analysis of the market position of leading service providers in the AI market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the AI market and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in global AI markets.

- The report also highlights key platform/service segments (Specialized AI applications, AI platforms, AI hardware, and AI consulting and support services), vertical industries (BFSI, Communication, Construction, Consumer Goods, Education, Energy, Government, Healthcare, Information Technology, Manufacturing, Media, Medical Devices, Mining, Pharmaceuticals, Retail, Transport and Logistics, Travel and Leisure, Utilities, Food Service and Others), and enterprise size band (Micro, small, medium, large, and very large)

- With more than 20 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in AI markets.

- The broad perspective of the report coupled with comprehensive, actionable detail will help AI hardware & software vendors, service providers, and other AI players succeed in the growing AI market globally.

Key Players

International Business Machines CorpMicrosoft Corp

Alphabet Inc

Intel Corp

Apple Inc

Advanced Micro Devices Inc

Alibaba Group Holding Ltd

SenseTime Group Ltd

Alteryx Inc

SparkCognition Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the Artificial Intelligence market size in 2023?

The Artificial Intelligence market size will be valued at $97 billion by 2023.

-

What is the AI market growth rate?

The AI market is expected to grow at a CAGR of more than 19% during the forecast period 2022-2026.

-

What are the key AI market drivers?

A significant increase in demand for conversational platforms, advancement in quantum computing, a surge in demand for big data, data analytics, and machine learning, and their integration with AI to provide data-driven insights for customers are stimulating the AI market growth.

-

What are the key Artificial Intelligence market segments?

Platform/Service Segments: Specialized AI applications, AI hardware, AI platforms, AI consulting, and support services

Vertical Segments: BFSI, Healthcare, Retail, Government, Information Technology. and others,

Enterprise Size Band Segments: Micro, Small & Medium Enterprises (MSME) and Large & Very Large Enterprises.

-

Which are the leading AI companies?

The leading companies in the AI market are IBM Corporation, Microsoft Corporation, Alphabet Inc., Intel Corporation, Apple Inc, Advanced Micro Devices Inc (AMD), Alibaba, SenseTime Group Ltd. (SenseTime), Alteryx Inc, and SparkCognition Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.