Belgium Foodservice Market Size and Trends by Profit and Cost Sector Channels, Consumers, Locations, Key Players, and Forecast, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The Belgium foodservice profit sector witnessed a significant decline since 2016–2021, mainly due to the fall in value of the travel and pub, club & bar channels. Sales in the travel channel were hampered by the enforcement of restrictions on tourism. In contrast, QSR was the most resilient profit sector channel during this period. However, the profit sector sales is expected to grow at a CAGR of more than 10% during 2021–2026 supported by the growth in the pub, club & bar, and travel channels, which will rebound from the lows of 2020 and 2021.

The Belgium foodservice market research report provides extensive insight and analysis of the Belgium Foodservice market over the next five years (2021-2026) and acts as a vital point of reference for operators or suppliers.

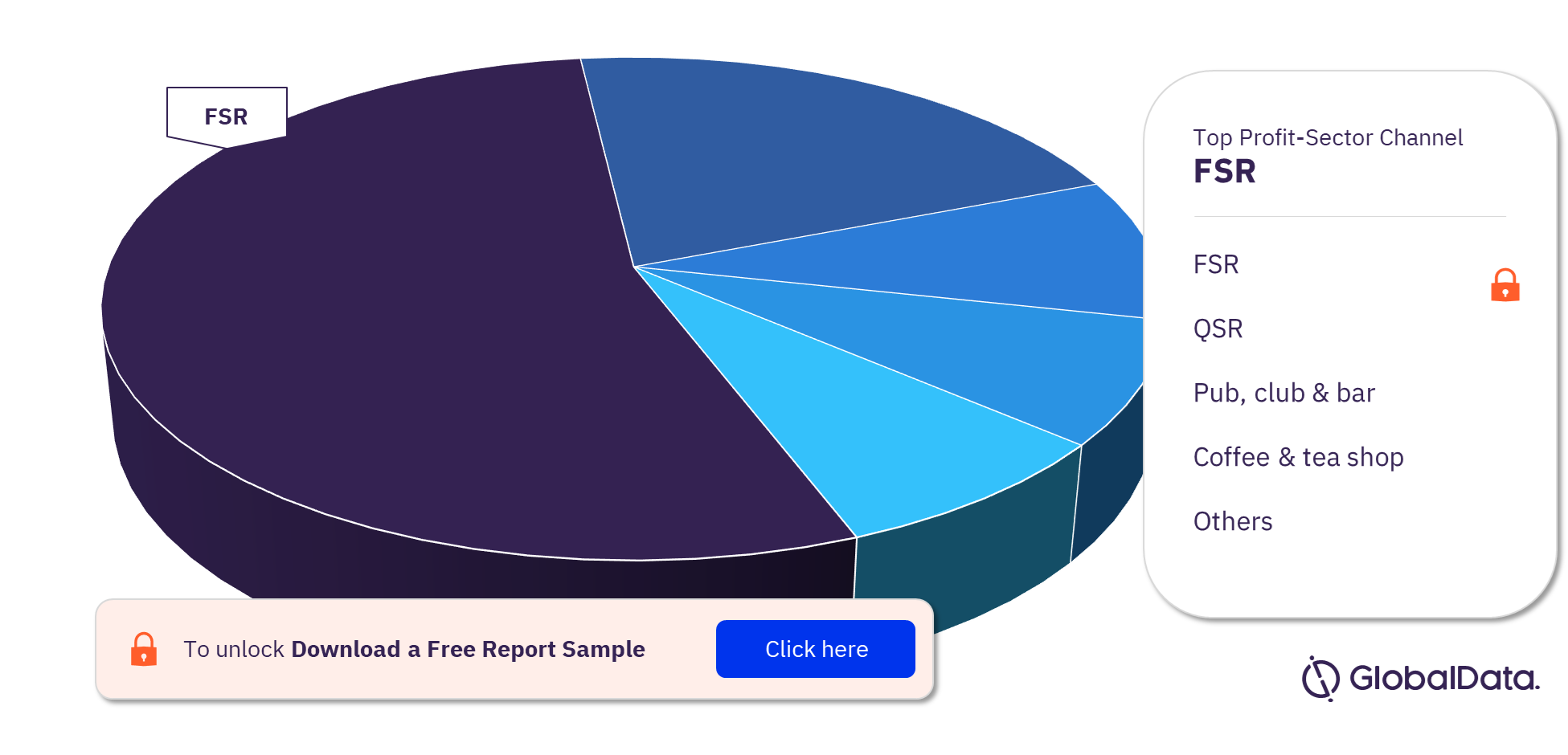

Belgium Foodservice Market Segmentation by Profit Sector Channels

The key channels in the Belgium foodservice market are FSR, accommodation, leisure, mobile operator, pub, club & bar, retail, travel, coffee & tea shop, QSR, ice-cream parlor, and workplace. FSR experienced the highest growth in the food service market. However, pub, club, and bar experienced significant value shares among all the other channels in the same year. Leisure and QSR were also strong in terms of 2021 growth. This is because consumers’ concerns about the risk of COVID-19 infection in their free time have decreased significantly, there is still relatively sluggish growth witnessed for accommodation and retail.

Full-Service Restaurant: FSR remained the largest foodservice channel in Belgium in 2021. High quality and availability of favorite cuisine are key influencing factors for consumers to choose an outlet. Consumers’ health awareness plays a key role in choosing a cuisine. Consumers in the 25–34 years age group are more likely than other age groups to visit the channel frequently. Also, male consumers visit the channel more than female consumers. Italian and pizza & pasta FSR was the leading cuisine type in 2021. Vegan/vegetarian food has been gaining momentum in recent years.

Pub, Club and Bar: During 2016–2021, the pub, club & bar channel suffered one of the steepest declines in the profit sector, owing to the enforcement of stringent COVID-19 restrictions. Beer is the most consumed alcoholic beverage in Belgium. In recent years, this category has been declining in volume terms, with many consumers shifting to specialty/craft beers. Male consumers are more likely to visit the channel than females.

Quick-Service Restaurant: QSR was more resilient than other profit sector channels during 2016–2021. This was mainly due to its relatively high dependence on take-aways, even before the pandemic, which meant that the channel was better prepared than others for the change in consumption patterns during the crisis. Burger-based and sandwich-based QSRs dominated the channel in 2021. Young consumers are more likely than their older counterparts to pay frequent visits to the QSR channel.

Belgium Foodservice Market Analysis, by Profit Sector Channels

For better insights on the key profit sector channels in the Belgium foodservice market, check our free report sample.

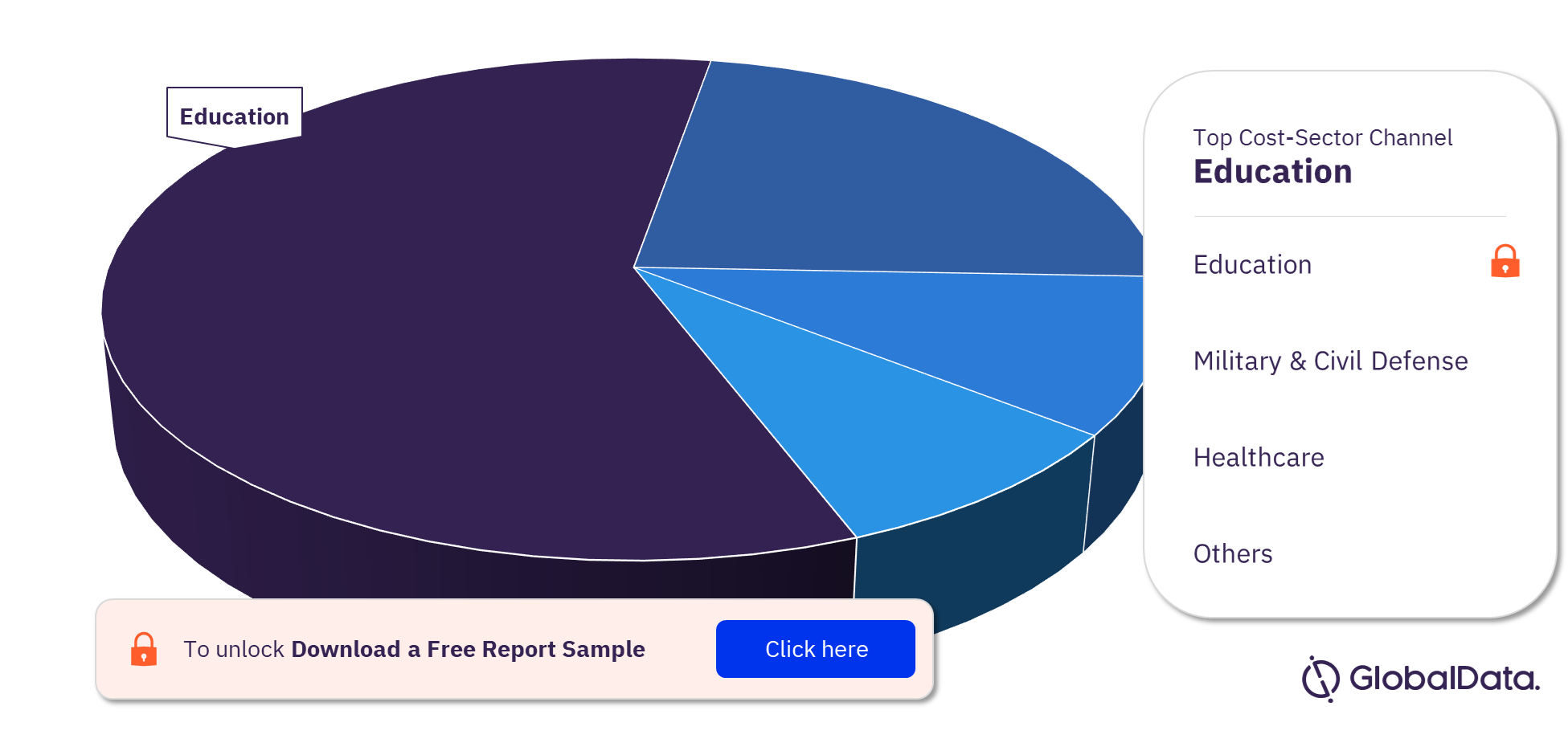

Belgium Foodservices Market Segmentation by Cost Sector Channels

The leading cost sector channels in the Belgium food services market are education, healthcare, military & civil defense, followed by welfare & services, and complementary services. Education was the largest channel in 2021. The growth of military & civil defense will be driven by the increase in military expenditure by the government.

Belgium Foodservice Market Analysis, by Cost Sector Channels

For better insights on the key cost sector channels in the Belgium foodservice market, check our free report sample.

For better insights on the key cost sector channels in the Belgium foodservice market, check our free report sample.

Belgium Foodservices Market – Competitive Landscape

The leading companies in the Belgium foodservice market are Vanherpe Food Group, McDonald’s Corporation, Groupe Bertrand, Domino’s Pizza Inc., HPS SA, and Lunch Garden.

Belgium Foodservice Market Report Overview

| Key Channels | FSR, Accommodation, Leisure, Mobile Operator, Pub, Club & Bar, Retail, Travel, Coffee & Tea Shop, QSR, Ice-Cream Parlor, and Workplace |

| Key Cost Sector Channel | Education, Healthcare, Military & Civil Defense, Welfare & Services, and Complementary Services |

| Leading Companies | Vanherpe Food Group, Mcdonald’s Corporation, Groupe Bertrand, Domino’s Pizza Inc., HPS SA, and Lunch Garden |

Key Highlights

- The value of the Belgian foodservice profit sector declined at a negative CAGR of more than 5% during 2016-2021. While the number of outlets grew, the number of transactions declined. In both 2020 and 2021, profit-sector sales were hampered by the enforcement of COVID-19 restrictions, including strict measures on nightclubs. This caused the pub, club & bar channel to suffer a significant decline during 2016-2021; this was among the steepest contractions in the sector. However, travel was the worst-hit channel owing to restrictions on tourism.

- Take-away sales achieved value growth during 2016-2021, with the health crisis amplifying the channel’s importance, particularly in the FSR channel in 2020. Take-away sales in casual dining FSR outlets rose in 2021. The increase in delivery service providers during the pandemic supported the growth of take-away sales.

Reasons to Buy

- Specific forecasts of the foodservice market over the next five years (2021-2026) will give readers the ability to make informed business decisions through identifying emerging/declining markets.

- Consumer segmentation detailing the desires of known consumers among all major foodservice channels (QSR, FSR, Coffee & Tea Shop, and Pub, Club & Bar) will allow readers understand the wants and needs of their target demographics.

McDonald's Corporation

Groupe Bertrand

Domino's Pizza Inc.

HPS SA

Lunch Garden

Table of Contents

Frequently asked questions

-

What is the Belgium foodservice profit sector growth rate during 2021-2026?

The Belgian food service profit sector is projected to grow at a CAGR of more than 10% during the forecast period.

-

What are the key profit sector channels in the Belgium foodservice market?

The key channels in the Belgium foodservice market are FSR, accommodation, leisure, mobile operator, pub, club & bar, retail, travel, coffee & tea shop, QSR, ice-cream parlor, and workplace.

-

What are the key cost sector channels in the Belgium foodservice market?

The leading cost sector channels in the Belgium food services market are education, healthcare, military & civil defense, welfare & services, and complementary services.

-

Which was the largest food service channel in Belgium foodservice market in 2021?

FSR remained the largest food service channel in Belgium in 2021.

-

What are the major Companies in the Belgium foodservice market?

The leading companies in the Belgium foodservice market are Vanherpe Food Group, McDonald’s Corporation, Groupe Bertrand, Domino’s Pizza Inc., HPS SA, and Lunch Garden.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports