Cryptocurrencies – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Access and explore in-depth trends and insights in our ‘Cryptocurrencies – Thematic Intelligence’ report:

- A comprehensive industry analysis, including market size and growth forecasts for cryptocurrency revenues to 2030.

- Key trends impacting the growth of the theme over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Analysis of GlobalData’s proprietary signals data – including M&A trends and predictions, venture financing trends, patent trends, company filing, hiring, and social media trends.

- Detailed cryptocurrency value chain consisting of four layers: infrastructure, blockchain, application, and services, each with multiple sub-categories.

How is the ‘Cryptocurrencies – Thematic Intelligence’ report different from other reports in the market?

- The report adapts a neutral stance towards cryptocurrencies, underlining both their transformative potential and the major challenges that need to be addressed.

- This report is the perfect introduction to the controversial and fast-moving cryptocurrency theme. It will help readers make sense of the technology behind cryptocurrencies, understand the potential implications of the theme, avoid the pitfalls, and identify the leading players.

- Given the dynamic and fast-paced nature of the cryptocurrency landscape, staying updated is paramount. This report provides up-to-the-minute insights and analysis, helping readers stay ahead of the curve in this rapidly evolving space.

- Not all cryptocurrencies are created equal. This report will help businesses understand the different features and benefits of each type.

- The cryptocurrency ecosystem is bigger than you think. This report provides a strategic framework that sets out what you should do, based on how cryptocurrencies could impact your business.

- Investing in cryptocurrency is a high-risk, high-reward proposition, and this report will help you understand the risks involved before you make any investment decisions. It will also provide insights into the different ways to buy, sell, and hold cryptocurrency.

- The pace of innovation in the crypto space is staggering. This report will highlight how cryptocurrency is related to many major technology trends such as NFTs, DeFi, the Metaverse, Web3, and more.

We recommend this valuable source of information to anyone involved in:

- Technology Leaders and Startups

- Banking Services/Alternative Payment Platforms

- Retailers/Businesses and Corporations

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC Firms

- M&A/Investment, Management Consultants, and Consulting Firms

To get a snapshot of the cryptocurrencies thematic intelligence report, download a free report sample

Cryptocurrencies Theme Analysis Overview

Cryptocurrency is a technology theme that sparks intense debates and divides opinions. For proponents, crypto represents an opportunity for significant wealth accumulation through value appreciation or new services like decentralized lending. Some also view it as a way to express discontent with issues ranging from financial bailouts to privacy infringements.

Conversely, critics contend that the fundamental question of whether cryptocurrencies have any inherent value remains unanswered and that the volatility of many tokens undermines the proposition of crypto as a distinct asset class separate from traditional financial assets.

The cryptocurrencies thematic intelligence report provides the key trends impacting the growth of the cryptocurrencies theme over the next 12 to 24 months. The report also includes a comprehensive industry analysis, including market size and growth forecasts for cryptocurrency revenues to 2030. It also offers an analysis of M&A, venture financing, patent, company filing, hiring, and social media.

| Report Pages | 102 |

| Regions Covered | Global |

| Market Size (May 16, 2023) | $1.1 Trillion |

| Leading Companies | · Binance

· Bitfinex · Chainalysis · Circle · Coinbase · ConsenSys |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Cryptocurrencies - Key Trends

The main trends shaping the cryptocurrencies industry are classified into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Technology trends: The key technology trends impacting the cryptocurrencies theme are web3, NFTs, social tokens, decentralized finance (DeFi), and the Metaverse among others. The amount and pace of innovation in the cryptocurrency space are staggering with new and highly complex concepts regularly emerging.

- Macroeconomic trends: The key macroeconomic trends explained in the report are ESG, cryptocurrency exchange traded funds (ETFs), and corporate treasury among others.

- Regulatory trends: Concerns over scams, regulations imposed by various countries, and illicit activities are a part of the regulatory trends impacting the cryptocurrencies theme.

Cryptocurrencies – Industry Analysis

The cryptocurrencies market was valued at $1.1 trillion on May 16, 2023. While the buzz around cryptocurrency might suggest it is significantly disrupting traditional finance, that is far from the truth. Despite 2021 being a record-breaking year for crypto and its development into what many believe is a new asset class, it remains in its infancy. For instance, Bernard Arnault, the wealthiest individual globally, could personally buy most bitcoins in circulation. Although often dubbed as digital gold, bitcoin’s value would need to multiply 25 times to match the value of gold as of May 16, 2023.

The cryptocurrencies industry thematic intelligence report also covers:

- Timeline

- Mergers and acquisitions trends

- Patent trends

- Company filings trends

- Hiring trends

- Social media trends

For more insights into the cryptocurrencies market, download a free report sample

Cryptocurrencies – Value Chain

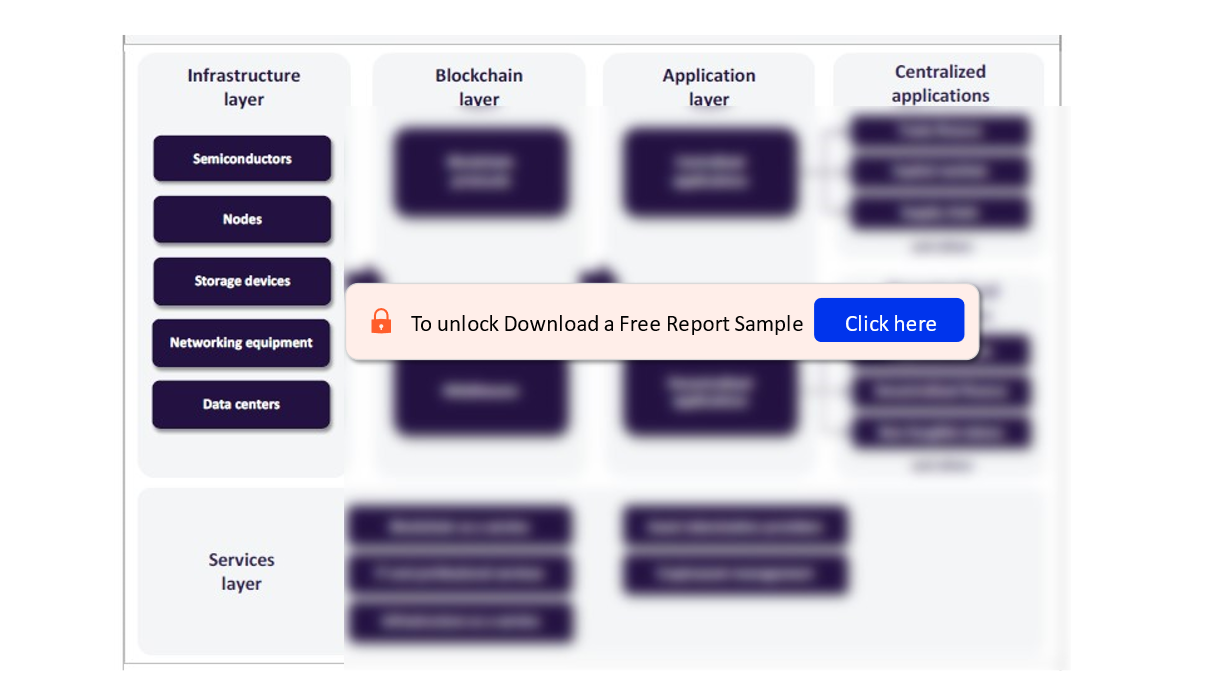

The main components of the cryptocurrencies industry value chain are infrastructure, blockchain, application, and centralized applications.

Infrastructure: The infrastructure layer focuses exclusively on the categories related to cryptocurrency mining, including mining rigs, mining software, application-specific integrated circuits (ASICs), and cryptocurrency mining farms. The other categories of the infrastructure layer are covered in our blockchain report, including traditional server hardware, plug-and-play nodes, client software, central processing units (CPUs), graphics processing units (GPUs), field-programmable gate arrays (FPGAs), hard disk drives (HDD), solid-state drives (SSD), on-premise data centers, and centralized cloud infrastructure.

The Blockchain and Cryptocurrency Value Chains Overlap

For more insights into the cryptocurrencies market, download a free report sample

Leading Companies

- Binance

- Bitfinex

- Chainalysis

- Circle

- Coinbase

- ConsenSys

To know more about the leading companies in the cryptocurrencies theme, download a free report sample

Payments Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Payments Sector Scorecard

To know more about sector scorecards, download a free report sample

Key Highlights

- Despite the 2022 crypto winter, both institutional interest and the number of retail users have grown, with governments positioning themselves as crypto hubs. The regulatory narrative has shifted significantly in favor of cryptocurrencies, moving from calls for outright bans to a focus on proper regulation. The EU is leading the way with its Markets in Crypto-Assets (MiCA) bill, which will introduce tougher but more consistent rules for crypto companies across the EU. Additionally, the crypto space continues to experience rapid innovation, from new token types to scalability solutions.

- The cryptocurrency market is challenging to track. It is one of the world’s most polarizing technologies, contributing to endless debate. Crypto is also a nascent industry, subject to high volatility and primarily driven by speculation. The industry has, however, come a long way in just a couple of years, and the pace of innovation is extraordinary. Crypto adoption and institutional interest have grown rapidly, and governments are making progress on regulation. Despite this progress, crypto has a long way to go before it achieves mainstream adoption.

Abra

ACI Worldwide

Adobe

Alchemy

Allnodes

Alphapoint

Amber

Anchorage Digital

Andreesen Horowitz

AnexMiner

AntPool

Apfinity

Applied Blockchain

APY.vision

Argo Blockchain

Armory

Atomic Wallet

AvaTrade

Awesome Miner

B2BinPay

B2Broker

Baikal Miner

Bakkt

Bank of America

BBVA

BeInCrypto

Big Commerce

Billfodl

Binance

Binance.US

BisonTrails

Bit Digital

BIT Mining

BitAccess

Bitcoin Depot

Bitcoin Suisse

Bitcoin.com

Bitcoinist.net

Bitdeer

Bitfarms

Bitfinex

BitFuFu

Bitfury

Bitget

BitGo

Bithumb

Bitmain

BitMex

BitPay

Bitstamp

Bitstop

Bitwise

Bleaumi

Block

Block.one

Blockchain

Blockpass

Blockstream

Bloomberg

BNY Mellon

Bolt

BTC.com

BTCM

Bullish

Bybit

Bytefederal

Caleb & Brown

Canaan Creative

Capital One

Cash2Bitcoin

Cathedra

Celsius

Certik

Cex.io

Chainalysis

ChainUp

Charles Schwab

Checkout.com

Chorus

Cipher Mining

Circle

Cleanspark

CNBC

Coatue

Coin Shares

Coin360

Coinbase

CoinCloud

CoinCodex

Coindesk

Coinfirm

Coingate

CoinGecko

CoinHub

Coinify

Coinigy

CoinLedger

CoinMarketCal

CoinMetrics

Coinmint

CoinPayments

Coinplug

CoinsBank

CoinStats

Cointelegraph

CoinTracking

Coinzoom

Consensys

CoolWallet

Copper

Core Scientific

CryptAPI

Crypto.com

CryptoCompare

Cryptonews

Cryptopay

CryptoQuant

CryptoSlate

Cryptowatch

Cudo Miner

Curv

Dapp

DAppRadar

Decrypt

DeepDAO

DeFi Llama

DeFi Pulse

Delta

Deribit

Deutsche Börse Group

Devexperts

Dfinity

Digital Currency Group

Drupal

Dune Analytics

Ebang Communication

Ebay

ECO

ECOS

Ellipal

Elliptic

Etherscan

Everstake

Exodus

F2Pool

FalconX

Fidelity Digital Assets

Figment

Financial Times

Finoa

Fireblocks

FIS

Flexa

Forestminer

Forte

Foundry

FTX

Galaxy Digital

Gate.io

Gemini

General Byts

Genesis Coin

Genesis Digital Assets

Genesis Mining

Glassnode

Goldman Sachs

Goldshell

Graph Blockchain

Grayscale

Greenidge Generation

Gryphon Digital Mining

Guarda

Happy Miner

Haru

HexTrust

HIVE Blockchain Technologies

Hive OS

HollaEx

Huboi

Hut 8 Mining

iBeLink

IBM

Idology

iFinex

IG

InfStones

Innosilicon

Intel

Interactive Brokers

IQ Mining

Iris Energy

ITrustCapital

Jaxx

Kaiko

Keepkey

Keystone

Kiln

Koinly

Kryptex Miner

Kucoin

KYC Chain

Lancium

Lbank

Ledger

Liquid Stack

LMAX

Localcoin

Luno

Luxor Mining

Marathon Digital Holdings

Mastercard

Matrixport

Mawson

Mawson Infrastructure Group

Merkle Science

Merkle Standard

Messari

Metaco

Metaps

MEXC

MicroBT

Microstrategy

MinerStat

MoonPay

Nansen

Nasdaq

Nash

nChain

NEA

Near Protocol

Nexo

NiceHash

Northern Data

Notabene

Now Payments

Nuvei

Nvidia

Nydig

OKX

Opencart

Openledger

OpenSea

Openware

Osprey Funds

P2P Validator

Pantera

Parafi Capital

Paxos

PayBito

PayPal

Payward (Kraken)

Pionex

Plus500

Plutus

Polychain Capital

PoolIn

Prime Trust

PrimeBlock

Revolut

Ribbit Capital

Riot Blockchain

Ripple Labs

Robinhood

RockitCoin

Routefirs

Roxe

SafePal

Samsung

Sardine

SBI Holdings

Scorechain

Seba Bank

Securitize

Segwit

Sequoia

Shopify

Siam Commercial Bank

Silicon Valley Bank

Silvergate

SimpleMining OS

Simplex

Skalex

Skew

Soft-FX

Solidius Labs

Soluna

SpectroCoin

SpicePay

Stake Fish

Staked

Stakewise

Staking Rewards

State of the dApps

State Street

Stripe

Stronghold Digital Mining

StrongU

Sumsub

Sunlune

Swissquote

Taurus

TaxBit

Terawulf

Tesla

Tether

The Block

The Daily HODL

Three Arrows Capital

Tiger Global

TradeStation

TradingView

Trezor

TRM

tZero

University of Cambridge

UpBit

US Bitcoin Corp

Utrust

Vauld

Velmie

Victory Park Capital

Visa

Voyager Digital

Webull

WhatToMine

Whinstone

Winklevoss Capital

Wirex

Wix

WonderFi

Woo Commerce

Worldline

Wyre

XTB

Youhodler

Ziglu

Zodia

Table of Contents

Frequently asked questions

-

What is the size of the cryptocurrencies market?

The cryptocurrencies market was valued at $1.1 trillion on May 16, 2023.

-

What are the key technology trends impacting the cryptocurrencies theme?

The key technology trends impacting the cryptocurrencies theme are web3, NFTs, and Metaverse among others. The amount and pace of innovation in the cryptocurrency space are staggering. New highly complex concepts are regularly emerging. The ecosystem will look very different in a few years.

-

Which are the leading companies making their mark in the cryptocurrencies theme?

Binance, Bitfinex, Chainalysis, Circle, Coinbase, and ConsenSys among others are the leading companies impacting the cryptocurrencies theme.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.