Bauxite Mining Market Analysis by Reserves, Production, Assets, Demand Drivers and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

GlobalData's "Global Bauxite Mining to 2030" provides a comprehensive coverage on the global bauxite industry. It provides historical and forecast data on bauxite production by country, production by company, reserves by country, world bauxite prices, bauxite trade and bauxite consumption. The report also includes a demand drivers section providing information on factors that are affecting the global bauxite industry. It further profiles major bauxite producers, information on the major active, planned and exploration projects by region.

Global bauxite production is expected to remain relatively flat in 2024, up by 1.8% to 421.5 million tonnes (Mt), owing primarily to expected increases in output from Guinea and Australia. Furthermore, global production is expected to grow by just 1.6% in 2025 to reach 428.3Mt, linked to expected stable production in Brazil, which is expected to be partially offset by the increase in Australia, Guinea and India. Guinea, Australia, China, Brazil and India are the world’s top five producers of bauxite, accounting for 87.4% or 361.9 million tonnes (Mt) of the global total in 2023.

Looking ahead, GlobalData anticipates global bauxite production will grow only marginally, with a projected annual compound growth rate (CAGR) of 0.4%, reaching 432.4Mt by 2030.

Bauxite Mining Market Drivers

The bauxite industry witnessed considerable growth in 2022 mainly due to increased production from China, Guinea, and Australia. Australia was the world’s leading bauxite producer, accounting to more than 27% of the total output in 2022. The increase in output is primarily due to operational improvement at mines such as Huntly and Willowdale and increased production from Weipa mining division due to plant reliability at Amrun mine, coupled with the operational stability at Boddington after the effect of bad weather conditions in the second quarter.

In addition, bauxite production from Guinea increased by more than 4% in 2022, primarily due to the increase in production at the Boffa Bauxite mine and Garafiri project coupled with increased output from Sangaredi mine. The bauxite production is further expected to accelerate due to the commencement of key projects including the Nhan Co Bauxite project in Da Nang, Vietnam. This project has a production capacity of 590kt bauxite per annum and is scheduled to start production in 2025.

For more insights on the bauxite mining market drivers, download a free sample report

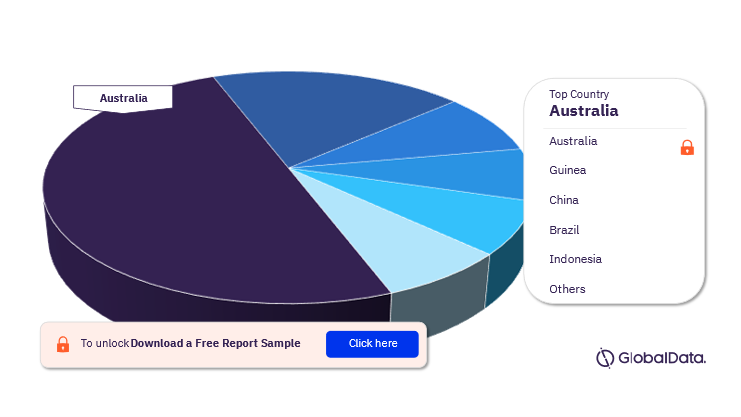

Bauxite Mining Market Segmentation by Countries

The leading countries in the bauxite mining market in terms of production are Australia, Guinea, China, Brazil, Indonesia, and others. Australia was the leading producer of Bauxite in 2022. The country is expected to account for the highest production even during the projected period.

Bauxite Mining Market Analysis by Countries, 2022 (%)

For more country insights into the bauxite mining market, download a free report sample

Bauxite Mining Market – Key Assets

Active Mines – Some of the key active bauxite mines are Panchpatmali Mine, Pingguo Mine, Kodingamali Mine, Stitovo II Mine, Zagrad Mine, and Timan Mine among others.

Development Projects – Some of the key bauxite development projects are Nhan Co Bauxite Project, Mempawah SGA Project, Bon Ami Project, Kindia Project, and Kanye Project among others.

Exploration Projects – Some of the key bauxite exploration projects are Bolaven Plateau Bauxite Project, Menjalin Project, Gaoual Bauxite Project, Gaoual Bauxite Project, and Mandoum Project among others.

For more asset insights into the Bauxite mining market, download a free report sample

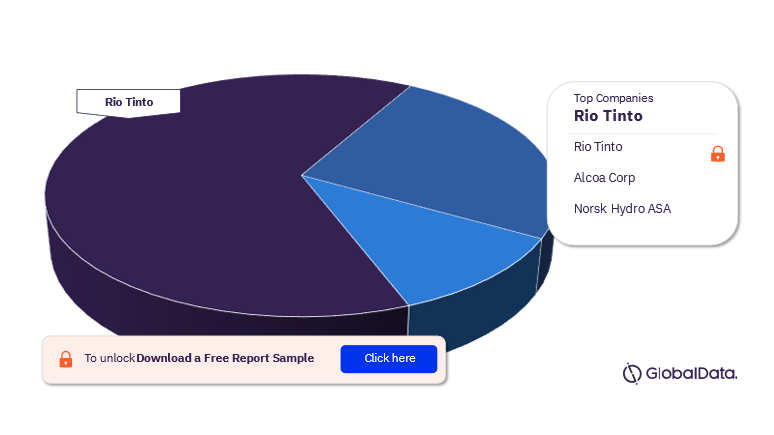

Bauxite Mining Market – Competitive Landscape

Some of the leading bauxite producing companies are Rio Tinto, Alcoa Corp, and Norsk Hydro ASA among others. In 2022, Rio Tinto dominated the bauxite mining market share, followed by Alcoa and Norsk Hydro respectively in terms of production.

Rio Tinto: Rio Tinto remained the largest bauxite producer in the world, with 54.6Mt of bauxite production in 2022. This growth can be mainly attributed to the strong operational performance from Weipa mine, due to improved plant reliability at the Amrun mine. The company’s operations includes mining, exploration, and processing of various mineral resources. The company’s operating bauxite mines include the Sangaredi in Guinea, Weipa and Gove mines in Australia and the MRN mine in Brazil. Rio Tinto together with Vale SA, Alcoa Corp, South 32, Votorantim SA and Norsk Hydro ASA, owns the Monte Branco project in Brazil, expected to commence operations in 2026.

Alcoa Corp: US-based Alcoa Corp. (Alcoa), is the second-largest bauxite producer in the world, with 42.1Mt of bauxite produced in 2022. The company also produces alumina and aluminum. The company operates with one of the biggest bauxite mining portfolios, alumina refining networks and energy portfolios in the world.

Norsk Hydro ASA: Norsk Hydro ASA (Hydro) is a global supplier of aluminum, headquartered in Oslo, Norway. Its operations span bauxite extraction to the production of rolled and extruded aluminum products and building systems. The company’s bauxite operating mines consist of the Paragominas and MRN mines, both located in Para, Brazil.

Bauxite Mining Market Analysis by Companies, 2022

For more insight on the key companies in bauxite mining market, download a free sample report

Bauxite Mining Market Overview

| Market Size in terms of Volume (2022) | 378.8 million tonnes (Mt) |

| CAGR (2023-2026) | >1% |

| Forecast Period | 2023-2026 |

| Historic Period | 2006-2022 |

| Key Countries | Australia, Guinea, China, Brazil, Indonesia, and others. |

| Active Mines | Panchpatmali Mine, Pingguo Mine, Kodingamali Mine, Stitovo II Mine, Zagrad Mine, and Timan Mine among others. |

| Exploration Projects | Nhan Co Bauxite Project, Mempawah SGA Project, Bon Ami Project, Kindia Project, and Kanye Project |

| Development Projects | Bolaven Plateau Bauxite Project, Menjalin Project, Gaoual Bauxite Project, Gaoual Bauxite Project, and Mandoum Project |

| Leading Producers | Rio Tinto, Alcoa Corp, and Norsk Hydro ASA |

Key Segments Covered in this Report

Bauxite Mining Market Country Outlook (Volume, Million Tonnes, 2006-2026)

- Australia

- Guinea

- China

- Brazil

- Indonesia

- Others

Scope

The report contains an overview of the global bauxite mining industry including key demand driving factors affecting the global bauxite mining industry. It provides detailed information on reserves, reserves by country, production, production by country, production by company, major operating mines, competitive landscape, major exploration and development projects.

Reasons to Buy

• To gain an understanding of the global bauxite mining industry, relevant driving factors

• To understand historical and forecast trend on global bauxite production

• To identify key players in the global bauxite mining industry

• To identify major active, exploration and development projects by region

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Bauxite mining market size in 2022?

The bauxite mining market production was estimated at 378.8 million tonnes (Mt) in 2022.

-

What will be the Bauxite mining market growth rate?

The bauxite production is expected to grow at a CAGR of more than 1% from 2023 to 2026.

-

Which are the leading countries in terms of Bauxite production?

The leading countries in terms of bauxite production are Australia, Guinea, China, Brazil, Indonesia, and others.

-

Which is the leading country Bauxite mining market?

Australia led the bauxite mining market in terms of production during 2022.

-

Who are the leading producers in the Bauxite mining market?

Some of the leading bauxite producers are Rio Tinto, Alcoa Corp, and Norsk Hydro ASA.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.