Carbon Offsets – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Reasons to buy the ‘Carbon Offsets’ thematic intelligence report:

- Get an overview of carbon offsets, which is a major topic within the ESG theme.

- Obtain a comprehensive introduction to carbon offsets and how they are used to offset greenhouse gas emissions.

- Acts as a guide to corporate offset strategies and advice on how companies should approach carbon offsets.

How is our ‘Carbon Offsets’ report unique from other reports in the market?

- Get a market overview, types of offsets, and who verifies and sells offsets.

- Understand corporate carbon offset strategies and why companies buy offsets.

- Understand why most companies should avoid carbon offsets.

- Gain access to an appendix that provides an overview of the offset strategies of the top 100 listed companies by market capitalization

We recommend this valuable source of information to anyone involved in:

- Cross Industry Manufacturing/Original Equipment Manufacturers

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the Carbon Offsets Thematic Report

Carbon Offsets Thematic Report Overview

The carbon offsets market has grown rapidly since 2015 and is being driven by some of the major corporates incorporating them into their net-zero strategies. For instance, Microsoft is shifting away from nature-based offsets and is supporting new tech-based carbon removals.

Carbon offsets are typically used to claim if a company or product is carbon neutral or as part of a longer-term pathway to net zero. Emissions are offset by supporting projects that reduce emissions or remove greenhouse gases from the atmosphere. Companies can achieve net zero greenhouse gas (GHG) emissions by reducing emissions to close to zero and then offsetting any that remain. Projects are usually supported by purchasing offsets, with one offset representing one ton of CO2e removed or avoided. But critics say most offsets are low-quality and criticize firms for using them as a “license to pollute.”

A small and growing number of companies are investing in technology-based carbon dioxide removal (CDR) projects such as biochar and direct air capture. These are more reliable when measuring the amount of carbon removed and have long-term storage capabilities. However, they are much more expensive and have yet to scale.

This carbon offsets thematic report will help you understand more about carbon offsets and provide guidance on how to incorporate them into your net-zero strategy.

| Key Company Categories | · Market Pioneers

· Market Pragmatists · DIY-ers · Outsourcers |

| Key Carbon Offset Types | · Avoidance Offsets

· Removal Offsets |

| Key Certification Registries | · Gold Standard

· Verra · Climate Action Reserve · American Carbon Registry |

| Leading Companies Adopting Carbon Offsets | · Meta

· Netflix · S&P Global · TotalEnergies · PetroChina |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Carbon Offsets – Company Categories

The companies with the best chance of offsetting success are classified into market pioneers, market pragmatists, DIY-ers, and outsourcers.

Market Pioneers: Market pioneers will secure long-term deals for tech-based carbon removal offsets. Direct air capture (DAC), biochar, and enhanced rock weathering are all examples of tech-based removal offsets. Market pioneers support start-ups developing these technologies, invest in them, and help them scale up their business.

DIY-ers: DIY-ers will prefer to manage their own nature-based offset removal projects with enhanced measurement, reporting, and verification. This will allow them to pay close attention to project performance and generate revenue from offset sales.

Buy the Full Report for Additional Insights on the Key Company Categories in the Carbon Offsets Theme, Download a Free Sample Report

Carbon Offsets – Key Types

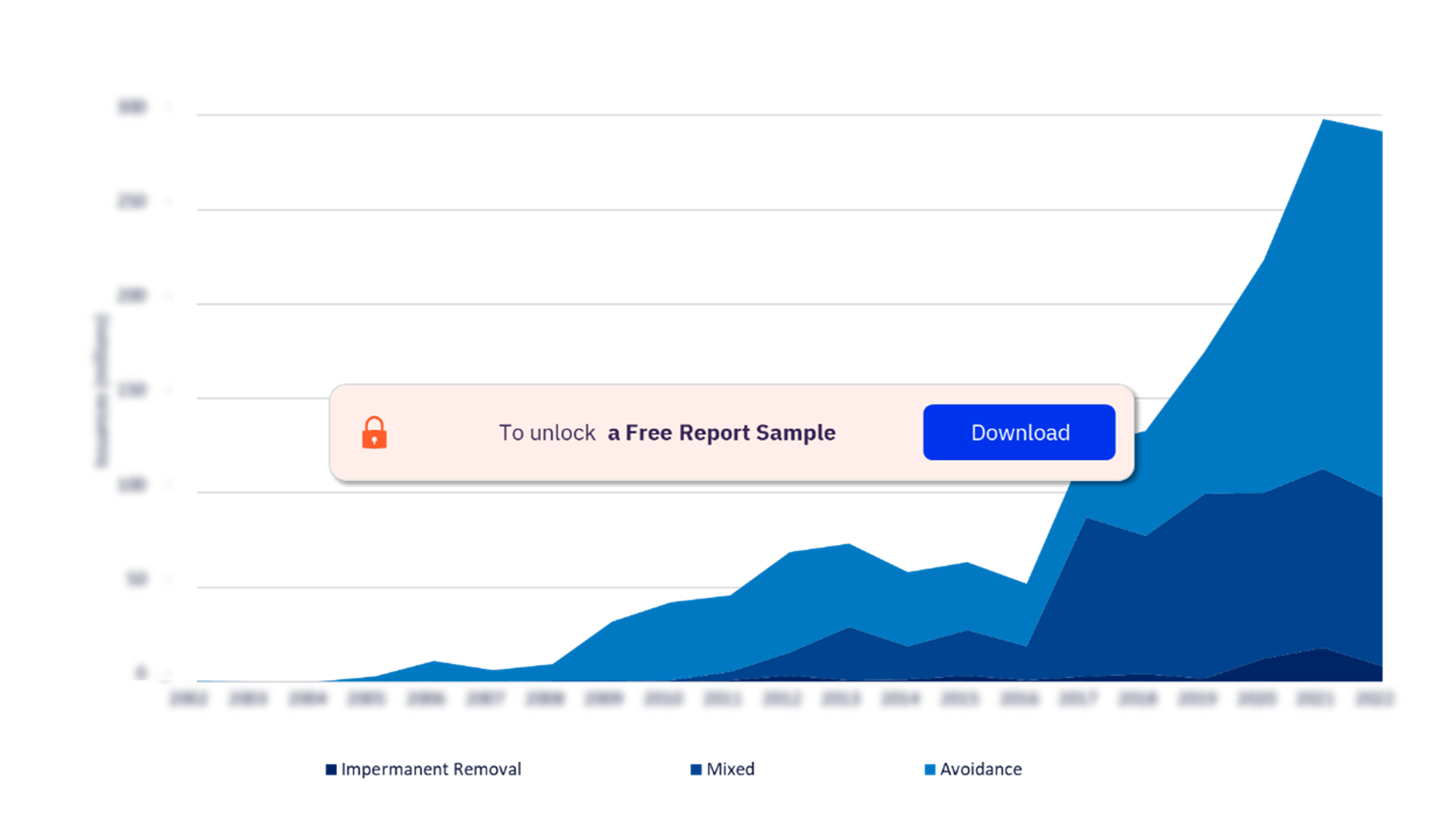

The taxonomy of carbon offsets boils down to emissions avoided, often called avoidance offsets, and carbon removed, often called removal offsets. By far the most popular type of offset is an avoidance offset, which is where a project reduces emissions compared to a baseline scenario in which the project was not undertaken. Most avoidance projects aim to protect forests from deforestation. Such nature-based offsets typically cost less than $10 per ton of CO2e. On the other hand, removal offset projects remove GHGs from the atmosphere and store them. The most popular type of removal offset project is reforestation, which lacks permanence in the form of long-term storage. Tech-based removal offsets are more reliable and can store CO2 for hundreds of years.

Key Carbon Offset Types

Buy the Full Report for More Insights on the Key Carbon Offset Types, Download a Free Sample Report

Carbon Offsets – Key Certification Registries

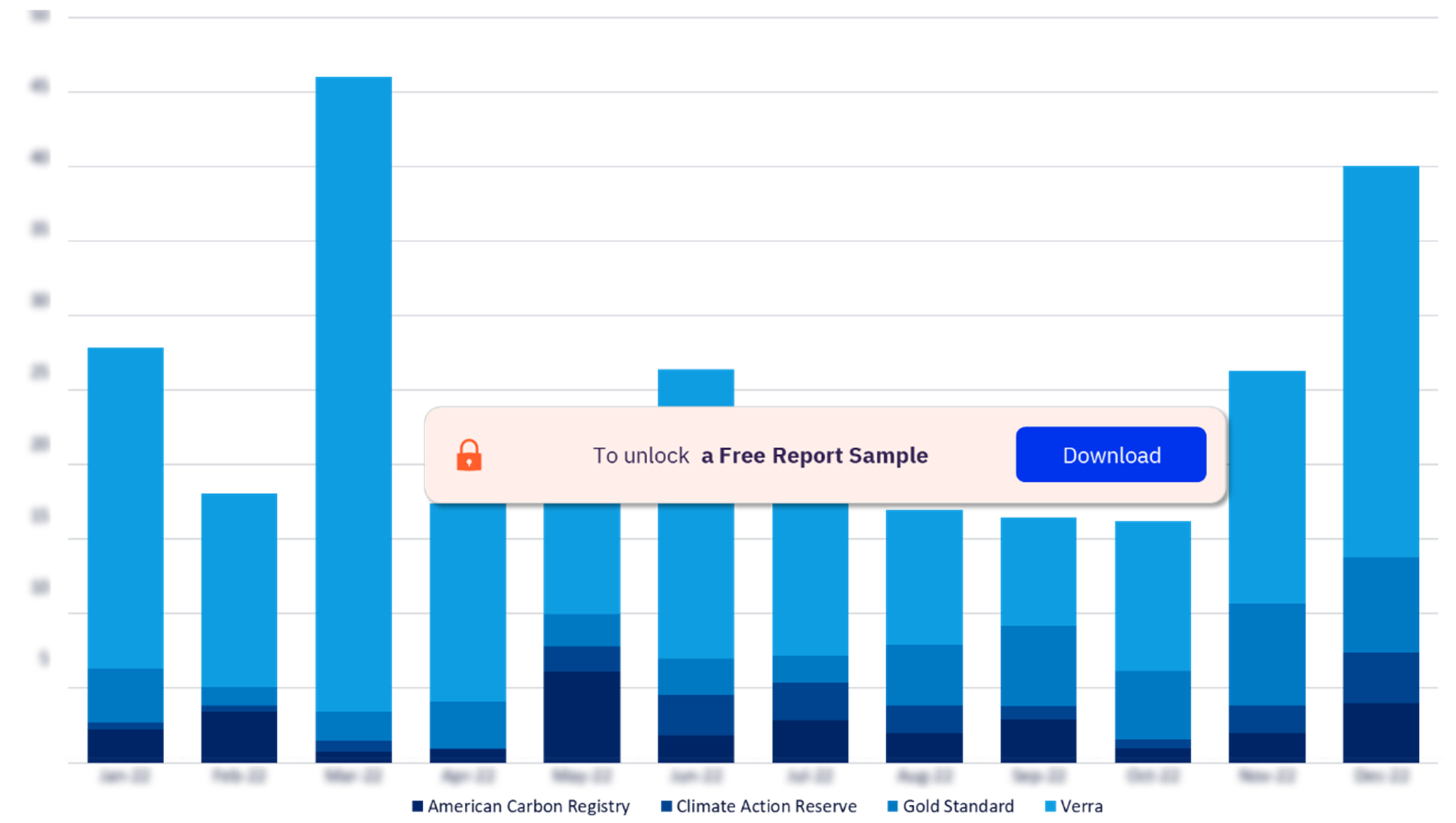

Companies can purchase offsets from retailers or project developers. Carbon market verifiers assess the quality of projects. Verra is by far the largest verifier of offsets, verifying 69% of all offsets in 2022.

Key Carbon Offset Certification Registries

Buy the Full Report for Additional Insights on the Key Carbon Offset Certification Registries, Download a Free Sample Report

Carbon Offsets – Competitive Landscape

The leading companies adopting carbon offsets are Meta, Netflix, S&P Global, TotalEnergies, and PetroChina among others. The world’s largest companies are using carbon offsets to support their net-zero targets. For instance, Saudi Aramco plans to offset 16 million tons of emissions to achieve its goal of a 52-million-ton reduction by 2035. Over half of the top 100 companies by market value are currently using carbon offsets. The finance and technology industry is already creating carbon-neutral operations with carbon offsets. Energy companies such as AstraZeneca are managing their offset project.

Leading Companies Adopting Carbon Offsets

Buy the Full Report for Additional Company-Wise Insights in the Carbon Offsets Theme, Download a Free Sample Report

Key Highlights

- The number of carbon offsets issued climbed 359% to 291 million between 2015 and 2022.

- Many offsets are unlikely to comply with emissions trading systems and cannot be used to meet emissions targets verified by the Science-Based Targets Initiative (SBTi).

- A small and growing number of companies are investing in technology-based carbon dioxide removal (CDR) projects such as biochar and direct air capture. These are more reliable when measuring the amount of carbon removed and have long-term storage capabilities.

- Demand for carbon offsets has been driven by some of the world’s largest companies incorporating them into their net-zero strategies.

AbbVie

Accenture

Adobe

Agricultural Bank of China

Alibaba

Alphabet

Amazon

AMD

American Express

Apple

ASML

AstraZeneca

Bank of America

Bank of China

Berkshire Hathaway

BHP Group

Boeing

Bristol-Myers Squibb

Broadcom

Caterpillar

CATL

Chevron

China Construction Bank

China Mobile

Cisco

Coca-Cola

Comcast

ConocoPhilips

Costco

Danaher

Delta Air Lines

Dior

Disney

Eli Lily

ExxonMobil

Hermes

Home Depot

Honeywell

HSBC

ICBC

Intel

Intuit

Johnson & Johnson

JP Morgan

KLM

Kweichow Moutai

Leon

Linde

L'Oréal

Lowe’s Companies

LVMH

Mastercard

McDonald’s

Merck

Meta

Microsoft

Morgan Stanley

Nestlé

Netflix

Nextera

Nike

Novartis

Novo Nordisk

NVIDIA

Oracle

Pepsico

PetroChina

Pfizer

Procter & Gamble

Prosus

Qualcomm

Raytheon Technologies

Reliance Industries

Roche

Royal Bank of Canada

S&P Global

Salesforce

Samsung

Sanofi

SAP

Saudi Aramco

Shell

Siemens

South Pole

Tata Consultancy

Tencent

Tesla

Texas Instruments

Thermo Fisher Scientific

T-Mobile US

TotalEnergies

Toyota

TSMC

Unilever

Union Pacific Corporation

United Parcel service

UnitedHealth

Verizon

Verra

Visa

Walmart

Walt Disney

Wells Fargo

Table of Contents

Frequently asked questions

-

Which is the leading carbon offset certification registry verifier?

Verra is by far the largest verifier of offsets, verifying 69% of all offsets in 2022.

-

Which is the most popular carbon offset type?

Avoidance offset is the most popular type of offset. Most avoidance projects aim to protect forests from deforestation.

-

Which are some of the most popular tech-based carbon removal offsets?

Direct air capture (DAC), biochar, and enhanced rock weathering are all examples of tech-based removal offsets.

-

Which are the leading companies in the carbon offset theme?

Some of the leading companies adopting carbon offsets are Meta, Netflix, S&P Global, TotalEnergies, and PetroChina among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.