Australia Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services)

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Australia Enterprise ICT Country Intelligence Report Overview

The Australia Enterprise ICT Country Intelligence Report, a new Country Intelligence Report by GlobalData, summarizes key findings from GlobalData’s ICT Customer Insight Survey carried out in H1-2023 and GlobalData’s Market Opportunity Forecasts to 2027: Australia. It reveals an executive-level overview of how the overall ICT budgets and their allocations towards various segments have changed for enterprises in the country in 2023 compared to 2022 and ICT revenue opportunity with detailed forecasts of key indicators up to 2027. The report provides a detailed analysis of overall Australia’s enterprise ICT market trends and growth drivers based on GlobalData’s ICT Customer Insight Survey and GlobalData’s Market Opportunity Forecasts.

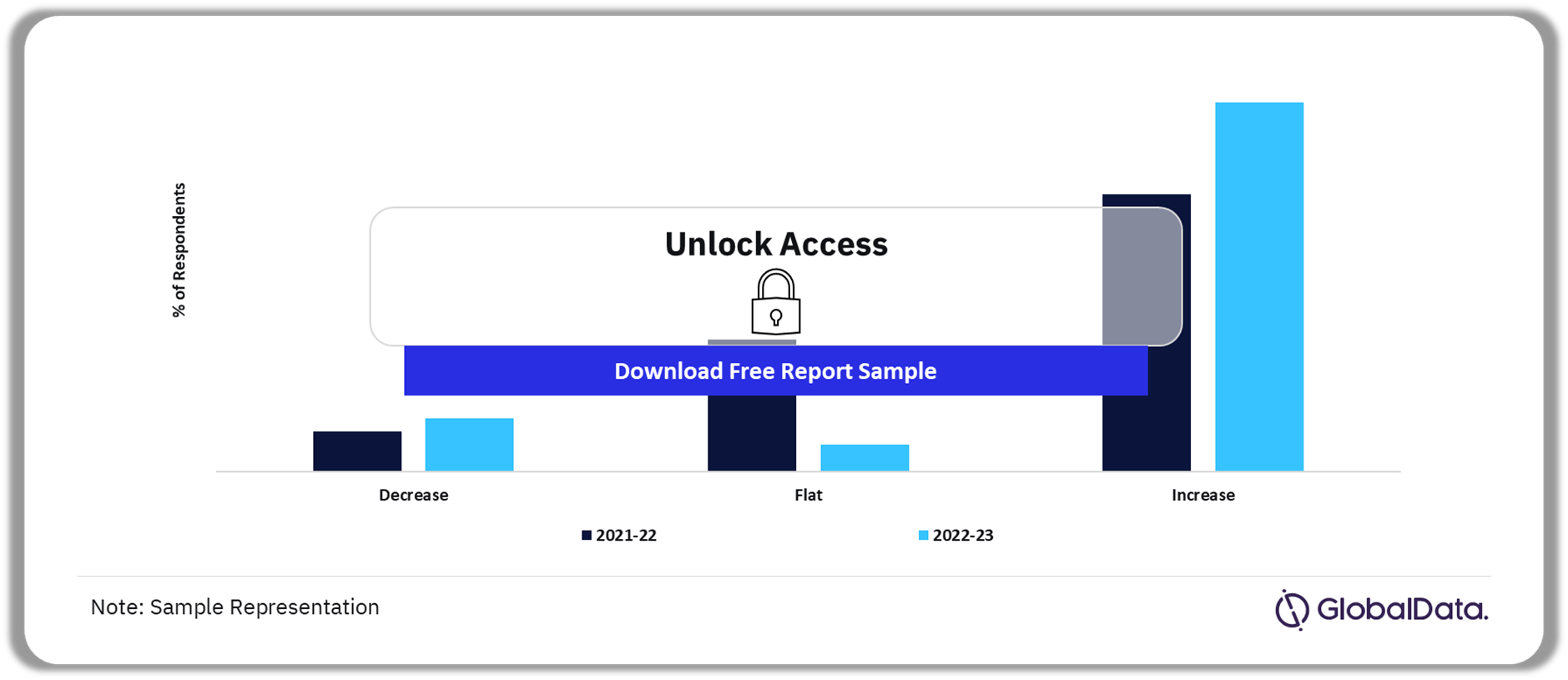

Annual change in Enterprise ICT budget allocation in Australia (2021-22 vs. 2022-23)

Buy The Full Report To Gain More Information On Australia Enterprise ICT Customer Survey Insights, Download A Free Sample

The report also discusses the market growth inhibitors impacting Australia’s overall ICT market. It sheds focus on enterprise ICT budget allocations and ICT revenue opportunities covering 18 solution areas, segmental analysis, and vertical analysis, as well as a review of key macroeconomic and regulatory trends, and government initiatives. The report also includes a brief profile of some of the key ICT vendors within the country.

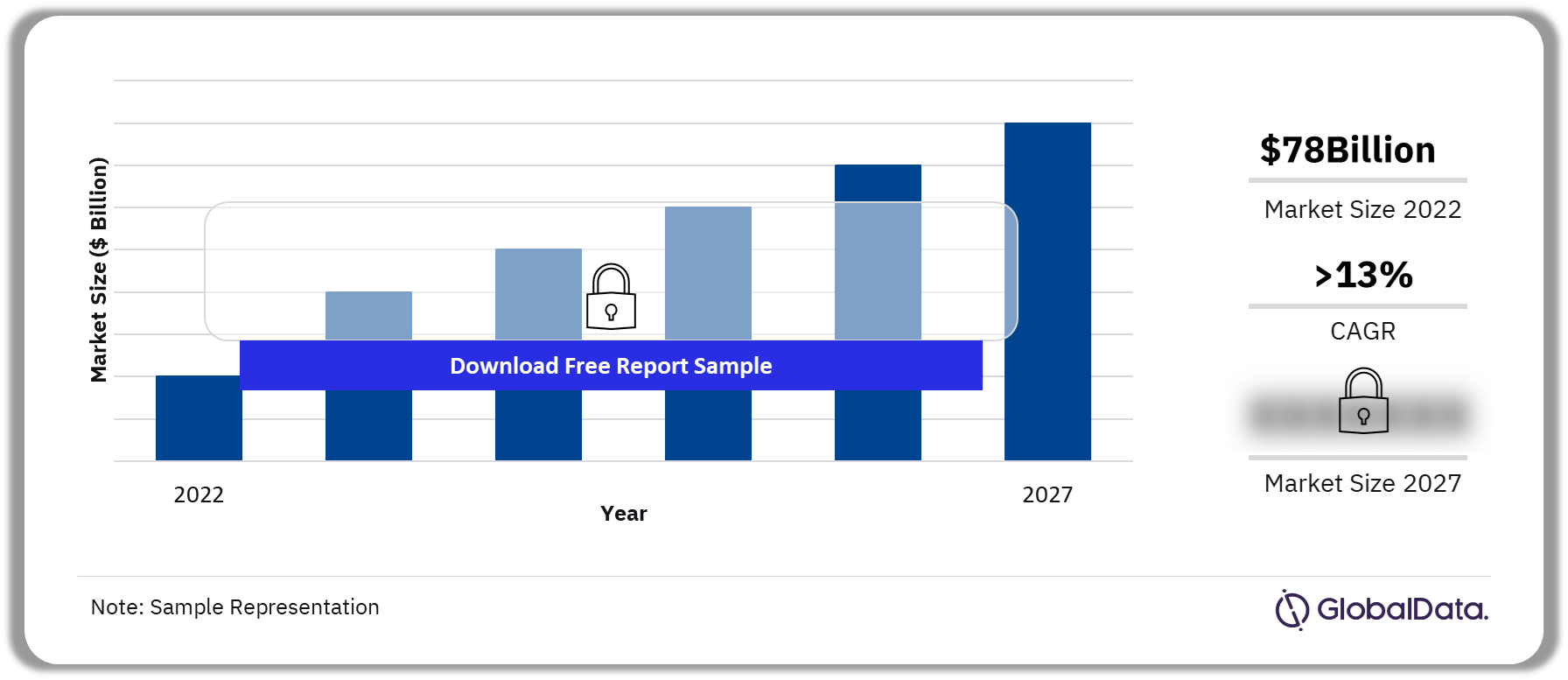

| Market Size 2022 | >$78 billion |

| CAGR | >13% |

| Forecast Period | 2022-2027 |

| Enterprise ICT Budget Allocation Analysis Period | 2022-2023 |

| ICT Segment | Hardware, Software, Services |

| ICT Solution Areas | Cloud Computing, IoT, Communications and Collaboration, Client Computing, Consulting & Integration Services, Networking, Business Process Outsourcing, Application Development and Management, Business Process Applications, IT Management, Security, Storage, Data and Analytics, Servers, Data Center & Hosting, Artificial Intelligence, Mobility, Edge Computing |

| Key End-use Verticals | BFSI, Government, Mining, Education, and Transport and Logistics |

| Enterprise Size Band | Micro (<50), Small (51-250), Medium (251-1,000), Large (1,001-4,999) and Very Large (5,000+) |

| Key Digital Transformation Areas | Artificial Intelligence & Machine Learning, Automation/RPA, IoT, Edge Computing and Others |

| Enterprise Technology Priorities and Spending Preferences | Cloud Computing, Business Process Outsourcing, Networking, IoT, Client Computing |

| Companies Mentioned | Microsoft, TPG Telecom, Accenture, IBM, Oracle, and others |

GlobalData’s ICT customer insight survey reveals a positive outlook for enterprise ICT spending in Australia, with a majority of respondents, more than 73% from the country, claiming that there has been an increase in the enterprise ICT budget in 2023 compared to 2022. This is over 32 percentage points (p.p.) higher than the percentage who claim that there was an increase in their ICT budget in 2022-23 compared to 2021-22. This upward trend is paving the way for a promising opportunity for optimistic growth in ICT revenue. The rise in investment signifies enterprises’ willingness to allocate a budget toward technological advancements.

Australia’s overall ICT market was pegged at over $78 billion in 2022 and is expected to grow at a CAGR of more than 13% during 2022-2027 to reach over $146 billion in 2027, driven by its robust digital infrastructure, strong 5G standalone coverage, digitally active population, strong affinity for technology and data consumption, and continued government initiatives for transforming into a digital economy.

Australia Total ICT Revenue Opportunity 2022-2027 ($Billion)

Buy The Full Report To Gain More Information On Australian Enterprise ICT Revenue Opportunities, Download A Free Sample

Australia Enterprise ICT Market Regulatory Highlights

- 5G Rollout & Expansion

- National Broadband Network (NBN)

- Digital Government Strategy & Digital Economy Strategy

- IoT Alliance Australia (IoTAA)

Australia Enterprise ICT Revenue Opportunity – Segment Analysis

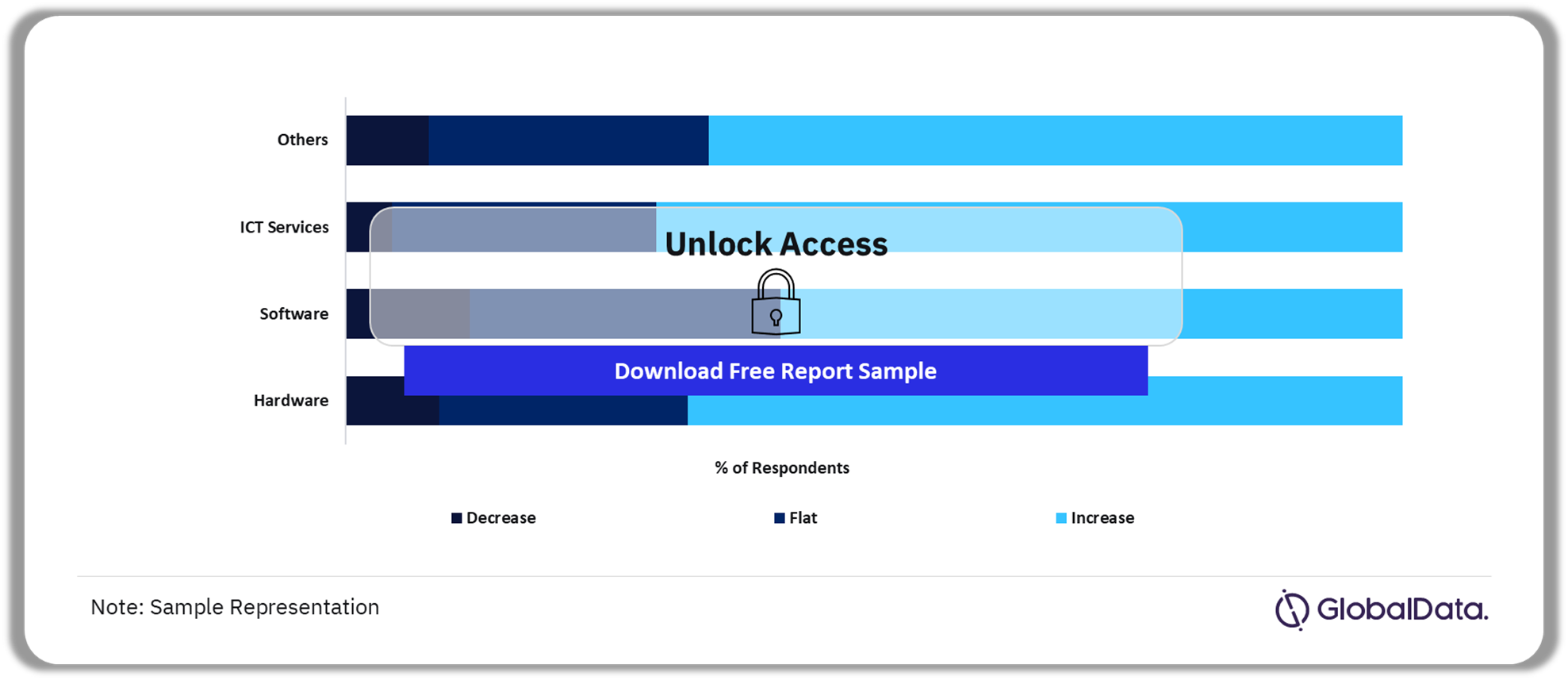

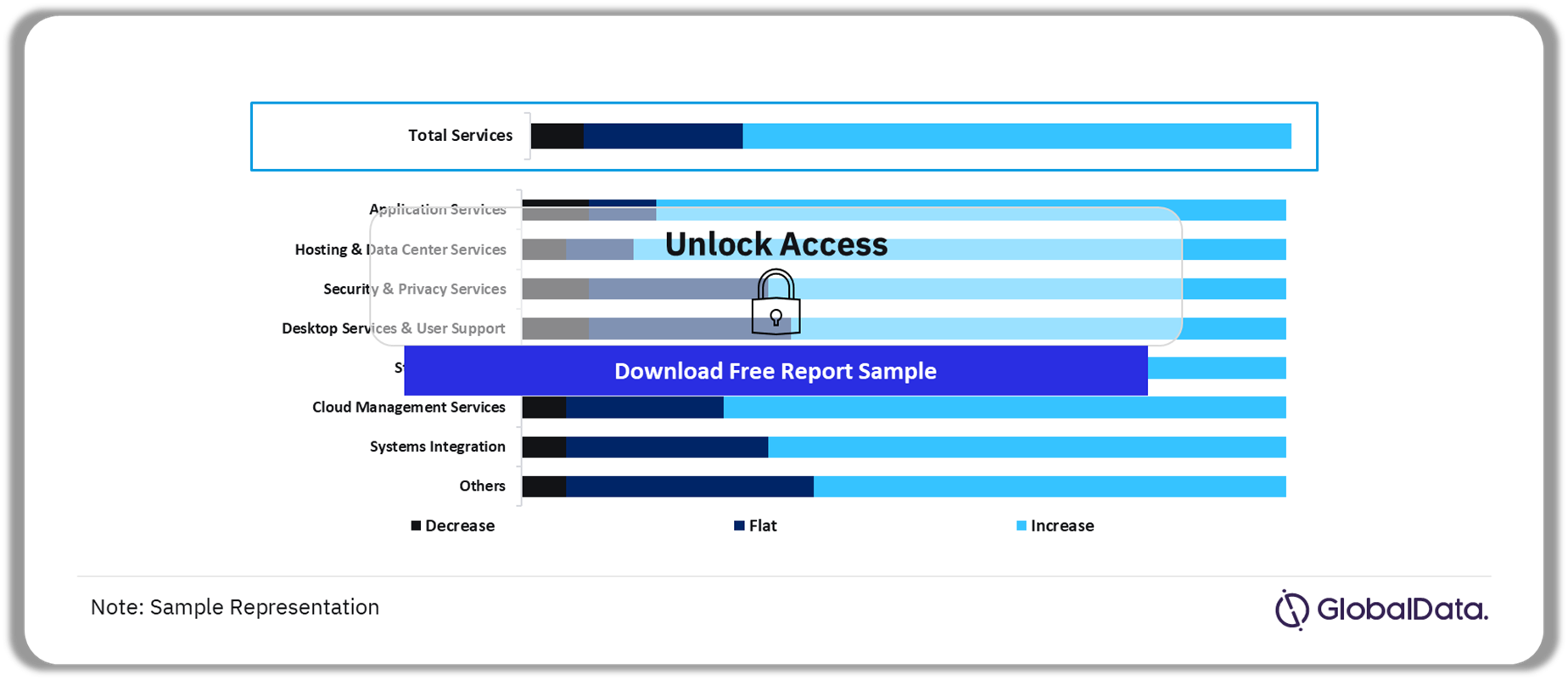

GlobalData’s survey findings suggest that the enterprise ICT budget allocations across all ‘services’ categories in Australia have increased in 2023 compared to 2022. More than 60% of respondents confirmed an increase in their enterprise ICT budget for overall ‘services’ in 2023 compared to 2022.

Annual Change in Distribution of Enterprise ICT Spending, By ICT Products/Services in 2023

Buy The Full Report For More Insights On ICT Segmental Investment In Australia, Download A Free Sample

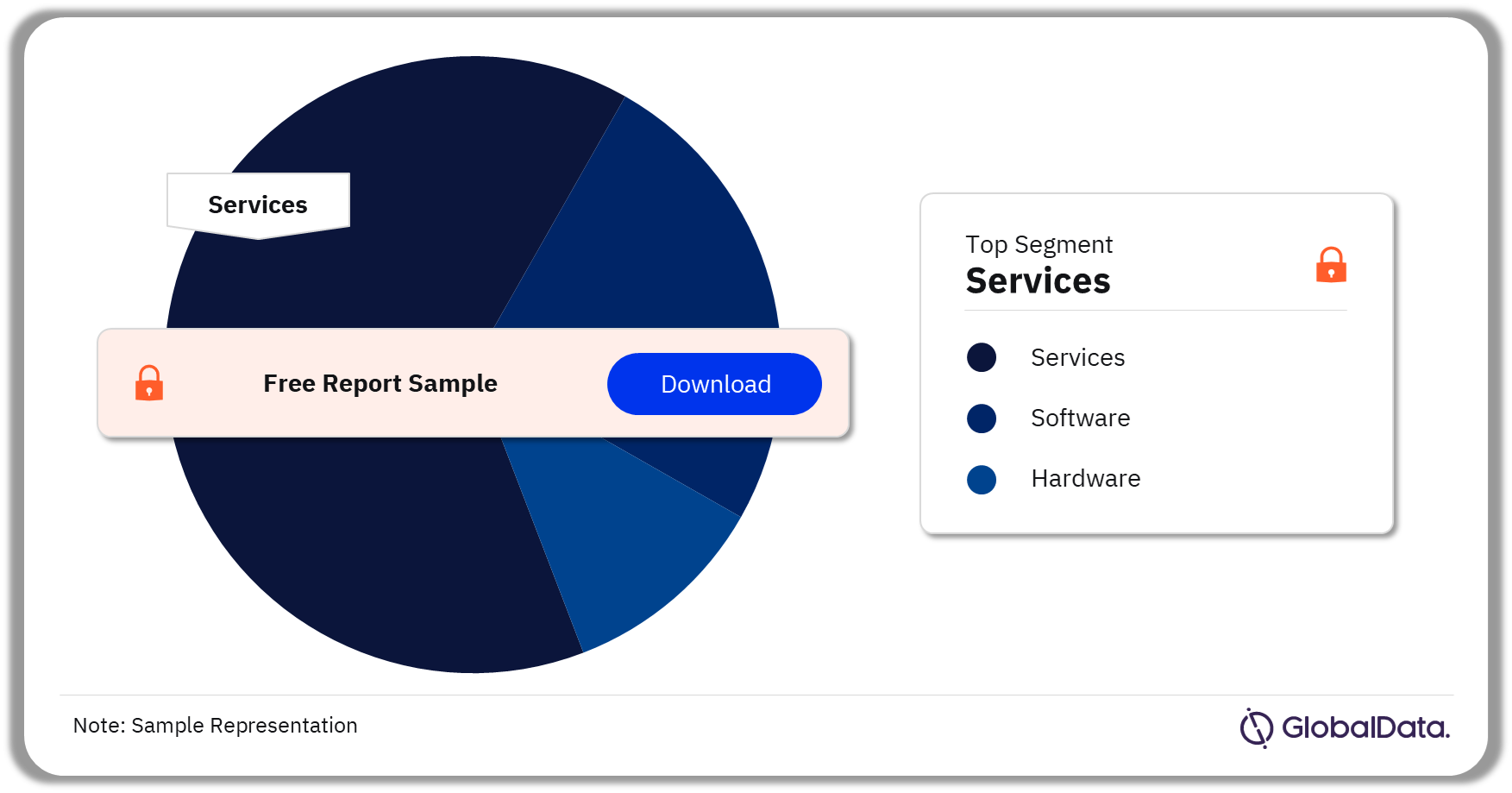

According to GlobalData, Australia’s ICT market would see a majority share of its revenue come from the IT services segment over the forecast period. The report also discusses the enterprise ICT revenue opportunity across IT software and IT hardware segments over the forecast period.

- IT Services

- IT Software

- IT Hardware

Australia Total ICT Revenue Opportunity, by Segment 2022 (%)

Buy The Full Report For More Insights To Australia ICT Revenue Opportunity By Segment, Download A Free Sample

Australia Enterprise ICT Market Dynamics – Drivers, Trends and Challenges

Buy The Full Report To Gain More Information On To Australia ICT Market Dynamics, Download A Free Sample

Australia Enterprise ICT Market by Infrastructure Segments – Services, Software, and Hardware

IT Services – Segment Outlook

GlobalData’s survey findings suggests that the enterprise ICT budget allocations across all ‘services’ categories in Australia have increased in 2023 compared to 2022. More than 52% respondents confirmed an increase in their enterprise ICT budget for overall ‘services’ in 2023 compared to 2022.

Annual Change in Australia Enterprise ICT Services Budget Allocations

Buy The Full Report For More Insights On Segment ICT Budget Allocation In Australia, Download A Free Sample

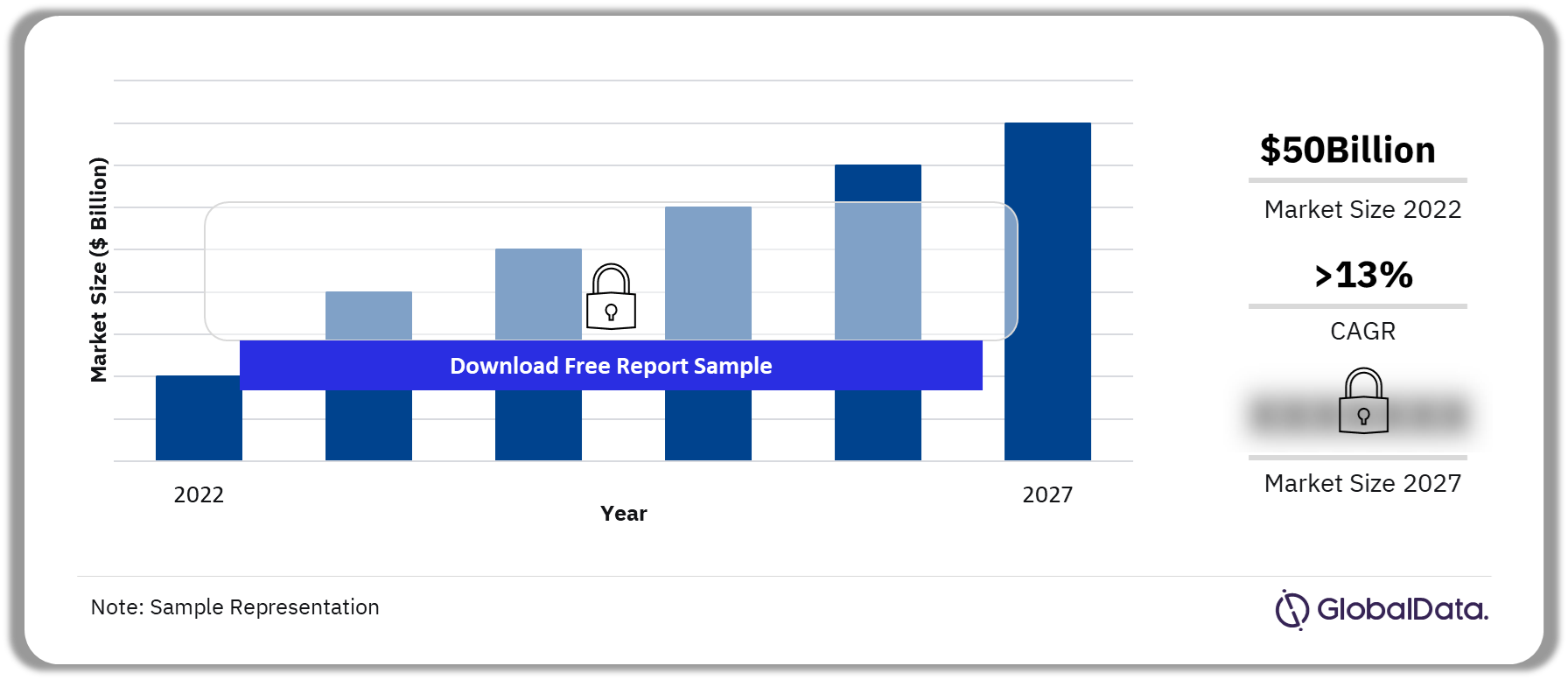

The ICT services market in Australia was pegged at over $50 billion in 2022 and is predicted to grow at a CAGR of more than 13% over 2022-2027 to reach over $95 billion in 2027. The growth of ICT services market in the country is driven by demand for digital technologies and initiatives, the rise in the overall demand for digitalization and scalable IT infrastructure, the widespread adoption of the 5G network, and the increasing penetration of technology giants.

Australia Total ICT Revenue Opportunity, by ICT Services 2022-2027 ($Billion)

Buy The Full Report For More Insights To Australia ICT Services Revenue Opportunity Market, Download A Free Sample

The Australia enterprise ICT country intelligence report offers ICT revenue market indicators across the following IT services solution areas:

- Cloud computing services

- Business Process Outsourcing services

- Networking services

- Consulting & Integration services

- Application development and management services

- Communication and Collaboration services

- Client computing services

- Data center and hosting services

- Internet of Things (IoT) services

- Security services

- Storage services

- Artificial intelligence (AI) services

- Mobility services

- Servers services

- Edge computing services

Australia Enterprise ICT Technology Revenue Opportunity and Spending Priorities – Key Solution Areas

Cloud computing is the most attractive market in Australia, driven by the government’s ongoing commitment for large scale cloud adoption. The revenue opportunity for cloud computing in Australia was pegged at over $12 billion in 2022 and is estimated to grow at a CAGR of more than 20%. Enterprises are increasingly utilizing cloud to transform their business operations and processes making them more efficient.

Australia Total ICT Revenue Opportunity, by Solution Areas 2022 (%)

Buy The Full Report For More Insights To Australia Key ICT Solution Areas Revenue Opportunity Market, Download A Free Sample

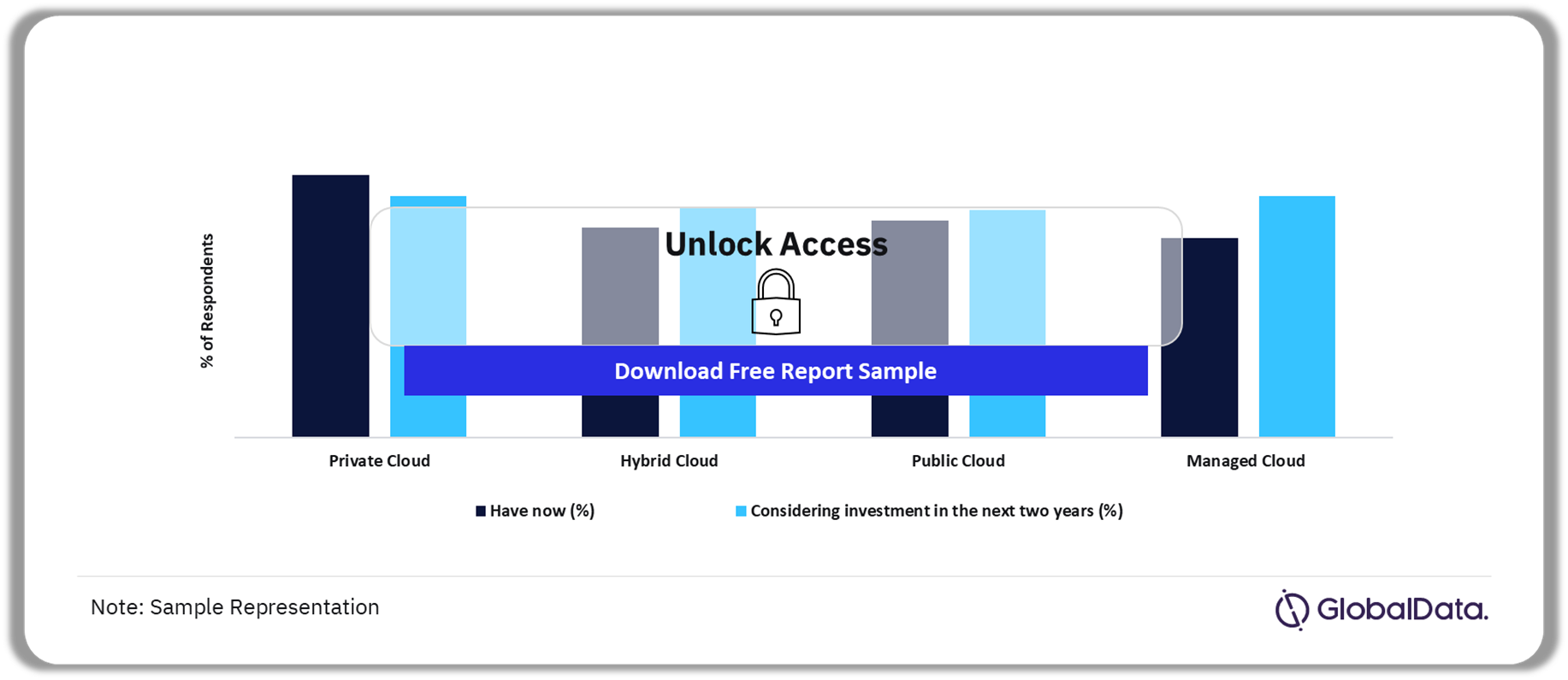

Australia Enterprise Cloud Computing Investment Priority – Now vs Next Two Years

Enterprises are increasingly utilizing cloud to transform their business operations and processes making them more efficient. This was validated by GlobalData’s survey, where over 67% confirmed that their budget allocation in cloud services increased in 2023 vs. 2022. More than 67% claimed that their enterprises have already invested in cloud, while a higher percentage around 68% indicated their enterprises would invest in cloud in the next two years.

Cloud Computing Technology Investment Priority – Current vs Next Two Years

Buy The Full Report For More Insights On Australia’s Enterprise Cloud Budget Allocation, Download A Free Sample

Australia Enterprise ICT Technology Revenue Opportunity – Key Verticals

The BFSI sector is the largest independent end-use vertical segment for the ICT market in Australia in terms of revenue contribution, through 2022 to 2027. ICT revenue from the BFSI sector reached over $ 8 billion in 2022 and is set to grow at a CAGR of over 12% between 2022-2027. The segment is set to account for a 11.2% share of the total cumulative revenue forecasted for the overall ICT market in Australia for 2022-2027.

Australia Total ICT Revenue Opportunity, by Verticals 2022 (%)

Buy The Full Report To Gain More Information On Australia Enterprise ICT Revenue Opportunity By Verticals, Download A Free Sample

Australia Enterprise ICT Revenue Opportunity by Enterprise Size Band

Large enterprises, comprising both large and very large companies, together accounted for over $48 billion in 2022 and is estimated to reach more than $88 billion by 2027. Due to their sound financial standing, large organizations are placing more emphasis on R&D efforts across a variety of ICT solution areas such as quantum technology, AI, 5G, cybersecurity, and cloud.

Australia Total ICT Revenue Opportunity ($billions) by Enterprise Size Band

Buy The Full Report To Gain More Information On Australia Enterprise ICT Revenue Opportunity By Enterprise Size Band, Download A Free Sample

Scope

The country intelligence report provides an in-depth analysis of the following –

- The macroeconomic and regulatory context and government initiatives in Australia.

- Enterprise ICT market outlook: analysis as well as historical figures and forecasts of revenue opportunities from ICT segments, ICT solution areas, end-use verticals, and enterprise size bands.

- Enterprise ICT Budget Allocations – 2022 vs 2023: Overview of survey findings regarding changes in the overall enterprise ICT budget allocations in 2023 compared to the previous year and across ICT segments, ICT solution areas, existing vs new IT projects.

- Enterprise ICT growth drivers, market trends and challenges

- IT hardware segment revenue and budget allocations outlook: analysis as well as historical figures and forecasts of revenue opportunities from ICT hardware solution areas and budget allocations by ICT hardware categories.

- IT software segment revenue and budget allocations outlook: analysis as well as historical figures and forecasts of revenue opportunities from ICT software solution areas and budget allocations by ICT software categories.

- IT services segment revenue and budget allocations outlook: analysis as well as historical figures and forecasts of revenue opportunities from ICT services solution areas and budget allocations by ICT services categories.

- Enterprise Technology Priorities: Overview of survey findings on enterprise investment priority for key solution areas in current vs next two years.

- Company landscape: analysis of the market position of leading ICT providers in Australia market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

- The survey was conducted in H1 2023 via an online methodology, with respondents all having ICT decision maker responsibility (typically CIOs and IT Managers). GlobalData plans to repeat the survey in H1 2024, to monitor ICT budget changes on an ongoing basis.

Reasons to Buy

- This Country Intelligence Report is based on GlobalData’s IT Customer Insight Survey carried out annually covering key ICT decision makers from enterprises across various industry verticals in Australia and GlobalData’s Market Opportunity Forecasts to 2027, to offer a thorough, forward-looking analysis of Australia’s enterprise ICT investment priorities and ICT revenue opportunity market.

- Accompanying GlobalData’s IT Customer Insight Survey and Market Opportunity Forecasts to 2027, the report examines the assumptions and drivers behind ongoing and upcoming trends in Australia’s enterprise ICT market.

- The report offers a thorough analysis of enterprise ICT investment trends and how it has changed this year compared to previous year.

- The report also presents an analysis of enterprise ICT budget allocations by various spending areas, business functions and product/service categories and how they have changed this year compared to previous years.

- The report also presents an analysis of enterprise ICT revenue opportunity by various solution areas, enterprise size band, end-use verticals, and segment over the forecast period 2022-2027.

- With more than 50 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides insights in a concise format to help executives build proactive and profitable growth strategies.

- The report provides an easily digestible market assessment for decision-makers built around research gathered from the local IT decision makers, which enables executives to quickly get up to speed with the current and emerging trends in enterprise ICT investment priorities.

Table of Contents

Frequently asked questions

-

How did the overall enterprise ICT budget in Australia change in 2023 compared to 2022?

More than 73% of respondents from Australia claimed that there has been an increase in their enterprise ICT budget for 2022-23 compared to 2021-22.

-

What was the Australia enterprise ICT revenue market size in 2022?

The enterprise ICT revenue market size in Australia was valued at over $78 billion in 2022.

-

What is the Australia enterprise ICT revenue market growth rate?

The enterprise ICT revenue in Australia is expected to grow at a CAGR of more than 13% during the forecast period 2022-2027.

-

What are the key ICT revenue market drivers in Australia?

Dynamic startup ecosystem offers a promising opportunity for Australia’s ICT market along with acceleration in enterprise digital transformation are the key market drivers for Australia ICT revenue market growth.

-

What are the key ICT segments in Australia?

IT services, IT software and IT hardware segments are the key ICT segments in Australia.

-

What are the key end-use verticals for ICT products/services in Australia?

BFSI, Government, Mining, Education, and Transport and Logistics are the key ICT end-use verticals for ICT products/services in Australia.

-

What are the key ICT solution areas with investment priorities in Australia?

Cloud Computing, Business Process Outsourcing, Networking, IoT and Client Computing are the key ICT solution areas in Australia.

-

Which are the ICT companies mentioned in Australia enterprise ICT country intelligence report?

The companies mentioned in the Australia enterprise ICT country intelligence report are Microsoft, TPG Telecom, Accenture, IBM, and Oracle among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.