Australia Energy Transition Market Trends and Analysis by Sectors and Companies Driving Development

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Australia Energy Transition Market Report Overview

The Australian government has significantly increased its emissions reduction targets, with the 2022 Climate Change Act legally committing the country to reducing its emissions by 43% (relative to a 2005 baseline) by 2030 and reaching net zero by 2050. While the country has significantly increased its renewable capacity in recent years, sectors such as hydrogen, electric vehicles, renewable fuels, and Carbon Capture, Use, and Storage (CCUS) remain in a relatively early stage of development.

Buy the Full Report for Additional Insights into the Australia Energy Transition Market Overview

Download a Free Sample Report

The ‘Australia Energy Transition Market Report’ analyzes the region’s energy transition to renewable energy sources from a fossil fuel-dominated market into a sustainable energy-producing region.

| Key Sectors | · Renewable Energy

· Electric Vehicles · Renewable Fuel · CCS/CCU · Hydrogen |

| Key Players (Solar) | · Sun Cable Pte Ltd

· Pilbara Energy Generation Pty Ltd · Lightsource BP Renewable Energy Investments Ltd · TotalEnergies SE · Total Eren SA |

| Key Players (Wind) | · Electricite de France SA

· Copenhagen Energy AS · BP Plc · Macquarie Group Ltd. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Australia Energy Transition Market Segmentation by Sectors

Renewable Energy A large increase in renewable capacity has decreased the country’s reliance on thermal resources. By individual technology, solar PV will have the largest share of power capacity, experiencing a strong CAGR of more than 12% between 2023 and 2035. The large share of solar PV reflects the environmental potential of this technology within Australia as well as the suite of government incentives that have been rolled out to encourage installations.

The second biggest renewable energy will be wind power, forecast to grow significantly in the coming years. The bulk of wind power will be provided by onshore wind farms, with this sub-segment accounting for 84% of total wind generation in 2030.

Electric Vehicles: Adoption of electric vehicles in Australia is expected to increase strongly between 2023 and 2030. This represents a strong increase compared to the 2018, where electric vehicles accounted for just 2% of light vehicles.

A strong increase in hybrid vehicles production has taken place in recent years because of their lower cost and greater availability. Car manufacturers such as Toyota have capitalized on the Australian appetite for hybrid vehicles, accounting for approximately 90% of hybrid vehicles sold within the country.

Renewable Fuels: Biofuels have had limited traction within Australia, with no active renewable refineries. Although its pipeline of projects will give a renewable fuel production capacity of 670mmgy by 2026. Factors such as high production costs, limited feedstock availability, and concerns of increasing food prices from using arable land for biofuel production rather than food production have all hampered adoption.

CCU: Australia currently has one Carbon Capture, and Utilization (CCU) project, with a further 24 projects in various stages of development. However, the development of this market has been significantly undermined by the scrapping of Australia’s CCUS Hubs and Technologies Program in October 2022.

Hydrogen: Australia’s hydrogen market is also in an early stage of development. However, several large-scale projects are expected to come online by the end of the decade, which will significantly boost production. A range of government grant schemes will also help to establish pipeline projects.

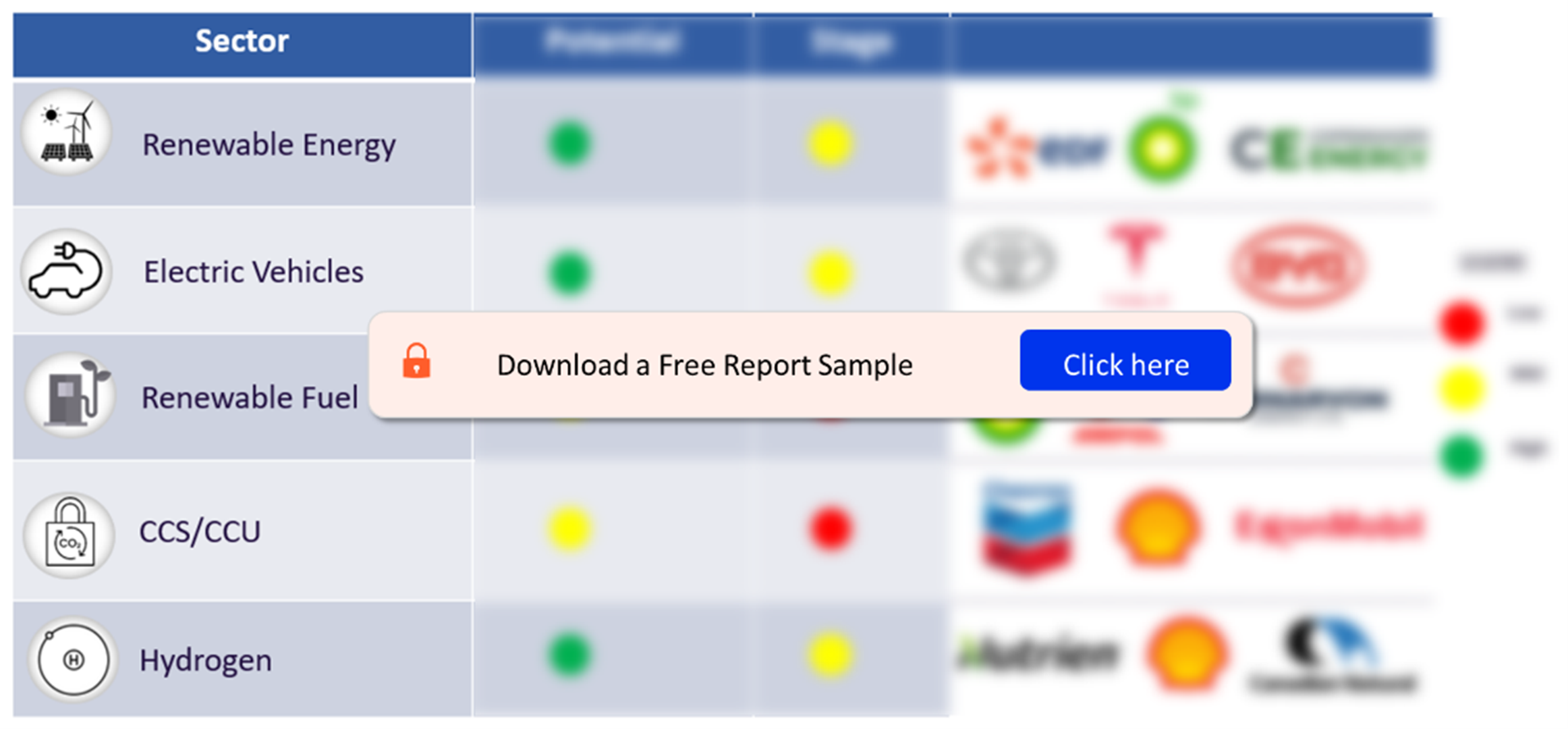

Australia Energy Transition Sector Grid and Leaders

Buy the Full Report for Additional Insights on the Key Sectors of the Australia Energy Transition Market

Download a Free Sample Report

Australia Energy Transition Market – Competitive Landscape

The ‘Australia Energy Transition Market Report’ analyses key players in the market. The leading companies in the Australian energy transition market are Sun Cable Pte Ltd, Pilbara Energy Generation Pty Ltd, Lightsource BP Renewable Energy Investments Ltd, TotalEnergies SE, Total Eren SA, Electricite de France SA, Copenhagen Energy AS, BP Plc, and Macquarie Group Ltd., among others.

Australia Energy Transition Market Players

Buy the Full Report for More Insights on the Key Players in the Australia Energy Transition Market, Download a Free Sample Report

Segments Covered in the Report

Australia Energy Transition Market Sectors Outlook (2018-2035)

- Electric Vehicles

- Renewable Fuels

- CCS/ CCU

- Hydrogen

Scope

The report provides:

- Regional Energy Transition in Australia

- Policies supporting energy transition

- Power renewable capacity and generation by 2035 and thermal decommissioning capacity

- Electric vehicles market and growth

- Renewable refineries in the EU

- Active and upcoming CCUS projects

- Hydrogen market analysis

Key Highlights

• Renewable power capacity share is expected to strongly increase in the coming years. As a result, renewables will overtake thermal in the power capacity share in 2028.

• By individual technology, solar PV will have the largest share of power capacity, alone accounting for 58.7% in 2035 after experiencing a strong CAGR of 12.4% between 2023 and 2035.

• While coal previously accounted for 60% of generation in 2018, the coming year will see its share in the power generation mix rapidly decline, with a negative CAGR of -6.5% between 2023 and 2035. Despite this rapid turnaround and Australia’s renewable energy aspirations, coal will still retain 14.6% share of power generation in 2035.

• Adoption of electric vehicles in Australia is expected to increase strongly between now and 2030, so that electric vehicles will account for 69% of light vehicle ownership.

• With no active renewable refineries, Australia currently has a low standing within the renewable fuels market. Although NSW and Queensland have their own biofuel polices, Australia lacks a federal biofuel mandate, which has arguably undermined business confidence.

• The bulk of Australia’s CCUS projects are in the feasibility stage and account for a maximum carbon capture capacity of 27.5mtpa.

• Australia’s 2023/24 budget sets aside over $2 billion for the nation’s renewable hydrogen industry.

Reasons to Buy

- Identify the latest trends, policies, and leaders in energy transition technologies.

- Develop market insight of current, in development, and announced capacity and latest trends of each of the sectors.

- Understand the potential market growth and policy support for renewable power, hydrogen, renewable refineries, CCU, and EVs.

- Facilitate understanding of where the market is growing as it is positioned as one of the main topics of the international agenda.

Toyota Motro Corporation

Tesla Inc.

BYD Co Ltd.

BP Plc

Ampol Ltd

Carnarvon Energy Ltd

Chevron Corp

Shell plc

Exxon Mobil Corp

Nutrien

Canadian Natural

Actividades de Construccion y Servicios SA

RCR Tomlinson Ltd

Shapoorji Pallonji & Co Pvt Ltd

Grupo Gransolar SL

Victoria Power Networks Pty Ltd

Canadian Solar Inc

PCL Construction Group Inc

Ellaktor SA

Green Light Contractors Pty Ltd

EMJ Corp

JinkoSolar Holding Co Ltd

First Solar Inc

Astroenergy

Trina Solar Co Ltd

JA Solar Technology Co Ltd

First Solar (Australia) Pty Ltd

LONGi Green Energy Technology Co Ltd

Risen Energy Co Ltd

TotalEnergies SE

Vestas Wind Systems AS

General Electric Co

Goldwind Science and Technology Co Ltd

Civil and Allied Technical Construction Pty Ltd

Siemens AG

Zenviron Pty Ltd

Suzlon Energy Ltd

Senvion SA

AECOM

Renewable Energy Systems Holdings Ltd

Nordex SE

Enercon GmbH

Baoding Tianwei Wind Power Technology Co Ltd

Vergnet SA

Transasia Minerals Ltd

ENEOS Corp

Oceania Biofuels Pty Ltd

Southern Oil Refineries (SRO)

AgBioEn

Jet Zero Australia Pty Ltd; Lanzalet Inc

Vitol Holding II SA

Frontier Impact Group

Chubu Electric Power Co Inc

Osaka Gas Co Ltd

Tokyo Electric Power Co Holdings Inc

Tokyo Gas Co Ltd

CWP Global

Intercontinental Energy Corp

Mining Green Energy Ltd

Macquaire Group Ltd

Woodside Energy Group Ltd

Aqua Aerem Pty Ltd

Copenhagen Infrastructure Partners KS

Hydrogen Renewables Australia

Eren Group SA

Province Resources Ltd

Hydrogen Utility Pty Ltd

Iwatini Corp

Kawasaki Heavy Industries Ltd

Keppel Corp Ltd

Marubeni Corp

Stanwell Corp Ltd

The Kansai Electric Power Co Inc

AGL Energy

Fortescue Industries Pty Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

Which is the leading power generation type in the Australia energy transition market in 2022?

Thermal was the leading power type in the Australia energy transition market in 2022.

-

Which renewable energy is expected to become the dominant source of power generation in Australia?

In terms of renewables, solar PV will become the dominant source of power for generation by 2035.

-

What are the key sectors in the Australian energy transition market?

The key sectors in the Australian energy transition market are electric vehicles, renewable fuels, CCS/ CCU, and hydrogen.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.